- 4 -

Enlarge image

|

10211411

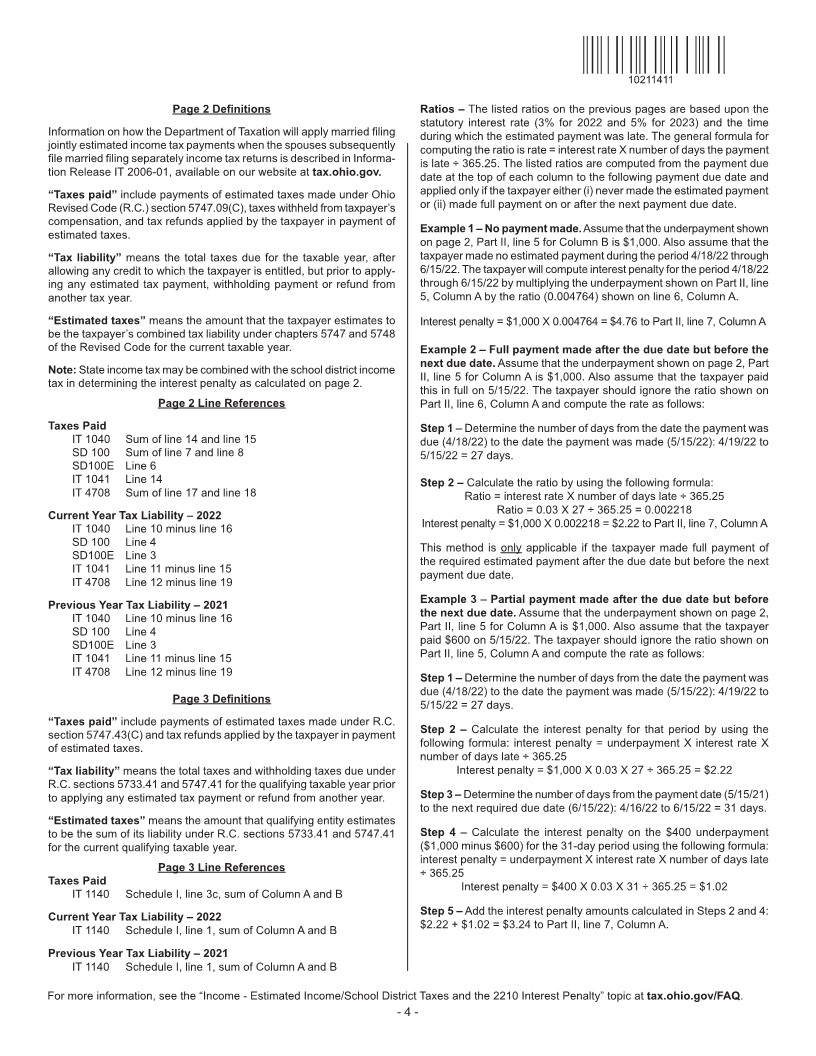

Page 2 Definitions Ratios – The listed ratios on the previous pages are based upon the

statutory interest rate (3% for 2022 and 5% for 2023) and the time

Information on how the Department of Taxation will apply married filing during which the estimated payment was late. The general formula for

jointly estimated income tax payments when the spouses subsequently computing the ratio is rate = interest rate X number of days the payment

file married filing separately income tax returns is described in Informa- is late ÷ 365.25. The listed ratios are computed from the payment due

tion Release IT 2006-01, available on our website at tax.ohio.gov. date at the top of each column to the following payment due date and

“Taxes paid” include payments of estimated taxes made under Ohio applied only if the taxpayer either (i) never made the estimated payment

Revised Code (R.C.) section 5747.09(C), taxes withheld from taxpayer’s or (ii) made full payment on or after the next payment due date.

compensation, and tax refunds applied by the taxpayer in payment of

estimated taxes. Example 1 – No payment made. Assume that the underpayment shown

on page 2, Part II, line 5 for Column B is $1,000. Also assume that the

“Tax liability” means the total taxes due for the taxable year, after taxpayer made no estimated payment during the period 4/18/22 through

allowing any credit to which the taxpayer is entitled, but prior to apply- 6/15/22. The taxpayer will compute interest penalty for the period 4/18/22

ing any estimated tax payment, withholding payment or refund from through 6/15/22 by multiplying the underpayment shown on Part II, line

another tax year. 5, Column A by the ratio (0.004764) shown on line 6, Column A.

