- 8 -

Enlarge image

|

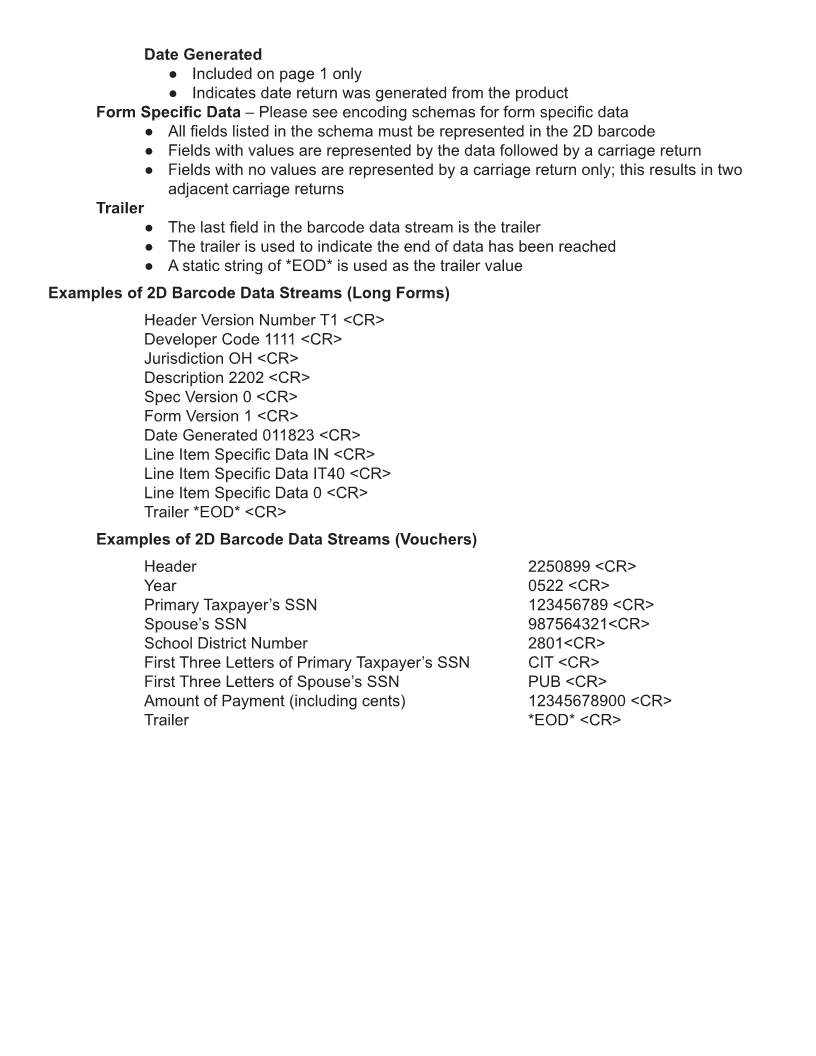

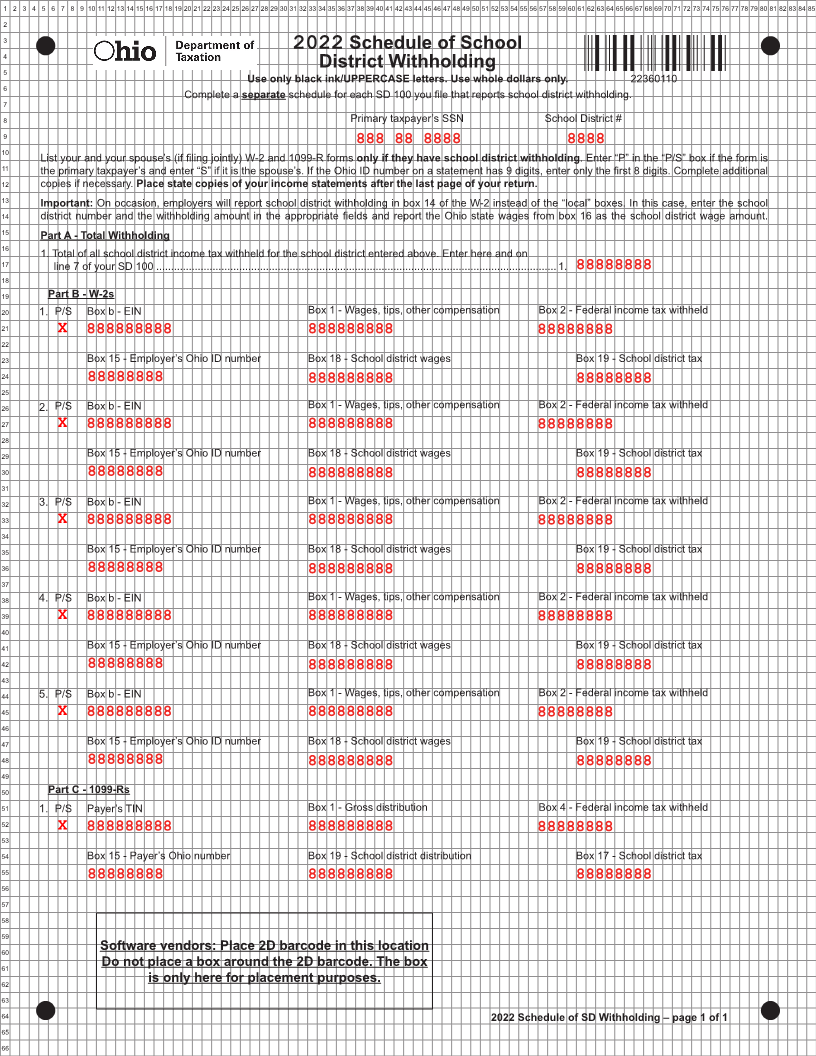

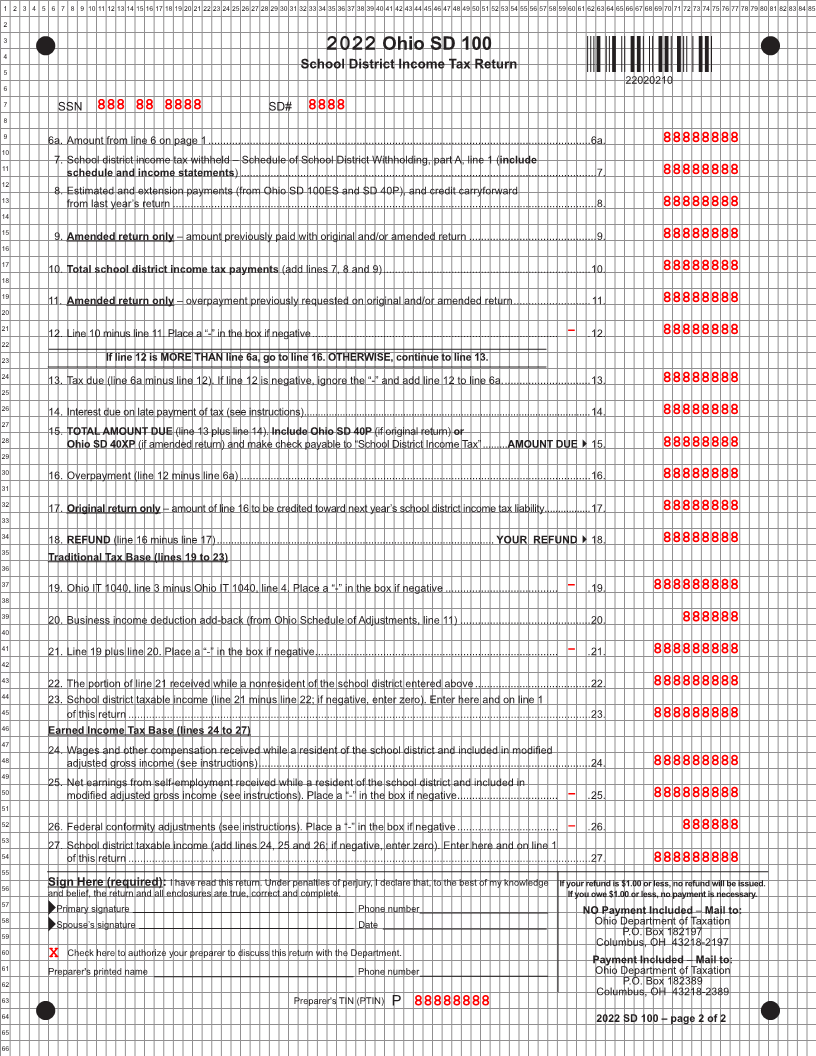

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 82 83 84 85

2

3

