- 12 -

Enlarge image

|

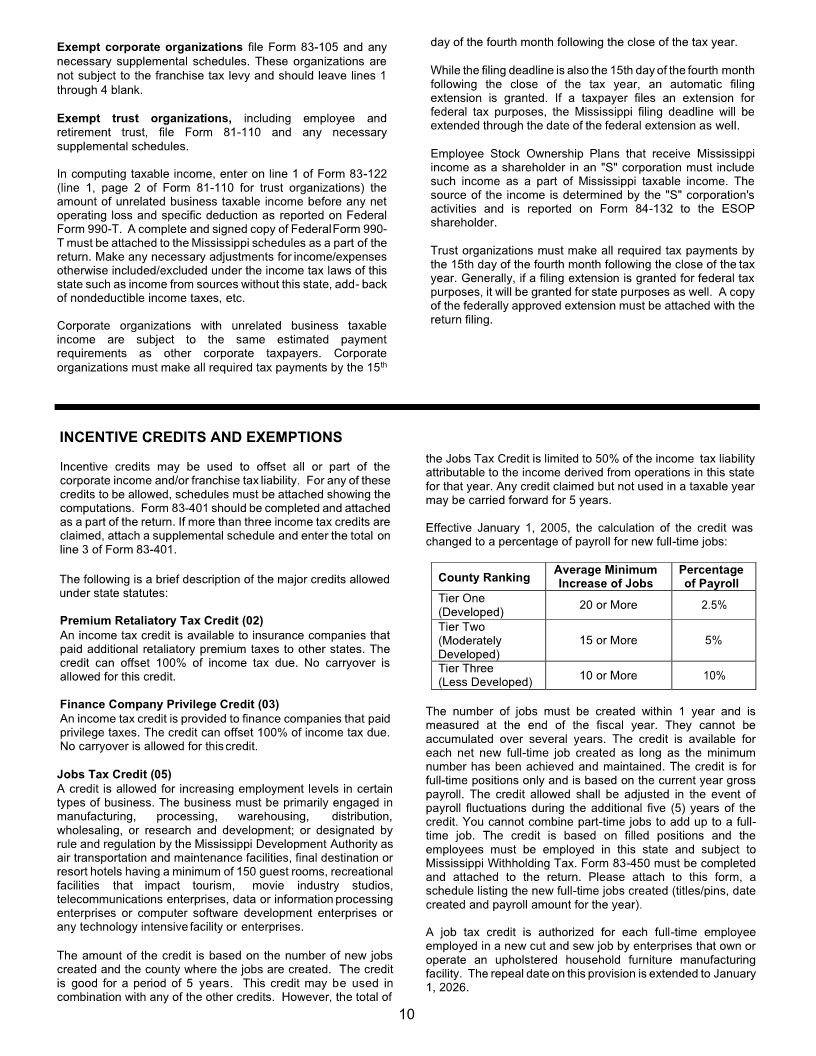

Ad Valorem Inventory Tax Credit (14) of broadband technologies. The credit applies to both income

This is an income tax credit for manufacturers, distributors and and franchise taxes. The credit is a percentage of the cost of the

wholesale or retail merchants for a certain amount of ad investments incurred after June 30, 2003 and before July 1,

valorem taxes paid on commodities, goods, wares and 2013. The percentage applied is 5%, 10%, and 15% for Tier 1,

merchandise held for resale. The ad valorem credit may be Tier 2, and Tier 3 counties respectively. For more details on

claimed for each location where such commodities, products, eligibility, computation of the credit, qualifying expenditures,

goods, wares and merchandise are found and upon which the limitations, carryovers, as well as any necessary forms or work

ad valorem taxes have been paid. The tax credit for each sheets, please contact the Corporate Tax Division at (601) 923-

location on which ad valorem taxes have been paid should 7700. Enterprises qualifying for this credit are able to receive

not exceed the lesser of $15,000 or the amount of income certain sales tax exemptions as well. For more information,

taxes attributable to such location. Previously, the credit may please contact the Sales Tax Bureau at (601) 923-7015.

