- 14 -

Enlarge image

|

IT 4708

Rev. 12/22

“Sales” includes gross business receipts earned by the PTE or other Additionally, if this credit is based on the PTE’s ownership of another

PTEs owned by the PTE, such as: PTE that holds the certificate, the PTE must also include, when

● Receipts from the sale of real property, tangible personal filing its return, documentation of the portion of the credit to which

property, or services; the PTE is entitled. For credits approved after September 13, 2022

● Receipts from rents and royalties from real and tangible and before July 1, 2024, the maximum annual credit amount was

personal property; OR increased from $5,000,000 to $10,000,000 per taxable year, and

● Receipts from the transfer of or the right to use intellectual the entire credit can be taken as a refundable credit.

property such as trademarks, trade names, patents, and

copyrights. For additional information about the requirements for this credit or

the new enhanced credit visit development.ohio.gov, or call 1-800-

“Sales” does not include: 848-1300. See R.C. 5747.76 and 149.311(I).

● Interest and dividends;

● Receipts from the transfer of intangible property other than Line 47 – Jobs Creation Credit and Job Retention Credit

trademarks, trade names, patents, copyrights or other similar These credits are granted by the Ohio Department of Development,

intellectual property; (ODOD). To claim the credit, the PTE must attach a copy of the

● Receipts from the transfer of real or tangible personal property certificate from ODOD that indicates the amount of the credit and

that is either a capital asset or an Internal Revenue Code the tax year for which the credit is awarded. Additionally, if this

section 1231 asset; AND credit is based on the PTE’s ownership of another PTE that holds

● Receipts from sales to certain public utilities, insurance the certificate, the PTE must also include, when filing its return,

companies, and financial institutions described in R.C. documentation of the portion of the credit to which the PTE is

5733.05(B)(2)(c). entitled. This amount can be refunded, in whole or in part, to the

Note: Income amounts excluded from the sales factor may still be extent that it exceeds the PTE’s total Ohio tax liability.

considered business income under Ohio law. For additional information about the requirements for this credit,

See R.C. 5747.21(B) and 5733.05(B)(2)(c). visit development.ohio.gov, or call 1-800-848-1300.

See R.C. 5747.058(A), 122.171, and former R.C 122.171(B).

Line 44 – Sales

Line 48 – Pass-Through Entity Credit

Within Ohio: Enter gross receipts from sales within Ohio during

the tax year. Sales within Ohio include all the following: This credit is for taxes paid on the PTE’s behalf by another PTE on

● Receipts from sales of tangible personal property, less returns its form IT 4708, IT 4738, or IT 1140. To claim this credit, attach a

and allowances, to the extent the property was received by the copy of the IT K-1 issued to this PTE reporting:

purchaser in Ohio; ● Income taxes paid by the PTE (IT K-1, line 3); AND/OR

● Receipts from services to the extent the purchaser ultimately ● Indirect PTE credits (IT K-1, line 4) from taxes paid by a PTE

used or received the benefit of the services in Ohio; the PTE indirectly owns.

● Rents and royalties from tangible personal property to the extent If the PTE does not have an IT K-1, the PTE must provide a narrative

the property was used in Ohio; and/or diagram, including ownership percentages and FEINs,

● Receipts from the transfer of certain intellectual property to the detailing the ownership structure of the PTEs.

extent the property was used in Ohio;

● Receipts from the right to use certain intellectual property See R.C. 5747.059, 5747.08(I) and 5747.39.

to the extent the receipts are based on the right to use the

property in Ohio; Line 49 – Venture Capital Credit

● Receipts from the sale of real property located in Ohio; AND This credit is granted by the Ohio Department of Development,

● Rents and royalties from real property located in Ohio. (ODOD). To claim the credit, the PTE must attach a copy of the

Note: For tangible personal property, where the property is “received certificate from ODOD that indicates the amount of the credit and

by the purchaser” is not the same as where the purchaser takes the tax year for which the credit is awarded. Additionally, if this credit

physical or legal possession. Instead, it is considered “received” is based on the PTE’s ownership of a PTE that holds the certificate,

where it is ultimately used by the purchaser. the PTE must also include, when filing its return, documentation of

See R.C. 5733.05(B)(2)(c)(i) and (ii). the portion of the credit to which the PTE is entitled. This amount

can be refunded, in whole or in part, to the extent that it exceeds

Total Everywhere: Enter the gross receipts from sales everywhere the PTE’s total Ohio tax liability.

during the tax year.

