Enlarge image

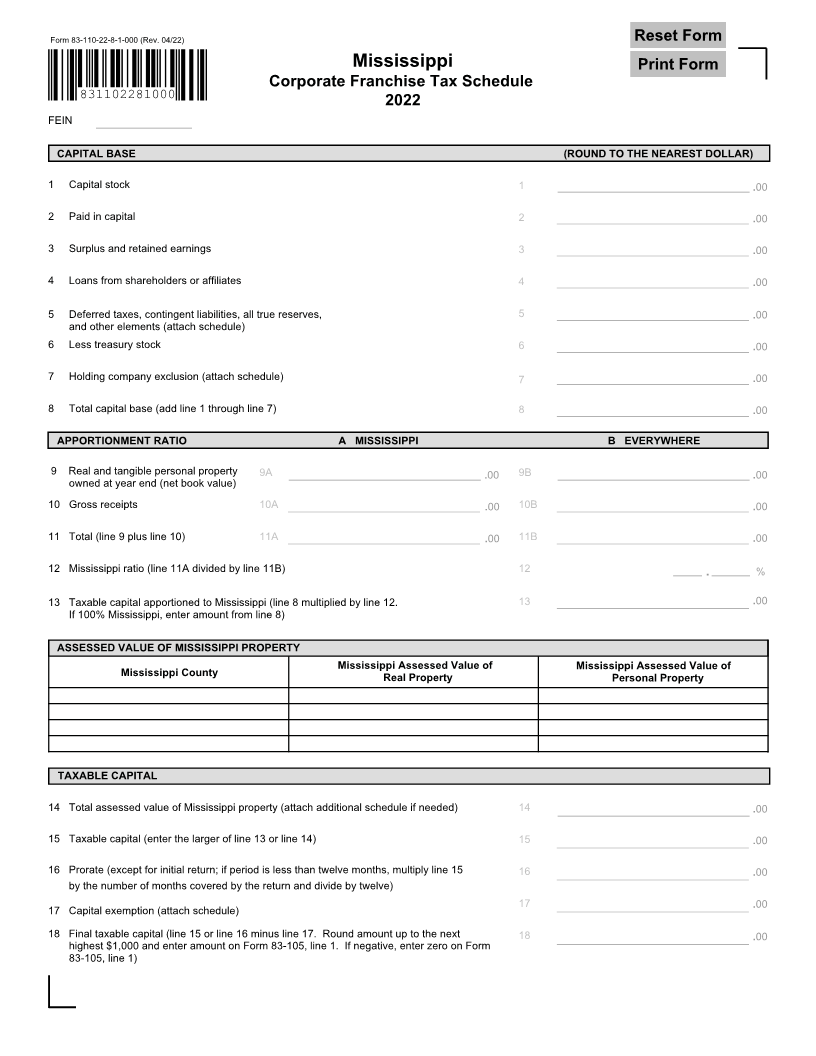

Form 83-110-22-8-1-000 (Rev. 04/22) Reset Form

Mississippi Print Form

Corporate Franchise Tax Schedule

831102281000 2022

FEIN

CAPITAL BASE (ROUND TO THE NEAREST DOLLAR)

1 Capital stock 1 .00

2 Paid in capital 2 .00

3 Surplus and retained earnings 3 .00

4 Loans from shareholders or affiliates 4 .00

5 Deferred taxes, contingent liabilities, all true reserves, 5 .00

and other elements (attach schedule)

6 Less treasury stock 6 .00

7 Holding company exclusion (attach schedule) 7 .00

8 Total capital base (add line 1 through line 7) 8 .00

APPORTIONMENT RATIO A MISSISSIPPI B EVERYWHERE

9 Real and tangible personal property 9A .00 9B .00

owned at year end (net book value)

10 Gross receipts 10A .00 10B .00

11 Total (line 9 plus line 10) 11A .00 11B .00

12 Mississippi ratio (line 11A divided by line 11B) 12 . %

13 Taxable capital apportioned to Mississippi (line 8 multiplied by line 12. 13 .00

If 100% Mississippi, enter amount from line 8)

ASSESSED VALUE OF MISSISSIPPI PROPERTY

Mississippi Assessed Value of Mississippi Assessed Value of

Mississippi County Real Property Personal Property

TAXABLE CAPITAL

14 Total assessed value of Mississippi property (attach additional schedule if needed) 14 .00

15 Taxable capital (enter the larger of line 13 or line 14) 15 .00

16 Prorate (except for initial return; if period is less than twelve months, multiply line 15 16 .00

by the number of months covered by the return and divide by twelve)

17

17 Capital exemption (attach schedule) .00

18 Final taxable capital (line 15 or line 16 minus line 17. Round amount up to the next 18 .00

highest $1,000 and enter amount on Form 83-105, line 1. If negative, enter zero on Form

83-105, line 1)