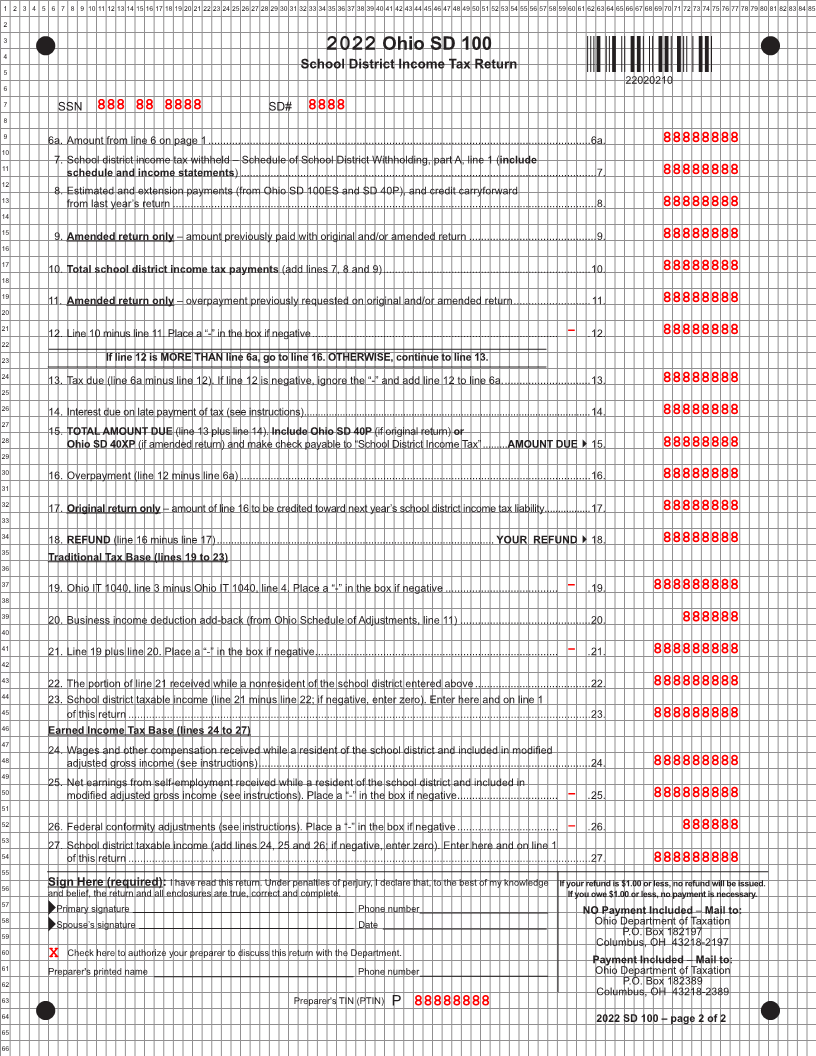

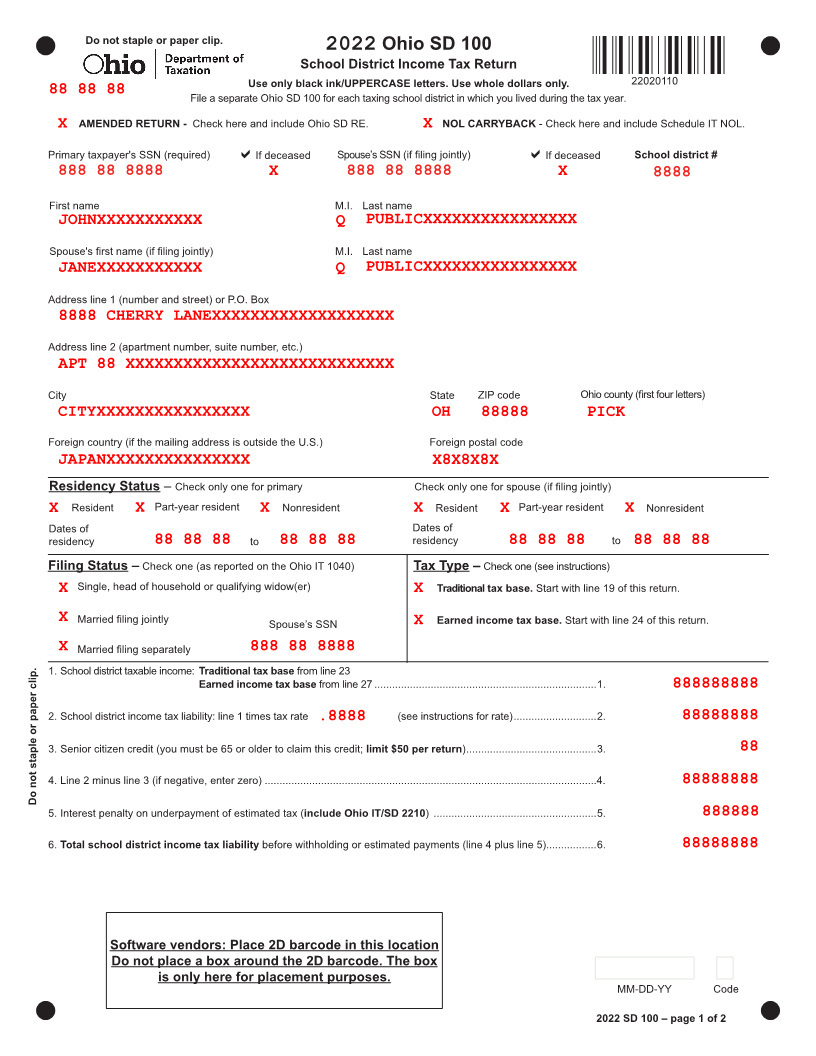

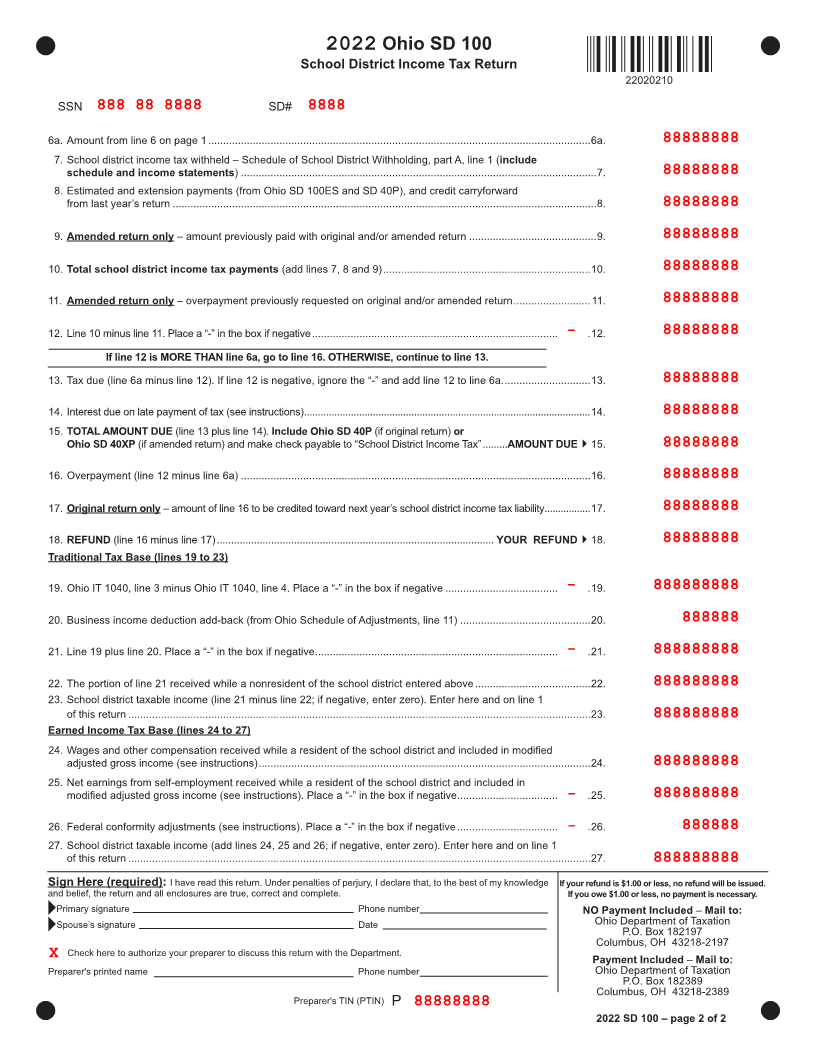

4 2022 Ohio SD 100

5 School District Income Tax Return

6 22020210

7 SSN 888 88 8888 SD# 8888

8

9 6a. Amount from line 6 on page 1 .................................................................................................................................6a. 88888888

10

11 7. School district income tax withheld – Schedule of School District Withholding, part A, line 1 (include

schedule and income statements ) ........................................................................................................................7.

