Enlarge image

• INSTRUCTIONS ONLY • NO RETURNS •

hio

2022

Instructions for Filing Original and Amended:

• Individual Income Tax (IT 1040)

• School District Income Tax (SD 100)

Department of

hio Taxation

tax. hio.gov

Enlarge image |

• INSTRUCTIONS ONLY • NO RETURNS •

hio

2022

Instructions for Filing Original and Amended:

• Individual Income Tax (IT 1040)

• School District Income Tax (SD 100)

Department of

hio Taxation

tax. hio.gov

|

Enlarge image |

2 2022 Ohio IT 1040 / SD 100

Table of Contents

A H N

Amended returns ....................................8 Highlights for 2022..................................5 Net operating loss (IT NOL) ..................50

Nonresident credit (IT NRC) ............23-26

B I Nonresident statement (IT NRS) ....13, 49

Business credits ..............................21-23 Individual credits ..............................20-21

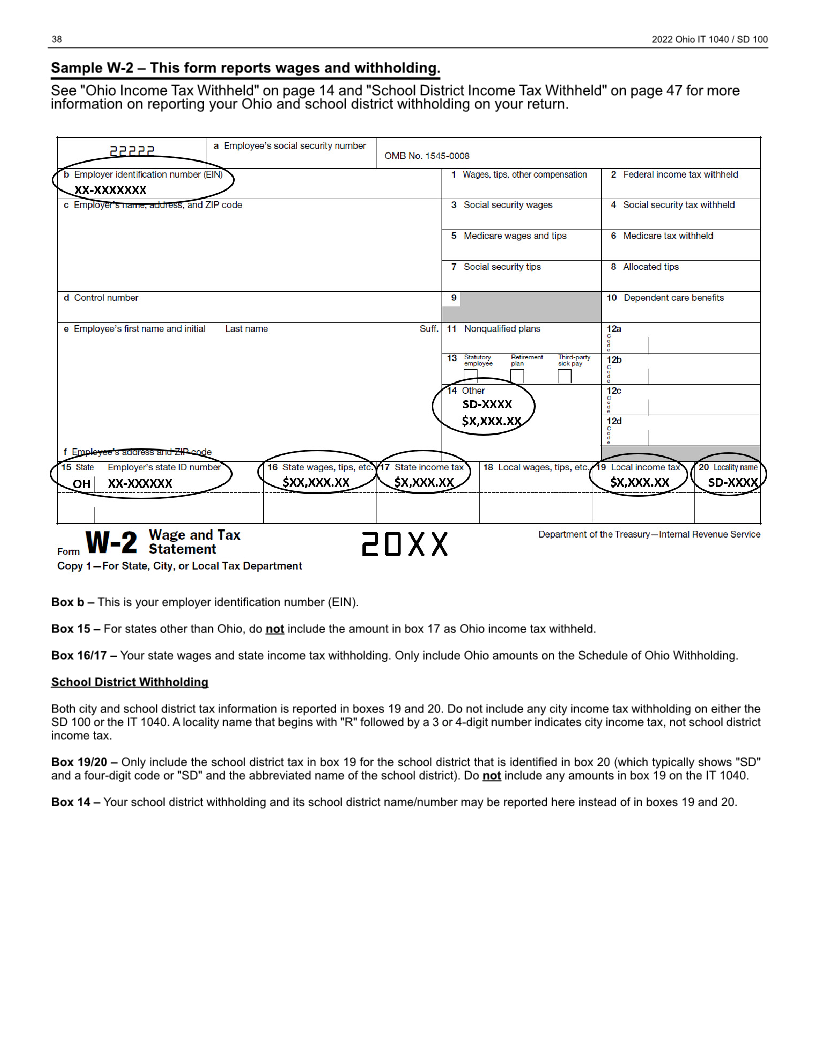

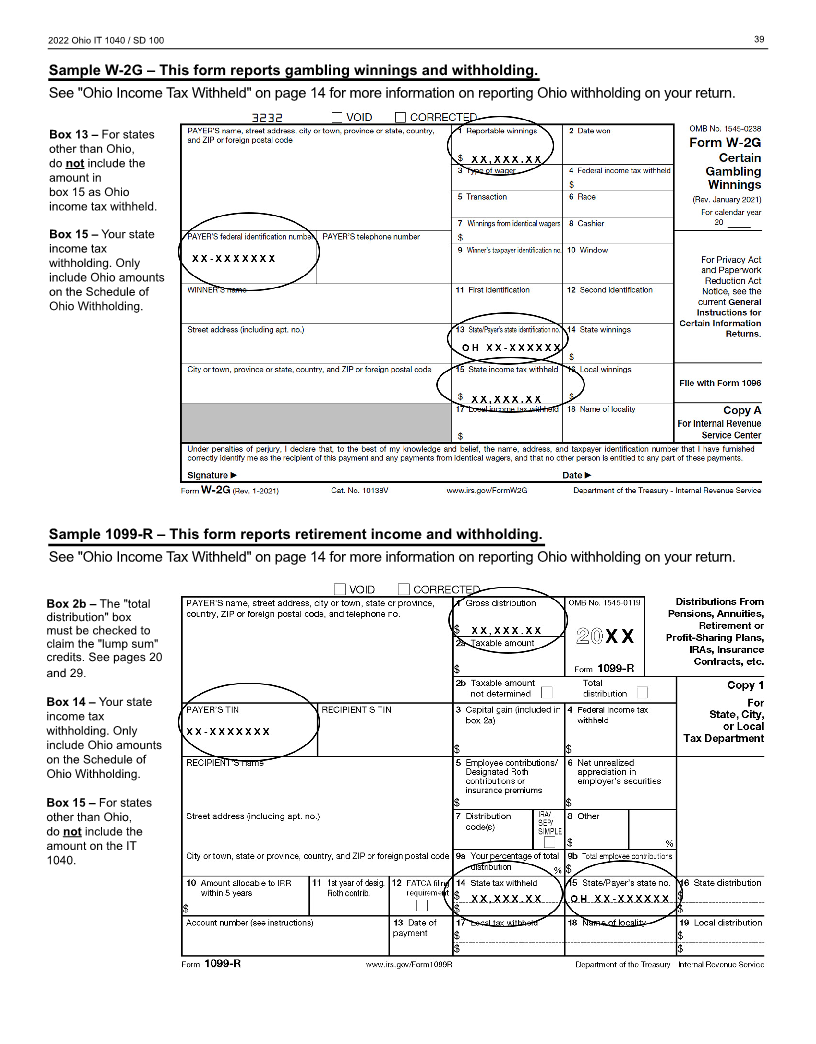

Business income Income statements (W-2, 1099) ......38-39 P

Business income deduction (IT BUS) ...19 Interest............................................15, 47 Payment options .....................................6

Definitions and examples ..................10 IT 1040

Completing the top portion ................13 R

C General information .......................... 11 Refund status .........................................2

College savings (Ohio 529 plan) Line instructions ...........................14-15 Residency ............................................. 11

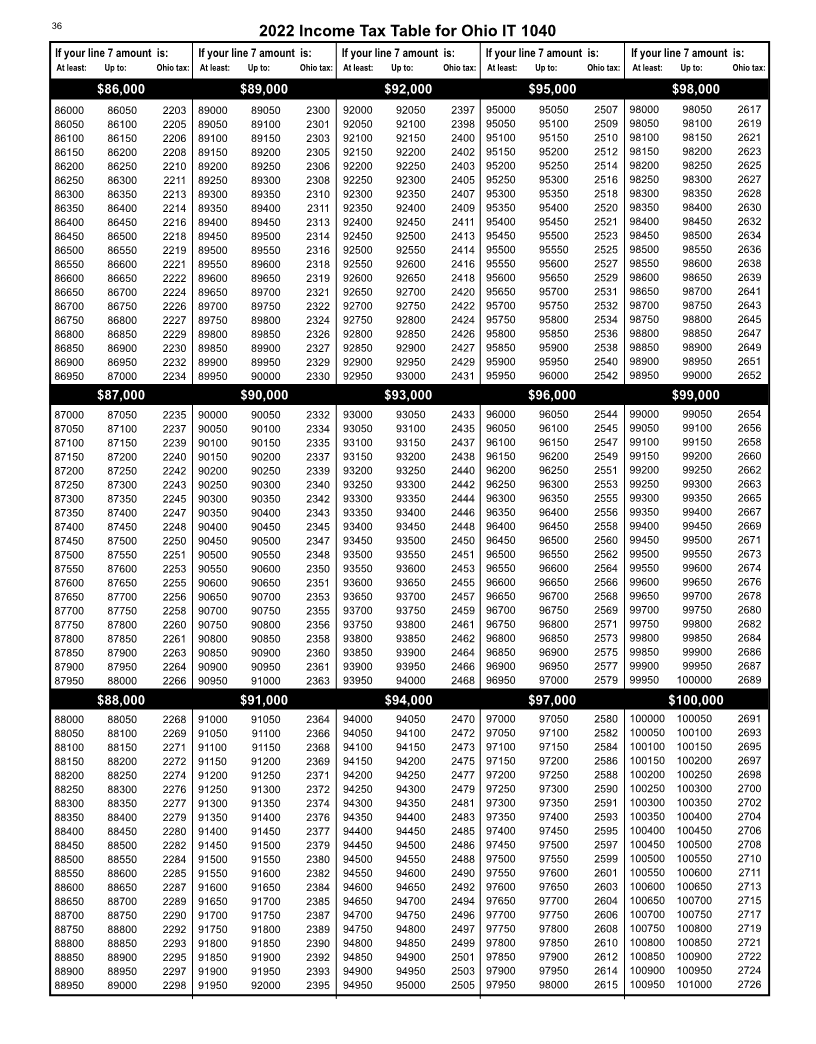

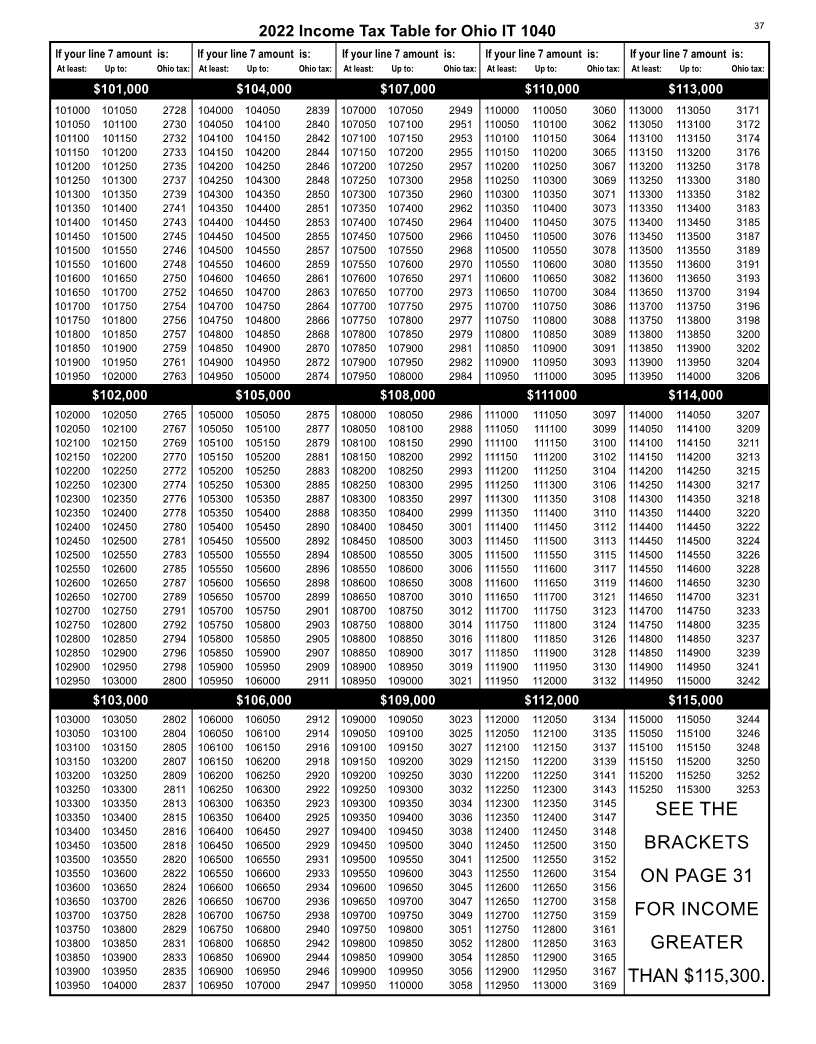

Instructions........................................18 Income tax rates and tables .........31-37 Resident credit (IT RC) .........................26

