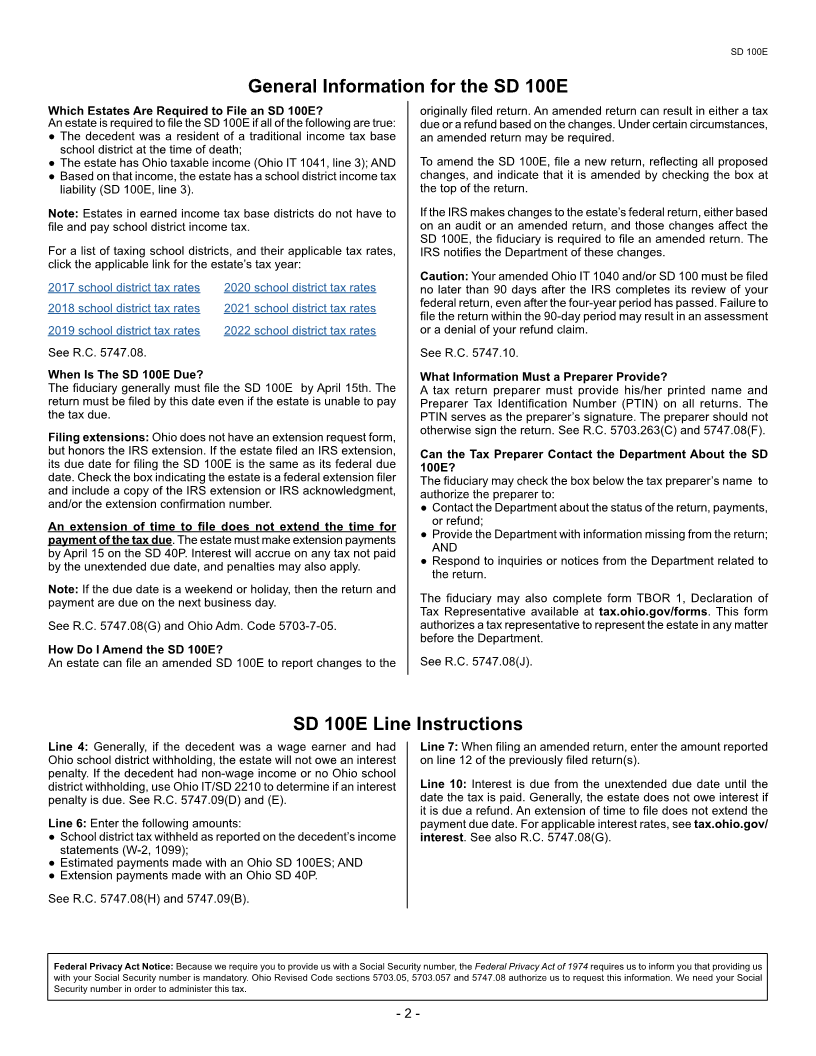

Enlarge image

Staple attachments here. Do not staple check.

Department of

Taxation

hio SD 100E

School District Estate Income Tax Return 10211411

For period beginning , 20 , and ending , 20 .

FEIN for estate SSN of decedent Amended Return

Name of estate Final Return

Name of fiduciary and title

Address of fiduciary Federal extension

filers - check here

City, State, ZIP code

Decedent’s school district of residence School district number

See the next page for instructions.

00

1. Ohio taxable income (Ohio IT 1041, line 3) ..............................................................................................1.

%

2. School district income tax rate (see instructions) .....................................................................................2.

00

3. School district income tax (line 1 times line 2) ..........................................................................................3.

00

4. Interest penalty on underpayment of estimated tax (include Ohio IT/SD 2210) .......................................4.

00

5. Total school district income tax liability (line 3 plus line 4) ........................................................................5.

6. Withholding, estimated payments, extension payments, and any other amounts paid with previously 00

filed returns (include income statements) .................................................................................................6.

00

7. Amended return only – Overpayment previously requested on original and/or amended return ............7.

00

8. Line 6 minus line 7 ....................................................................................................................................8.

If line 8 is MORE THAN line 5, skip to line 12. OTHERWISE, continue to line 9.

9.Tax due (line 5 minus line 8) ......................................................................................................................9. 00

00

10. Interest due on late payment of tax ........................................................................................................10.

11. TOTAL AMOUNT DUE (line 9 plus line 10). Include SD 40P and make check

payable to “School District Income Tax” .....................................................................AMOUNT DUE 11. 00

00

12. REFUND (line 8 minus line 5) ............................................................................................REFUND 12.

SIGN Here (required): I have read this return. Under penalties of perjury, I declare that, to the best of my

knowledge and belief, the return and all enclosures are true, correct and complete.

Mail to:

Ohio Department of Taxation

Attn: School District Income Tax

Fiduciary’s signature Date Phone Number P.O. Box 182389

Columbus, OH 43218-2389

Preparer’s printed name PTIN Phone number

Check here to authorize your preparer to discuss this return with the Department.

SD 100E – page 1 of 1