Enlarge image

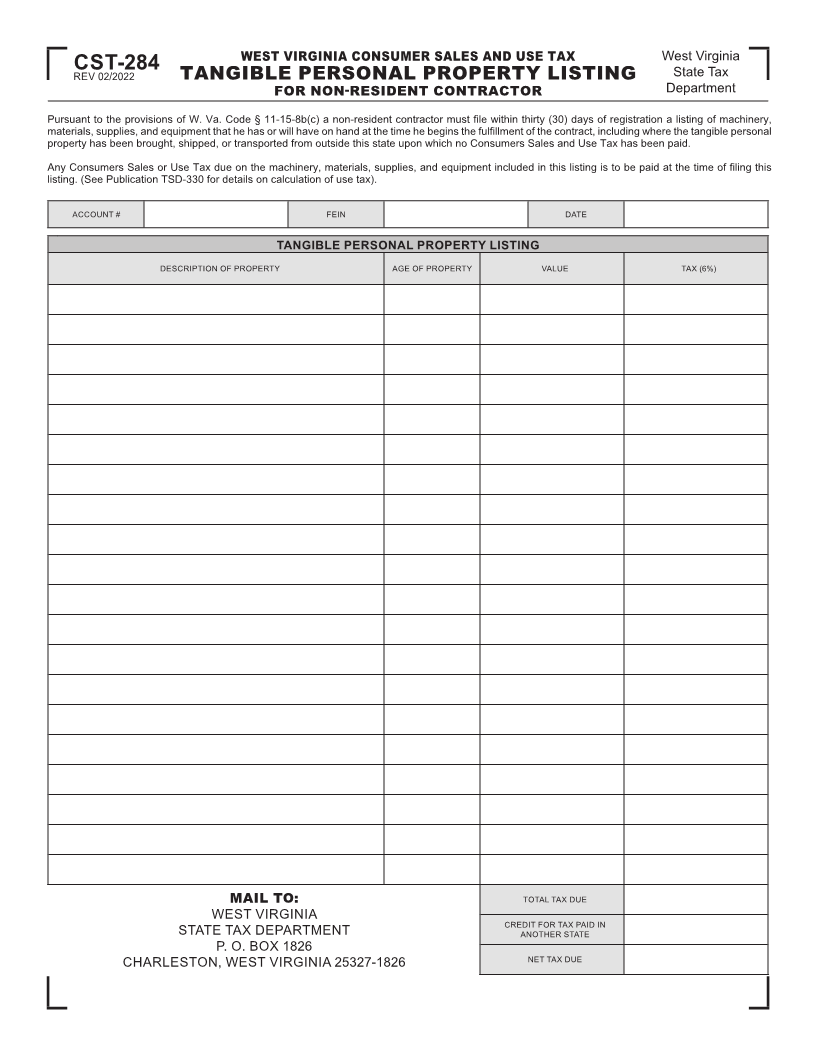

WEST VIRGINIA CONSUMER SALES AND USE TAX West Virginia

CST-284 State Tax

REV 02/2022 TANGIBLE PERSONAL PROPERTY LISTING

FOR NON-RESIDENT CONTRACTOR Department

Pursuant to the provisions of W. Va. Code § 11-15-8b(c) a non-resident contractor must file within thirty (30) days of registration a listing of machinery,

materials, supplies, and equipment that he has or will have on hand at the time he begins the fulfillment of the contract, including where the tangible personal

property has been brought, shipped, or transported from outside this state upon which no Consumers Sales and Use Tax has been paid.

Any Consumers Sales or Use Tax due on the machinery, materials, supplies, and equipment included in this listing is to be paid at the time of filing this

listing. (See Publication TSD-330 for details on calculation of use tax).

ACCOUNT # FEIN DATE

TANGIBLE PERSONAL PROPERTY LISTING

DESCRIPTION OF PROPERTY AGE OF PROPERTY VALUE TAX (6%)

MAIL TO: TOTAL TAX DUE

WEST VIRGINIA

CREDIT FOR TAX PAID IN

STATE TAX DEPARTMENT ANOTHER STATE

P. O. BOX 1826

CHARLESTON, WEST VIRGINIA 25327-1826 NET TAX DUE