Worksheet .........................................28 Residency credits .................................22

J Retirement income credit......................20

D Joint filing credit ....................................20

Deceased taxpayers ...............................7 S

Direct deposit options ............. Back cover L Schedule of Adjustments .................15-19

Donations .......................................12, 15 Lump sum credits Schedule of Credits..........................20-23

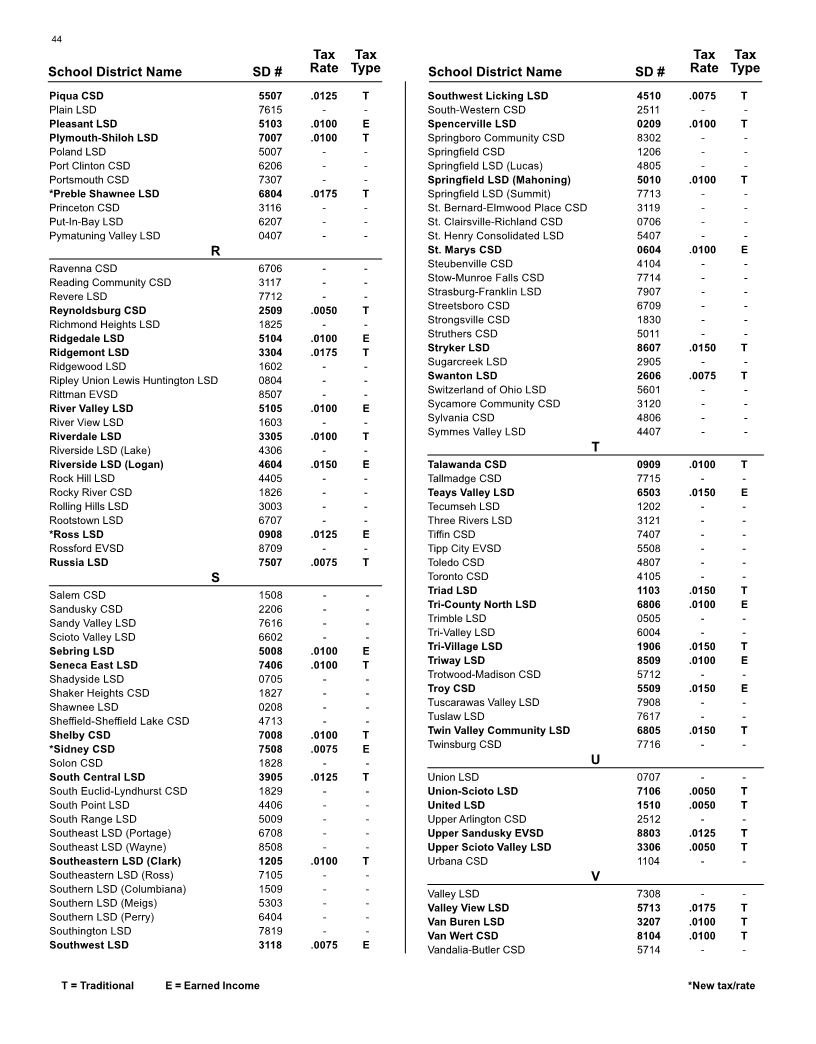

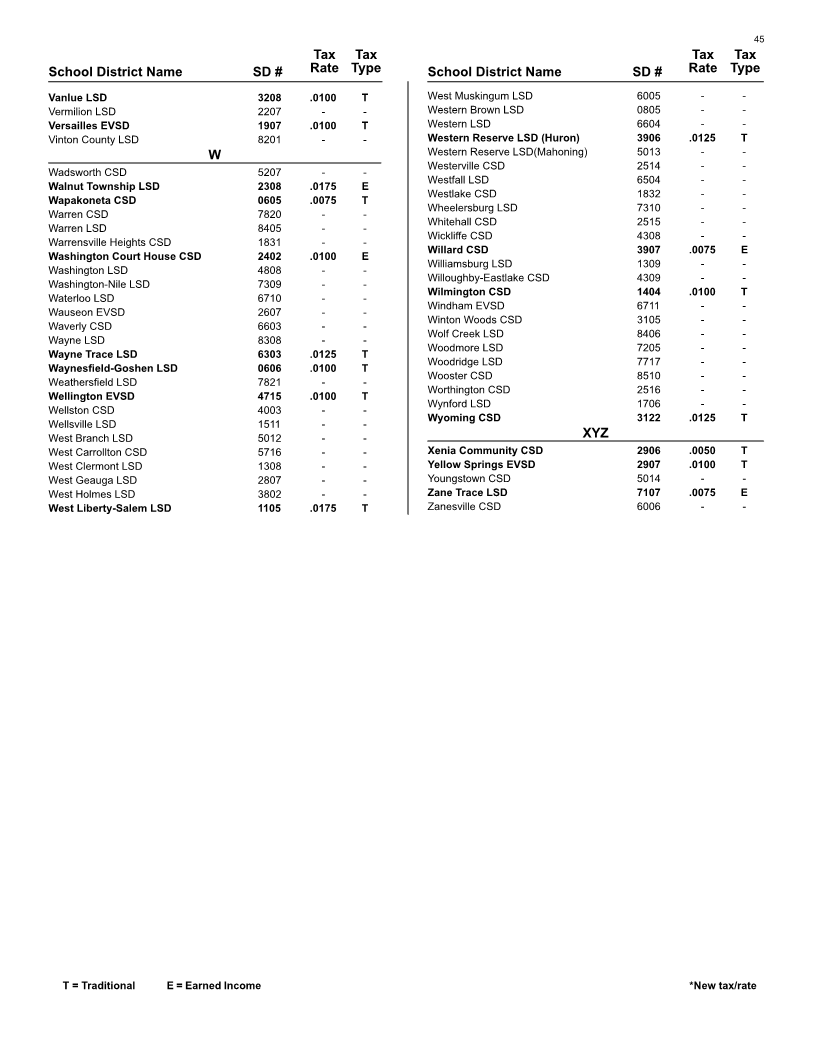

Instructions........................................20 School district numbers....................40-45

E Worksheets .......................................29 SD 100

Earned income credit............................21 Completing the top portion................13

Electronic filing options ........... Back cover M General information ..........................46

Estimated tax payments for 2023 ...........7 Mailing addresses...................................6 Line instructions ................................47

Exemptions ...........................................14 Medical & health care expenses School district tax rates ................40-45

Instructions........................................18 Senior citizen credit ........................20, 47

F Worksheet .........................................27 Social Security income .........................16

Filing extensions ...............................7, 13 Military .........................................9, 17-18

Filing requirements ......................... 11, 46 Modified adjusted gross income .............7 U

Use (sales) tax

G Instructions........................................14

General information ................................7 Worksheet .........................................31

These instructions contain law references for specific line items and requirements. To review Ohio income and school district

income tax law, see codes.ohio.gov/orc/5747 and codes.ohio.gov/orc/5748, respectively.

Check Your Refund Status Anytime, Anywhere!

¬ 24-Hour Hotline - 1-800-282-1784

¬ Online at tax.ohio.gov/refund

¬ Mobile App - Search "Ohio Taxes" on your device's app store.

Federal Privacy Act Notice: Because we require you to provide us with a Social Security number, the Federal Privacy Act of 1974 requires us to inform you that providing us

with your Social Security number is mandatory. Ohio Revised Code sections 5703.05, 5703.057 and 5747.08 authorize us to request this information. We need your Social

Security number in order to administer this tax.

|

Enlarge image |

2022 Ohio IT 1040 / SD 100 3

Taxpayer Assistance

Need Help? – To help answer your questions and ensure that your tax returns are filed accurately, the Department of Taxation

provides the following resources at tax.ohio.gov:

Forms – Find all individual and school district income tax forms (including related schedules and worksheets). Many forms have

fill-in versions that you can complete online, print, and then submit to the Department. You can also request tax forms anytime

by calling 1-800-282-1782.

FAQs – Review answers to common questions on topics such as business income and residency issues.

Online Services – File your state and school district income tax returns for free. There are also several self-service options

such as making payments, viewing transcripts, and accessing your 1099-G and 1099-INT statements from the Department.

Online Notice Response Service – Securely submit documents online in response to most notices or requests for ad-

ditional information sent by the Department.

Guest Payment Service – Make individual and school district income tax payments electronically without having to register

for an Online Services account.

Information Releases – Research detailed explanations and legal analyses of certain tax topics such as residency and tax

issues facing military servicemembers and their civilian spouses.

The Finder – Look up your address to determine if you live in a taxing school district as well as the tax rate and four-digit

school district number.

Ohio Virtual Tax Academy – View webinars designed and presented by Department staff on Ohio's state taxes.

Tax Alerts – Sign up to receive tax updates and reminders from the Department via email.

Contact Us - If you cannot find the answer using the website, you may contact the Department using any of the following

methods:

Email – Visit tax.ohio.gov/emailus to access a Write – Contact the Department by mail at:

secure email form. Complete all required fields

Ohio Department of Taxation

before submitting your question.

P.O. Box 182847

Call – You may call to speak with an examiner Columbus, OH 43218-2847

at 1-800-282-1780* during the Department's

normal business hours (8:00 a.m. to 5:00 p.m.,

Monday through Friday excluding holidays).

*Persons who use text telephones (TTYs) or adaptive telephone equipment only: Contact the Ohio Relay Service at 7-1-1 or

1-800-750-0750 and give the communication assistant the Ohio Department of Taxation phone number that you wish to contact.

Additional Resources

Volunteer Income Tax Assistance Program (VITA) and Tax Counseling for the Elderly (TCE): These programs help

persons with disabilities as well as elderly, low-income and limited English-speaking taxpayers complete their state and

federal returns. For locations in your area, call 1-800-906-9887, or visit their website:

http://www.irs.gov/Individuals/Free-Tax-Return-Preparation-for-You-by-Volunteers

AARP: Trained and certified AARP tax aide volunteer counselors assist low- to middle-income taxpayers, with special

attention to those age 50 and older. For more information, call 1-888-227-7669 or visit their website:

http://www.aarp.org/money/taxes/aarp_taxaide/

|

Enlarge image |

4 2022 Ohio IT 1040 / SD 100

Our Mission

To provide quality service to Ohio taxpayers by helping them comply with their tax responsibilities and by fairly applying the tax law.

A Message From the Ohio Tax Commissioner

Dear Ohio Taxpayers,

Thank you to all Ohioans for taking the time to prepare and file the 2022 Ohio income tax return.

You will find some changes this year to Ohio’s income tax filing system. This instruction booklet will explain those changes and

how best to fill out your return.

Please note some of the changes to Ohio’s income tax for tax year 2022:

• All tax brackets have been adjusted for inflation. As a result, taxpayers with taxable income of $26,050 or less will pay no

income tax.

• A new addition and credit are applicable to investors in a pass-through entity that files the IT 4738.

• A new, nonrefundable credit is available for employing certain persons enrolled in a certified vocational training program.

If you aren’t already filing your tax return electronically, please consider joining the 93 percent of taxpayers who do so. It’s more

accurate, more secure, and the quickest way to get a refund. Remember, you can file your Ohio tax return online and for free

with our I-File system.

Please keep in mind the deadline for filing both your Ohio and federal tax return is April 18, 2023. And as a reminder, a request

for a filing extension does not extend your payment due date.

If you have any questions or need assistance with your return, you can contact our Taxpayer Assistance line at 1-800-282-

1780, or click on ‘Contact Us’ at tax.ohio.gov.