be claimed only in the year in which the ad valorem taxes are

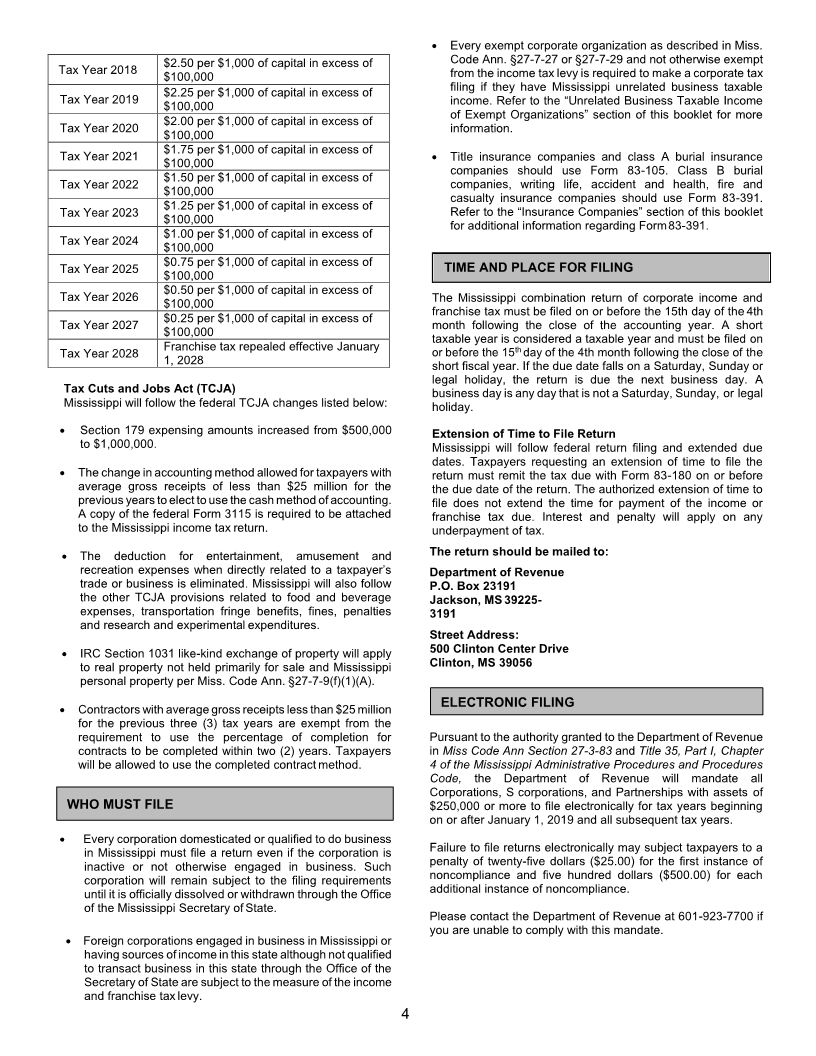

paid; however, Senate Bill 2934 amended Miss. Code Ann. House Bill 1729 amended Miss. Code Ann. §57-87-5 to extend

§27-7-22.5 increasing the income tax credit for ad valorem until July 1, 2025, the franchise tax credit authorized for

taxes paid on certain inventory and authorizes any unused telecommunications enterprises for the cost of equipment used in

tax credit claimed to be carried forward for five (5) consecutive the deployment of broadband technologies and to extend until

years effective July 1, 2012. July 1, 2025 the ad valorem tax exemption for equipment used in

the deployment of broadband technologies by

Effective January 1, 2014, House Bill 787 amends Miss. Code telecommunications enterprises.

