Enlarge image

Reset Form Print Form

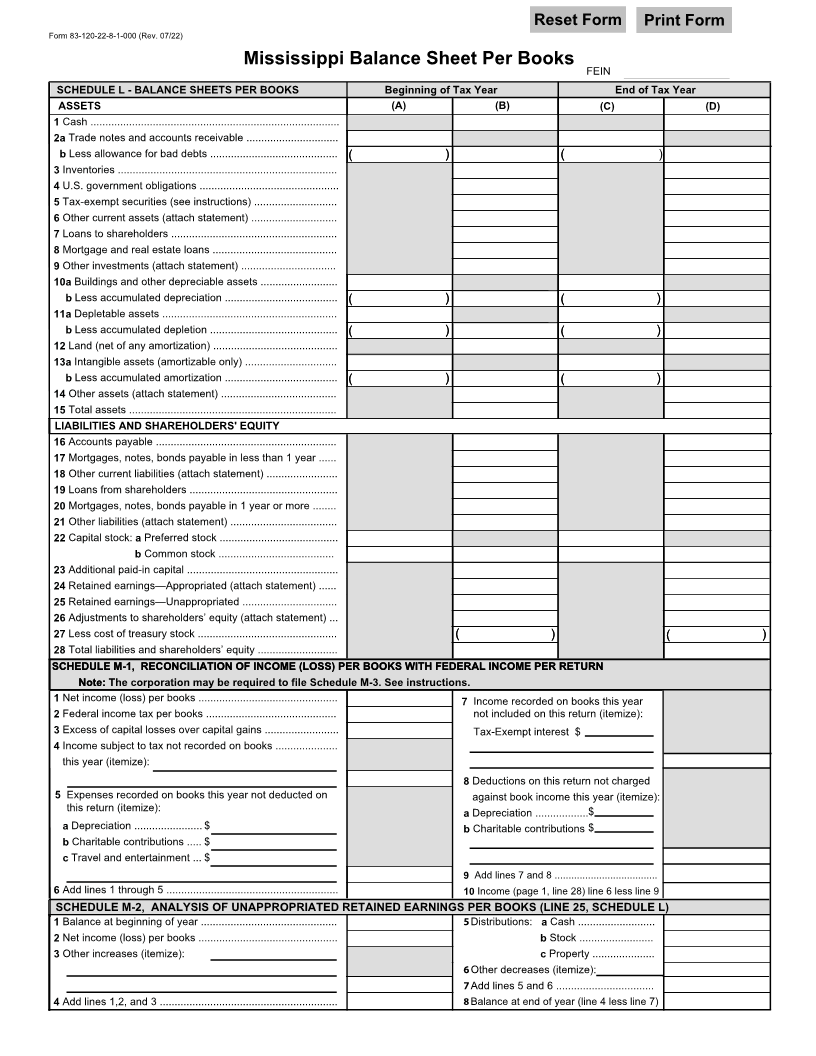

Form 83-120-22-8-1-000 (Rev. 07/22)

Mississippi Balance Sheet Per Books

FEIN

SCHEDULE L - BALANCE SHEETS PER BOOKS Beginning of Tax Year End of Tax Year

ASSETS (A) (B) (C) (D)

1 Cash ....................................................................................

2a Trade notes and accounts receivable ...............................

b Less allowance for bad debts ........................................... ( ( ) ) ( ( )

3 Inventories ..........................................................................

4 U.S. government obligations ...............................................

5 Tax-exempt securities (see instructions) ............................

6 Other current assets (attach statement) .............................

7 Loans to shareholders ........................................................

8 Mortgage and real estate loans ..........................................

9 Other investments (attach statement) ................................

10a Buildings and other depreciable assets ..........................

b Less accumulated depreciation ...................................... ( ( ) ) ( ( ) )

11a Depletable assets ...........................................................

b Less accumulated depletion ........................................... ( ( ) ) ( ( ) )

12 Land (net of any amortization) ..........................................

13a Intangible assets (amortizable only) ...............................

b Less accumulated amortization ...................................... ( ( ) ) ( ( ) )

14 Other assets (attach statement) .......................................

15 Total assets ......................................................................

LIABILITIES AND SHAREHOLDERS' EQUITY

16 Accounts payable .............................................................

17 Mortgages, notes, bonds payable in less than 1 year ......

18 Other current liabilities (attach statement) ........................

19 Loans from shareholders ..................................................

20 Mortgages, notes, bonds payable in 1 year or more ........

21 Other liabilities (attach statement) ....................................

22 Capital stock: aPreferred stock ........................................

b Common stock .......................................

23 Additional paid-in capital ...................................................

24 Retained earnings—Appropriated (attach statement) ......

25 Retained earnings—Unappropriated ................................

26 Adjustments to shareholders’ equity (attach statement) ...

27 Less cost of treasury stock ............................................... ( ( ) ) ( ( ) )

28 Total liabilities and shareholders’ equity ...........................

SCHSCHEDULE M-1, RECONCILIATION OF INCOME (LOSS) PER BOOKS WITH FEDERAL INCOME PER RETURN EDULE M-1, RECONCILIATION OF INCOME (LOSS) PER BOOKS WITH FEDERAL INCOME PER RETURN

NNote: ote: The corporation may be required to file Schedule M-3. See instructions.

1 Net income (loss) per books ............................................... 7 Income recorded on books this year

2 Federal income tax per books ............................................ not included on this return (itemize):

3 Excess of capital losses over capital gains ......................... Tax-Exempt interest $

4 Income subject to tax not recorded on books .....................

this year (itemize):

8 Deductions on this return not charged

5 Expenses recorded on books this year not deducted on against book income this year (itemize):

this return (itemize): a Depreciation ..................$

a Depreciation ....................... $ b Charitable contributions $

b Charitable contributions ..... $

c Travel and entertainment ... $

9 Add lines 7 and 8 .....................................

6 Add lines 1 through 5 .......................................................... 10 Income (page 1, line 28) line 6 less line 9

SCHEDULE M-2, ANALYSIS OF UNAPPROPRIATED RETAINED EARNINGS PER BOOKS (LINE 25, SCHEDULE L)

1 Balance at beginning of year .............................................. Distributions: aCash ..........................

2 Net income (loss) per books ............................................... b Stock .........................

3 Other increases (itemize): c Property .....................

Other decreases (itemize):

Add lines 5 and 6 .................................

4 Add lines 1,2, and 3 ............................................................ Balance at end of year (line 4 less line 7)