Best wishes,

Jeff McClain

Ohio Tax Commissioner

IMPORTANT: The printed version of these instructions are accurate as of December 12, 2022. The following corrections have been made

to the online version:

• Page 17: "Space Force" was added to the list of uniformed services in the line 28 instruction.

|

Enlarge image |

2022 Ohio IT 1040 / SD 100 5

Highlights for 2022

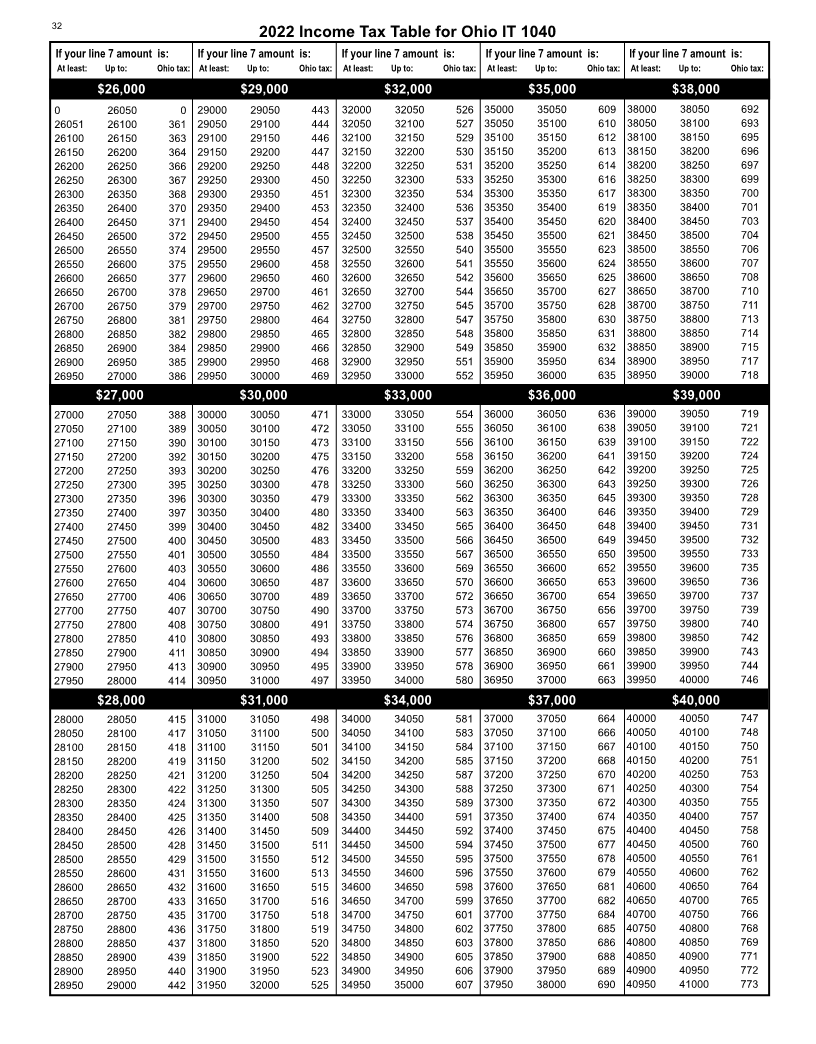

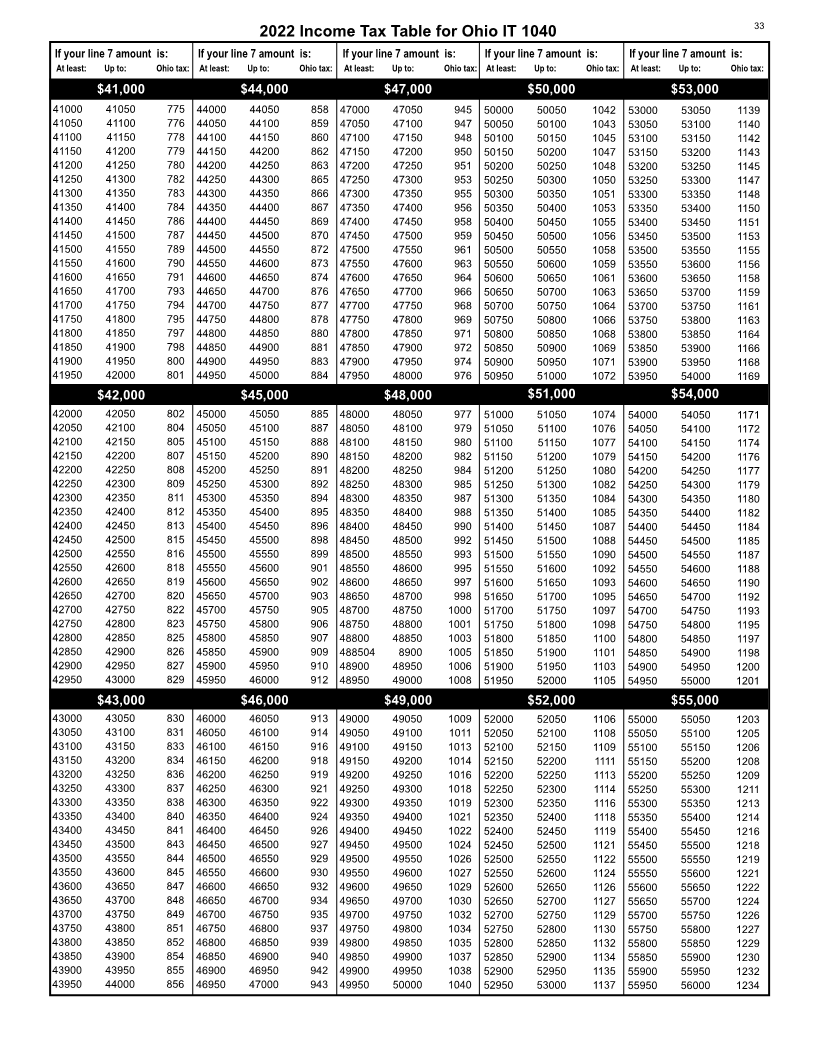

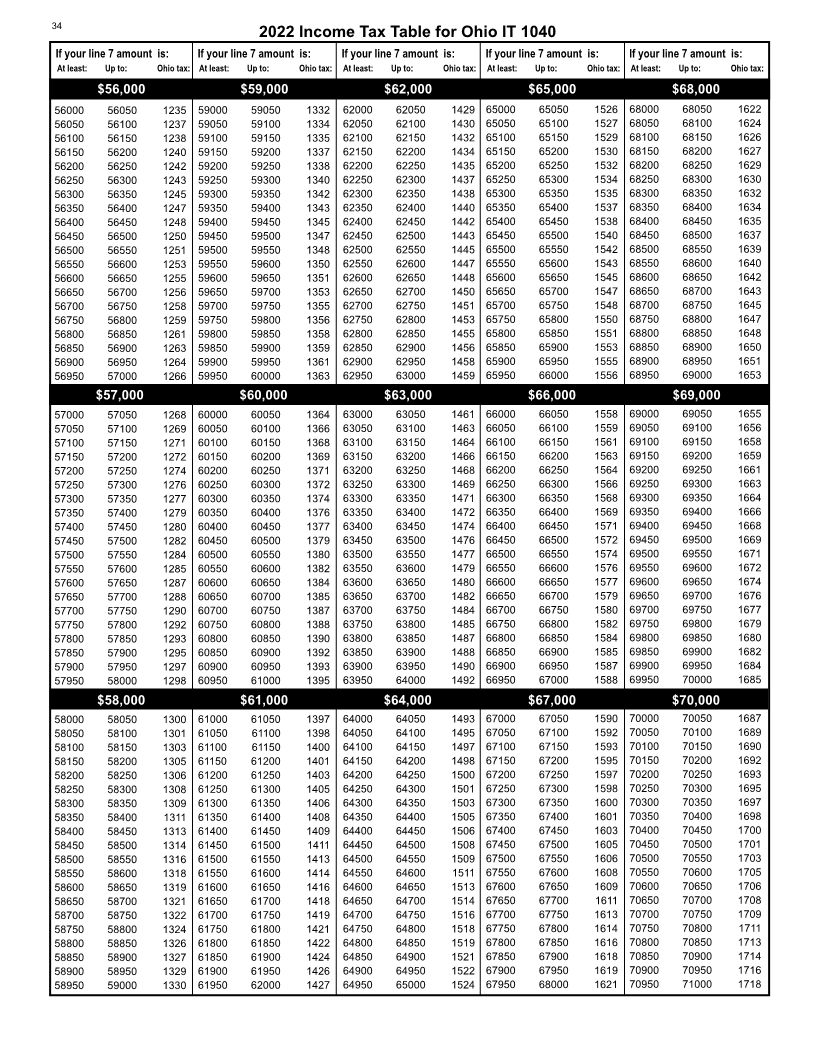

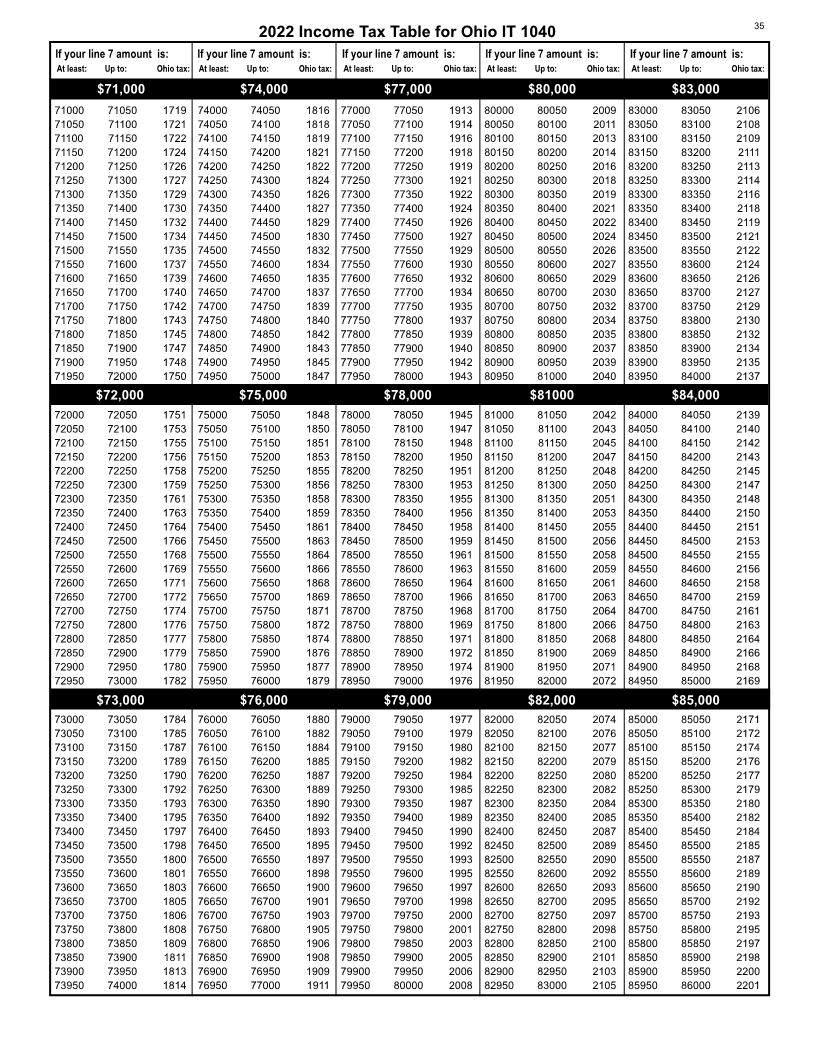

New Ohio Income Tax Tables. For tax year 2022, individuals with Schedules of Withholding. Paper filers must complete the

Ohio taxable nonbusiness income of $26,050 or less are not subject Schedule of Ohio Withholding (and Schedule of School District

to Ohio income tax. Also, the tax brackets have been indexed for Withholding) listing each income statement reporting Ohio (or school

inflation per Ohio Revised Code section 5747.02(A)(5). See pages district) tax withheld. See pages 14 and 47 for more information.

31-37.

Modified Adjusted Gross Income. Beginning with tax year 2019,

New Pass-Through Entity Related Addition and Credit. A new your exemption amount, certain credits, and the school district

addition and credit are applicable to investors in a pass-through income tax bases are determined using "modified adjusted gross

entity that files the IT 4738. See pages 15 and 23. income" or "modified adjusted gross income less exemptions." See

the instructions on page 7.

New Vocational Job Credit. A new nonrefundable credit is

available for individuals who employ eligible employees in a work Electronic Estimated Payments. Estimated payments can be

based learning experience, internship, or cooperative education submitted with your electronically filed Ohio IT 1040 and/or SD

program and were issued a credit certificate from the Ohio 100 through a participating third-party tax preparation product.

Department of Education. See the instructions on page 21. Payments may be future-dated but must be scheduled by the 4th

quarter estimated payment due date.

Guest Payment Service. The Department now has an option to

make Ohio income tax payments without registering for an account. Electronic 1099-G. Your 1099-G is available to view and print using

For more information, see tax.ohio.gov/Pay. Online Services at tax.ohio.gov/File. You can elect to receive your

1099-G electronically.

Common Filing Tips for Paper Filers

Write legibly using black ink and UPPERCASE letters. Include all necessary schedules and worksheets.