Ann. §27-7-22.5 to provide an income tax credit for ad valorem

taxes paid on rental equipment. Rental equipment is defined Manufacturing Investment Tax Credit (23)

as any rental equipment or other rental items which are held for A manufacturing enterprise who falls within the definition of the

short-term rental to the public under rental agreements that are term “manufacturer” in Miss. Code Ann. § 27-65-11 and has

not subject to privilege taxes. The bill also provides for the operated in the state for at least 2 years is allowed a

amount of credit to increase each year until the 2016 taxable manufacturing investment tax credit for income tax equal to 5% of

year in which the amount of the credit will be limited to the the eligible investments made by the manufacturing enterprise.

lesser of the amount of ad valorem taxes paid or the amount "Eligible investment" means an investment of at least

of income taxes due for each location. Any ad valorem taxes $1,000,000.00 in buildings and/or equipment for the

paid by a taxpayer that is applied toward the tax credit may manufacturing enterprise.

not be used as a deduction by the taxpayer for state income

tax purposes. The maximum credit that may be claimed by a taxpayer on any

project shall be limited to $1,000,000. The Manufacturing

A copy of the tax receipt from the county that shows the Investment Tax Credit should not exceed 50% of the taxpayer's

inventory valuation and a schedule showing the state income tax liability in any 1 tax year net of all other credits.

calculation of the ad valorem tax paid based on the Any Manufacturing Investment Tax Credit claimed but not used

valuation must be attached to the return. may be carried forward for 5 years from the close of the tax year

in which the eligible investment was made. For more details on

Export Port Charges Credit (15) eligibility, computation of the credit, qualifying expenditures,

An income tax credit is authorized for taxpayers that utilize the limitations, carryovers, as well as any necessary forms or work

port facilities at state, county, or municipal ports. The income sheets, please contact the Corporate Tax Division at (601) 923-

tax credit is equal to the total export cargo charges paid by 7700.

the taxpayer for: (a) receiving in the port; (b) handling to a

vessel; and (c) wharfage. The credit provided should not Historic Structure Rehabilitation Credit (26)

exceed 50% of the amount of tax imposed upon the taxpayer An income tax credit is allowed for certain costs and expenses in

for the taxable year reduced by the sum of all other credits. rehabilitating eligible property certified as a historic structure or

Any unused portion of the credit may be carried forward for structure in a certified historic district. The taxpayer may elect to

the succeeding 5 years. receive a 75% rebate on the total amount of excess historic

rehabilitation credit in lieu of a ten-year carryforward.

Import Port Charges Credit (17)

An income tax credit is authorized for taxpayers that utilize the New Markets Credit (28)

port facilities at state, county, or municipal ports for the import The New Markets Credit allows a credit for income, insurance

of cargo. To be eligible, a taxpayer must locate its United premium, or premium retaliatory taxes to investors in eligible

States headquarters in Mississippi on or after January 1, 2005 equity securities issued by a Qualified Community Development

employ at least 5 permanent full-time employees who actually Entity that has entered into an allocation agreement with the

work at such headquarters and have a minimum capital Community Development Financial Institutions Fund of the U.S.

investment of $5,000,000 in Mississippi. The income tax credit Treasury Department (CDFI) with respect to federal income tax

is equal to the charges paid by the taxpayer for: (a) receiving credits authorized by the Federal NMTC Law, which includes the

in the port; (b) handling to a vessel; and (c) wharfage. The State of Mississippi in the service area outlined in such

credit provided shall not exceed 50% of the amount of tax agreement. This Qualified Community Development Entity is

imposed upon the taxpayer for the taxable year reduced by commonly referred to as a “CDE”.

the sum of all other credits. Any unused portion of the credit

may be carried forward for the succeeding 5 years. The

maximum cumulative credit that may be claimed ranges The CDE must use 85% or more of the proceeds of the issuance

between $1,000,000 and $4,000,000 depending on the of the equity security to make investments that are Mississippi

number of permanent full-time employees of the taxpayer. Qualified Low-Income Community Investments (MQLICIs), and

those investments must be maintained for a minimum of 7 years.

Broadband Technology Credit (BTC) (19) A MQLICI is an investment in Mississippi in a business that meets

A tax credit is provided for telecommunications enterprises the requirements of a Qualified Active Low-Income Community

making investments in equipment used in the deployment Business (QALICB) or an investment in Mississippi approved as

12

|