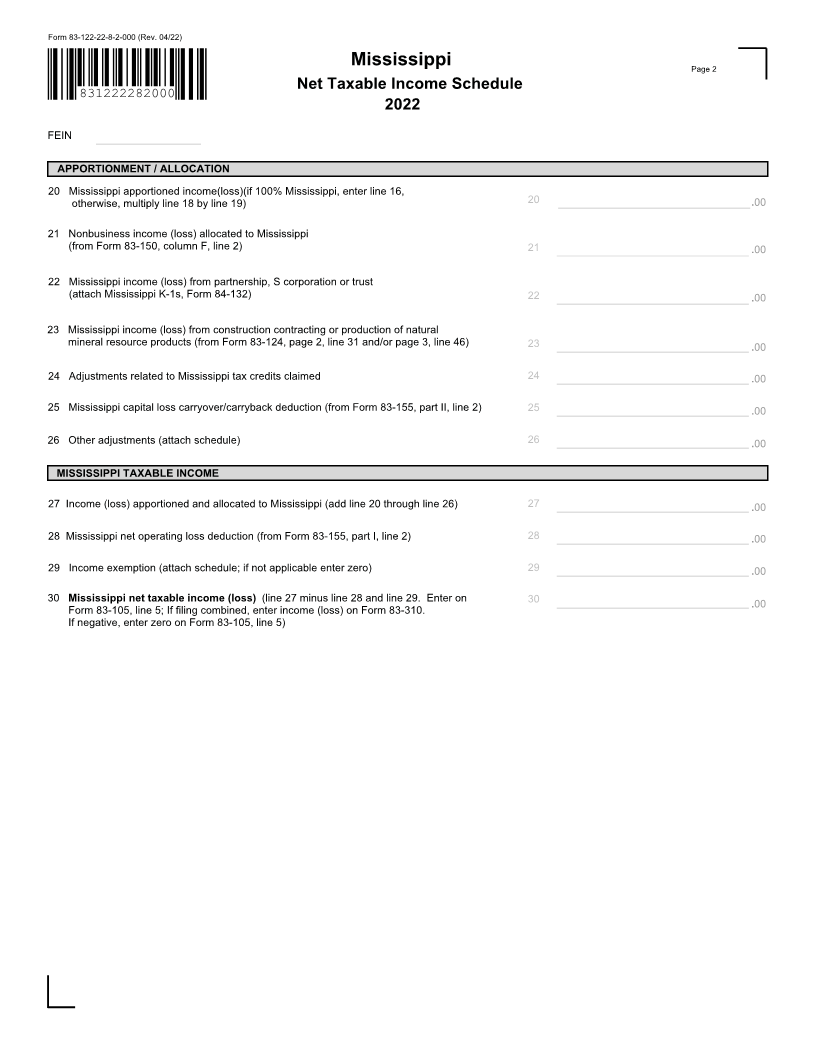

Enlarge image

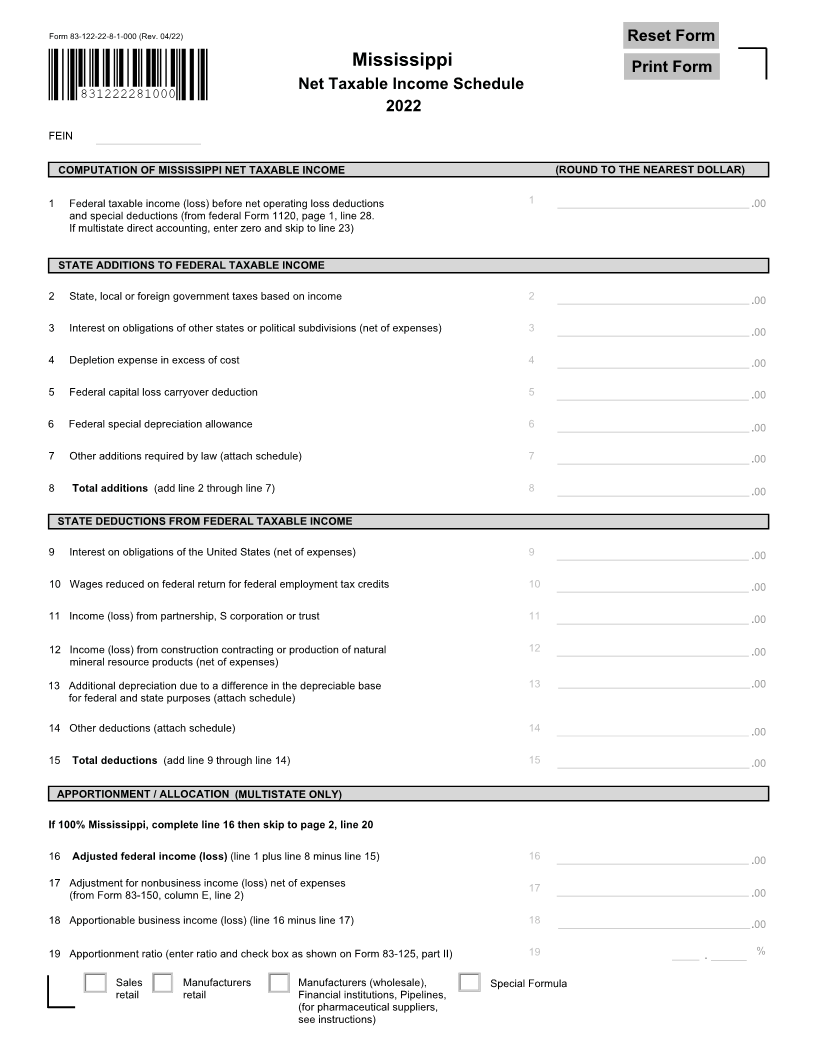

Form 83-122-22-8-1-000 (Rev. 04/22) Reset Form

Mississippi Print FormPage 1

Net Taxable Income Schedule

831222281000

2022

FEIN

COMPUTATION OF MISSISSIPPI NET TAXABLE INCOME (ROUND TO THE NEAREST DOLLAR)

1 Federal taxable income (loss) before net operating loss deductions 1 .00

and special deductions (from federal Form 1120, page 1, line 28.

If multistate direct accounting, enter zero and skip to line 23)

STATE ADDITIONS TO FEDERAL TAXABLE INCOME

2 State, local or foreign government taxes based on income 2 .00

3 Interest on obligations of other states or political subdivisions (net of expenses) 3 .00

4 Depletion expense in excess of cost 4 .00

5 Federal capital loss carryover deduction 5 .00

6 Federal special depreciation allowance 6 .00

7 Other additions required by law (attach schedule) 7 .00

8 Total additions (add line 2 through line 7) 8 .00

STATE DEDUCTIONS FROM FEDERAL TAXABLE INCOME

9 Interest on obligations of the United States (net of expenses) 9 .00

10 Wages reduced on federal return for federal employment tax credits 10 .00

11 Income (loss) from partnership, S corporation or trust 11 .00

12 Income (loss) from construction contracting or production of natural 12 .00

mineral resource products (net of expenses)

13 Additional depreciation due to a difference in the depreciable base 13 .00

for federal and state purposes (attach schedule)

14 Other deductions (attach schedule) 14 .00

15 Total deductions (add line 9 through line 14) 15 .00

APPORTIONMENT / ALLOCATION (MULTISTATE ONLY)

If 100% Mississippi, complete line 16 then skip to page 2, line 20

16 Adjusted federal income (loss) (line 1 plus line 8 minus line 15) 16 .00

17 Adjustment for nonbusiness income (loss) net of expenses 17 .00

(from Form 83-150, column E, line 2)

18 Apportionable business income (loss) (line 16 minus line 17) 18 .00

19 Apportionment ratio (enter ratio and check box as shown on Form 83-125, part II) 19 . %

Sales Manufacturers Manufacturers (wholesale), Special Formula

retail retail Financial institutions, Pipelines,

(for pharmaceutical suppliers,

see instructions)