• If you have an amount on line 2a and/or 2b of your IT 1040,

Double-check your demographic information. include the Ohio Schedule of Adjustments.

• Verify your name(s) and SSN(s) are correct. • If you have an amount on line 9 and/or 16 of your IT 1040,

• Verify your current address. If you are due a refund, it will be include the Ohio Schedule of Credits and any appropriate

mailed to this address. worksheets.

Verify the forms and vouchers are for the correct tax year. • If you have an amount on line 11 of your Ohio Schedule of

• The Department releases new forms and vouchers each tax Adjustments, include the Ohio Schedule IT BUS.

year. Do not change the year on the form or voucher. If you • If you have dependents, include Ohio Schedule of Dependents.

do this, processing of your form or voucher may be delayed. • Ensure your return is placed in the proper order:

1) Ohio IT 1040 (pages 1 and 2)

Do not write on software-generated returns. 2) Ohio Schedule of Adjustments

• If you print a software-generated return from a tax preparation 3) Ohio Schedule IT BUS

program and later need to change information on the return, 4) Ohio Schedule of Credits

do not write in the changes. Use the software to make the 5) Ohio Schedule of Dependents

necessary changes and reprint the return. 6) Ohio Schedule of Withholding

• The Department’s system will not pick up handwritten changes 7) Worksheets and attachments

on returns generated by tax preparation software. 8) Wage and income statements

Use the proper payment voucher. Include verification for your withholding and credits.

• Use the Ohio IT 40P to pay your Ohio income tax, and the • If you have an amount on line 14 of your IT 1040 and/or an

Ohio SD 40P to pay your school district tax due. amount on line 7 of your SD 100, include the Schedule of Ohio

• If you are amending your return(s), use the Ohio IT 40XP to Withholding and/or Schedule of School District Withholding

pay your Ohio income tax, and the Ohio SD 40XP to pay your as well as copies of your wage and income statements.

school district tax due. • If you are claiming any refundable and/or nonrefundable busi-

ness credits on your Ohio Schedule of Credits, include copies

Do not staple, paper clip, or otherwise attach your return of the required certificates and/or Ohio K-1s.

together.

• This will allow the Department to process your return as Do not include any banking information with your return.

quickly as possible. We will ensure your return information • Direct deposit of individual income and school district income

stays grouped together. tax refunds is not available to paper filers.

Round all figures to the nearest dollar. When filing both Ohio and school district income tax returns,

● To round, drop any cents less than 50 cents and increase send each return in its own envelope.

amounts 50 cents or above to the next dollar.

|

Enlarge image |

6 2022 Ohio IT 1040 / SD 100

Payment Options and Mailing Addresses

Generally, Ohio income and school district ACI Payments charges a service fee of 2.65% What if there’s a problem with my

income tax is due by April 18, 2023. There of your payment or $1, whichever is greater. payment?

are several options for paying these taxes. Ohio does not receive any of this fee. Call ACI Payments at 1-800-487-4567.

Payments for Ohio and school district The payment will appear on your credit card

income taxes must be made separately. statement as two separate entries – one for Paper Check or Money Order

The Department is not authorized to the payment and another for the service fee. Any filer can pay by check or money order.

set up payment plans. You may submit What information do I need when using If you use a money order, keep a copy for

partial payments toward any outstanding this payment method? your records. You will be charged a $50 fee

tax, interest, or penalty. However, such Please have the following information for writing a bad check.

payments will not stop the Department's available:

billing process or collection attempts by the ● The Ohio jurisdiction code: 6446; Ohio IT 1040: Make your check or money

Ohio Attorney General's Office. ● Your SSN and your spouse’s SSN (if fil - order payable to “Ohio Treasurer of State.”

Include the tax year, form name, and

Electronic Check ing jointly); the last four digits of your SSN on the

● The tax year of your payment; Include the appropriate

“Memo” line.

Any filer can pay by electronic check via ● The payment amount;

the Department's Online Services or Guest ● Your credit or debit card number and voucher:

● IT 40P for original returns; OR

Payment service, both available at tax.ohio. expiration date; AND

gov/Pay. ● The school district number (if making a ● IT 40XP for amended returns.

school district income tax payment). SD 100: Make your check or money order

Note: If you are filing in Ohio for the first

time, you may not be eligible to use the How do I make a debit or credit card payable to “School District Income Tax.”

Department's Online Services or Guest payment by phone? Include the tax year, form name, the last

Payment service to pay your Ohio income When you call ACI Payments: four digits of your SSN, and the school

taxes. district number on the "Memo" line.

● First, when prompted, enter “2”. Include the appropriate voucher:

Additionally, electronic filers can follow their ● Second, when prompted, enter “6446#”. ● SD 40P for original returns; OR

filing software's payment prompts at the time ● Third, verify the information. If correct, ● SD 40XP for amended returns.

they file their returns. enter “1”.

● Fourth, when prompted, enter “1” if ma- All payment vouchers are available at tax.

An electronic check withdraws funds directly king an income tax payment, or “2” if .

ohio.gov/forms

from your checking or savings account. making a school district income tax

There is no fee for using this payment payment.

method. Generally, your payment will be

withdrawn within 24 hours of the date you You will then be prompted to enter your

choose for payment. You must ensure that payment information.

the funds are in your account and available

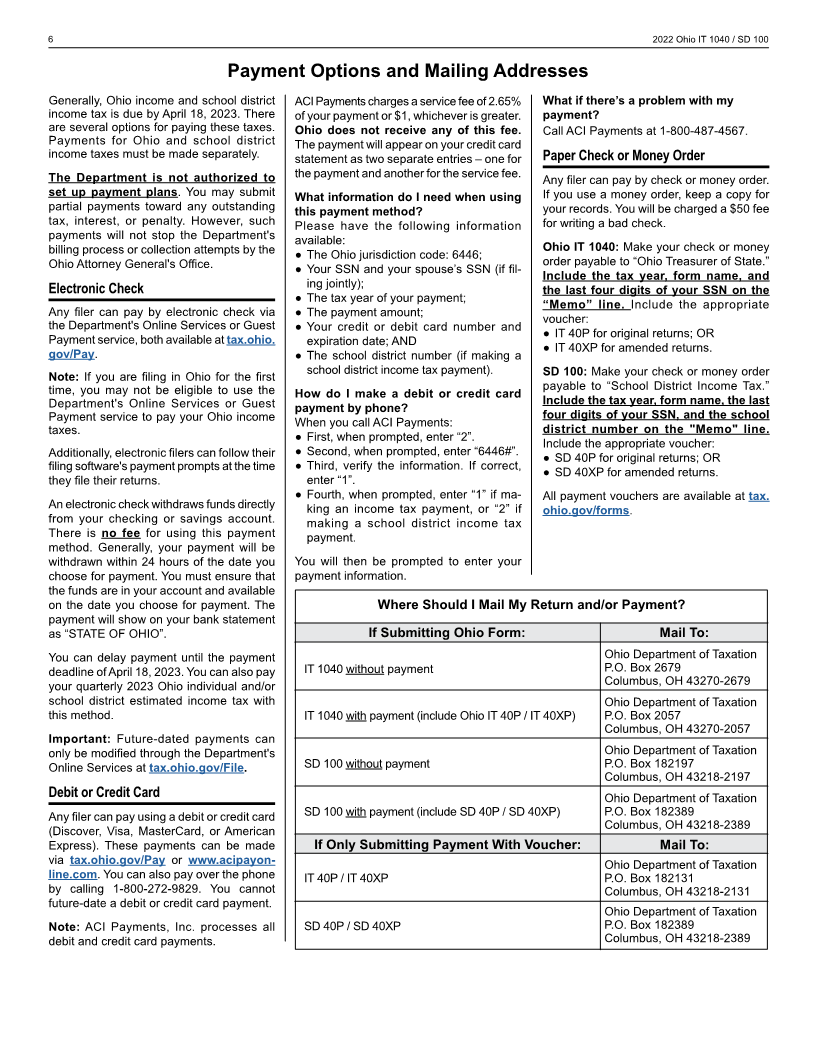

on the date you choose for payment. The Where Should I Mail My Return and/or Payment?

payment will show on your bank statement

as “STATE OF OHIO”. If Submitting Ohio Form: Mail To:

You can delay payment until the payment Ohio Department of Taxation

deadline of April 18, 2023. You can also pay IT 1040 without payment P.O. Box 2679

your quarterly 2023 Ohio individual and/or Columbus, OH 43270-2679

school district estimated income tax with Ohio Department of Taxation

this method. IT 1040 with payment (include Ohio IT 40P / IT 40XP) P.O. Box 2057

Columbus, OH 43270-2057

Important: Future-dated payments can

only be modified through the Department's Ohio Department of Taxation

Online Services at tax.ohio.gov/File. SD 100 without payment P.O. Box 182197

Columbus, OH 43218-2197

Debit or Credit Card Ohio Department of Taxation

Any filer can pay using a debit or credit card SD 100 with payment (include SD 40P / SD 40XP) P.O. Box 182389

(Discover, Visa, MasterCard, or American Columbus, OH 43218-2389

Express). These payments can be made If Only Submitting Payment With Voucher: Mail To:

via tax.ohio.gov/Pay or www.acipayon- Ohio Department of Taxation

line.com. You can also pay over the phone IT 40P / IT 40XP P.O. Box 182131

by calling 1-800-272-9829. You cannot Columbus, OH 43218-2131

future-date a debit or credit card payment.

Ohio Department of Taxation

Note: ACI Payments, Inc. processes all SD 40P / SD 40XP P.O. Box 182389

debit and credit card payments. Columbus, OH 43218-2389

|

Enlarge image |

2022 Ohio IT 1040 / SD 100 7

General Information for the Ohio IT 1040 and SD 100

When Are My Ohio Returns Due? Can My Tax Preparer Contact the What Is Modified Adjusted Gross Income?

Most taxpayers must file their Ohio IT 1040 Department About My Tax Return? Modified adjusted gross income is your Ohio

and SD 100 (if applicable) by April 18, 2023. You may check the box above your tax adjusted gross income (Ohio IT 1040, line 3)

You must file your return by this date even preparer's name on page 2 of the return to plus your business income deduction (Ohio

if you are unable to pay the tax due. For an authorize your preparer to: Schedule of Adjustments, line 11). If you did

exception for certain military servicemem- ● Contact the Department about the status not take a business income deduction, your

bers, see page 9. of your return, payments, or refund; modified adjusted gross income matches

Filing extensions: Ohio does not have an ● Provide the Department with information your Ohio adjusted gross income.

extension request form, but honors the IRS missing from your return; AND You will need to know your modified adjusted

extension. If you filed an IRS extension, your ● Respond to inquiries or notices from the gross income to determine your personal

due date for filing your Ohio IT 1040 and SD Department related to the return. exemption amount and if you qualify for any

100 is October 16, 2023. Include a copy of You may also complete form TBOR 1, Dec- of the following credits:

your IRS extension or IRS acknowledgment, laration of Tax Representative available at ● Retirement income credit;

and/or your extension confirmation number. tax.ohio.gov/forms. This form authorizes ● Lump sum retirement credit;

An extension of time to file does not ex- a tax representative to represent you in any ● Senior citizen credit;

tend the time for payment of the tax due. matter before the Department. ● Lump sum distribution credit;

● Child care and dependent care credit;

You must make extension payments by April See R.C. 5747.08(J). ● Exemption credit; AND

18, 2023 on the Ohio IT 40P and/or SD 40P. ● Joint filing credit.

Interest will accrue on any tax not paid by Should I Make Estimated Tax Payments

April 18, 2023, and penalties may also apply. Additionally, if you live in an earned income

for Tax Year 2023? tax base school district, your taxable income

See R.C. 5747.08(G) and Ohio Adm. Code If your income is subject to Ohio withholding, is limited to only earned income included in

5703-7-05. you generally do not need to make estimated your modified adjusted gross income.

payments. You should make estimated pay- Use the worksheet on page 31 to calculate

What Tax Records Do I Need to Keep? ments for tax year 2023 if your estimated your modified adjusted gross income.

Keep a copy of your: Ohio tax liability (total tax minus total credits)

● Income tax returns and schedules; less Ohio withholding is more than $500. See R.C. 5747.01(II).

● Wage and income statements; Estimated payments are made quarterly ac- What if a Taxpayer Is Deceased?

