Enlarge image

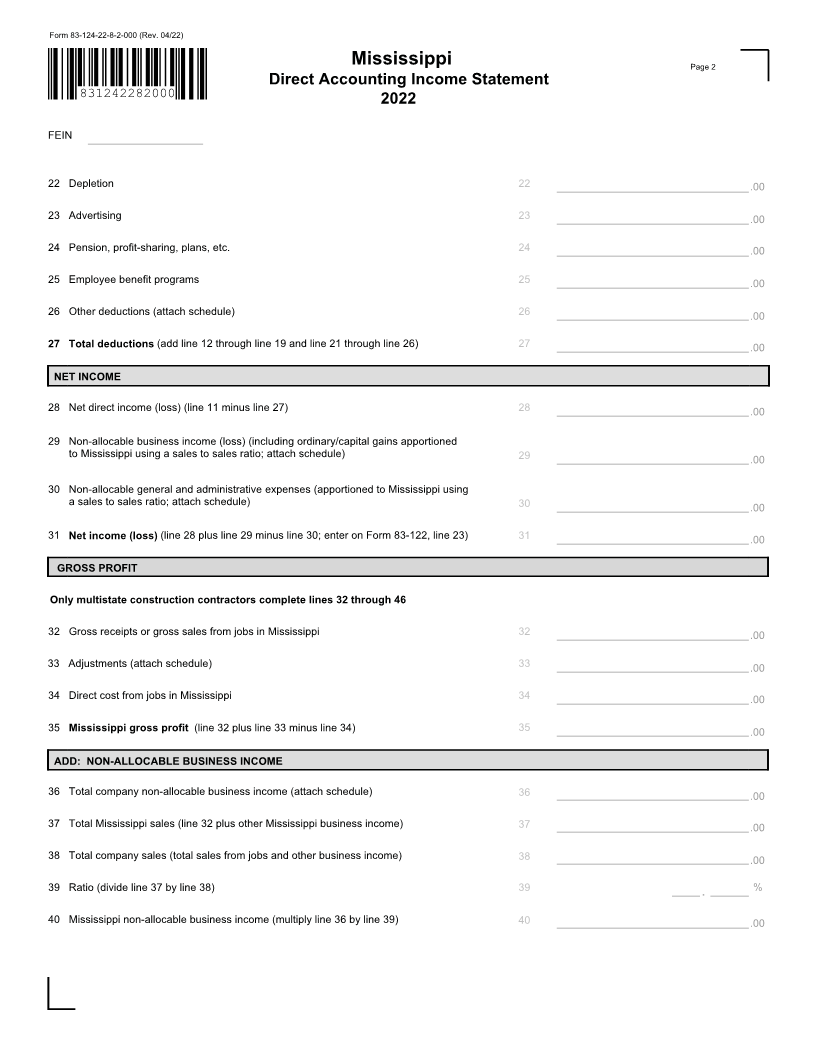

Form 83-124-22-8-1-000 (Rev. 04/22) Reset Form

Mississippi

Print FormPage 1

Direct Accounting Income Statement

831242281000 2022

FEIN

Producers of mineral or natural resource products should complete lines 1 through 31. Multistate construction contractors complete lines 32 through 46.

INCOME (ROUND TO THE NEAREST DOLLAR)

1 Gross receipts or sales .00

Less: returns and allowances .00 1 .00

2 Cost of goods sold and/or operations (attach schedule) 2 .00

3 Gross profit (line 1 minus line 2) 3 .00

4 Dividends (attach schedule) 4 .00

5 Interest 5 .00

6 Gross rents 6 .00

7 Gross royalties 7 .00

8 Allocable capital gain (attach schedule) 8 .00

9 Allocable net gain (loss) (attach schedule) 9 .00

10 Other income (loss) (attach schedule) 10 .00

11 Total income (add line 3 through line 10) 11 .00

DEDUCTIONS

12 Compensation of officers 12 .00

13 Salaries and wages 13 .00

14 Repairs 14 .00

15 Bad debts 15 .00

16 Rents 16 .00

17 Taxes (attach schedule) 17 .00

18 Interest 18 .00

19 Contributions 19 .00

20a Total depreciation 20a .00

20b Depreciation claimed on return 20b .00

21 Depreciation balance claimed (line 20a minus 20b) 21 .00