- 12 -

Enlarge image

|

IT 4738

Rev. 1/23

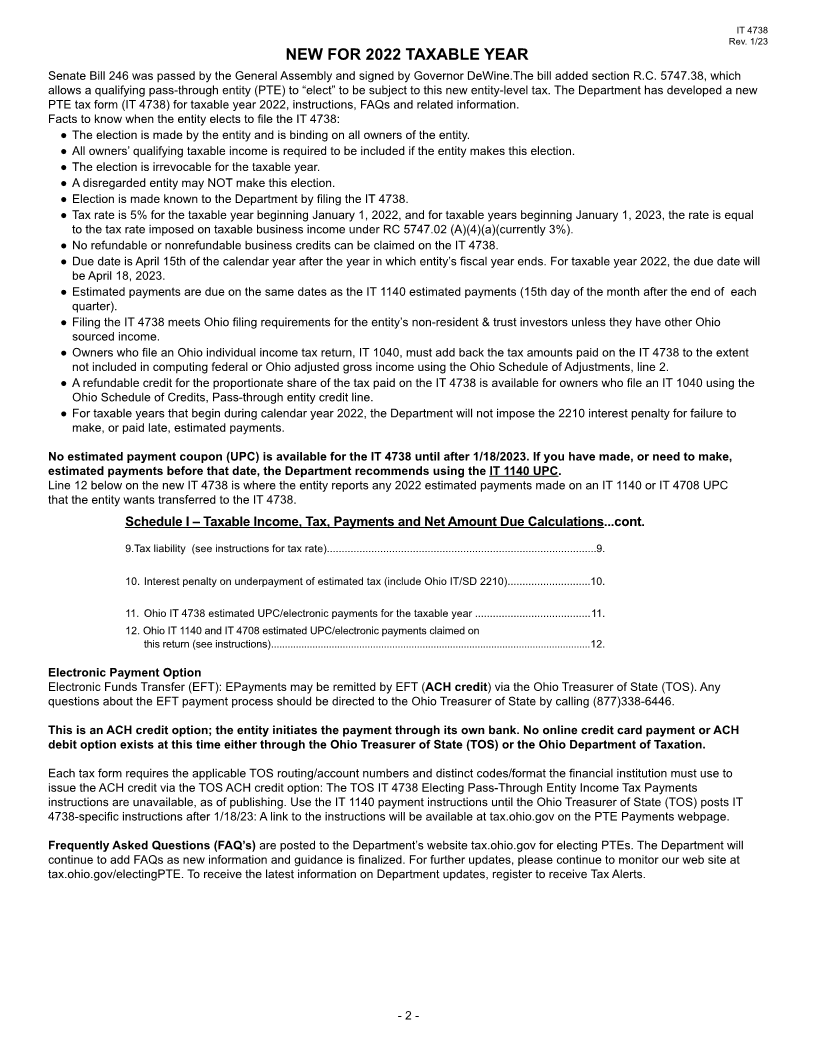

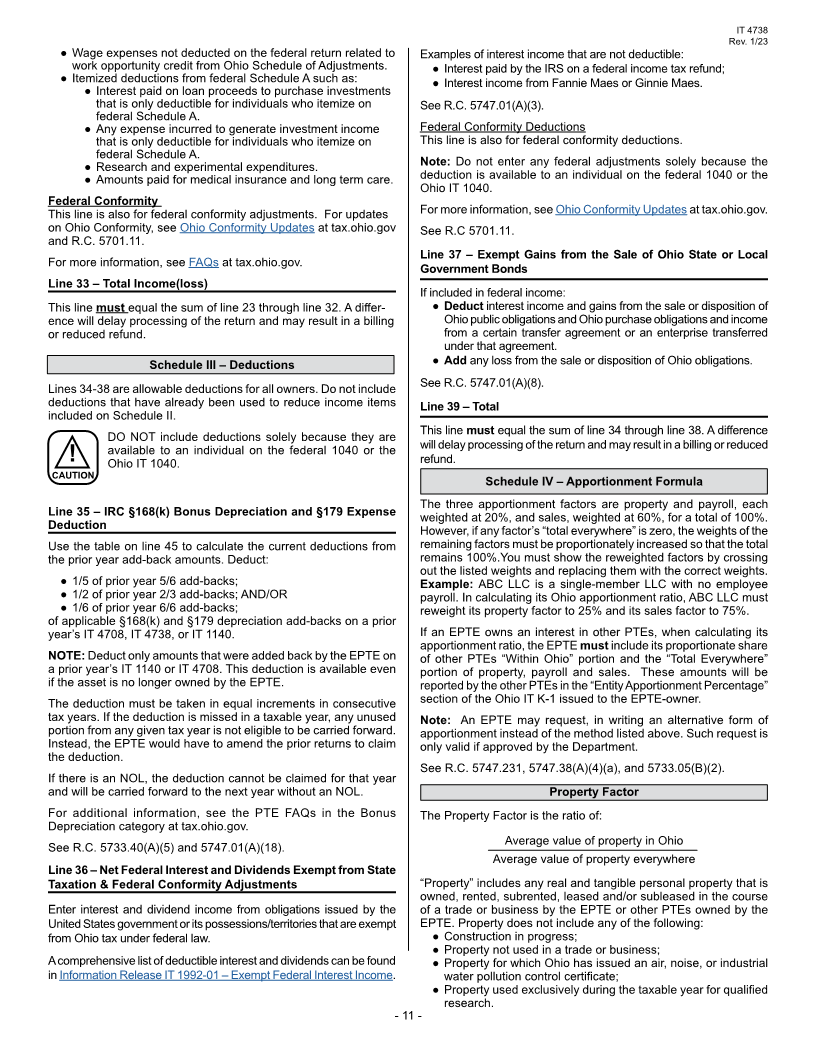

Line 26 and 27 – Guaranteed Payments and Compensation Example 1: EPTE A has total of $180,000 subject to add-back for

the current tax year. The $100,000 of §179 depreciation is from

Enter compensation or guaranteed payments the EPTE paid, or a EPTE A’s business operations. The $80,000 of §168(k) depreciation

professional employer organization (PEO) paid on behalf of the is from its distributive share of bonus expense from EPTE B.