“Estimated taxes” means the amount that the taxpayer estimates to Interest penalty = $1,000 X 0.004764 = $4.76 to Part II, line 7, Column A

be the taxpayer’s combined tax liability under chapters 5747 and 5748

of the Revised Code for the current taxable year. Example 2 – Full payment made after the due date but before the

Note: State income tax may be combined with the school district income next due date. Assume that the underpayment shown on page 2, Part

tax in determining the interest penalty as calculated on page 2. II, line 5 for Column A is $1,000. Also assume that the taxpayer paid

this in full on 5/15/22. The taxpayer should ignore the ratio shown on

Page 2 Line References Part II, line 6, Column A and compute the rate as follows:

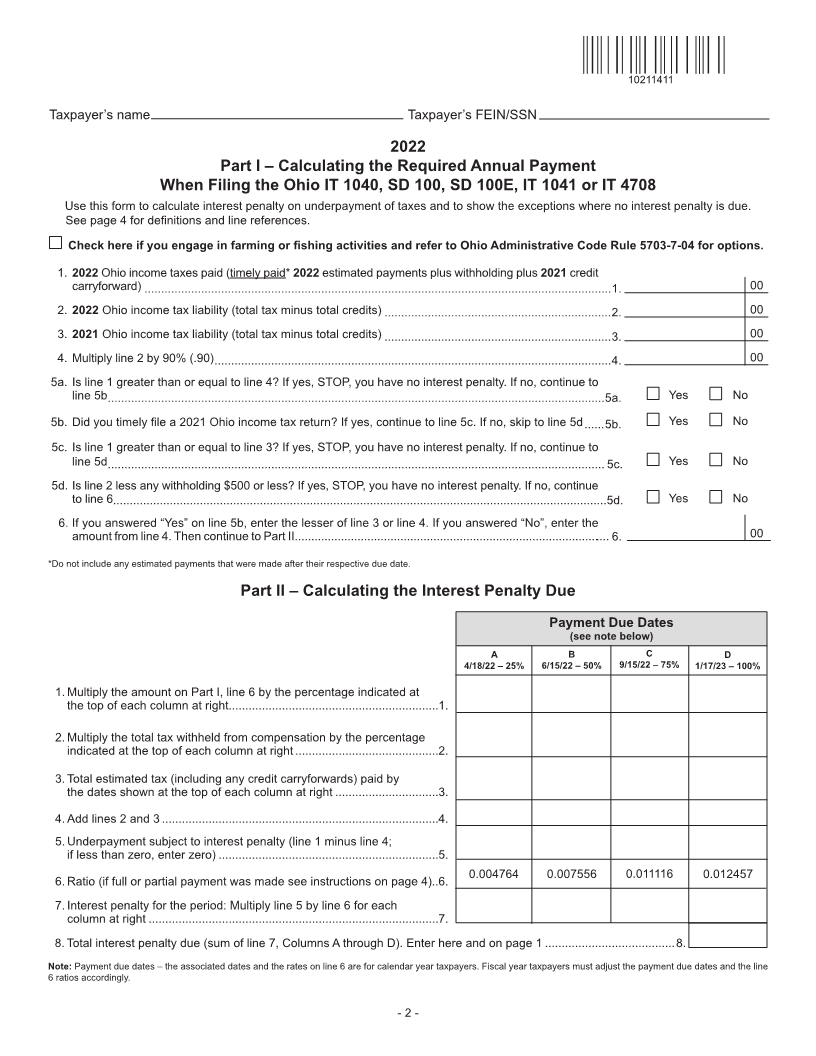

Taxes Paid Step 1 – Determine the number of days from the date the payment was

IT 1040 Sum of line 14 and line 15 due (4/18/22) to the date the payment was made (5/15/22): 4/19/22 to

SD 100 Sum of line 7 and line 8 5/15/22 = 27 days.

SD100E Line 6

IT 1041 Line 14 Step 2 – Calculate the ratio by using the following formula:

IT 4708 Sum of line 17 and line 18 Ratio = interest rate X number of days late ÷ 365.25

Current Year Tax Liability – 2022 Ratio = 0.03 X 27 ÷ 365.25 = 0.002218

IT 1040 Line 10 minus line 16 Interest penalty = $1,000 X 0.002218 = $2.22 to Part II, line 7, Column A

SD 100 Line 4 This method is only applicable if the taxpayer made full payment of

SD100E Line 3 the required estimated payment after the due date but before the next

IT 1041 Line 11 minus line 15 payment due date.

IT 4708 Line 12 minus line 19

Previous Year Tax Liability – 2021 Example 3 – Partial payment made after the due date but before

IT 1040 Line 10 minus line 16 the next due date. Assume that the underpayment shown on page 2,

SD 100 Line 4 Part II, line 5 for Column A is $1,000. Also assume that the taxpayer

SD100E Line 3 paid $600 on 5/15/22. The taxpayer should ignore the ratio shown on

IT 1041 Line 11 minus line 15 Part II, line 5, Column A and compute the rate as follows:

IT 4708 Line 12 minus line 19 Step 1 – Determine the number of days from the date the payment was

due (4/18/22) to the date the payment was made (5/15/22): 4/19/22 to

Page 3 Definitions 5/15/22 = 27 days.

