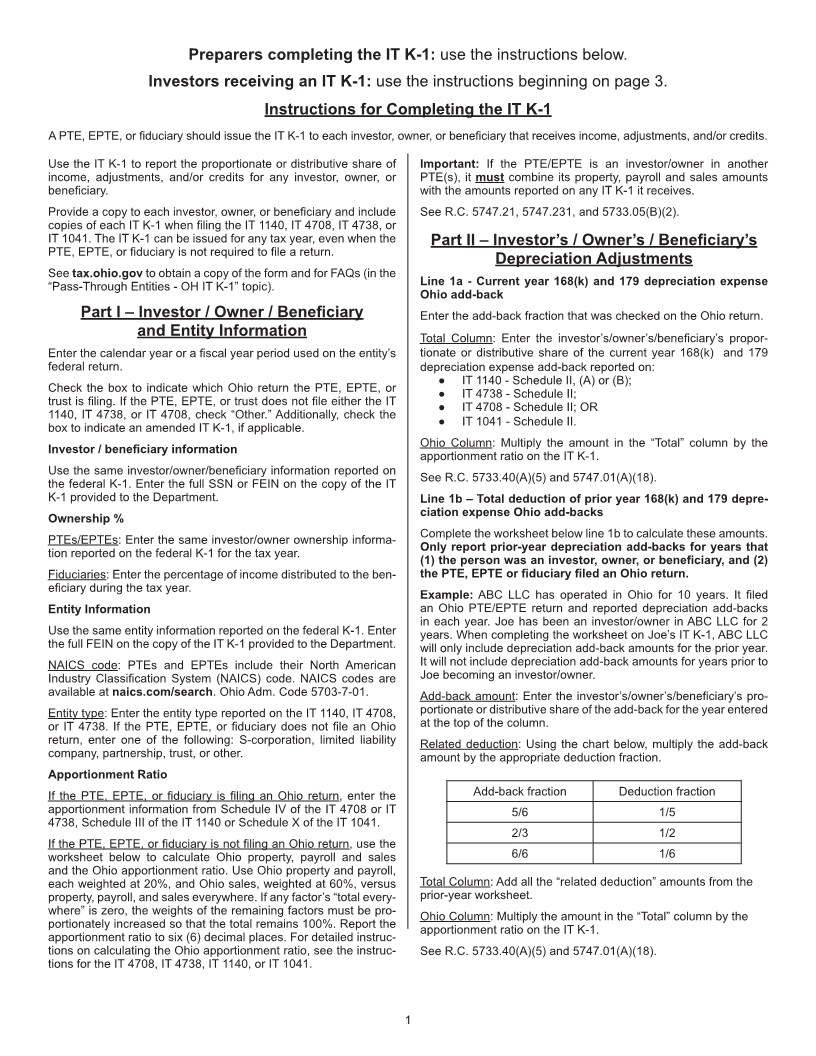

Enlarge image

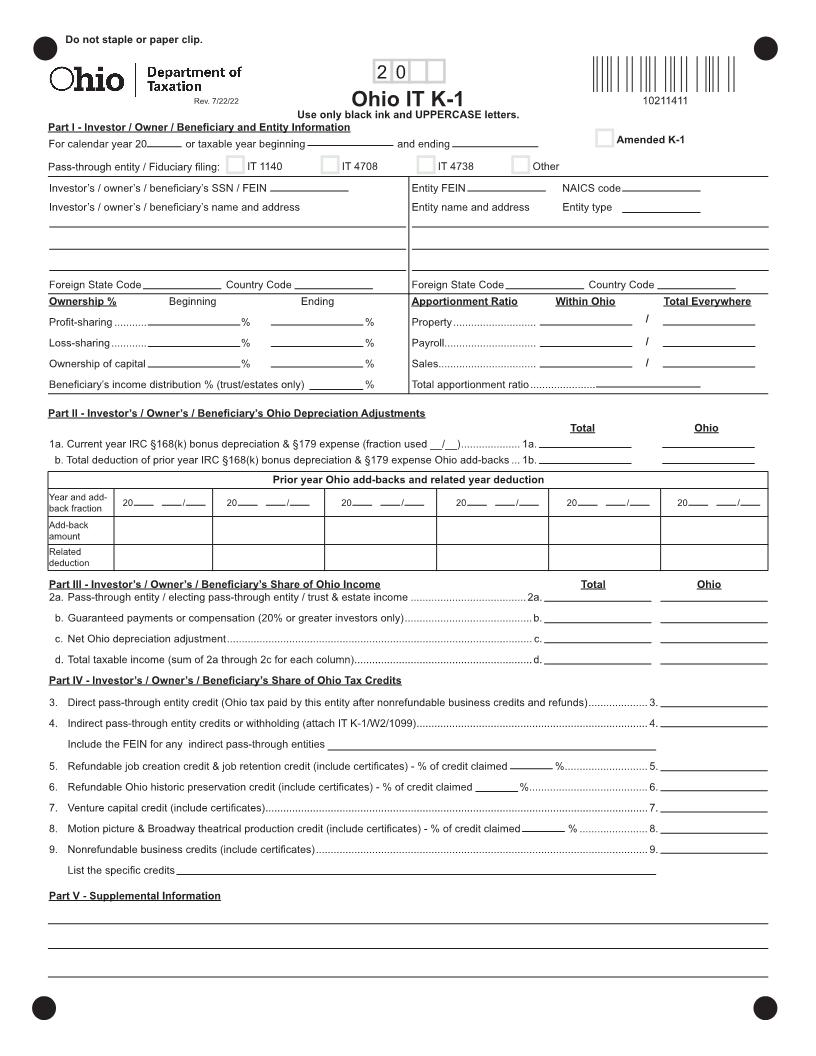

Do not staple or paper clip.

2 0

Rev. 7/22/22

Ohio IT K-1 10211411

Use only black ink and UPPERCASE letters.

Part I - Investor / Owner / Beneficiary and Entity Information

For calendar year 20 or taxable year beginning and ending Amended K-1

Pass-through entity / Fiduciary filing: IT 1140 IT 4708 IT 4738 Other

Investor’s / owner’s / beneficiary’s SSN / FEIN Entity FEIN NAICS code

Investor’s / owner’s / beneficiary’s name and address Entity name and address Entity type

Foreign State Code Country Code Foreign State Code Country Code

Ownership % Beginning Ending Apportionment Ratio Within Ohio Total Everywhere

Profit-sharing ........... % % Property ............................ /

Loss-sharing ............ % % Payroll............................... /

Ownership of capital % % Sales................................. /

Beneficiary’s income distribution % (trust/estates only) % Total apportionment ratio ......................

Part II - Investor’s / Owner’s / Beneficiary’s Ohio Depreciation Adjustments

Total Ohio

1a. Current year IRC §168(k) bonus depreciation & §179 expense (fraction used __/__) .................... 1a.

b. Total deduction of prior year IRC §168(k) bonus depreciation & §179 expense Ohio add-backs ... 1b.

Prior year Ohio add-backs and related year deduction

Year and add- 20 / 20 / 20 / 20 / 20 / 20 /

back fraction

Add-back

amount

Related

deduction

Part III - Investor’s / Owner’s / Beneficiary’s Share of Ohio Income Total Ohio

2a. Pass-through entity / electing pass-through entity / trust & estate income .......................................2a.

b. Guaranteed payments or compensation (20% or greater investors only) ...........................................b.

c. Net Ohio depreciation adjustment ....................................................................................................... c.

d. Total taxable income (sum of 2a through 2c for each column) ............................................................d.

Part IV - Investor’s / Owner’s / Beneficiary’s Share of Ohio Tax Credits

3. Direct pass-through entity credit (Ohio tax paid by this entity after nonrefundable business credits and refunds) .................... 3.

4. Indirect pass-through entity credits or withholding (attach IT K-1/W2/1099) .............................................................................. 4.

Include the FEIN for any indirect pass-through entities

5. Refundable job creation credit & job retention credit (include certificates) - % of credit claimed % ............................ 5.

6. Refundable Ohio historic preservation credit (include certificates) - % of credit claimed % ........................................ 6.

7. Venture capital credit (include certificates) .................................................................................................................................7.

8. Motion picture & Broadway theatrical production credit (include certificates) - % of credit claimed % ....................... 8.

9. Nonrefundable business credits (include certificates) ................................................................................................................ 9.

List the specific credits

Part V - Supplemental Information