● Supporting documentation; cording to the following schedule:

● Payment records; 1st quarter - April 18, 2023 The taxpayer's representative, such as an

for at least four years from the later of the executor or administrator, must file the de-

filing due date or the date you filed the re- 2nd quarter - June 15, 2023 ceased taxpayer's return by:

turn. You must be able to support all items 3rd quarter - Sept. 15, 2023 ● Checking the "Deceased" box after the

4th quarter - Jan. 16, 2024

listed on your return. See R.C. 5747.17. applicable SSN;

Use the Ohio IT 1040ES vouchers to make ● Selecting the filing status from the federal

How Should I Complete My Income Tax estimated Ohio income tax payments. Use income tax return; AND

Returns? the Ohio SD 100ES vouchers to make es- ● Signing the return on behalf of the de-

timated Ohio school district tax payments. ceased.

● Only use black ink. You can determine your estimated pay-

● Round numbers to the nearest dollar. ments using the worksheet included with the If the taxpayer is due a refund, the check

● Print numbers and letters (UPPER vouchers. Joint filers should determine their will be issued in the taxpayer's name. The

CASE only) inside the boxes as shown: combined estimated Ohio tax liability and taxpayer's representative can present proof

make joint estimated payments. that she or he is the executor or administrator

1 2 3 A N Y S T R E E T to the bank when cashing the check.

Note: Instead of making estimated pay-

When Will I Receive my Refund? ments, you can increase your Ohio with- If the taxpayer's representative needs the

holding by filing a revised Ohio IT 4 with check reissued to include his or her name,

Most taxpayers who file their returns your employer. Also, special rules regarding see the "Income - General" topic at tax.

electronically and request direct deposit estimated payments apply to certain taxpay- ohio.gov/FAQ for instructions.

will receive their refunds in approximately ers with farming and/or fishing income. See

15 business days. Paper returns will take See R.C. 5747.08(A).

approximately 8 to 10 weeks to process. Adm. Code 5703-7-04.

If you do not make the required estimated What if I Move After Filing My Return?

What Information Must a Preparer payments, you may be subject to an interest If you move after filing your return, notify the

Provide? penalty for underpayment of estimated taxes. Department of your new address as soon

See form IT/SD 2210.

A tax return preparer must provide his/her as possible. You should also notify the post

printed name and Preparer Tax Identifica - For more information, see the "Income - Es- office at moversguide.usps.com.

tion Number (PTIN) on all returns. The timated Income/School District Taxes and

PTIN serves as the preparer's signature. the 2210 Interest Penalty" topic at tax.ohio.

The preparer should not otherwise sign . See also R.C. 5747.09.

gov/FAQ

the return.

See R.C. 5703.263(C) and 5747.08(F).

|

Enlarge image |

8 2022 Ohio IT 1040 / SD 100

Amending Your Ohio IT 1040 and SD 100

You can file an amended Ohio IT 1040 or ● Residency status: Any document sup- Net Operating Loss: To claim a federal NOL

SD 100 to report changes to your originally porting your residency change including carryback, check both boxes at the top of

filed return(s). An amended return can re- property records (mortgage statements, the return(s) and include a completed Ohio

sult in either a tax due or a refund based on lease agreements, etc.), driver's licenses Schedule IT NOL. See the instructions for the

the changes. Under certain circumstances, or state IDs, voter registration, resident Ohio Schedule IT NOL on page 50.

an amended return may be required. state tax returns, armed services records

and utility bills. Your amended Ohio IT 1040

To amend the Ohio IT 1040 or SD 100, ● Payments/credits: Copies of your income and/or SD 100 must be filed

you should file a new return, reflecting all statements (W-2, 1099, etc.), Ohio IT K-1, no later than 90 days after the

CAUTION

proposed changes, and indicate that it is or credit certificates; ! IRS completes its review of

amended by checking the box at the top ● Nonresident credit: Ohio form IT NRC. your federal return, even after

of page 1. You must include the IT RE with

your amended IT 1040 and/or the SD RE See R.C. 5747.11. the four-year period has passed. Failure

with your amended SD 100. Use your cur- to file the return within the 90-day period

rent mailing address on the amended re- Reporting Additional Tax Due may result in an assessment or a denial

of your refund claim.

turn. Allow at least 120 days from the date You should amend your return to report addi-

of receipt to process your amended return. tional income, or reduce a previously claimed See R.C. 5747.10.

For more information, see the "Income - credit or deduction. Such changes may result

Amended Returns" topic at tax.ohio.gov/ in additional tax due. Include payment with Changes to Your Resident Credit

FAQ. your amended return using an IT 40XP and/

You must file an Ohio amended return based

When Not to Amend Your Return or SD 40XP payment voucher.

on changes made by another state if all of

Some common mistakes may not require an Changes to Your Federal Return the following are true:

● You claimed a resident credit on your Ohio

amended return. Some examples include: If the IRS makes changes to your federal re- IT 1040;

● Math errors; turn, either based on an audit or an amended ● You filed income tax returns in other states;

● Missing pages or schedules; ● The Ohio resident credit claimed was

● Demographic errors; return, and those changes affect your Ohio

● Missing income statements (W-2, 1099, return(s), you are required to file an amended based on either the taxes due or the taxes

K-1) or credit certificates; IT 1040 and/or SD 100. The IRS notifies the paid to the other states;

● Unclaimed payments or withholding. Department of these changes. ● The other states made changes to the

returns; AND

In these situations, the Department will ei- Do not file your amended Ohio return(s) ● The changes will affect your Ohio resident

ther make the corrections or contact you to until the IRS has finalized the changes to credit calculation.

request documentation. your federal return. Once they are finalized,

include a copy of all of the following: Your income taxes paid to other states

Requesting a Refund ● Your federal 1040X; may change after the four-year period has

● The IRS acceptance letter; AND passed. If the taxes paid would otherwise

You may amend your return to request an ● The refund check issued to you by the qualify for the Ohio resident credit, you have

additional credit, deduction or payment. Such IRS, if applicable. an additional 90 days after the changes

changes may result in a refund. Generally, have been finalized by the state(s) to file an

you have four years from the date of the Note: Instead of providing these documents, amended return and request any refund that

payment to request a refund. You must in- you may be able to submit a copy of the results from the changes.

clude documentation to support the changes IRS Tax Account Transcript reflecting your

reported on your amended return. Some updated federal return information. Once the changes are finalized, please in-

common required documentation includes: clude a copy of all of the following:

● Business Income: Page 1 of your federal If there is a change in your filing status and/ ● A revised Ohio form IT RC;

return, the federal schedules reporting or dependents, it must be reflected on your ● The other state return(s) or correction

your business income, and IT K-1 forms; amended Ohio return(s). Additionally, for notice(s); AND

● Social security, disability, survivorship, and changes to dependents, complete an up- ● Proof of payment to the other state(s).

retirement benefits: Copies of 1099(s), dated Ohio Schedule of Dependents.

See R.C. 5747.05(B)(3).

page 1 of your federal return, and the

retirement plan paying the benefits;

|

Enlarge image |

2022 Ohio IT 1040 / SD 100 9

Ohio Income Tax for Military Servicemembers and Their Civilian Spouses

Residency. A military servicemember is a ● Line 27 - Deduction for military pay the deductions available under Ohio law.

resident of their "state of legal residence." earned by a nonresident servicemember However, the Department recommends

This is generally the same as the service- ● Line 28 - Deduction for uniformed services that such taxpayers file an Ohio IT 1040

member's "home of record" unless it is sub- retirement income or IT 10 to avoid delinquency billings. For

sequently changed. The servicemember's ● Line 29 - Deduction for military injury relief more information on who must file an Ohio

state of legal residence does not change fund grants and veteran's disability sever- income tax return, see page 11.

based on military orders. ance payments

● Line 30 - Deduction for certain reimburse- Extensions to File/Pay. Generally, Ohio

A servicemember's civilian spouse will also ments and benefits received for service in recognizes any extensions granted by the

retain their original state of legal residence the Ohio National Guard IRS. Certain military servicemembers will

if the servicemember and spouse have have the same extensions to file their Ohio

the same state of legal residence and the Additionally, a servicemember's nonresi- returns and pay any Ohio tax due. These

spouse is accompanying the servicemem- dent civilian spouse can deduct, on line 27, servicemembers do not owe interest, pen-

ber as part of military orders. Additionally, a compensation earned in Ohio, when the alties, or the interest penalty in connec-

civilian spouse can elect to have the same servicemember and spouse have the same tion with this extension period. See R.C.

state of legal residence as the servicemem- state of residence and are present in Ohio 5747.026 for more information.

ber. due to military orders.

Taxability. The charts below summarize

Deductions. Ohio provides five deductions See pages 17-18 for specific instructions on the taxability of income for military service-

to military servicemembers. Only income each of these deductions. members and their civilian spouses.

included in the taxpayer's federal adjusted

gross income is eligible for these deduc- Withholding. A servicemember who quali-

tions. For example, Ohio Veterans Bonus fies for the deduction on line 26 or a civil- School District Income Tax. Military ser-

payments are not included in federal adjust- ian spouse who qualifies for the deduction vicemembers and their civilian spouses

ed gross income and thus are not deduct- on line 27 can complete form IT 4 to avoid may be liable for school district income tax

ible. The following deductions are in the Ohio withholding on income not subject to if they are Ohio residents, even if they are

"Uniformed Services" section of the Ohio tax. Such taxpayers should check the ap- not present in Ohio due to military orders.

Schedule of Adjustments: propriate box in Section III of the IT 4 and To determine if you are liable for school dis-

provide the form to their employers. trict income tax, see page 46.

● Line 26 - Deduction for military pay and

allowances for certain active duty service- Filing. Certain military service members

