- 12 -

Enlarge image

|

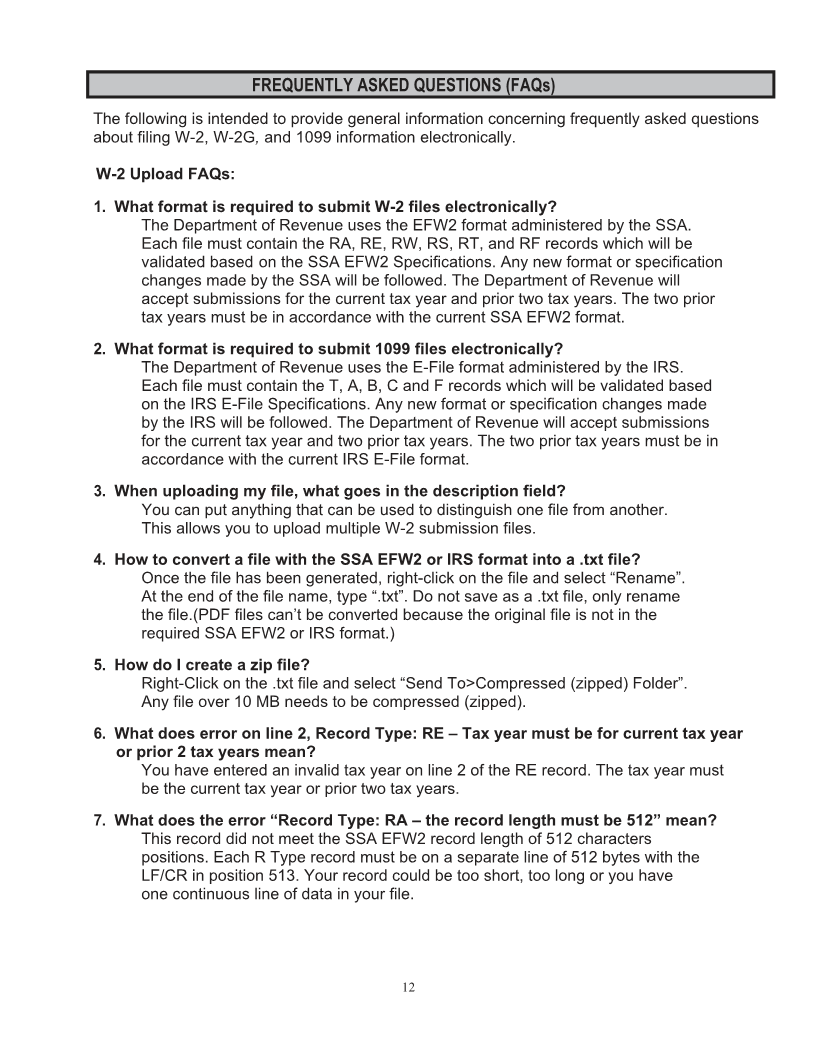

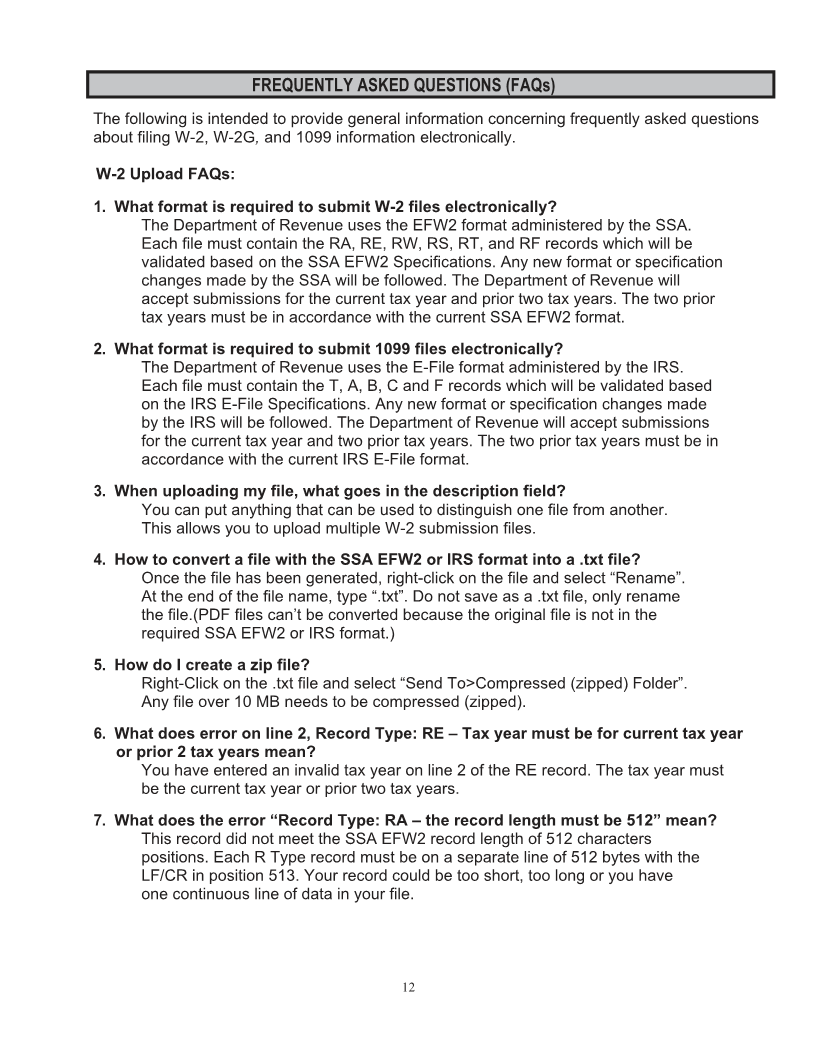

FREQUENTLY ASKED QUESTIONS (FAQs)

The following is intended to provide general information concerning frequently asked questions

about filing W-2, W-2G,and 1099 information electronically.

W-2 Upload FAQs:

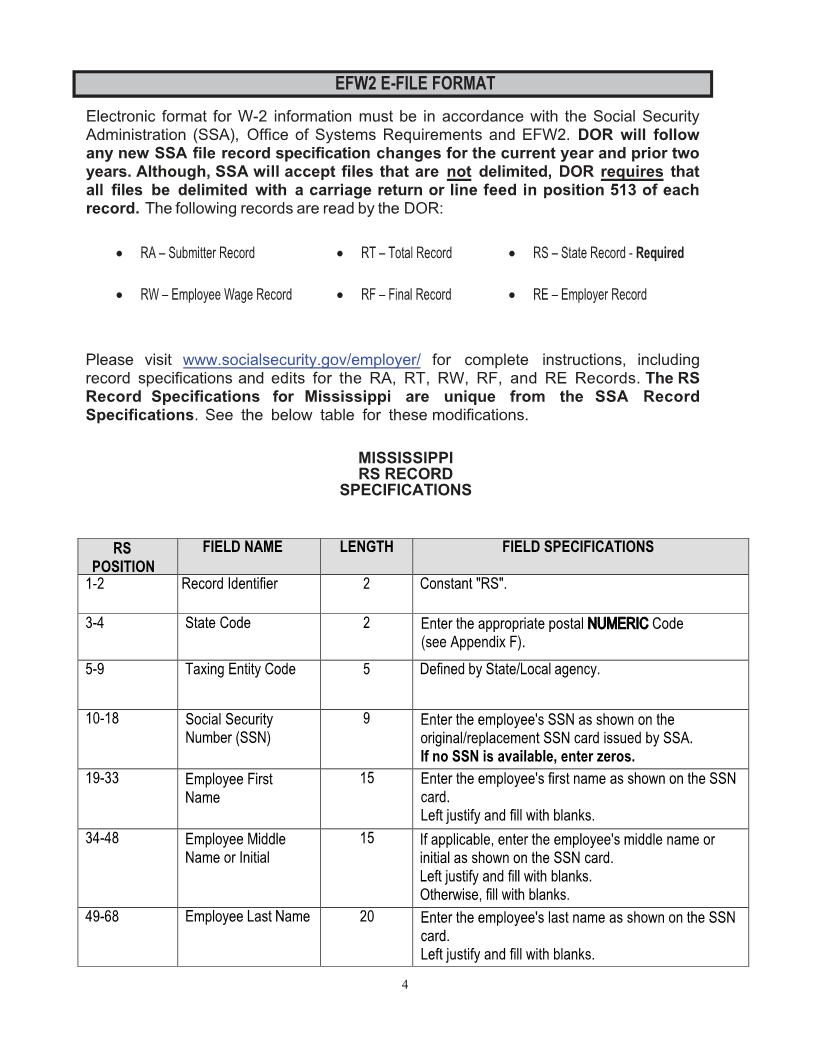

1. What format is required to submit W-2 files electronically?

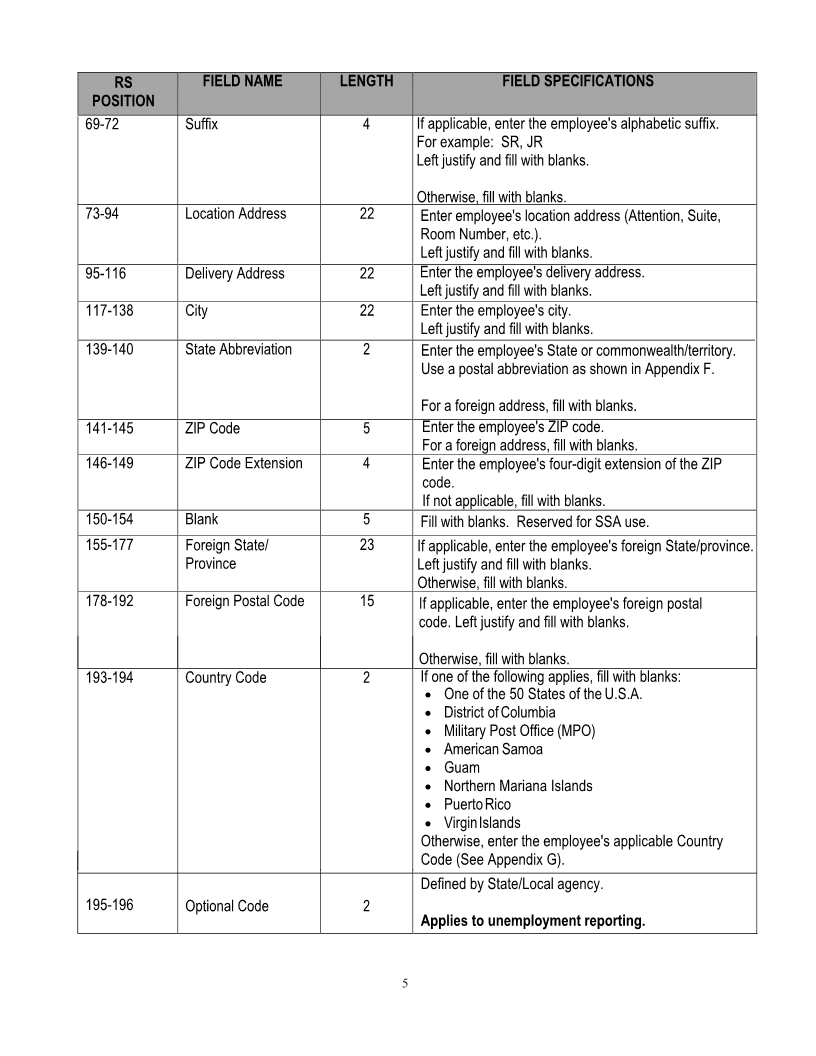

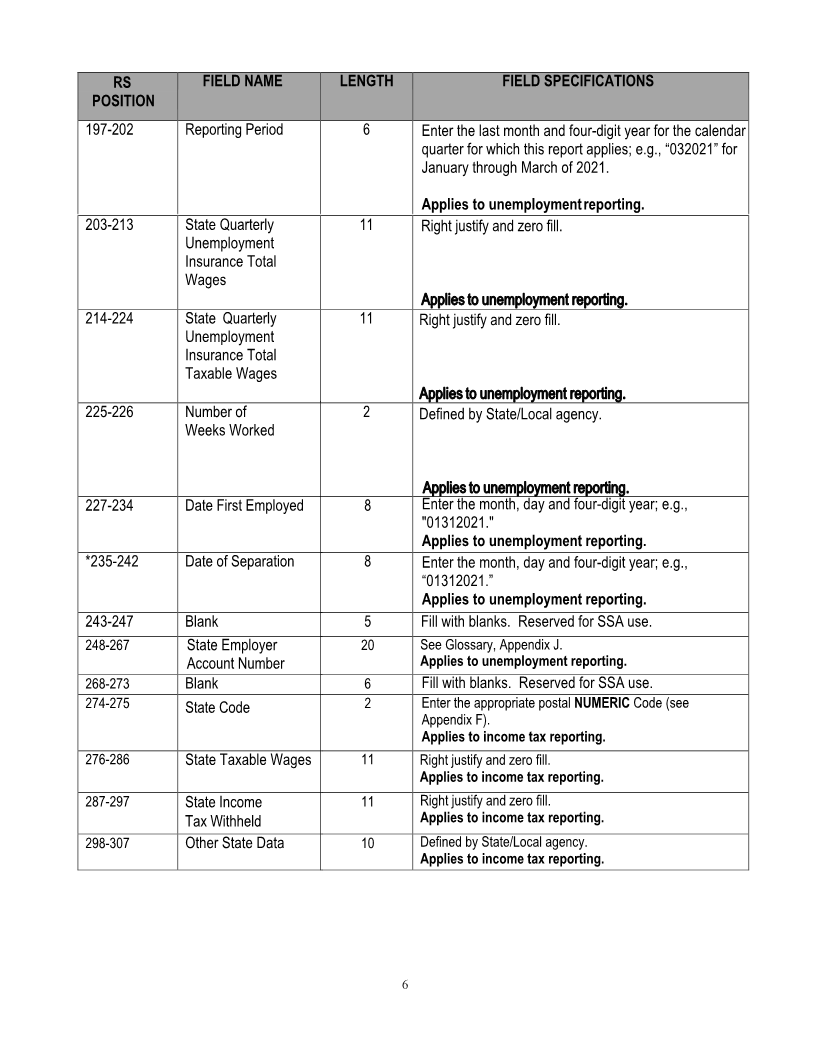

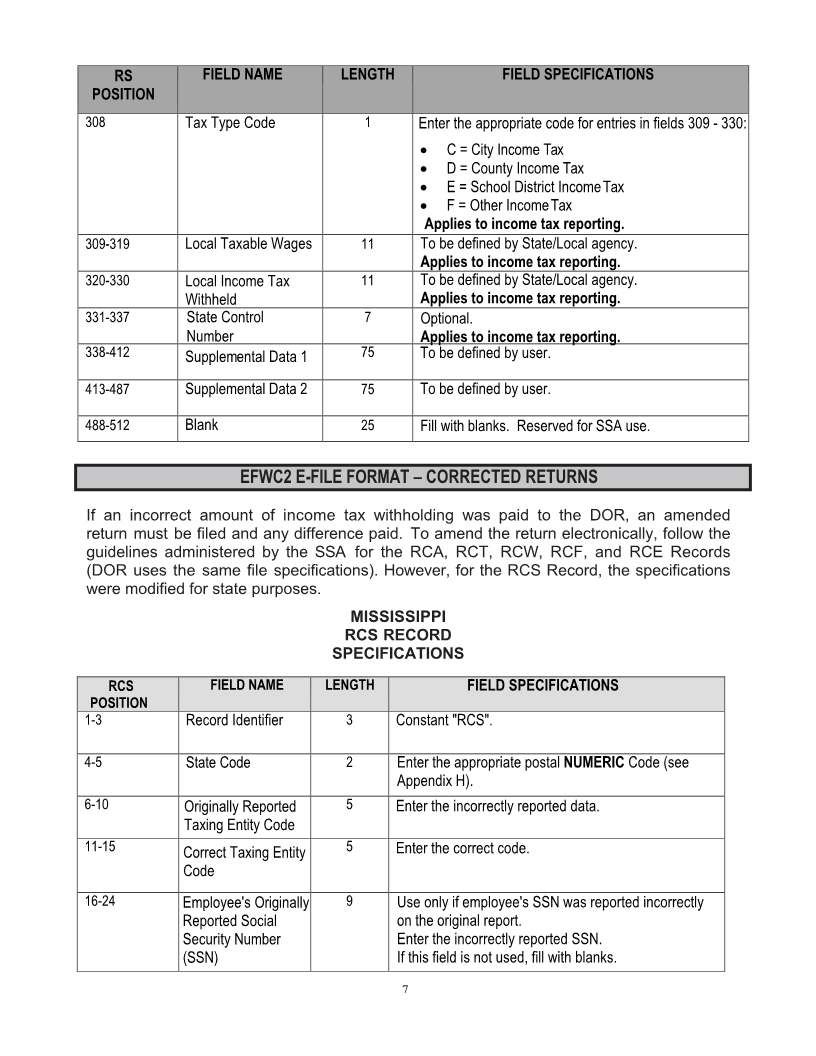

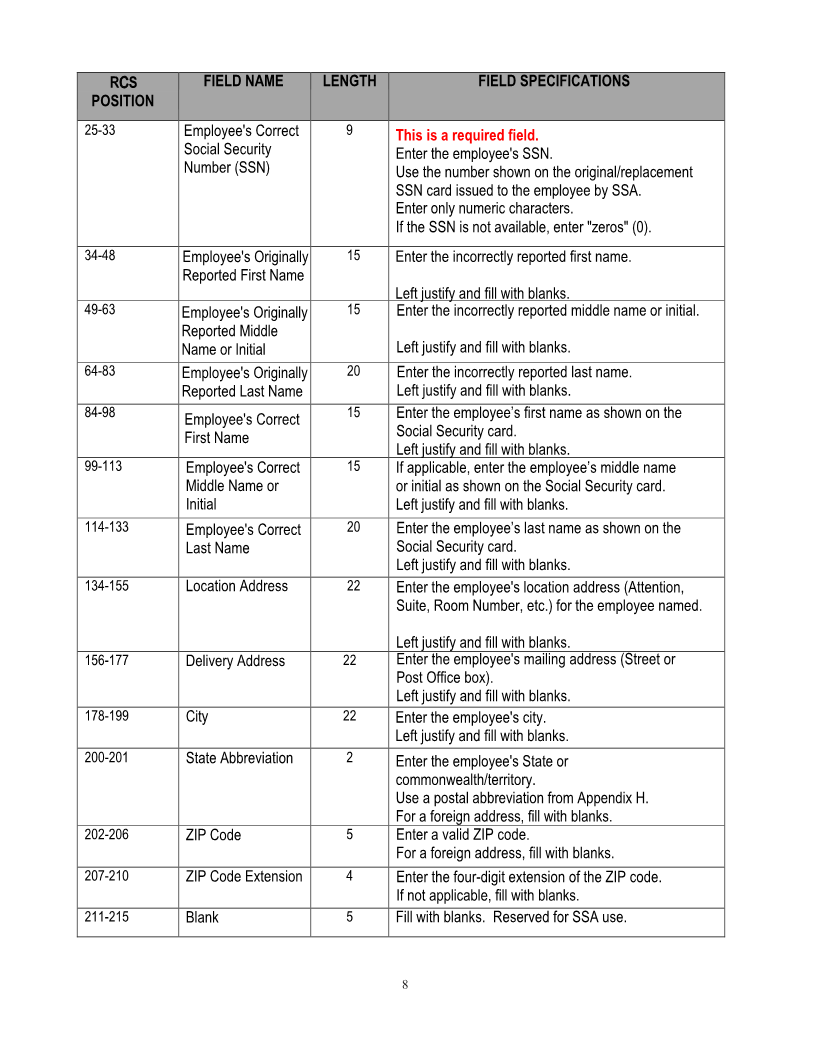

The Department of Revenue uses the EFW2 format administered by the SSA.

Each file must contain the RA, RE, RW, RS, RT, and RF records which will be

validated based on the SSA EFW2 Specifications. Any new format or specification

changes made by the SSA will be followed. The Department of Revenue will

accept submissions for the current tax year and prior two tax years. The two prior