EPTE, to an owner who directly or indirectly owns at least 20%

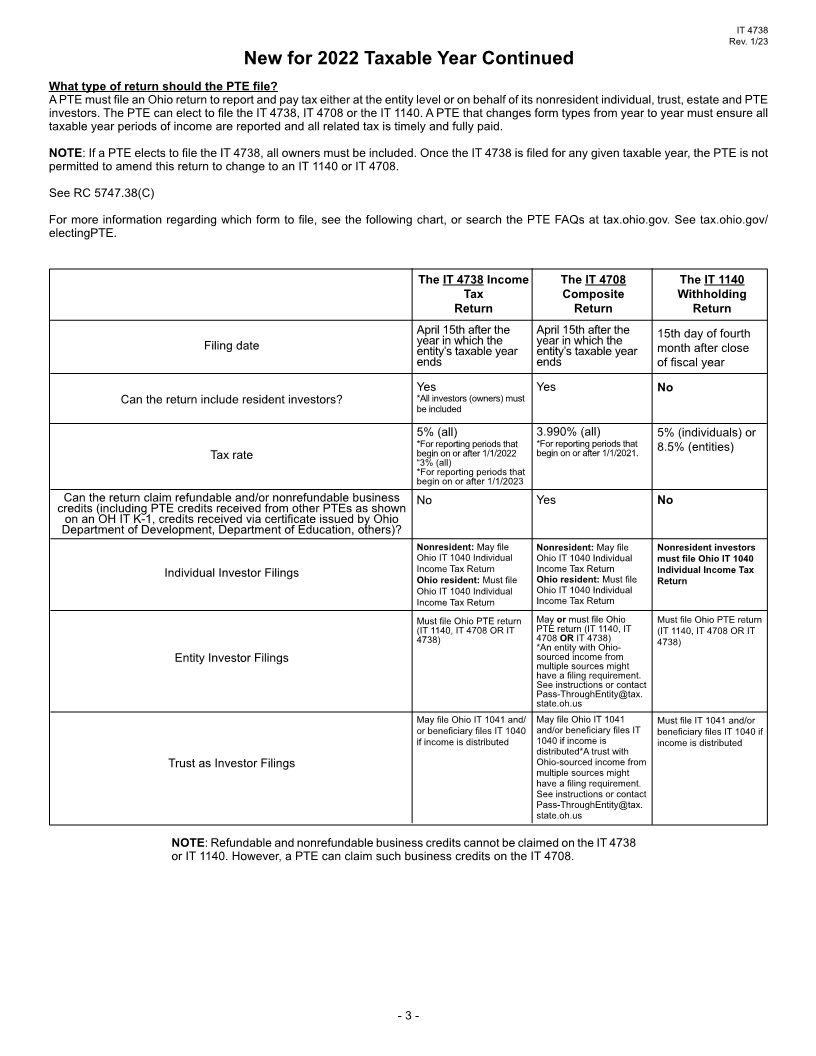

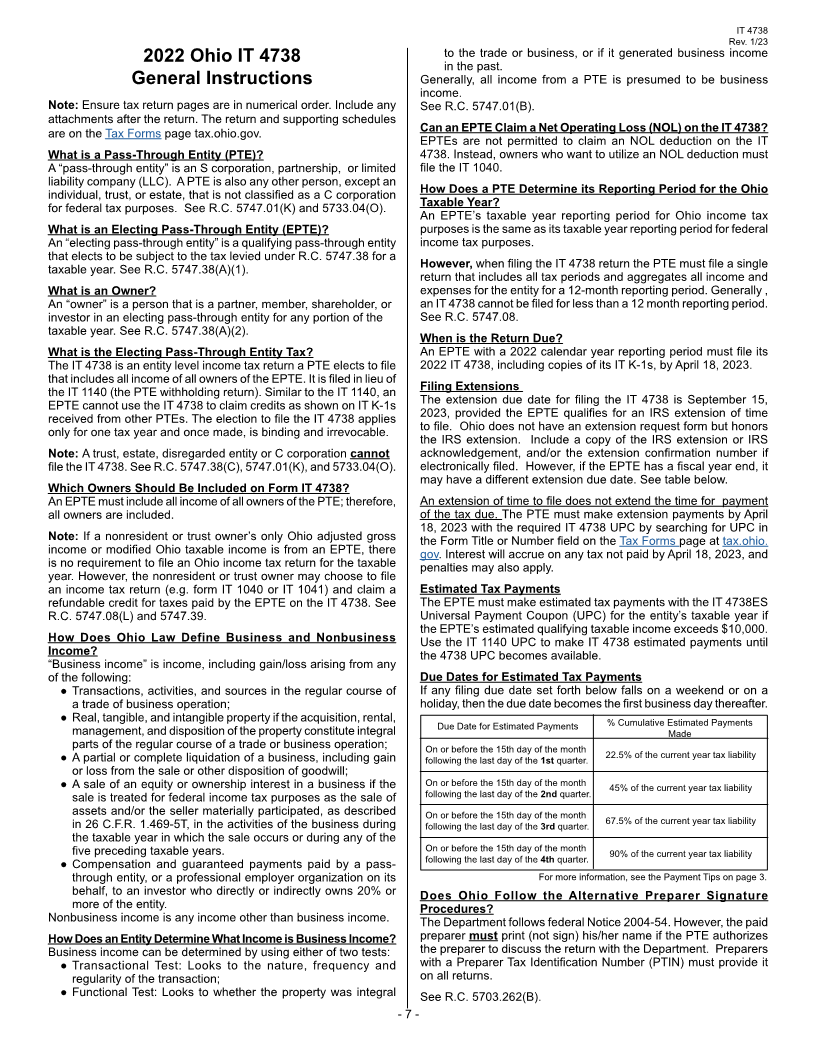

of the profits or capital of the EPTE at any point during the tax Source of Add-back Amount §168(k) Add-back Add-back

year. These amounts are reclassified from guaranteed payments/ Depreciation (§179-$25,000) Ratio Amount

compensation to a distributive share of income. EPTE A - $100,000 $0 5/6 $83,333

operations

Note: Agreements that Ohio has with Kentucky, West Virginia, EPTE B-

Pennsylvania, Michigan, and Indiana relating to the taxation of distributive share/ $80,000 5/6 $66,667

bonus expense

compensation do not apply. Compensation paid to a 20% or more Total add-back $100,000 $80,000 $150,000

owner must be included on this line. for tax year:

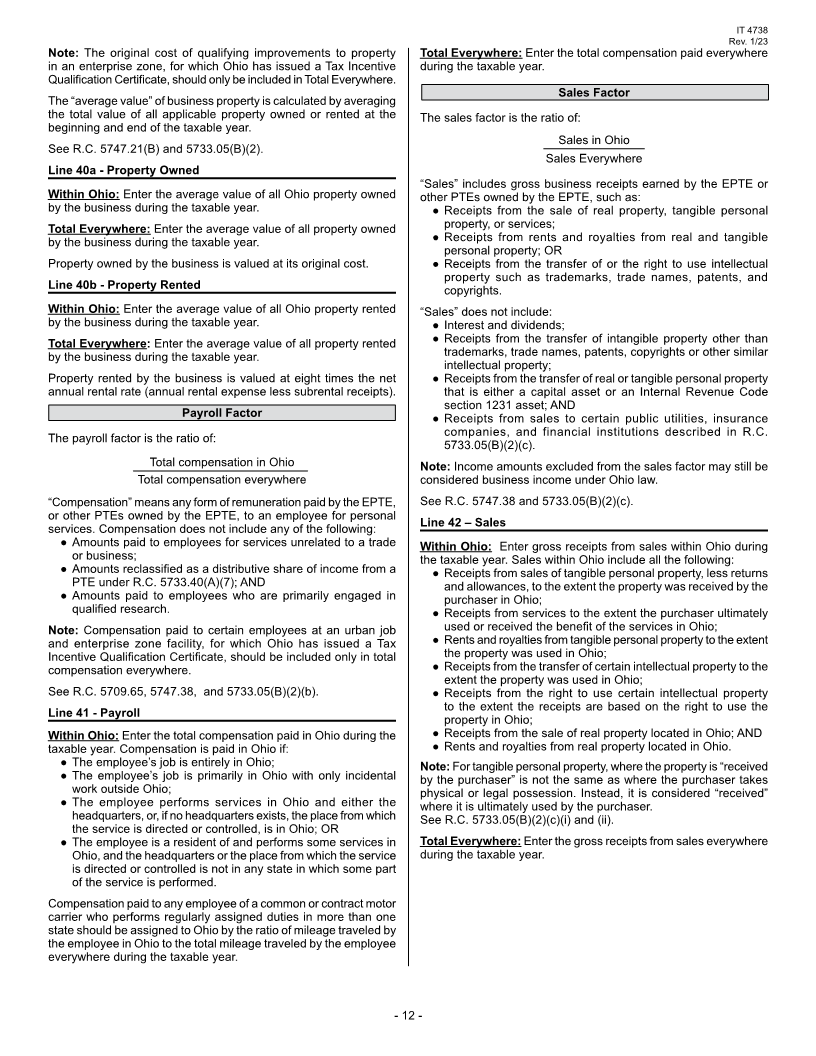

Example 1: Jim is a Kentucky resident who owns 30% of EPTE A. Example 2: EPTE A owns 100% of EPTE B. EPTE A has

He provides services for EPTE A in Kentucky and is paid a wage for $180,000 subject to add-back for the current tax year. EPTE B

his services. Since Jim owns at least 20% of EPTE A, his wages

are reclassified as a distributive share of income. Thus, the wages increased its Ohio employer withholding for its employees by at

are required to be included on EPTE A’s return as a related member least 10% over the previous tax year. EPTE A must use a differ-

add-back, even though Jim is a Kentucky resident. ent add-back ratio for each source of depreciation, and calculates

its depreciation add-back as follows:

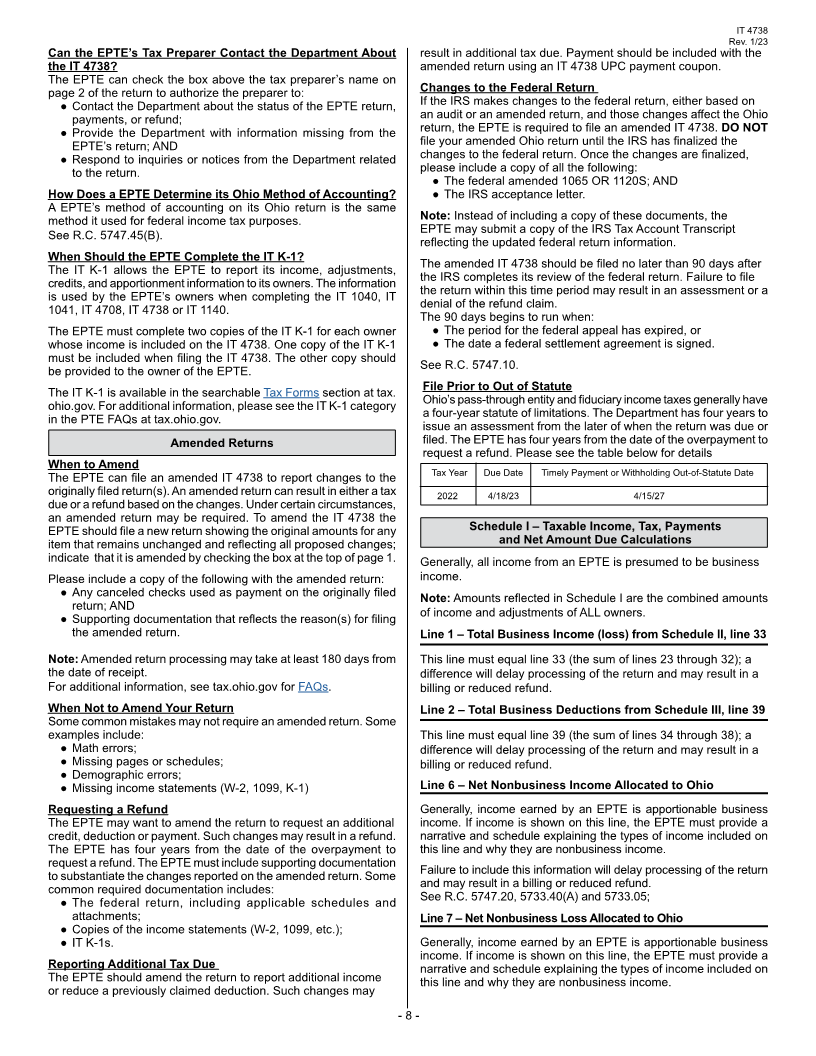

Example 2: Karen is an Iowa resident who owns 19% of EPTE A. Add-Back - Combined add-back

Karen receives wages from EPTE A. However, since Karen does Source of Add-back Amount §168(k) Add-back Add-back

not own at least 20% of EPTE A, her wages are not reclassified as Depreciation (§179-$25,000) Ratio Amount

a distributive share of income or added back onto the return as a EPTE A - $100,000 $0 5/6 $83,333

related member add-back. operations

See R.C. 5733.40(A)(7). EPTE B-

distributive share/ $0 $80,000 2/3 $53,333

bonus expense

Line 28 - Portfolio Income(loss) a. - e.

Total add-back

List the amount of each type of portfolio income (or loss) on each for tax year: $100,000 $80,000 $136,666