members stationed outside Ohio may not have a filing requirement due to

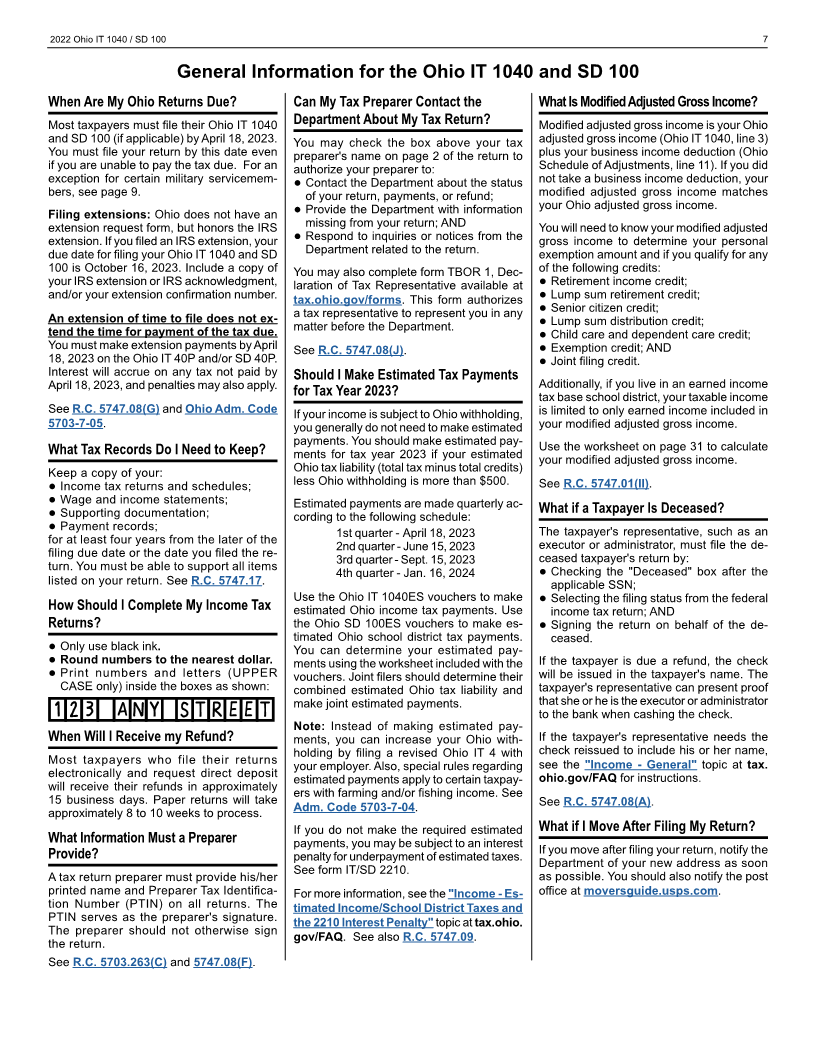

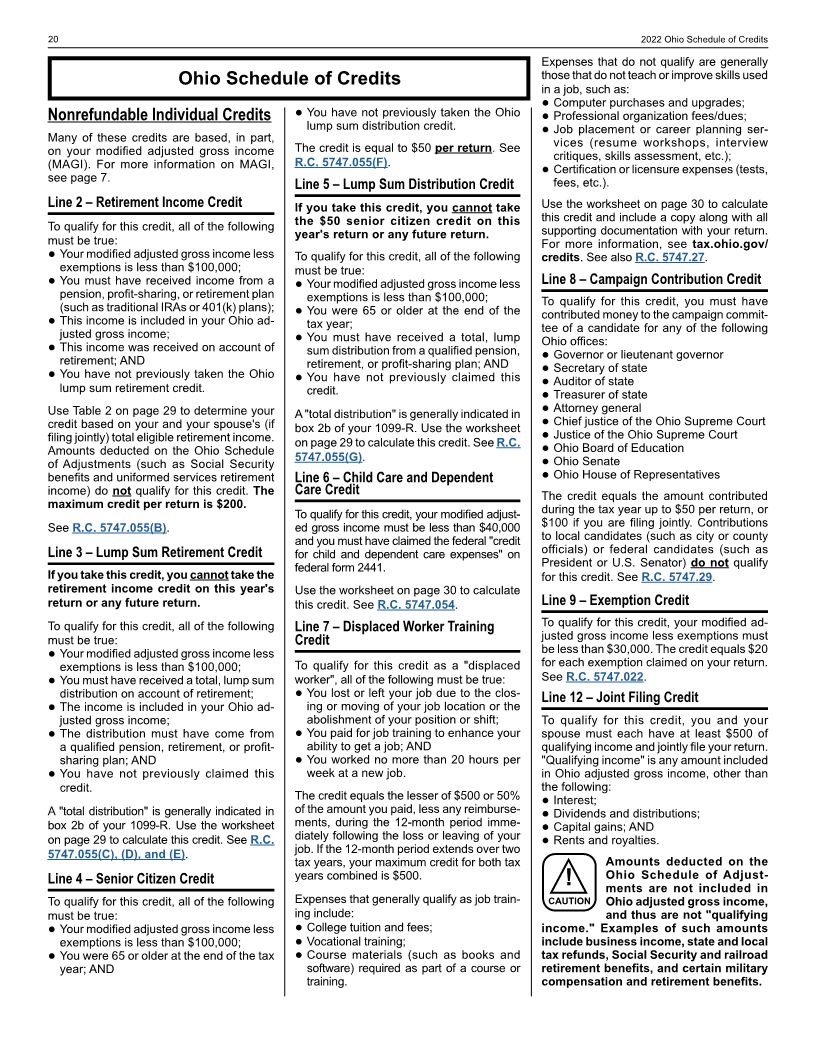

Taxability of a Military Servicemember's Income in Ohio

If the servicemember

1) is a: Resident of Ohio Nonresident of Ohio

And the income is In Ohio Outside of Ohio In Ohio Outside of Ohio

2) earned:

3) And the source of Military Non- Military Non- Military Non- Military Non-

the income is: Service Military Service Military Service Military Service Military

Deductible on Eligible for Deductible on Deductible on Eligible for the

4) Taxed in Taxed in Taxed in

Then the income is: Ohio Ohio Sch. of Adj., the Resident Ohio

Sch. of Adj., Sch. of Adj., Nonresident

line 26 Credit line 27 line 27 Credit

Taxability of a Servicemember's Civilian Spouse's Income in Ohio

1) If the spouse is a: Resident of Ohio Nonresident of Ohio

And the spouse and

2) servicemember: N/A (Skip to #3) The same state of legal residence Different states of legal residence

3) And the income is In Ohio Outside of Ohio In Ohio Outside of Ohio In Ohio Outside of Ohio

earned:

Deductible on Eligible for the

4) Eligible for the

Then the income is: Taxed in Eligible for the Sch. of Adj., Nonresident Taxed in Ohio Nonresident Credit

Ohio Resident Credit line 27 Credit

For more information, see tax.ohio.gov/military, or Information Release IT 2008-02, "Ohio Taxable Income and Deductions for Service-

members and Civilian Spouses." You can also email the Department at military-info@tax.state.oh.us.

|

Enlarge image |

10 2022 Ohio IT 1040 / SD 100

Ohio Definitions and Examples of Business and Nonbusiness Income

How Is Business Income Treated on My activities of the business during the taxable Mineral Rights Income: Cynthia allows

Ohio Return? year in which the sale occurs or during any a company to extract minerals from her

of the five preceding taxable years. residential property. She receives income

Taxpayers can deduct the first $250,000 based on the company's usage of her land.

($125,000 for married separate filers) of their Generally, income recognized by a sole Since Cynthia is not engaged in a trade or

business income included in their federal proprietorship or pass-through entity is business related to this income, it is not

adjusted gross income. Also, any business business income. However, determining business income.

income not deducted is taxed at a flat 3%. if income is business income is highly

See the instructions for the Ohio Schedule dependent upon the specific facts and Pass-Through Income: Ellen owns 15% of

IT BUS on page 19. circumstances. a pass-through entity. She reports $50,000

of ordinary income, $10,000 of bonus

Additionally, Ohio-related business income What Are Some Examples of Business depreciation, and $60,000 of guaranteed

earned by nonresidents is taxable to Ohio. Income vs. Nonbusiness Income? payments on federal Schedule E. Since

See the instructions for the IT NRC on page 23. Ellen owns less than 20% of the entity, the

Interest and Dividends: John reports guaranteed payments are nonbusiness

How Does Ohio Law Define Business $1,500 of interest and dividend income on

and Nonbusiness Income? federal Schedule B. $200 of his interest income. Thus, her net business income from

federal Schedule E is $40,000 (her ordinary

"Business income" is income, including gain/ income is from a pass-through entity that income less bonus depreciation).

loss, arising from any of the following: primarily operates an investment business.

● Transactions, activities, and sources in The remaining $1,300 is from personal, Guaranteed Payments: Stan owns 25% of

the regular course of a trade or business nonbusiness sources. Thus, only $200 of a pass-through entity. He reports a $60,000

operation; John’s interest is business income. guaranteed payment on federal Schedule

● Real, tangible, and intangible property Capital Gains and Losses: Andrew rec- E. Because he owns at least 20% of the

if the acquisition, rental, management, ognizes a capital gain from the sale of a entity, the guaranteed payment is business

and disposition of the property constitute tractor used to harvest wheat on his farm. income.

integral parts of the regular course of a Since the tractor was integral to his farming Wages/Compensation: Jim owns 80% of

trade or business operation; business, the capital gain is business an S corporation. Jim receives $200,000 of

● A partial or complete liquidation of a busi- income. wages from the S corporation, which are

ness, including gain or loss from the sale reported on a W-2. Because he owns at

or other disposition of goodwill; Capital Gains and Losses: Paul reports least 20% of the corporation, the wages are

● Income from certain sales of equity or $8,000 of capital gain income on his reclassified as business income.

ownership interests in a business; OR federal Schedule D. $2,000 of the capital

● Compensation and guaranteed pay- gains are from a pass-through entity that Trust Income: Brett sets up a trust, with

ments paid by a pass-through entity, or primarily operates an investment business. himself as the beneficiary, that invests in

a professional employer organization on The remaining $6,000 is from personal, multiple pass-through entities. Operating

its behalf, to an investor who directly or nonbusiness sources. Thus, only $2,000 of income from these entities is distributed

indirectly owns 20% or more of the entity. Paul’s capital gains are business income. to the trust, which further distributes the

income to Brett. Since the income was

"Nonbusiness income" is any income other Rental Income and Losses: Debbie owns business income to the entities, it retains its

than business income. a rental property. She actively advertises, character as business income as it passes

manages, and maintains the property. through to the trust and to Brett.

See R.C. 5747.01(B) 5747.01(C), and Debbie is in the trade or business of property

5733.40(A)(7). rental. Therefore, her rental income is Trust Income: David sets up a trust, with

How Do I Determine What Income Is business income. himself as the beneficiary, to hold his

Business Income? personal investments. Although David uses

Rental Income and Losses: Ryan a trust, the usage of a trust does not create a

Business income can be determined by occupies a home on a golf course. The trade or business. Therefore, the investment

using either test: golf course hosts a two-week tournament income is nonbusiness income to both the

every year. Ryan annually takes a vacation trust and to David.

Transactional Test: Looks to the nature, to Florida and rents out his home during

frequency and regularity of the transaction. the tournament. While the rental might be

Functional Test: Looks to if the property considered regular, Ryan is not in the trade

was integral to the trade or business, or if or business of property rental. Therefore,

it generated business income in the past. his rental income is not business income.

See Kemppel v. Zaino, 2001-Ohio-92. Royalty Income: Hannah works full-time

from her home writing children’s books.

Sale of an equity or ownership interest in a Hannah has an agreement with a publisher

business means the sale was treated as an that pays her a royalty for each copy of her

asset sale for federal income tax purposes book that is sold. Hannah is in the trade or

and/or the seller materially participated, business of writing books. Therefore, her

as described in 26 C.F.R. 1.469-5T, in the royalty income is business income.

For more information, see the "Income – Business Income and the Business Income Deduction" topic at tax.ohio.gov/FAQ.

.

|

Enlarge image |

2022 Ohio IT 1040 11

General Information for the Ohio IT 1040

Who Must File an Ohio Income Tax Ohio Residency How Do I Show I Am a Nonresident of

Return? Ohio?

What Is my Ohio Residency Status?

Every Ohio resident and every part-year Any individual can challenge the pre-

resident is subject to the Ohio income tax. Resident: You are an Ohio resident for sumption of Ohio residency by providing

Every nonresident having Ohio-sourced income tax purposes if you are domiciled documentation showing that they are a

income must also file. Examples of Ohio- in Ohio. Thus, under Ohio law, the terms nonresident. Ohio uses a contact period test

sourced income include the following: “domiciled” and “resident” mean the same to determine the burden of proof needed to

● Wages or other compensation earned in thing. show that an individual is a nonresident.

Ohio (see "Exception" below);

● Ohio lottery winnings; Generally, any individual with an abode If you had fewer than 213 contact periods

● Ohio casino gaming winnings; in Ohio is presumed to be a resident. The in Ohio during the tax year, you must

● Income or gain from Ohio property; abode can be either owned or rented. provide enough documentation to show

● Income or gain from a sole proprietorship Temporary absence from your Ohio abode, that it is more likely than not that you were

doing business in Ohio; no matter how long, does not change your a nonresident. If you had 213 or more

● Income or gain from a pass-through entity residency status. Thus, if you live in Ohio, contact periods, you must provide clear and

doing business in Ohio. the presumption is that you are an Ohio convincing documentation that you were a

resident. nonresident.

Exception: A full-year nonresident living in

Indiana, Kentucky, Michigan, Pennsylvania, Example: Brent travels to Florida each Alternatively, certain individuals can change

or West Virginia does not have to file if the winter and returns to Ohio each spring. the presumption of Ohio residency to a

nonresident's only Ohio-sourced income is However, he maintains his Ohio driver's presumption of nonresidency by filing the

wages. license, voter registration, etc. and has not Ohio Nonresident Statement (form IT NRS).

established permanent residence in Florida. For more information on this statement, see

Example: Charley lives in Kentucky but Therefore, he is a full-year resident of Ohio. pages 13 and 49.

commutes to Cincinnati every day to her

job. Charley's wages are not taxable in Ohio Part-year resident: You are a part-year See R.C. 5747.24(B), (C) and (D).

even though they are earned here. resident of Ohio if you were a resident of

Ohio for a portion of the tax year and a What Is a Contact Period?

You do not have to file an Ohio income nonresident for the rest of the tax year.

You have a contact period in Ohio if all of

tax return if: Thus, you are a part-year resident if you the following are true:

● Your Ohio adjusted gross income (Ohio permanently moved into or out of Ohio ● You have an abode outside of Ohio;

IT 1040, line 3) is less than or equal to $0; during the tax year.

