Enlarge image

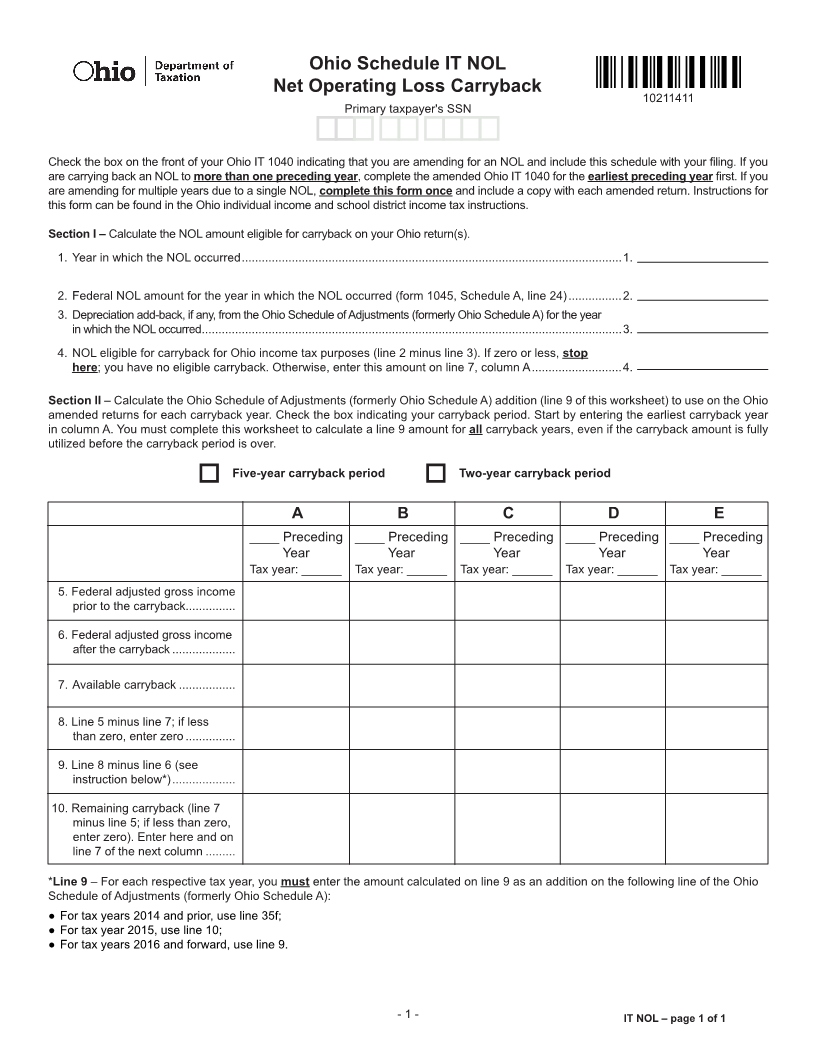

Ohio Schedule IT NOL

Net Operating Loss Carryback

10211411

Primary taxpayer's SSN

Check the box on the front of your Ohio IT 1040 indicating that you are amending for an NOL and include this schedule with your filing. If you

are carrying back an NOL to more than one preceding year, complete the amended Ohio IT 1040 for the earliest preceding year first. If you

are amending for multiple years due to a single NOL, complete this form once and include a copy with each amended return. Instructions for

this form can be found in the Ohio individual income and school district income tax instructions.

Section I – Calculate the NOL amount eligible for carryback on your Ohio return(s).

1. Year in which the NOL occurred ..................................................................................................................1.

2. Federal NOL amount for the year in which the NOL occurred (form 1045, Schedule A, line 24) ................2.

3. Depreciation add-back, if any, from the Ohio Schedule of Adjustments (formerly Ohio Schedule A) for the year

in which the NOL occurred ..............................................................................................................................3.

4. NOL eligible for carryback for Ohio income tax purposes (line 2 minus line 3). If zero or less, stop

here; you have no eligible carryback. Otherwise, enter this amount on line 7, column A ...........................4.

Section II – Calculate the Ohio Schedule of Adjustments (formerly Ohio Schedule A) addition (line 9 of this worksheet) to use on the Ohio

amended returns for each carryback year. Check the box indicating your carryback period. Start by entering the earliest carryback year

in column A. You must complete this worksheet to calculate a line 9 amount for all carryback years, even if the carryback amount is fully

utilized before the carryback period is over.

Five-year carryback period Two-year carryback period

A B C D E

____ Preceding ____ Preceding ____ Preceding ____ Preceding ____ Preceding

Year Year Year Year Year

Tax year: ______ Tax year: ______ Tax year: ______ Tax year: ______ Tax year: ______

5. Federal adjusted gross income

prior to the carryback...............

6. Federal adjusted gross income

after the carryback ...................

7. Available carryback .................

8. Line 5 minus line 7; if less

than zero, enter zero ...............

9. Line 8 minus line 6 (see

instruction below*) ...................

10. Remaining carryback (line 7

minus line 5; if less than zero,

enter zero). Enter here and on

line 7 of the next column .........

*Line 9 – For each respective tax year, you must enter the amount calculated on line 9 as an addition on the following line of the Ohio

Schedule of Adjustments (formerly Ohio Schedule A):

● For tax years 2014 and prior, use line 35f;

● For tax year 2015, use line 10;

● For tax years 2016 and forward, use line 9.

- 1 - IT NOL – page 1 of 1