Enlarge image

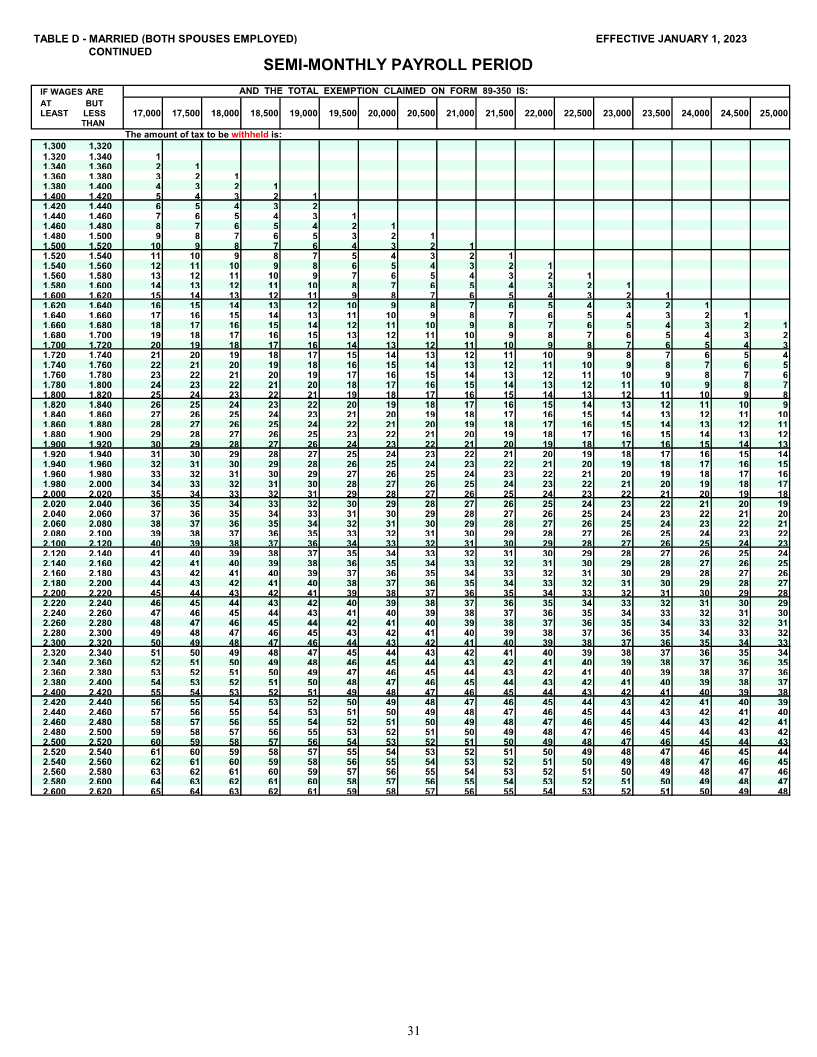

TABLE A - SINGLE EFFECTIVE JANUARY 1, 2023

SEMI-MONTHLY PAYROLL PERIOD

IF WAGES ARE AND THE TOTAL EXEMPTION CLAIMED ON FORM 89-350 IS:

AT BUT

LEAST LESS 0 6,000 7,500 9,000 10,500 12,000 13,500 15,000 16,500 18,000

THAN

The amount of tax to be withheld is:

520 540 1

540 560 2

560 580 3

580 600 4

600 620 5

620 640 6

640 660 7

660 680 8

680 700 9

700 720 10

720 740 11

740 760 12

760 780 13

780 800 14 1

800 820 15 2

820 840 16 3

840 860 17 4 1

860 880 18 5 2

880 900 19 6 3

900 920 20 7 4 1

920 940 21 8 5 2

940 960 22 9 6 3

960 980 23 10 7 4 1

980 1,000 24 11 8 5 2

1,000 1,020 25 12 9 6 3

1,020 1,040 26 13 10 7 4 1

1,040 1,060 27 14 11 8 5 2

1,060 1,080 28 15 12 9 6 3

1,080 1,100 29 16 13 10 7 4 1

1,100 1,120 30 17 14 11 8 5 2

1,120 1,140 31 18 15 12 9 6 3

1,140 1,160 32 19 16 13 10 7 4 1

1,160 1,180 33 20 17 14 11 8 5 2

1,180 1,200 34 21 18 15 12 9 6 3

1,200 1,220 35 22 19 16 13 10 7 4 1

1,220 1,240 36 23 20 17 14 11 8 5 2

1,240 1,260 37 24 21 18 15 12 9 6 3

1,260 1,280 38 25 22 19 16 13 10 7 4

1,280 1,300 39 26 23 20 17 14 11 8 5 1

1,300 1,320 40 27 24 21 18 15 12 9 6 2

1,320 1,340 41 28 25 22 19 16 13 10 7 3

1,340 1,360 42 29 26 23 20 17 14 11 8 4

1,360 1,380 43 30 27 24 21 18 15 12 9 5

1,380 1,400 44 31 28 25 22 19 16 13 10 6

1,400 1,420 45 32 29 26 23 20 17 14 11 7

1,420 1,440 46 33 30 27 24 21 18 15 12 8

1,440 1,460 47 34 31 28 25 22 19 16 13 9

1,460 1,480 48 35 32 29 26 23 20 17 14 10

1,480 1,500 49 36 33 30 27 24 21 18 15 11

1,500 1,520 50 37 34 31 28 25 22 19 16 12

1,520 1,540 51 38 35 32 29 26 23 20 17 13

1,540 1,560 52 39 36 33 30 27 24 21 18 14

1,560 1,580 53 40 37 34 31 28 25 22 19 15

1,580 1,600 54 41 38 35 32 29 26 23 20 16

1,600 1,620 55 42 39 36 33 30 27 24 21 17

1,620 1,640 56 43 40 37 34 31 28 25 22 18

1,640 1,660 57 44 41 38 35 32 29 26 23 19

1,660 1,680 58 45 42 39 36 33 30 27 24 20

1,680 1,700 59 46 43 40 37 34 31 28 25 21

1,700 1,720 60 47 44 41 38 35 32 29 26 22

1,720 1,740 61 48 45 42 39 36 33 30 27 23

1,740 1,760 62 49 46 43 40 37 34 31 28 24

1,760 1,780 63 50 47 44 41 38 35 32 29 25

1,780 1,800 64 51 48 45 42 39 36 33 30 26

1,800 1,820 65 52 49 46 43 40 37 34 31 27

1,820 1,840 66 53 50 47 44 41 38 35 32 28

1,840 1,860 67 54 51 48 45 42 39 36 33 29

1,860 1,880 68 55 52 49 46 43 40 37 34 30

1,880 1,900 69 56 53 50 47 44 41 38 35 31

1,900 1,920 70 57 54 51 48 45 42 39 36 32

26