Enlarge image

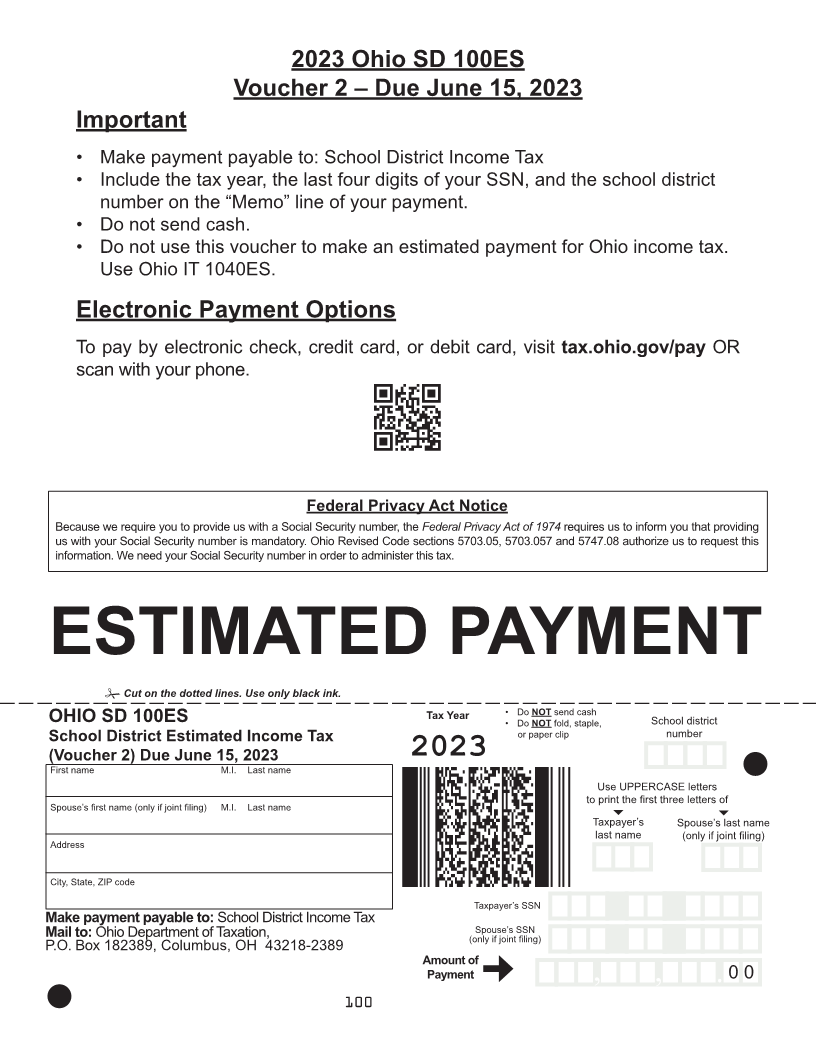

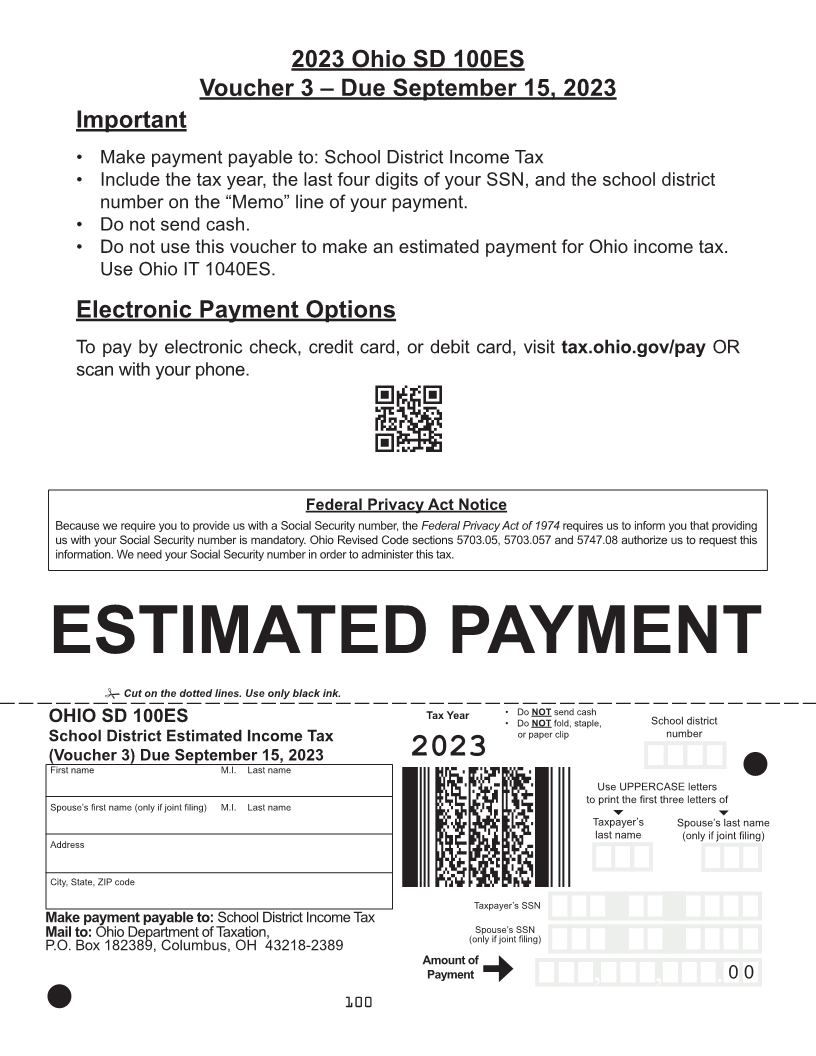

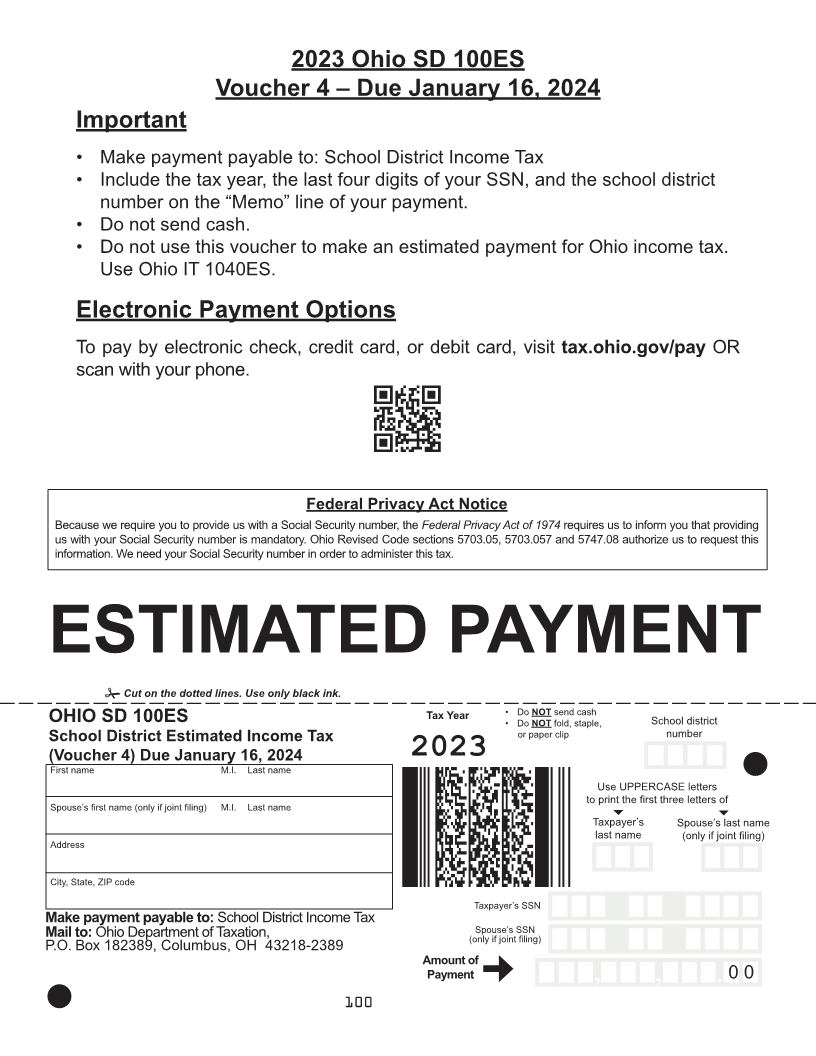

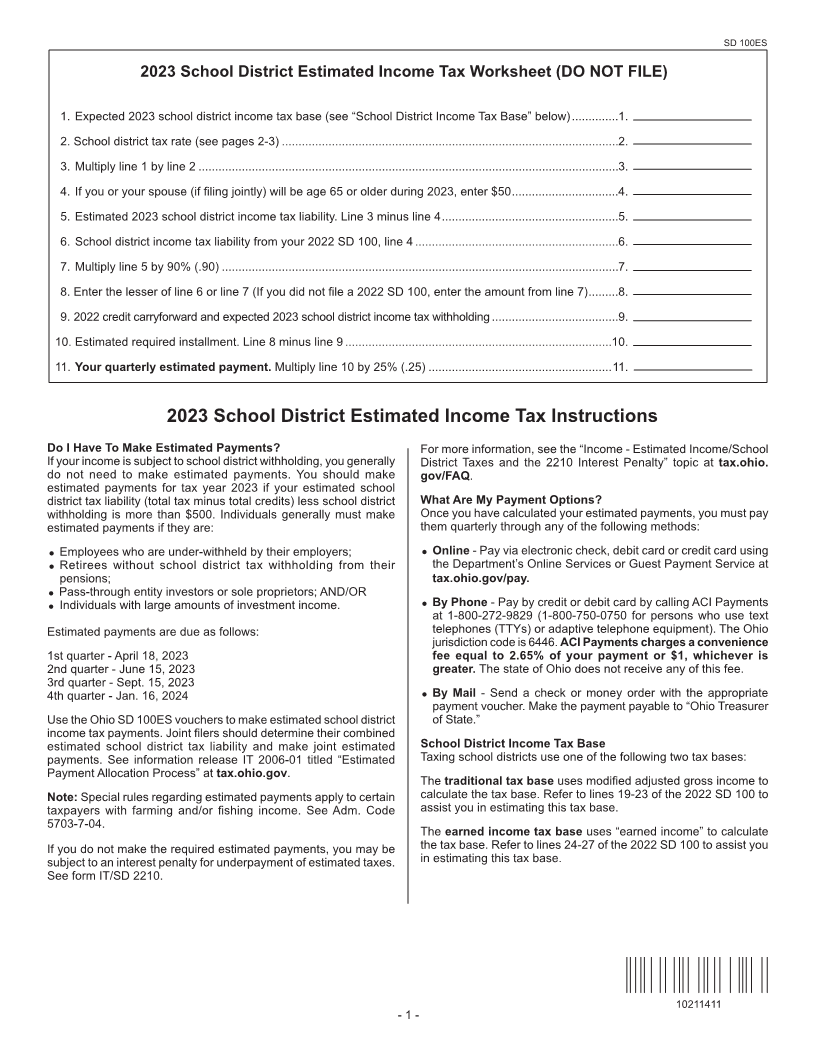

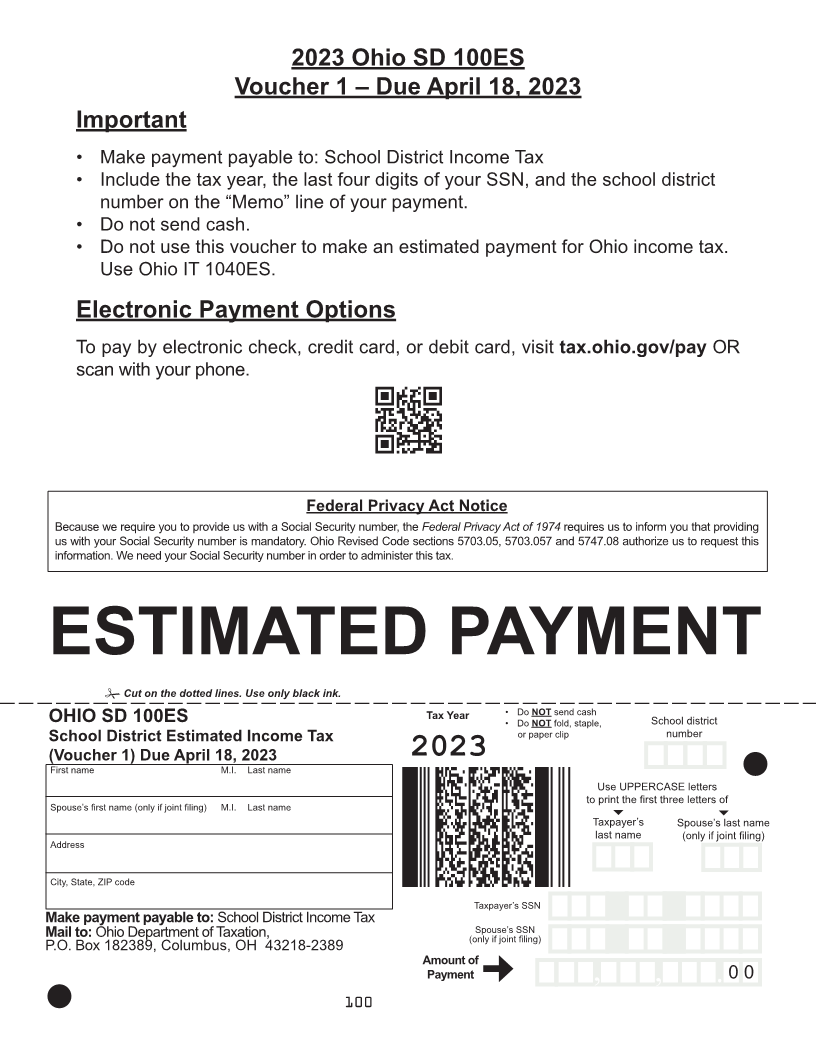

2023 Ohio SD 100ES

Voucher 1 – Due April 18, 2023

Important

• Make payment payable to: School District Income Tax

• Include the tax year, the last four digits of your SSN, and the school district

number on the “Memo” line of your payment.

