Enlarge image

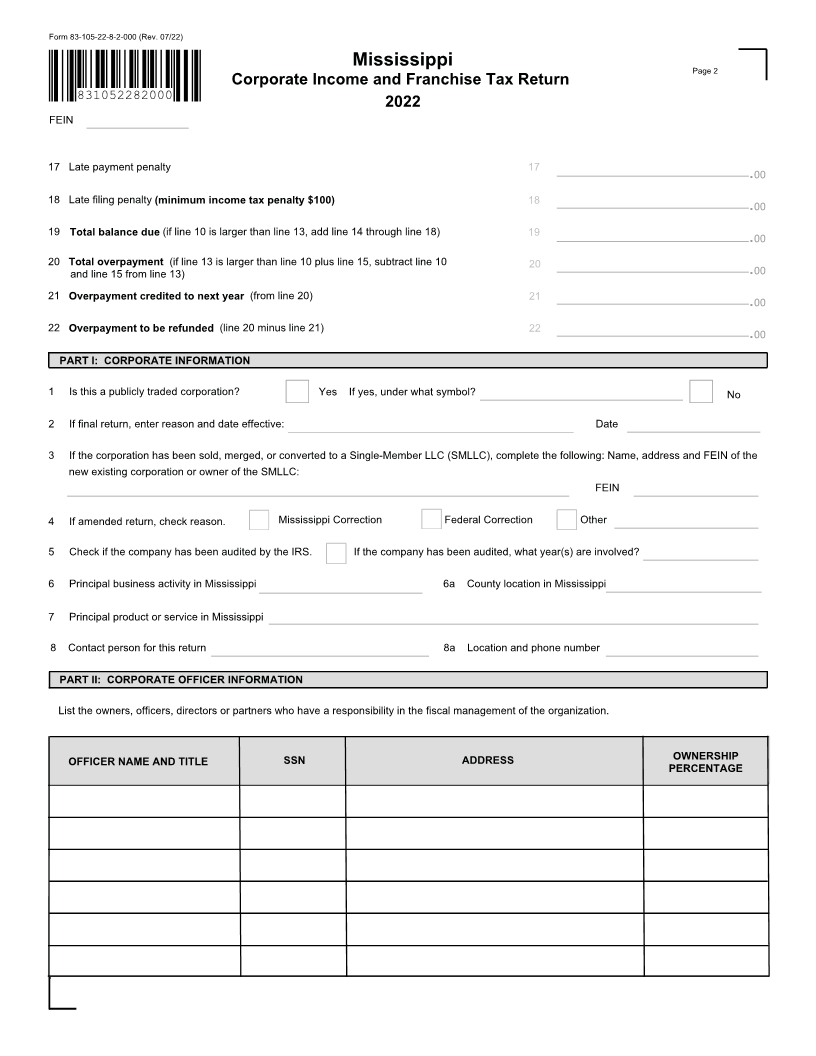

Form 83-105-22-8-1-000 (Rev. 07/22) Reset Form

Mississippi Print Form

Corporate Income and Franchise Tax Return

831052281000

2022

Tax Year Beginning Tax Year Ending

mm dd yyyy mm dd yyyy

FEIN Mississippi Secretary of State ID

Legal Name and DBA

CHECK ALL THAT APPLY CHECK ONE

Address

Amended Return 100% Mississippi

City State Zip +4 Final Return Multistate Apportioning

County Code NAICS Code Non Profit Multistate Direct

Accounting

FRANCHISE TAX (ROUND TO THE NEAREST DOLLAR)

1 Taxable capital (from Form 83-110, line 18) 1 00

.

2 Franchise tax (minimum tax $25) Fee-In-Lieu 2 00

.

3 Franchise tax credit (from Form 83-401, line 1) 3 00

.

4 Net franchise tax due (line 2 minus line 3) 4 00

.

INCOME TAX

Combined income tax return (enter FEIN of reporting corporation)

5 Mississippi net taxable income (from Form 83-122, line 30 or Form 83-310,

line 5, column C) 5

.00

6 Income tax 6

.00

7 Credit for tax paid on an electing Pass-Through Entity Tax Return (must attach K-1s) 7

.00

8 Income tax credits (from Form 83-401, line 3 or Form 83-310, line 5, column B) 8

.00

9 Net income tax due (line 6 minus line 7 and line 8) 9

.00

PAYMENTS AND TAX DUE

10 Total franchise and income tax (line 4 plus line 9) 10

.00

11 Overpayments from prior year 11

.00

12 Estimated tax payments and payment with extension 12

.00

13 Total payments (line 11 plus line 12) 13

.00

14 Net total franchise and income tax (line 10 minus line 13) 14

.00

15 Interest and penalty on underestimated income tax payments (from Form 83-305, line 19) 15

.00

16 Late payment interest 16

.00