- 2 -

Enlarge image

|

Ohio Department of Taxation Scannable Tax Forms

1. Introduction:

The Ohio Department of Taxation (ODT) prescribes the format of Ohio tax returns and forms.

The department’s primary objective is to ensure that the tax forms are compatible with the

department’s automated remittance processing systems and can be processed in an efficient,

accurate and economical manner.

These guidelines are for computerized tax processors, software developers, computer

programmers, commercial printers, and others who develop and use substitute and reproduced

tax forms.

2. Definitions:

2.01 Substitute Tax Forms

A form other than the official ODT form that is computer-produced, computer-programmed

or commercially typeset and printed. ODT must be able to process substitute tax forms

in the same manner as the official forms. Substitute tax forms that are electronically

produced must duplicate the appearance and layout of the official form including size of

margins, special keying symbols and line numbers.

2.02 Facsimile (Text Mode) Forms

For filing purposes, ODT does not accept dot matrix facsimile signature returns and

schedules. They do not contain the data-entry symbols and other requirements necessary

for processing. Companies must clearly print in the top margin of electronically processed

text mode forms: “DO NOT FILE THIS FORM.”

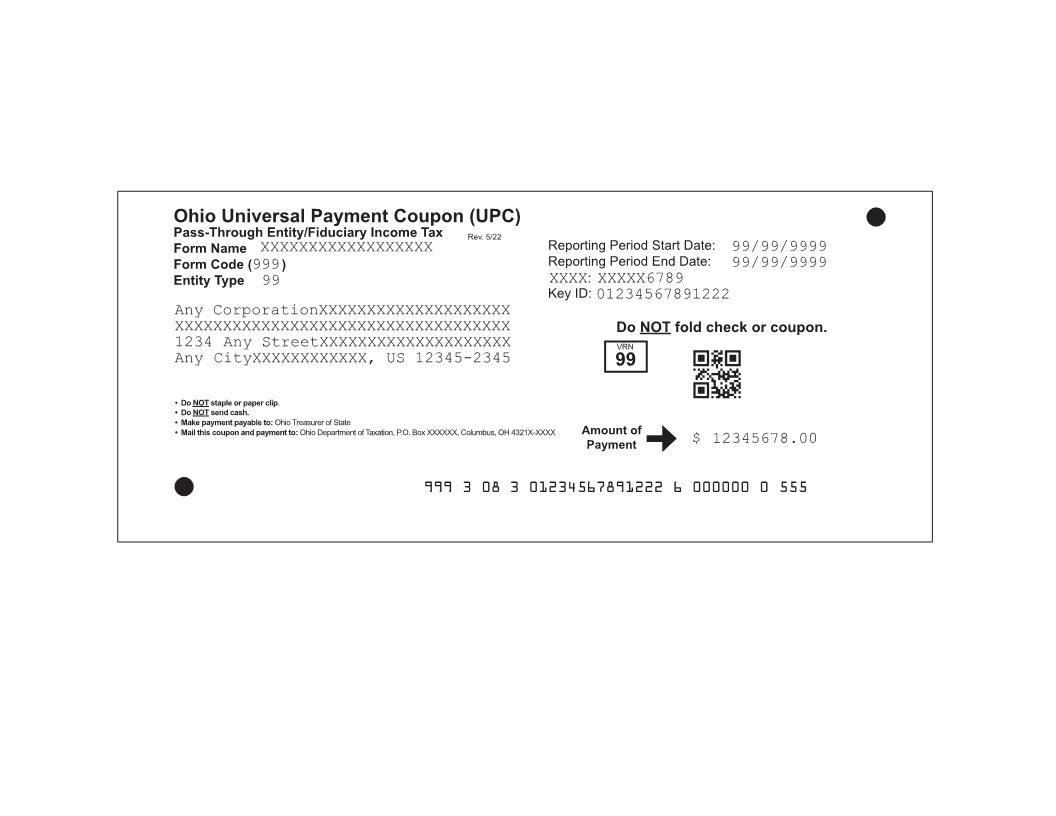

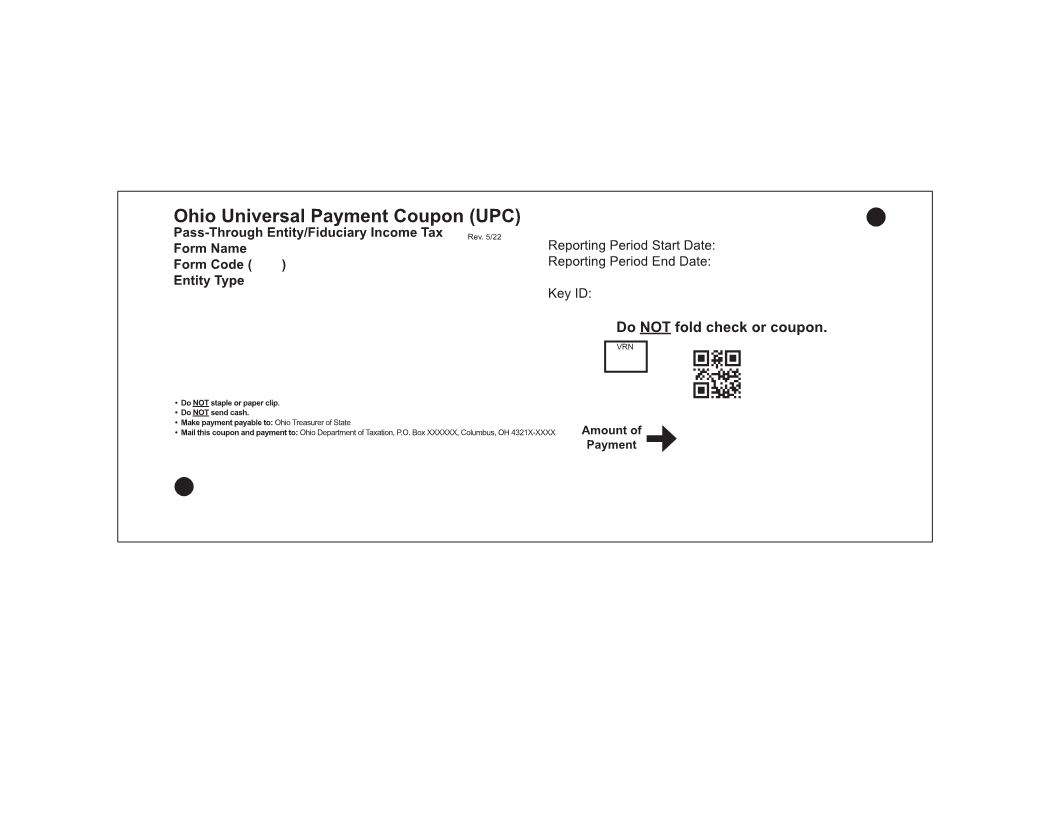

2.03 Scannable Tax Forms

The computer-prepared scannable forms are similar to the official ODT tax forms with

the following exceptions: 1) the taxpayer-entity information layout and 2) a scanline that

contains the taxpayers’ tax data.

2.04 Reproduced Tax Forms

Reproduced tax forms are photocopies of the official ODT forms. ODT does not accept

reproductions of official forms.

2.05 Demographic Section

The area where the name, address, account number/Social Security number (SSN)/Federal

Identification Number (FEIN) are printed.

2.06 Static Text

The text, including item numbers, specifying the information to be entered into a data field.

2.07 Optical Character Recognition (OCR)-Readable Field

Scanline field read using OCR technology.

2.08 Record Layout

A 6-line-per-inch vertical (row) and 10-characters-per-inch horizontal (column) spacing

grid, specifying the exact placement of all fields and characters on the facsimile form, is

provided with each form specification to assist in proper spacing and alignment.

2.09 Capture Areas

The specific space on the form where a numeric figure is entered. The scanline on the

UPC is utilized first to read the data. If the scanline fails or is damaged, the data fields

are used to aide the keyer and therefore must be populated.

|