Enlarge image

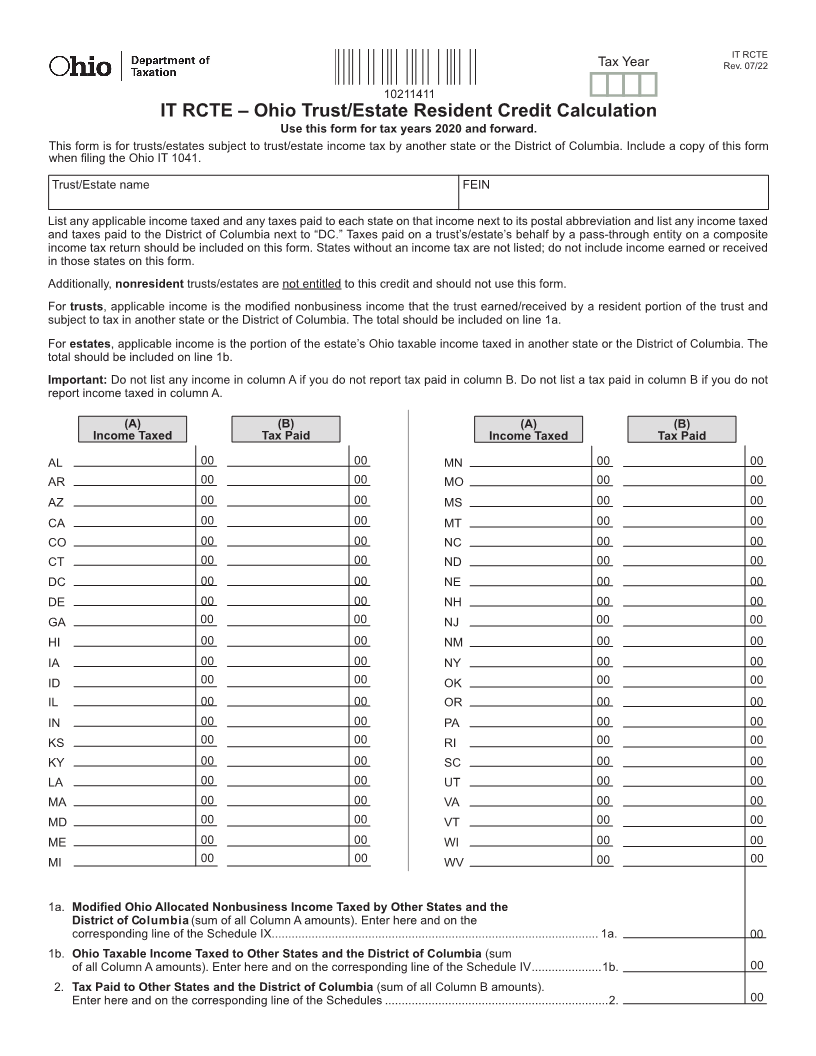

IT RCTE

Tax Year Rev. 07/22

10211411

IT RCTE – Ohio Trust/Estate Resident Credit Calculation

Use this form for tax years 2020 and forward.

This form is for trusts/estates subject to trust/estate income tax by another state or the District of Columbia. Include a copy of this form

when filing the Ohio IT 1041.

Trust/Estate name FEIN

List any applicable income taxed and any taxes paid to each state on that income next to its postal abbreviation and list any income taxed

and taxes paid to the District of Columbia next to “DC.” Taxes paid on a trust’s/estate’s behalf by a pass-through entity on a composite

income tax return should be included on this form. States without an income tax are not listed; do not include income earned or received

in those states on this form.

Additionally, nonresident trusts/estates are not entitled to this credit and should not use this form.

For trusts, applicable income is the modified nonbusiness income that the trust earned/received by a resident portion of the trust and

subject to tax in another state or the District of Columbia. The total should be included on line 1a.

For estates, applicable income is the portion of the estate’s Ohio taxable income taxed in another state or the District of Columbia. The

total should be included on line 1b.

Important: Do not list any income in column A if you do not report tax paid in column B. Do not list a tax paid in column B if you do not

report income taxed in column A.

(A) (B) (A) (B)

Income Taxed Tax Paid Income Taxed Tax Paid

AL 00 00 MN 00 00

AR 00 00 MO 00 00

AZ 00 00 MS 00 00

CA 00 00 MT 00 00

CO 00 00 NC 00 00

CT 00 00 ND 00 00

DC 00 00 NE 00 00

DE 00 00 NH 00 00

GA 00 00 NJ 00 00

HI 00 00 NM 00 00

IA 00 00 NY 00 00

ID 00 00 OK 00 00

IL 00 00 OR 00 00

IN 00 00 PA 00 00

KS 00 00 RI 00 00

KY 00 00 SC 00 00

LA 00 00 UT 00 00

MA 00 00 VA 00 00

MD 00 00 VT 00 00

ME 00 00 WI 00 00

MI 00 00 WV 00 00

1a. Modified Ohio Allocated Nonbusiness Income Taxed by Other States and the

District of Co l u m b i a (sum of all Column A amounts). Enter here and on the

corresponding line of the Schedule IX.................................................................................................. 1a. 00

1b. Ohio Taxable Income Taxed to Other States and the District of Columbia (sum

of all Column A amounts). Enter here and on the corresponding line of the Schedule IV .....................1b. 00

2. Tax Paid to Other States and the District of Columbia (sum of all Column B amounts).

Enter here and on the corresponding line of the Schedules ...................................................................2. 00