Enlarge image

Reset Form

Mississippi Print Form

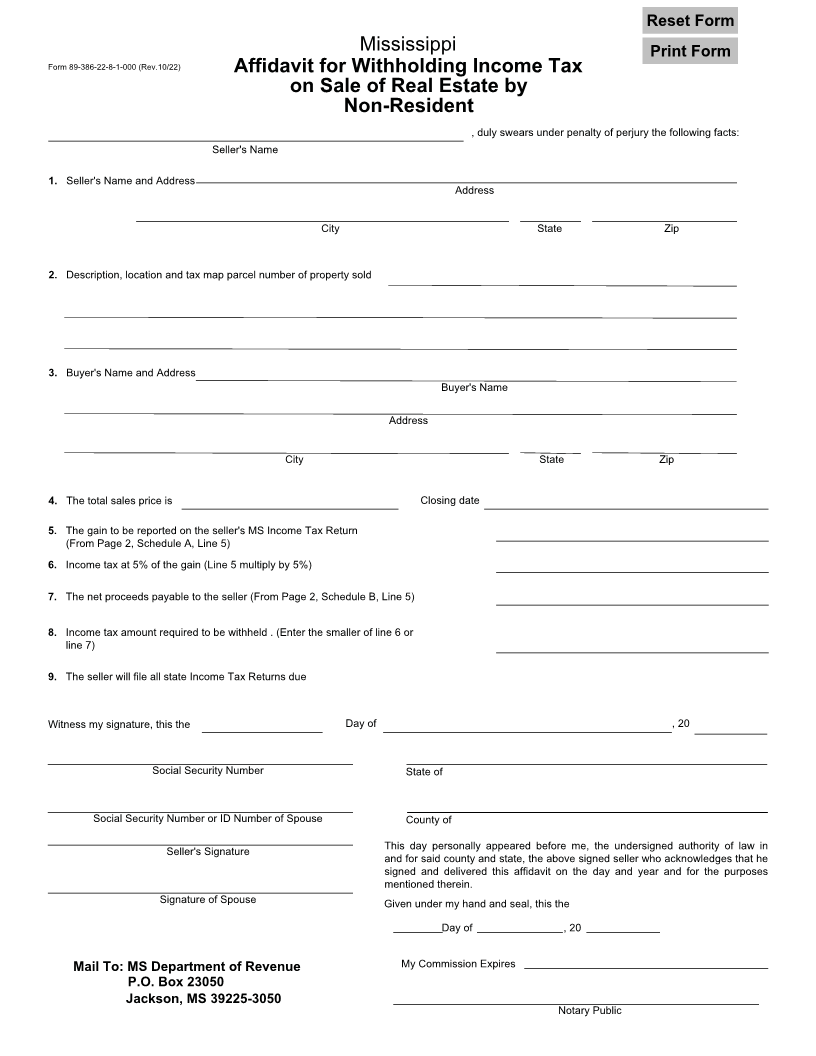

Form 89-386-22-8-1-000 (Rev.10/22) Affidavit for Withholding Income Tax

on Sale of Real Estate by

Non-Resident

, duly swears under penalty of perjury the following facts:

Seller's Name

1. Seller's Name and Address

Address

City State Zip

2. Description, location and tax map parcel number of property sold

3. Buyer's Name and Address

Buyer's Name

Address

City State Zip

4. The total sales price is Closing date

5. The gain to be reported on the seller's MS Income Tax Return

(From Page 2, Schedule A, Line 5)

6. Income tax at 5% of the gain (Line 5 multiply by 5%)

7. The net proceeds payable to the seller (From Page 2, Schedule B, Line 5)

8. Income tax amount required to be withheld . (Enter the smaller of line 6 or

line 7)

9. The seller will file all state Income Tax Returns due

Witness my signature, this the Day of , 20

Social Security Number State of

Social Security Number or ID Number of Spouse County of

Seller's Signature This day personally appeared before me, the undersigned authority of law in

and for said county and state, the above signed seller who acknowledges that he

signed and delivered this affidavit on the day and year and for the purposes

mentioned therein.

Signature of Spouse Given under my hand and seal, this the

Day of , 20

Mail To: MS Department of Revenue My Commission Expires

P.O. Box 23050

Jackson, MS 39225-3050

Notary Public