“Taxes paid” include payments of estimated taxes made under R.C.

section 5747.43(C) and tax refunds applied by the taxpayer in payment Step 2 – Calculate the interest penalty for that period by using the

of estimated taxes. following formula: interest penalty = underpayment X interest rate X

number of days late ÷ 365.25

“Tax liability” means the total taxes and withholding taxes due under Interest penalty = $1,000 X 0.03 X 27 ÷ 365.25 = $2.22

R.C. sections 5733.41 and 5747.41 for the qualifying taxable year prior

to applying any estimated tax payment or refund from another year. Step 3 – Determine the number of days from the payment date (5/15/21)

to the next required due date (6/15/22): 4/16/22 to 6/15/22 = 31 days.

“Estimated taxes” means the amount that qualifying entity estimates

to be the sum of its liability under R.C. sections 5733.41 and 5747.41 Step 4 – Calculate the interest penalty on the $400 underpayment

for the current qualifying taxable year. ($1,000 minus $600) for the 31-day period using the following formula:

interest penalty = underpayment X interest rate X number of days late

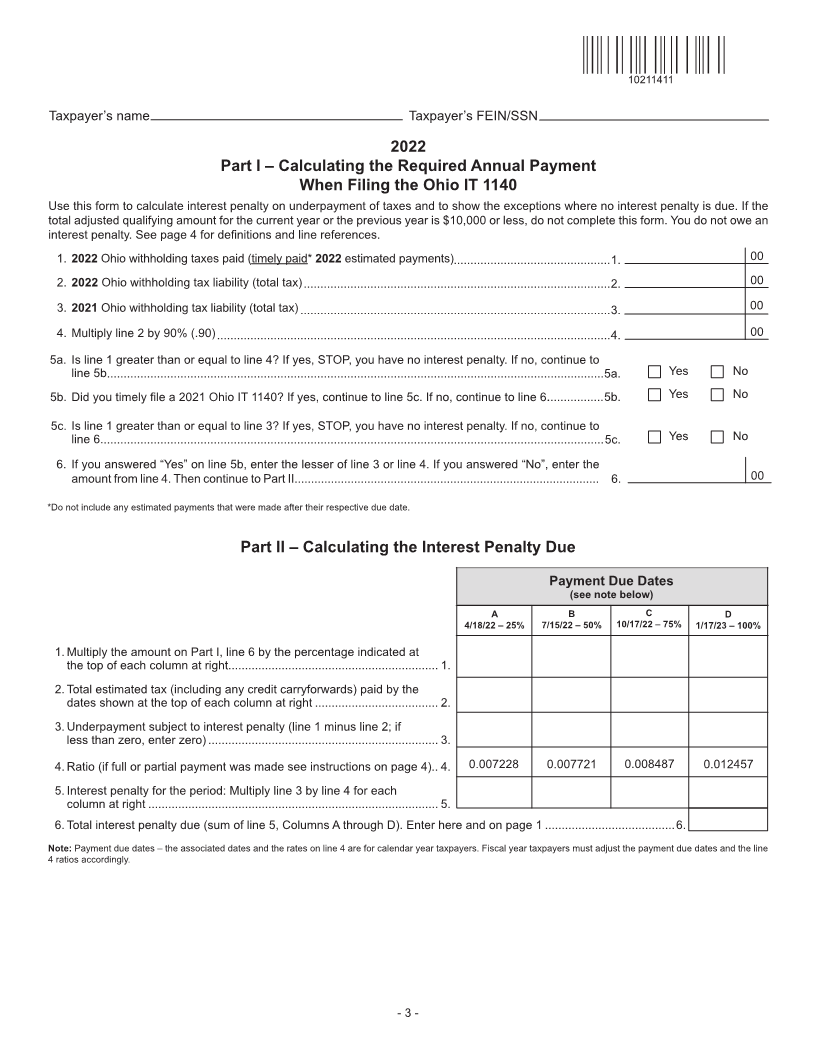

Page 3 Line References ÷ 365.25

Taxes Paid Interest penalty = $400 X 0.03 X 31 ÷ 365.25 = $1.02

IT 1140 Schedule I, line 3c, sum of Column A and B

Current Year Tax Liability – 2022 Step 5 – Add the interest penalty amounts calculated in Steps 2 and 4:

IT 1140 Schedule I, line 1, sum of Column A and B $2.22 + $1.02 = $3.24 to Part II, line 7, Column A.

Previous Year Tax Liability – 2021

IT 1140 Schedule I, line 1, sum of Column A and B

For more information, see the “Income - Estimated Income/School District Taxes and the 2210 Interest Penalty” topic at tax.ohio.gov/FAQ.

- 4 -

|