tax years must be in accordance with the current SSA EFW2 format.

2. What format is required to submit 1099 files electronically?

The Department of Revenue uses the E-File format administered by the IRS.

Each file must contain the T, A, B, C and F records which will be validated based

on the IRS E-File Specifications. Any new format or specification changes made

by the IRS will be followed. The Department of Revenue will accept submissions

for the current tax year and two prior tax years. The two prior tax years must be in

accordance with the current IRS E-File format.

3. When uploading my file, what goes in the description field?

You can put anything that can be used to distinguish one file fr m another. o

This allows you to upload multiple W-2 submission files.

4. How to convert a file with the SSA EFW2 or IRS format into a .txt file?

Once the file has been generated, right-click on the file and select “Rename”.

At the end of the file name, type “.txt”. Do not save as a .txt file, only rename

the file.(PDF files can’t be converted because the original file is not in the

required SSA EFW2 or IRS format.)

5. How do I create a zip file?

Right-Click on the .txt file and select “Send To>Compressed (zipped) Folder”.

Any file over 10 MB needs to be compressed (zipped).

6. What does error on line 2, Record Type: RE – Tax year must be for current tax year

or prior 2 tax years mean?

You have entered an invalid tax year on line 2 of the RE record. The tax year must

be the current tax year or prior two tax years.

7. What does the error “Record Type: RA – the record length must be 512” mean?

This record did not meet the SSA EFW2 record length of 512 characters

positions. Each R Type record must be on a separate line of 512 bytes with the

LF/CR in position 513. Your record could be too short, too long or you have

one continuous line of data in your file.

12

|