● The total of your senior citizen credit, ● You are away overnight from your abode;

lump sum distribution credit, and joint fil- Part-year residents are entitled to the AND

ing credit (Ohio Schedule of Credits, lines nonresident credit for any income earned ● While away, you spend any portion of two

4, 5 and 12) is equal to or exceeds your while they were a resident of another state. consecutive days in Ohio.

income tax liability (Ohio IT 1040, line 8c) They are also eligible for the resident credit

and you are not liable for school district on non-Ohio income earned while they were You do not have to spend the night in

income tax; OR an Ohio resident, if they were subject to, and Ohio. For example, if you spend portions of

● Your exemption amount (Ohio IT 1040, paid tax on, that income in another state. Monday and Tuesday in Ohio, but stay in

line 4) is the same as or more than your a hotel in Kentucky on Monday night, you

Ohio adjusted gross income (Ohio IT Nonresident: You are a nonresident if you would still have a contact period in Ohio.

1040, line 3). were a resident of another state for the entire

tax year. Nonresidents who earn or receive You must spend consecutive days in Ohio to

However, even if you meet one of these ex- income within Ohio will be able to claim the have a contact period. For example, if you

ceptions, if you have a school district income nonresident credit with respect to all items of spend portions of Monday and Wednesday

tax liability (SD 100, line 2), you are required income not earned and not received in Ohio. in Ohio, but not Tuesday, then you would not

to file the Ohio IT 1040. have a contact period in Ohio.

If you are currently a member of the

Note: If your federal adjusted gross income military and you have questions about your See R.C. 5747.24(A).

is greater than $28,450, the Department residency status, see page 9.

recommends that you file an Ohio IT

1040 or IT 10, even if you do not owe For more information, see tax.ohio.gov/

any tax, to avoid delinquency billings. residency, or Information Release IT

2018-01, "Residency Guidelines - Tax

Ohio IT 10: Certain taxpayers can file Ohio Imposed on Resident and Nonresident

form IT 10 instead of the Ohio IT 1040. The Individuals for Taxable Years 2018 and

four types of taxpayers described on form IT Forward." See also R.C. 5747.01(I)(1) and

10 are eligible to file the form if they: Cunningham v. Testa, 2015-Ohio-2744.

● Do not have an Ohio individual income

or school district income tax liability; AND

● Are not requesting a refund.

Do not file the IT 10 if you file the IT 1040.

See R.C. 5747.08.

|

Enlarge image |

12 2022 Ohio IT 1040

Donations that Apply to Ohio IT 1040

A donation will reduce the If you do not have an overpayment on your Wildlife Species and

amount of the refund that Ohio IT 1040, but you want to donate to Endangered Wildlife

! you are due. If you decide to provide grants to such individuals, you may

CAUTION donate, this decision is final. do so by writing a check payable to "Ohio The Division of Wildlife uses these funds to

You cannot change your Treasurer of State (ODVS)" and mailing it to: establish habitat and protect open spaces

mind and later ask for your donations to for wildlife. Past donations have helped to

be refunded. If you do not want to donate, Ohio Department of Veterans Services restore populations of endangered species.

do not enter an amount on Ohio IT 1040, Military Injury Relief Fund Your generous donation will continue to help

lines 26a-g. P.O. Box 373 support Ohio's native wildlife – a natural

Sandusky, OH 44871 treasure!

Because your tax return is confidential, the

Department cannot release your name to the Ohio History Fund If you do not have an overpayment on your

fund administrators, but the administrators Ohio IT 1040, but you want to donate to

extend appreciation to those who donate. The Ohio History Fund is a 501(c)(3) non- provide grants to protect Ohio's natural

Your donation may be tax-deductible on a profit organization that allocates these funds heritage, you may do so by writing a check

future federal income tax return. toward a matching grants program to sup- payable to the "Nongame and Endangered

port state and local history-related projects Wildlife Special Account" and mailing it to:

See R.C. 5747.113. throughout Ohio.

Ohio Department of Natural Resources

Breast and Cervical Cancer Project If you do not have an overpayment on Division of Wildlife

your Ohio IT 1040, but you want to donate 2045 Morse Road, Building G-1

Contributions made to the project are used to provide grants to promote and protect Columbus, OH 43229-6693

to provide free breast and cervical cancer Ohio's rich history, you may do so by writ-

screening, diagnostic and outreach/case ing a check payable to "The Ohio History To learn more, go to wildlife.ohiodnr.gov.

management services to uninsured and Connection Income Tax Contribution Fund"

underinsured Ohio women. The project is and mailing it to: Wishes for Sick Children

administered by the Ohio Department of

Health and is operated through 11 regional The Ohio History Connection Contributions are distributed by the Ohio

agencies, which enroll women in the pro- Attn: Business Office Department of Health to fund a program

gram and schedule them for services with 800 E. 17th Avenue administered by a nonprofit corporation that

clinical providers in the agency's service Columbus, OH 43211-2474 grants the wishes of individuals who are

area. under the age of 18, Ohio residents, and

Donations may also be made online at have been diagnosed with a life-threatening

If you do not have an overpayment on your www.ohiohistory.org. medical condition.

Ohio IT 1040, but you want to donate to

provide grants for free breast and cervical State Nature Preserves and If you do not have an overpayment on your

cancer screening, you may do so by writ- Scenic Rivers Ohio IT 1040, but you want to donate to

ing a check payable to "Ohio Treasurer of Contributions are used to protect Ohio's provide funds for Wishes for Sick Children,

State" or "Ohio Department of Health" and state nature preserves, scenic rivers, rare you may do so by writing a check payable to

mailing it to: species and unique habitats. Your donations "Ohio Treasurer of State" or "Ohio Depart-

ment of Health" and mailing it to:

Ohio Department of Health play a critical role in caring for Ohio's most Ohio Department of Health

Attn: Breast & Cervical Cancer exceptional forests, wetlands, prairies, rivers Attn: Wishes for Sick Children

P.O. Box 15278 and streams. Donations fund educational P.O. Box 15278

Columbus, Ohio 43215-0278 outreach programs, research and monitoring Columbus, OH 43215-0278

for rare species and construction of facilities

In the description on the check, please write that improve public access.

"Breast and Cervical Cancer Donation."

If you do not have an overpayment on

Military Injury Relief Fund your Ohio IT 1040, direct donations may

also be made by check or online. Please

The Military Injury Relief Fund provides visit the "Support Natural Areas" section

grants to individuals injured while in active at naturepreserves.ohiodnr.gov for

service as a member of the U.S. armed information.

forces and to individuals diagnosed with

post-traumatic stress disorder while serving,

or after having served, in Operation Iraqi

Freedom, Operation New Dawn or Opera-

tion Enduring Freedom.

|

Enlarge image |

2022 Ohio IT 1040 / SD 100 / IT 10 13

Completing the Top Portion of Your Ohio Returns

These instructions are used to complete the top portions of the Ohio IT 1040, SD 100, and IT 10.

IT 1040, SD 100 and IT 10 IT 1040 and IT 10 SD 100 Only

Amended Return Check Box School District Number School District Number

Check this box if you are amending your If you were an Ohio resident for any part of Enter the school district number for which

previously filed return. You must include the tax year, enter the number of the school you are filing this return on pages 1 and

the Ohio IT RE and/or SD RE with your district in which you lived during the majority 2. See pages 40-45 for a full list of Ohio’s

amended return. See page 8 for amended of the year. Full-year nonresidents should school districts or use The Finder at tax.

return instructions. This box is not available enter 9999. ohio.gov/Finder.

on form IT 10.

See pages 40-45 for a full list of Ohio’s School District Residency Status

Net Operating Loss (NOL) Check Box school districts or use The Finder at tax.

ohio.gov/Finder. Check the box corresponding to your resi-

Check this box if you are amending due to dency status for the school district number

a net operating loss carryback. You must Note: Some school districts levy an income you entered on the return. If you are a part-

include the Ohio Schedule IT NOL with your tax on their residents. See page 46 for more year resident, enter the dates of residency.

amended return. This box is not available

on form IT 10. information.

Tax Type

Name(s), Address and SSN(s) Residency Status

Check the box indicating the tax type of the

Enter your name and current address on Check the box corresponding to your resi- school district for which you are filing this

page 1 and your SSN on pages 1 and 2 of dency status. If your filing status is married return. The list of school districts on pages

your return (if filing jointly, also enter your filing jointly, each spouse must indicate his/ 40-45 indicates the tax type of each taxing

spouse’s name and SSN on page 1). Do not her residency status. school district.

include your spouse’s name and SSN if

you are not filing jointly. If you checked the box for "part-year resi- For more information on the two tax types,

dent" or “nonresident,” write, in the space see page 46.

Note: If you and/or your spouse have an provided, the two-letter abbreviation of the

Individual Taxpayer Identification Number state where you resided for the majority of

(ITIN), you should enter the ITIN in the the tax year.

spaces provided on the return for the SSN.

For more information on Ohio residency,

see page 11.

County

If you were an Ohio resident for any part of Ohio Nonresident Statement

the tax year, enter the first four letters of the Nonresidents who meet certain required

county in which you lived during the major- criteria and wish to establish an irrebuttable

ity of the tax year. Full-year nonresidents presumption of non-Ohio residency for the

should leave these boxes blank. tax year may check these boxes instead

of filing form IT NRS. The five required

Filing Status criteria are listed on page 49 under the

heading, “What Criteria are Required to File

Your filing status must be the same as your the Ohio Nonresident Statement?”

federal income tax filing status for the tax

year. See R.C. 5747.08(E). Nonresidents who file jointly and both meet

the required criteria can each check the

If you check “married filing separately,” enter appropriate box to establish an irrebuttable

your spouse’s SSN in the spaces provided. presumption of non-Ohio residency.

If you and your spouse filed a Note: Individuals who do not meet the

joint federal return, you must required criteria are still able to file as non-

! file a joint Ohio income tax residents. Residents and part-year residents

CAUTION return even if one or both of cannot check these boxes to establish

you are nonresidents of Ohio. an irrebuttable presumption of non-Ohio

You may claim the nonresident credit residency.

(see the Ohio Schedule of Credits) for

income not earned or received in Ohio. Extension Filer

If you and your spouse filed separate

federal returns, you must file separate

Ohio returns. Any taxpayer with a valid federal extension

is allowed an extension of time to file their

Ohio returns. Such taxpayers should check

the box indicating they are a federal exten-

sion filer for this tax year to qualify for the

Ohio extension. For more information on

filing extensions, see page 7.

|

Enlarge image |

14 2022 Ohio IT 1040

Note: The tax amount listed in the Income

Ohio IT 1040 - Individual Income Tax Return Tax Table may be slightly lower or higher

than the tax amount computed by using the

Income Tax Brackets.

Line 1 – Federal Adjusted Gross Line 4 – Personal and Dependent

Income Exemptions See R.C. 5747.02(A)(3).

Enter the amount from your 2022 federal Ohio allows an exemption for the following: Line 11 – Interest Penalty

income tax return: ● You, if not claimed as a dependent on

● Federal 1040, line 11; another person’s return; Generally, if you are a wage earner and have

● Federal 1040-SR, line 11; OR ● Your spouse, if filing jointly and not Ohio withholding, you will not owe an interest

● Federal 1040-NR, line 11. claimed as a dependent on another per- penalty. If you have non-wage income or

son’s return; AND no Ohio withholding, use Ohio IT/SD 2210

Generally, line 1 of your Ohio ● Your dependents claimed on your federal to determine if an interest penalty is due.

income tax return must match tax return. For more information, see the "Income -

! your federal adjusted gross in- Estimated Income/School District Taxes

CAUTION come as defined in the Internal The personal and dependent exemption is and the 2210 Interest Penalty" topic at tax.

Revenue Code. based on your modified adjusted gross in- ohio.gov/FAQ. See also R.C. 5747.09(D)

come (see page 7): and (E).