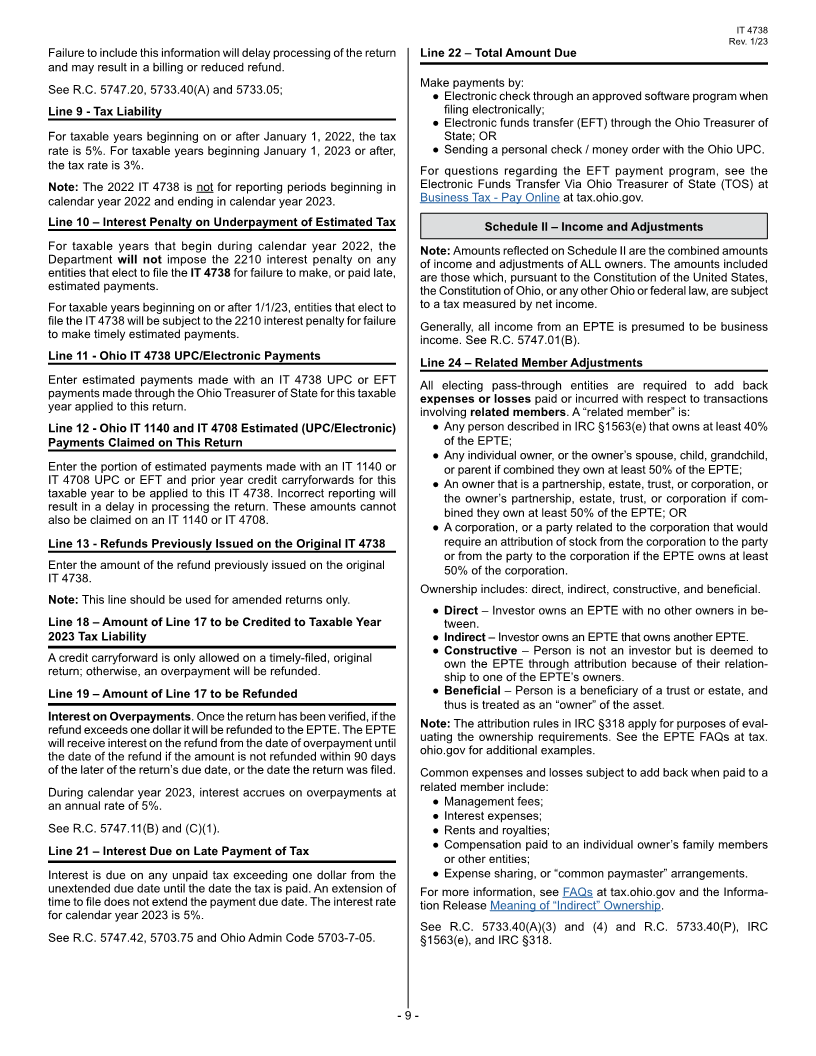

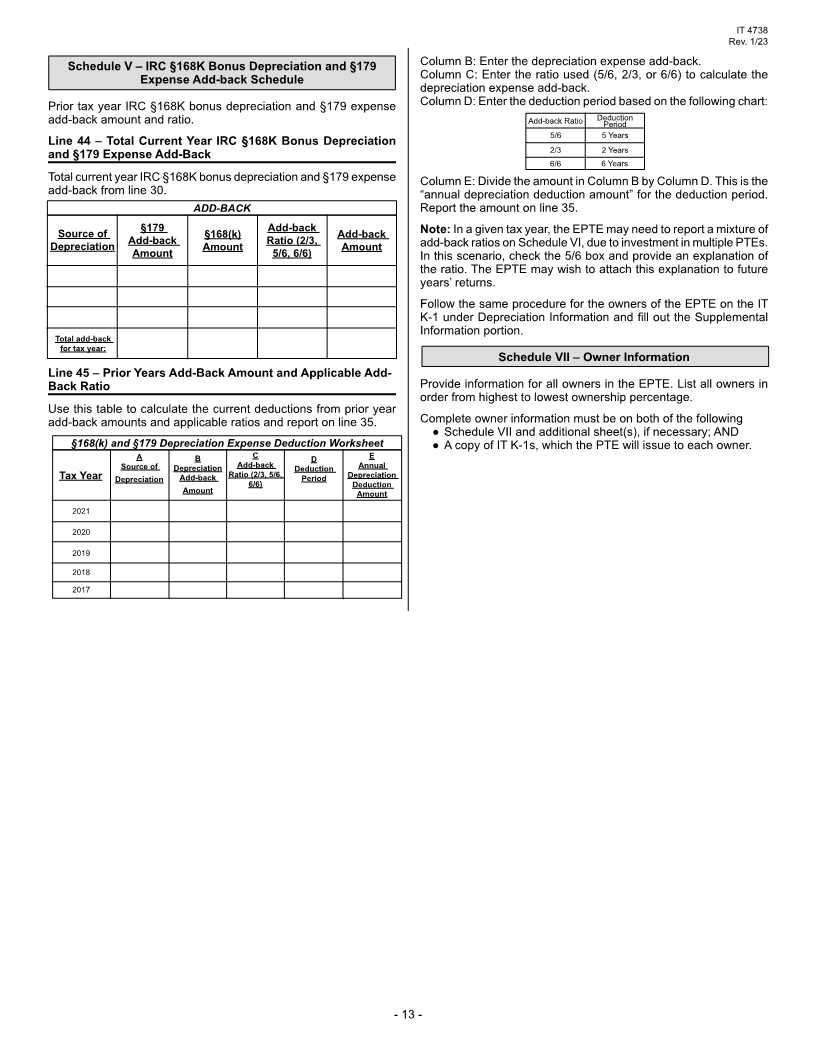

line. Example 3: EPTE A still has $180,000 subject to add-back for

NOTE: If the sum of lines 28d and 28e (capital gains/losses) is the current tax year, but its federal taxable income is ($100,000)

an overall loss, the amount on line 28e is limited to $3,000 per (i.e. EPTE A has a federal NOL). EPTE A would calculate its

participating owner. depreciation add-back as follows:

Add-Back - NOL

Line 30 – IRC §168(k) Bonus Depreciation and §179 Expense Source of Add-back Amount §168(k) Add-back Add-back

Add-Back and Schedule VI, Line 39 Depreciation (§179-$25,000) Ratio Amount

EPTE A - $100,000

Check the box for the appropriate add-back ratio. operations $0 6/6 $100,000

EPTE B-

Add 5/6 of IRC §168(k) bonus depreciation allowed under the IRC. distributive share/ $0 $80,000 6/6 $80,000

Also, add 5/6 of any qualifying §179 depreciation expense. bonus expense

Total add-back

However: for tax year: $100,000 $80,000 $180,000

● Replace “5/6” with “2/3” for employers who increase their Ohio

income taxes withholding by an amount equal to or greater than Put the total year add-back amount on line 44 of Schedule VI.

10 percent over the previous year; OR For additional information, please see the FAQs and R.C.

● Replace “5/6” with “6/6” for taxpayers who incur a net operating 5733.40(A)(5) and 5747.01(A)(17)(a)(i-v).

loss (NOL) for federal income tax purposes if the loss was a Line 31 – Other Income or Deduction and Federal Conformity

direct/indirect result of the §168(k) and/or §179 depreciation Additions

expenses.

Enter income or deductions not otherwise reported on Schedule

If the amount of qualifying IRC §179 depreciation expense is II that are part of an investor’s distributive share from the EPTE.

