Enlarge image

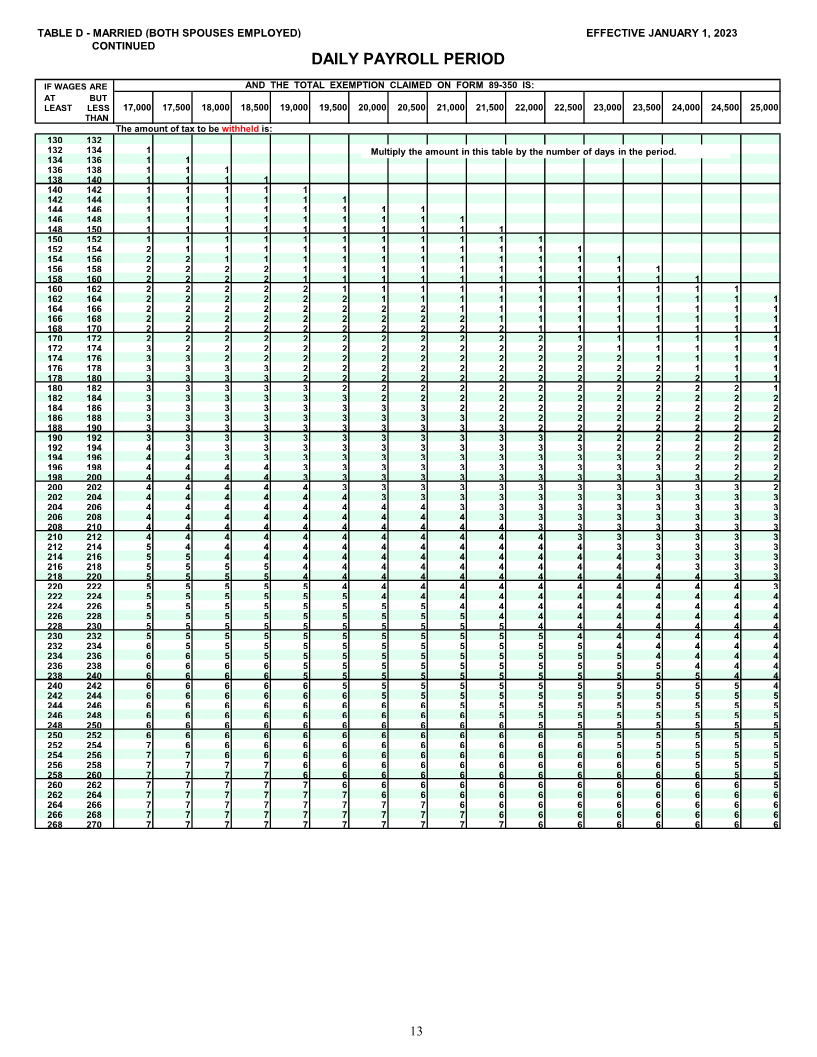

TABLE A - SINGLE EFFECTIVE JANUARY 1, 2023

DAILY PAYROLL PERIOD

IF WAGES ARE AND THE TOTAL EXEMPTION CLAIMED ON FORM 89-350 IS:

AT BUT

LEAST LESS 0 6,000 7,500 9,000 10,500 12,000 13,500 15,000 16,500 18,000

THAN

The amount of tax to be withheld is:

58 60 1

60 62 1 Multiply the amount in this table by the number of days in the period.

62 64 1

64 66 1

66 68 1

68 70 1

70 72 1

72 74 1

74 76 1

76 78 1

78 80 2

80 82 2 1

82 84 2 1

84 86 2 1

86 88 2 1 1

88 90 2 1 1

90 92 2 1 1

92 94 2 1 1 1

94 96 2 1 1 1

96 98 2 1 1 1

98 100 3 1 1 1 1

100 102 3 2 1 1 1

102 104 3 2 1 1 1

104 106 3 2 1 1 1 1

106 108 3 2 2 1 1 1

108 110 3 2 2 1 1 1

110 112 3 2 2 1 1 1 1

112 114 3 2 2 2 1 1 1

114 116 3 2 2 2 1 1 1 1

116 118 3 2 2 2 1 1 1 1

118 120 4 2 2 2 2 1 1 1

120 122 4 3 2 2 2 1 1 1 1

122 124 4 3 2 2 2 1 1 1 1

124 126 4 3 2 2 2 2 1 1 1

126 128 4 3 3 2 2 2 1 1 1 1

128 130 4 3 3 2 2 2 1 1 1 1

130 132 4 3 3 2 2 2 2 1 1 1

132 134 4 3 3 3 2 2 2 1 1 1

134 136 4 3 3 3 2 2 2 2 1 1

136 138 4 3 3 3 2 2 2 2 1 1

138 140 5 3 3 3 3 2 2 2 1 1

140 142 5 4 3 3 3 2 2 2 2 1

142 144 5 4 3 3 3 2 2 2 2 1

144 146 5 4 3 3 3 3 2 2 2 1

146 148 5 4 4 3 3 3 2 2 2 2

148 150 5 4 4 3 3 3 2 2 2 2

150 152 5 4 4 3 3 3 3 2 2 2

152 154 5 4 4 4 3 3 3 2 2 2

154 156 5 4 4 4 3 3 3 3 2 2

156 158 5 4 4 4 3 3 3 3 2 2

158 160 6 4 4 4 4 3 3 3 2 2

160 162 6 5 4 4 4 3 3 3 3 2

162 164 6 5 4 4 4 3 3 3 3 2

164 166 6 5 4 4 4 4 3 3 3 2

166 168 6 5 5 4 4 4 3 3 3 3

168 170 6 5 5 4 4 4 3 3 3 3

170 172 6 5 5 4 4 4 4 3 3 3

172 174 6 5 5 5 4 4 4 3 3 3

174 176 6 5 5 5 4 4 4 4 3 3

176 178 6 5 5 5 4 4 4 4 3 3

178 180 7 5 5 5 5 4 4 4 3 3

180 182 7 6 5 5 5 4 4 4 4 3

182 184 7 6 5 5 5 4 4 4 4 3

184 186 7 6 5 5 5 5 4 4 4 3

186 188 7 6 6 5 5 5 4 4 4 4

188 190 7 6 6 5 5 5 4 4 4 4

190 192 7 6 6 5 5 5 5 4 4 4

192 194 7 6 6 6 5 5 5 4 4 4

194 196 7 6 6 6 5 5 5 5 4 4

196 198 7 6 6 6 5 5 5 5 4 4

198 200 8 6 6 6 6 5 5 5 4 4

200 202 8 7 6 6 6 5 5 5 5 4

202 204 8 7 6 6 6 5 5 5 5 4

204 206 8 7 6 6 6 6 5 5 5 4

8