• Do not send cash.

• Do not use this voucher to make an estimated payment for Ohio income tax.

Use Ohio IT 1040ES.

Electronic Payment Options

To pay by electronic check, credit card, or debit card, visit tax.ohio.gov/pay OR

scan with your phone.

Federal Privacy Act Notice

Because we require you to provide us with a Social Security number, the Federal Privacy Act of 1974 requires us to inform you that providing

us with your Social Security number is mandatory. Ohio Revised Code sections 5703.05, 5703.057 and 5747.08 authorize us to request this

information. We need your Social Security number in order to administer this tax.

ESTIMATED PAYMENT

Cut on the dotted lines. Use only black ink.

• Do NOT send cash

OHIO SD 100ES Tax Year • Do NOT fold, staple, School district

School District Estimated Income Tax or paper clip number

(Voucher 1) Due April 18, 2023 2023

First name M.I. Last name

Use UPPERCASE letters

to print the first three lettersof

Spouse’s first name (only if joint filing) M.I. Last name

Taxpayer’s Spouse’s last name

last name (only if joint filing)

Address

City, State, ZIP code

Taxpayer’s SSN

Make payment payable to: School District Income Tax

Mail to: Ohio Department of Taxation, Spouse’s SSN

(only if joint filing)

P.O. Box 182389, Columbus, OH 43218-2389

Amount of

Payment , , 0 0

100