Enlarge image

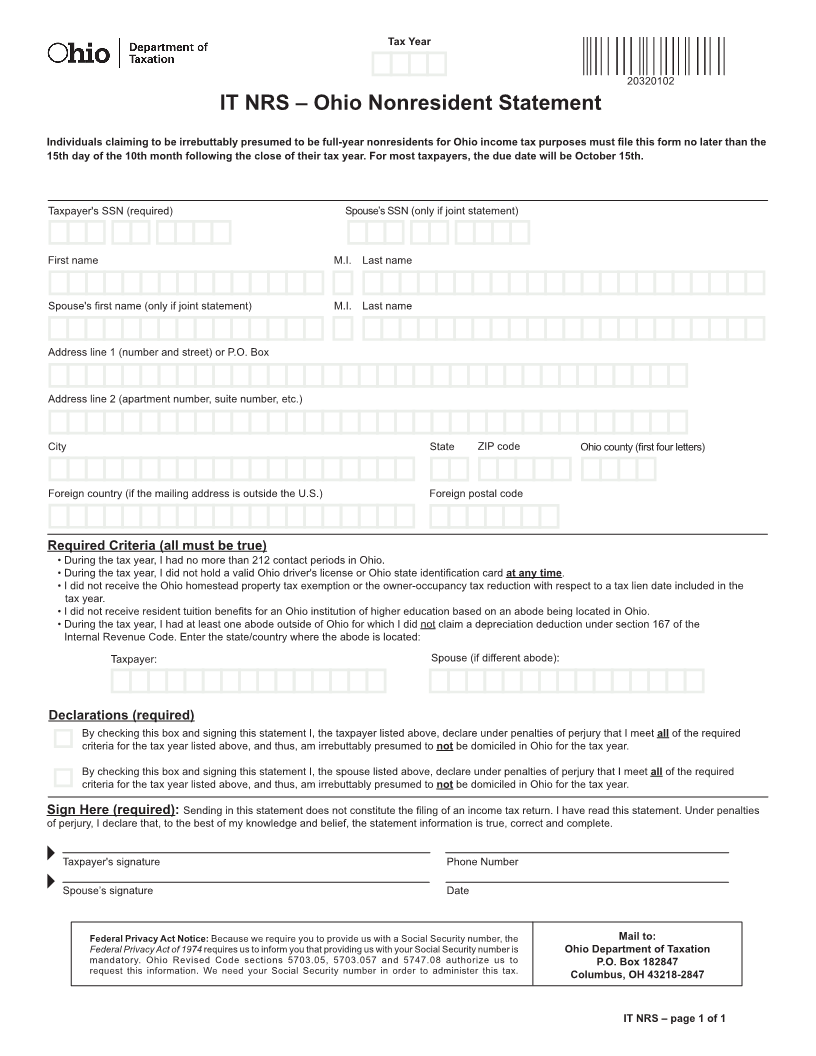

Tax Year

20320102

IT NRS – Ohio Nonresident Statement

Individuals claiming to be irrebuttably presumed to be full-year nonresidents for Ohio income tax purposes must file this form no later than the

15th day of the 10th month following the close of their tax year. For most taxpayers, the due date will be October 15th.

Taxpayer's SSN (required) Spouse’s SSN (only if joint statement)

First name M.I. Last name

Spouse's first name (only if joint statement) M.I. Last name

Address line 1 (number and street) or P.O. Box

Address line 2 (apartment number, suite number, etc.)

City State ZIP code Ohio county (first four letters)

Foreign country (if the mailing address is outside the U.S.) Foreign postal code

Required Criteria (all must be true)

• During the tax year, I had no more than 212 contact periods in Ohio.

• During the tax year, I did not hold a valid Ohio driver's license or Ohio state identification card at any time.

• I did not receive the Ohio homestead property tax exemption or the owner-occupancy tax reduction with respect to a tax lien date included in the

tax year.

• I did not receive resident tuition benefits for an Ohio institution of higher education based on an abode being located in Ohio.

• During the tax year, I had at least one abode outside of Ohio for which I did not claim a depreciation deduction under section 167 of the

Internal Revenue Code. Enter the state/country where the abode is located:

Taxpayer: Spouse (if different abode):

Declarations (required)

By checking this box and signing this statement I, the taxpayer listed above, declare under penalties of perjury that I meet all of the required

criteria for the tax year listed above, and thus, am irrebuttably presumed to not be domiciled in Ohio for the tax year.

By checking this box and signing this statement I, the spouse listed above, declare under penalties of perjury that I meet all of the required

criteria for the tax year listed above, and thus, am irrebuttably presumed to not be domiciled in Ohio for the tax year.

Sign Here (required): Sending in this statement does not constitute the filing of an income tax return. I have read this statement. Under penalties

of perjury, I declare that, to the best of my knowledge and belief, the statement information is true, correct and complete.

Taxpayer's signature Phone Number

Spouse’s signature Date

Federal Privacy Act Notice: Because we require you to provide us with a Social Security number, the Mail to:

Federal Privacy Act of 1974 requires us to inform you that providing us with your Social Security number is Ohio Department of Taxation

mandatory. Ohio Revised Code sections 5703.05, 5703.057 and 5747.08 authorize us to P.O. Box 182847

request this information. We need your Social Security number in order to administer this tax. Columbus, OH 43218-2847

IT NRS – page 1 of 1