Enlarge image

Schedule E

Department of Rev. 08/22

hio Taxation

10211411

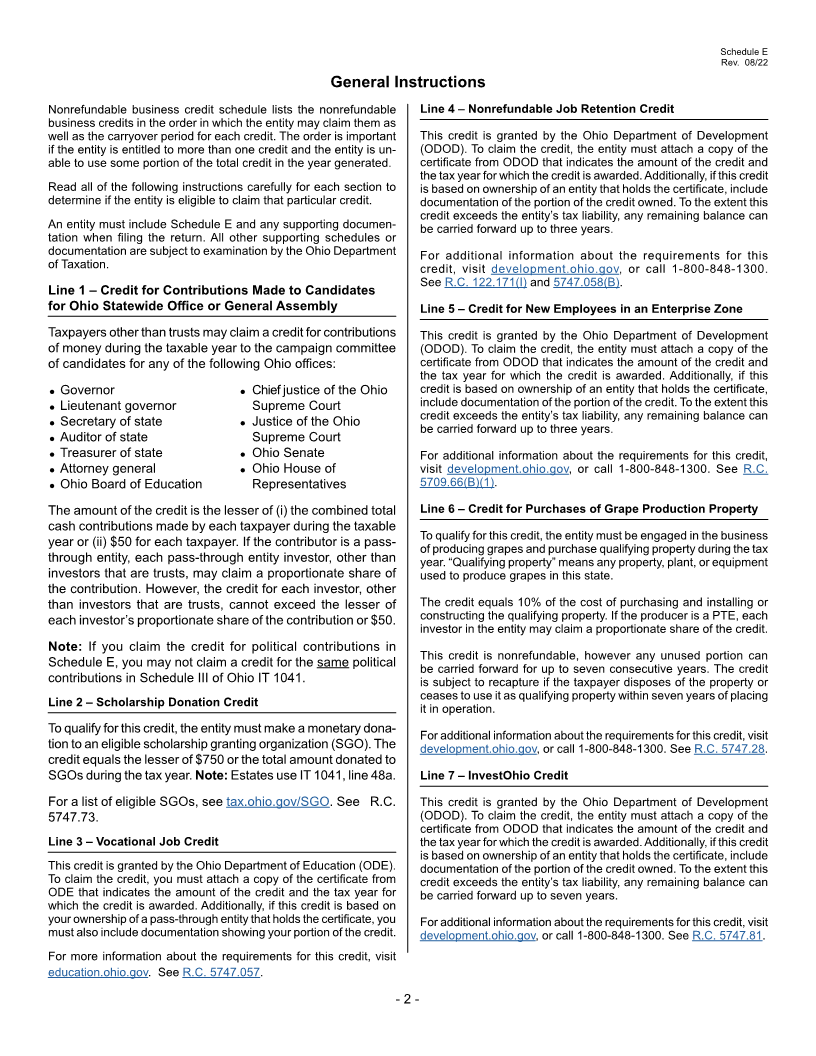

2022 Ohio Schedule E Nonrefundable Business Credits

For use by pass-through entities filing the IT 4708 or trusts/estates filing the IT 1041 and claiming nonrefundable business credits

Taxpayer Information Certificate Holder Information (If different from Taxpayer)

Entity FEIN Percent of Ownership Entity FEIN

Taxpayer name and address Taxpayer name and address

Foreign State Code Country Code Foreign State Code Country Code

A B C D

Credit Earned

Carryforward Unused Credit Credit Used Remaining

NONREFUNDABLE BUSINESS CREDITS During

Period Balance on this Return Credit Balance

Current Year

1. Campaign contribution credit for

None

Ohio statewide office or General Assembly

2. Scholarship Donation Credit None

3. Vocational Job Credit None

4. Job retention credit (include a copy

of the credit certificate) 3 years

5. Credit for New Employees in an

Enterprise Zone (include a copy of 3 years

the credit certificate)

6. Credit for Purchases of Grape

7 years

Production Property

7. InvestOhio credit (include a copy of 7 years

the certificate)

8. Lead abatement credit (include a 7 years

copy of the certificate)

9. Opportunity Zone Investment Credit

5 years

(include a copy of the credit certificate)

10. Technology investment credit

15 years

(include a copy of the credit certificate)

11. Enterprise zone day-care and

training credits (include a copy of Unlimited

the credit certificate)

12. Research & Development loan

repayment credit (include a copy of Unlimited

the credit certificate)

13. Ohio historic preservation credit

5 years

(include a copy of the credit certificate)

14. Total Nonrefundable business credits (sum of Column C lines 1 through 13)

Enter here and on IT 4708, line 11 or IT 1041, line 10

- 1 -