12 88888888

8. Estimated and extension payments (from Ohio SD 100ES and SD 40P), and credit carryforward

13 from last year’s return ...............................................................................................................................................8. 88888888

14

15 9. Amended return only – amount previously paid with original and/or amended return ...........................................9. 88888888

16

10. Total school district income tax payments (add lines 7, 8 and 9) ......................................................................10.

17 88888888

18

19 11. Amended return only – overpayment previously requested on original and/or amended return ..........................11. 88888888

20

12. Line 10 minus line 11. Place a “-” in the box if negative ................................................................................... .12.

21 88888888

22 -

23 If line 12 is MORE THAN line 6a, go to line 16. OTHERWISE, continue to line 13.

24 13. Tax due (line 6a minus line 12). If line 12 is negative, ignore the “-” and add line 12 to line 6a. .............................13. 88888888

25

26 14. Interest due on late payment of tax (see instructions) ........................................................................................................14. 88888888

27

15.

28 TOTAL AMOUNT DUE (line 13 plus line 14). Include Ohio SD 40P (if original return) or

Ohio SD 40XP (if amended return) and make check payable to “School District Income Tax” ......... AMOUNT DUE15.

29 88888888

30 16. Overpayment (line 12 minus line 6a) ......................................................................................................................16. 88888888

31

32

17. Original return only – amount of line 16 to be credited toward next year’s school district income tax liability .................17.

33 88888888

34 18. REFUND (line 16 minus line 17) ................................................................................................. YOUR REFUND18. 88888888

35

Traditional Tax Base (lines 19 to 23)

36

37 19. Ohio IT 1040, line 3 minus Ohio IT 1040, line 4. Place a “-” in the box if negative ...................................... - .19. 888888888

38

39 20. Business income deduction add-back (from Ohio Schedule of Adjustments, line 11) ............................................20. 888888

40

41 21. Line 19 plus line 20. Place a “-” in the box if negative .................................................................................. - .21. 888888888

42

43 22. The portion of line 21 received while a nonresident of the school district entered above .......................................22. 888888888

44 23. School district taxable income (line 21 minus line 22; if negative, enter zero). Enter here and on line 1

45 of this return ............................................................................................................................................................23. 888888888

46

Earned Income Tax Base (lines 24 to 27)

47 24. Wages and other compensation received while a resident of the school district and included in modified

48 adjusted gross income (see instructions) ................................................................................................................24. 888888888

49

25. Net earnings from self-employment received while a resident of the school district and included in

50 modified adjusted gross income (see instructions). Place a “-” in the box if negative .................................. - .25. 888888888

51

52 26. Federal conformity adjustments (see instructions). Place a “-” in the box if negative .................................. - .26. 888888

53

27. School district taxable income (add lines 24, 25 and 26; if negative, enter zero). Enter here and on line 1

54 of this return ............................................................................................................................................................27. 888888888

55

56 Sign Here (required): I have read this return. Under penalties of perjury, I declare that, to the best of my knowledge If your refund is $1.00 or less, no refund will be issued.

and belief, the return and all enclosures are true, correct and complete. If you owe $1.00 or less, no payment is necessary.

57 Primary signature Phone number NO Payment Included –Mail to:

58 Spouse’s signature Date Ohio Department of Taxation

59 P.O. Box 182197

Columbus, OH 43218-2197

60 X Check here to authorize your preparer to discuss this return with the Department.

61 Payment Included –Mail to:

Preparer's printed name Phone number Ohio Department of Taxation

62 P.O. Box 182389

63 Columbus, OH 43218-2389

Preparer's TIN (PTIN) P

88888888

64 2022 SD 100 – page 2 of 2

65

66

|