greater than $200,000, the $25,000 deduction is reduced dollar for Include a supporting schedule detailing each amount reported

dollar by any amount over $200,000, per the IRC as it existed as on this line, as well as an explanation of why each amount is

of December 31, 2002. included on this line. Failure to provide this information may delay

Using the following lines from federal form 4562, the add-back the processing of the return.

formula is (line 12 - $25,000) + line 14 + line 25. The sum of these The following generally can be included on this line:

lines is multiplied by the appropriate ratio. ● Section 59(e)(2) – depletion amortized on federal Schedule

Additionally, there is no requirement to make Ohio’s depreciation E; include federal form 4562.

add-back in either of the following circumstances: ● Deductions allocable to royalties appearing on federal

● The depreciation is from an EPTE, and the owner owns less Schedule E.

● §754 election – § 754 election is made to adjust the basis

than 5% of the EPTE. This is true even if the EPTE performed of partnership property in the event of a sale or exchange of

the add-back on its Ohio filing (i.e. the IT 1140 or IT 4708); OR partnership interest, a partner’s death, or certain distributions

● An EPTE that increases its Ohio income taxes withheld over to partners.

the previous year’s by an amountgreater than or equal to the ● §743(b) – 743(b) provides certain adjustments in the case of

sum of §168(k) and/or §179 depreciation amounts. a sale or exchange of a partnership interest in which a §754

election is in place.

The following generally cannot be included on this line:

● Charitable contributions.

● Any state or federal credit amount, including the research

and development tax credit and the work opportunity credit.

- 10 -

|