For additional information about the requirements for this credit, visit

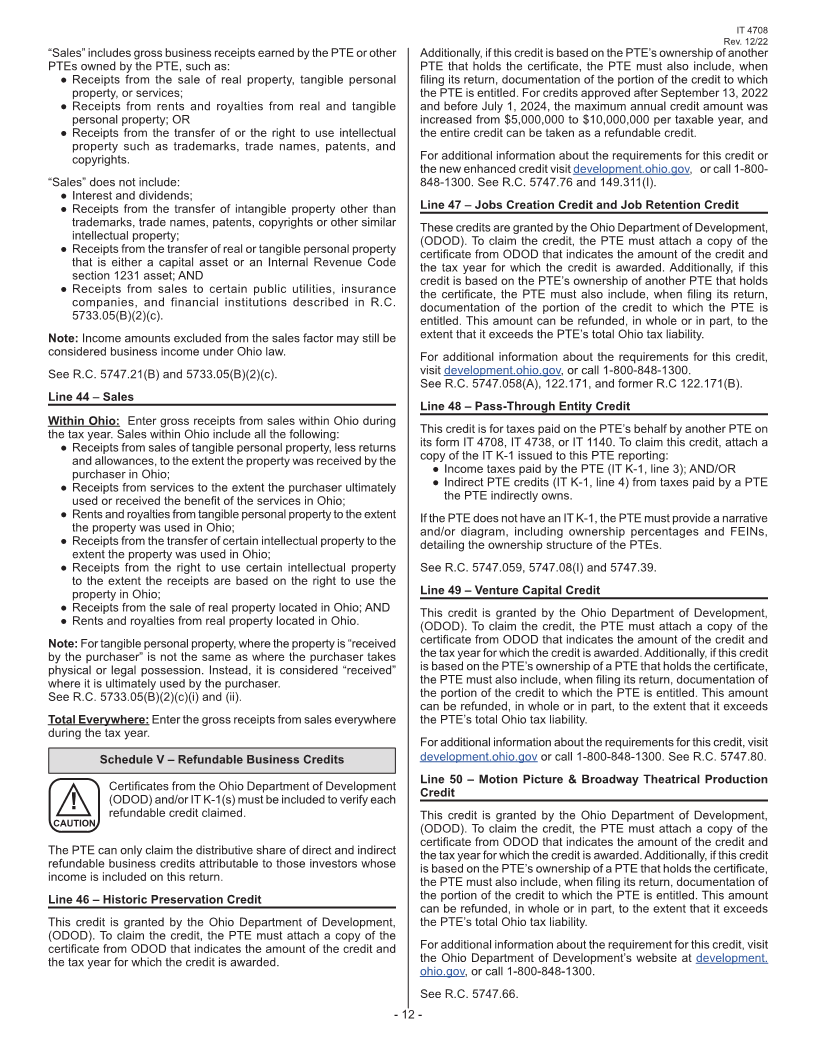

Schedule V – Refundable Business Credits development.ohio.gov or call 1-800-848-1300. See R.C. 5747.80.

Certificates from the Ohio Department of Development Line 50 – Motion Picture & Broadway Theatrical Production

(ODOD) and/or IT K-1(s) must be included to verify each Credit

! refundable credit claimed. This credit is granted by the Ohio Department of Development,

CAUTION (ODOD). To claim the credit, the PTE must attach a copy of the

certificate from ODOD that indicates the amount of the credit and

The PTE can only claim the distributive share of direct and indirect the tax year for which the credit is awarded. Additionally, if this credit

refundable business credits attributable to those investors whose is based on the PTE’s ownership of a PTE that holds the certificate,

income is included on this return. the PTE must also include, when filing its return, documentation of

Line 46 – Historic Preservation Credit the portion of the credit to which the PTE is entitled. This amount

can be refunded, in whole or in part, to the extent that it exceeds

This credit is granted by the Ohio Department of Development, the PTE’s total Ohio tax liability.

(ODOD). To claim the credit, the PTE must attach a copy of the

certificate from ODOD that indicates the amount of the credit and For additional information about the requirement for this credit, visit

the tax year for which the credit is awarded. the Ohio Department of Development’s website at development.

ohio.gov, or call 1-800-848-1300.

See R.C. 5747.66.

- 12 -

|