Enlarge image

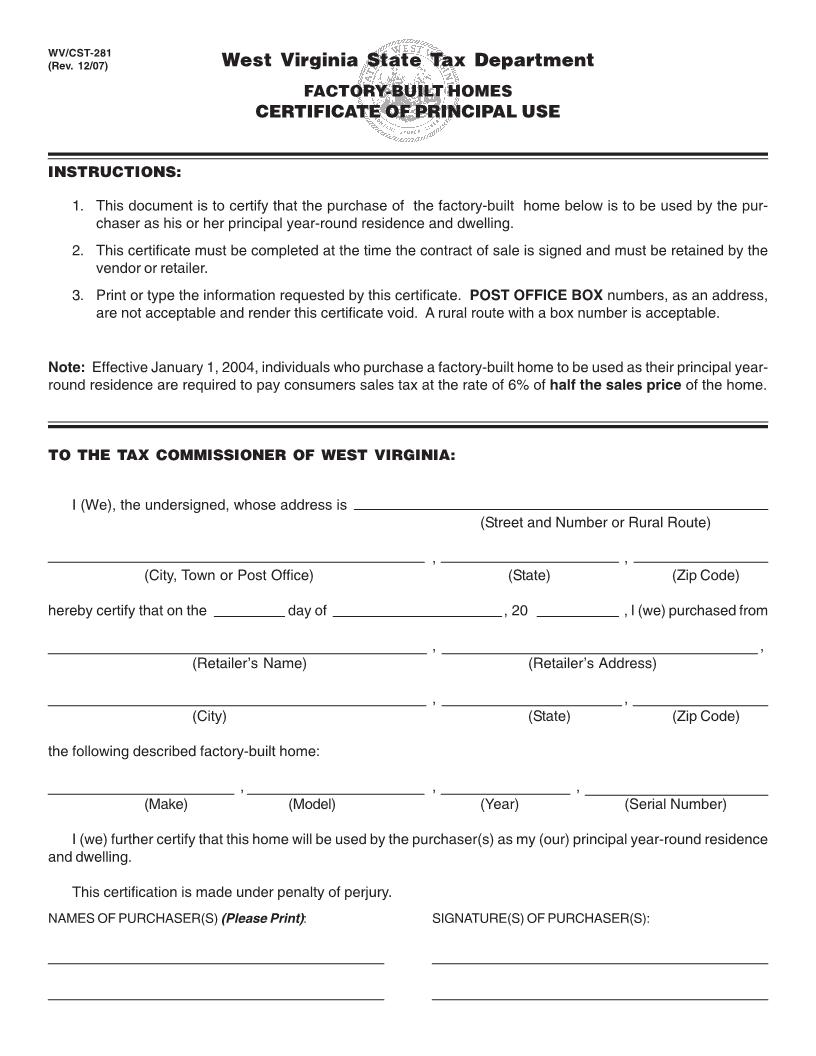

WV/CST-281

(Rev. 12/07) West Virginia State Tax Department

FACTORY-BUILT HOMES

CERTIFICATE OF PRINCIPAL USE

INSTRUCTIONS:

1. This document is to certify that the purchase of the factory-built home below is to be used by the pur-

chaser as his or her principal year-round residence and dwelling.

2. This certificate must be completed at the time the contract of sale is signed and must be retained by the

vendor or retailer.

3. Print or type the information requested by this certificate. POST OFFICE BOX numbers, as an address,

are not acceptable and render this certificate void. A rural route with a box number is acceptable.

Note: Effective January 1, 2004, individuals who purchase a factory-built home to be used as their principal year-

round residence are required to pay consumers sales tax at the rate of 6% of half the sales price of the home.

TO THE TAX COMMISSIONER OF WEST VIRGINIA:

I (We), the undersigned, whose address is

(Street and Number or Rural Route)

,,

(City, Town or Post Office) (State) (Zip Code)

hereby certify that on the day of , 20 , I (we) purchased from

, ,

(Retailer’s Name) (Retailer’s Address)

,,

(City) (State) (Zip Code)

the following described factory-built home:

, , ,

(Make) (Model) (Year) (Serial Number)

I (we) further certify that this home will be used by the purchaser(s) as my (our) principal year-round residence

and dwelling.

This certification is made under penalty of perjury.

NAMES OF PURCHASER(S) (Please Print): SIGNATURE(S) OF PURCHASER(S):