Zero or Negative Federal Adjusted Gross

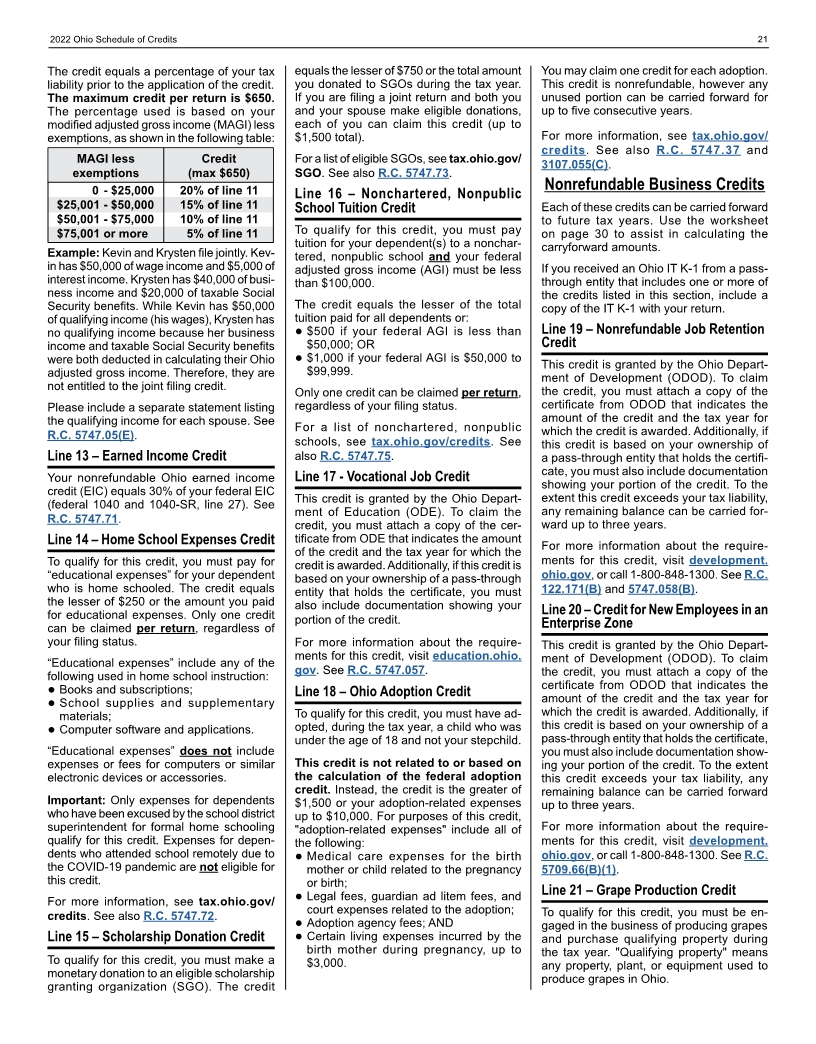

Income. If you have a zero or negative Personal/ Line 12 – Unpaid Use (Sales) Tax

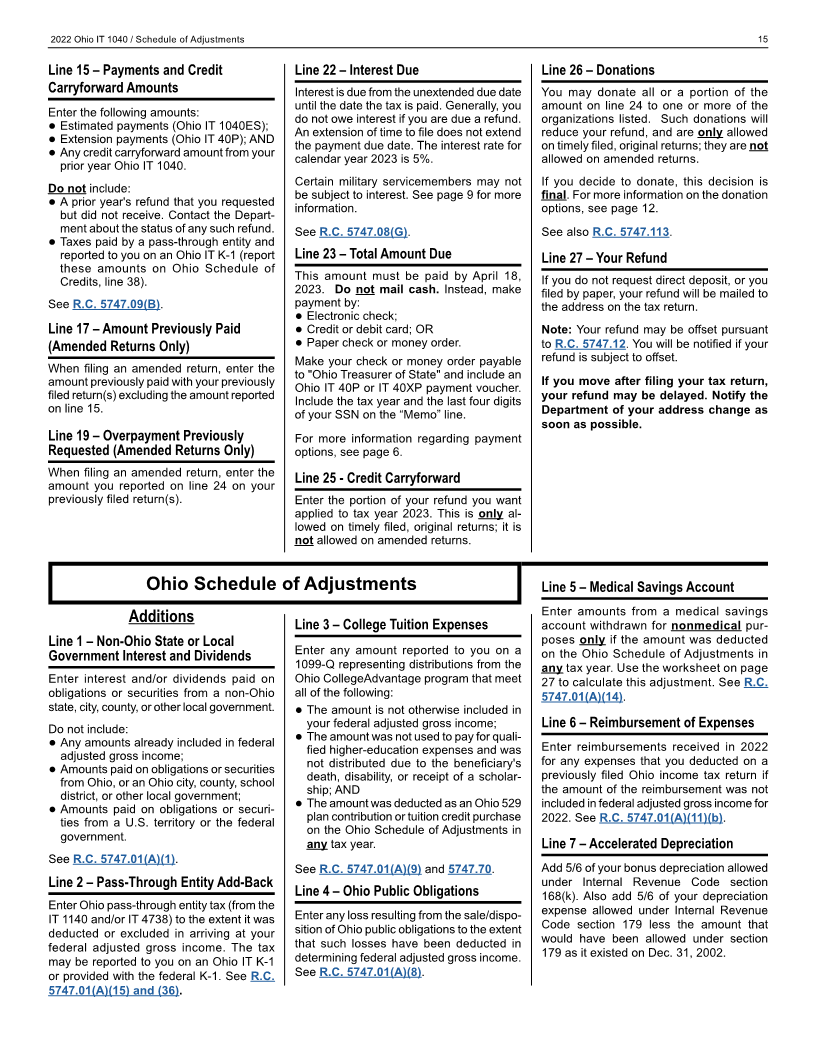

federal adjusted gross income, you must Modified Adjusted Dependent

include a copy of page 1 of your federal Gross Income Exemption Report the amount of unpaid use (sales)

return. tax due for the tax year. You owe Ohio use

$40,000 or less $2,400 tax if both of the following are true:

A foreign trust that files federal form 1040- ● You made purchases where sales tax

NR should not use the IT 1040 to file with $40,001 – $80,000 $2,150 was not collected; AND

Ohio. Such trusts must file form IT 1041. More than $80,000 $1,900 ● The purchases were not qualifying

purchases made during Ohio's sales

See R.C. 5747.01(A). Enter your number of exemptions in the tax holiday.

spaces provided. Multiply your exemptions Use tax eliminates the disadvantage to

Line 2a – Ohio Schedule of Adjust- by the appropriate amount from above and

ments (Additions) enter the result on line 4. Ohio retailers when Ohio shoppers buy

from out-of-state sellers who do not col-

The Ohio Schedule of Adjustments lists Example: John and Mary claim their son lect sales tax. Use tax is most commonly

the additions to your federal adjusted Patrick as an exemption on their jointly filed due on out-of-state purchases such as

gross income. For more information federal income tax return. Their modified those made from the internet, television,

about the additions you must make, see adjusted gross income is $75,000. Thus, or catalogs.

pages 15-16. they claim three exemptions totaling $6,450

● If you have no additions to your Ohio on their Ohio return. Patrick files his own Use the worksheet on page 31 to calculate

income, leave line 2a blank. tax return. Since Patrick is a dependent your use tax. For more information, see the

● Any additions listed on this line must be and his parents claim an exemption for him, "Sales and Use Tax" topics at tax.ohio.

supported by the applicable Schedule he is not eligible for an exemption on his gov/FAQ. See also R.C. 5747.083.

of Adjustments line item(s). Enter the return. He should check the box indicating

amount from Schedule of Adjustments, he can be claimed by someone else and Line 14 – Ohio Income Tax Withheld

line 10 on this line. enter $0 on line 4. Enter your Ohio income tax withheld as

reported on Part A, line 1 of the Schedule

You must include a copy of the Ohio Ohio Schedule of Dependents. If you of Ohio Withholding.

Schedule of Adjustments with your return. included dependents on your Ohio re-

turn, complete the Ohio Schedule of De- Schedule of Ohio Withholding. Complete

Line 2b – Ohio Schedule of pendents. If your dependent has an indi- this schedule if you are reporting an amount

Adjustments (Deductions) vidual tax identification number (ITIN) or on line 14 of the IT 1040. Enter only income

adoption taxpayer identification number statements (W-2, W-2G, 1099) reporting

The Ohio Schedule of Adjustments lists (ATIN), enter that number in the boxes for Ohio income tax withheld. Do not include:

the deductions from your federal adjusted the dependent's SSN. If the dependent ● Taxes withheld for another state, a city, or

gross income. For more information about information is not provided, incomplete, a school district; OR

the deductions you must make, see pages or contains errors, you may be asked for ● Taxes paid by a pass-through entity and

16-19. supporting documentation. reported to you on an Ohio IT K-1 (report

● If you have no deductions to your Ohio these amounts on Ohio Schedule of

income, leave line 2b blank. See R.C. 5747.025 and 5747.01(O). Credits, line 38).

● Any deductions listed on this line must

be supported by the applicable Schedule Line 8a – Tax on Line 7a See the sample statements on pages 38-39.

of Adjustments line item(s). Enter the Calculate your tax on your Ohio income tax Do not list income statements that do not

amount from Schedule of Adjustments, base less business income. report Ohio income tax withheld.

line 39 on this line. ● All taxpayers can utilize the Income Tax Place the state copies of your income

You must include a copy of the Ohio Brackets found on page 31. statements after the last page of your return.

Schedule of Adjustments with your return. ● If your nonbusiness taxable income is Do not include income statements that are

less than $115,300, your tax has been handwritten, self-created, or generated by

calculated for you in the Income Tax Table your tax preparation software.

found on pages 32-37.

See R.C. 5747.08(H).

|

Enlarge image |

2022 Ohio IT 1040 / Schedule of Adjustments 15

Line 15 – Payments and Credit Line 22 – Interest Due Line 26 – Donations

Carryforward Amounts Interest is due from the unextended due date You may donate all or a portion of the

until the date the tax is paid. Generally, you amount on line 24 to one or more of the

Enter the following amounts: do not owe interest if you are due a refund. organizations listed. Such donations will

● Estimated payments (Ohio IT 1040ES); An extension of time to file does not extend reduce your refund, and are only allowed

● Extension payments (Ohio IT 40P); AND the payment due date. The interest rate for on timely filed, original returns; they are not

● Any credit carryforward amount from your calendar year 2023 is 5%. allowed on amended returns.

prior year Ohio IT 1040.

Certain military servicemembers may not If you decide to donate, this decision is

Do not include: be subject to interest. See page 9 for more final. For more information on the donation

● A prior year's refund that you requested information. options, see page 12.

but did not receive. Contact the Depart-

ment about the status of any such refund. See R.C. 5747.08(G). See also R.C. 5747.113.

● Taxes paid by a pass-through entity and

reported to you on an Ohio IT K-1 (report Line 23 – Total Amount Due Line 27 – Your Refund

these amounts on Ohio Schedule of

Credits, line 38). This amount must be paid by April 18, If you do not request direct deposit, or you

2023. Do not mail cash. Instead, make filed by paper, your refund will be mailed to

See R.C. 5747.09(B). payment by: the address on the tax return.

● Electronic check;

Line 17 – Amount Previously Paid ● Credit or debit card; OR Note: Your refund may be offset pursuant

● Paper check or money order. to R.C. 5747.12. You will be notified if your

(Amended Returns Only)

Make your check or money order payable refund is subject to offset.

When filing an amended return, enter the to "Ohio Treasurer of State" and include an

amount previously paid with your previously Ohio IT 40P or IT 40XP payment voucher. If you move after filing your tax return,

filed return(s) excluding the amount reported Include the tax year and the last four digits your refund may be delayed. Notify the

on line 15. of your SSN on the “Memo” line. Department of your address change as

soon as possible.

Line 19 – Overpayment Previously For more information regarding payment

Requested (Amended Returns Only) options, see page 6.

When filing an amended return, enter the

amount you reported on line 24 on your Line 25 - Credit Carryforward

previously filed return(s). Enter the portion of your refund you want

applied to tax year 2023. This is only al-

lowed on timely filed, original returns; it is

not allowed on amended returns.

Ohio Schedule of Adjustments Line 5 – Medical Savings Account

Enter amounts from a medical savings

Additions Line 3 – College Tuition Expenses account withdrawn for nonmedical pur-

Line 1 – Non-Ohio State or Local poses only if the amount was deducted

Enter any amount reported to you on a

Government Interest and Dividends on the Ohio Schedule of Adjustments in

1099-Q representing distributions from the any tax year. Use the worksheet on page

Enter interest and/or dividends paid on Ohio CollegeAdvantage program that meet 27 to calculate this adjustment. See R.C.

obligations or securities from a non-Ohio all of the following: 5747.01(A)(14).

state, city, county, or other local government. ● The amount is not otherwise included in

Do not include: your federal adjusted gross income; Line 6 – Reimbursement of Expenses

● Any amounts already included in federal ● The amount was not used to pay for quali-

adjusted gross income; fied higher-education expenses and was Enter reimbursements received in 2022

● Amounts paid on obligations or securities not distributed due to the beneficiary's for any expenses that you deducted on a

from Ohio, or an Ohio city, county, school death, disability, or receipt of a scholar- previously filed Ohio income tax return if

district, or other local government; ship; AND the amount of the reimbursement was not

● Amounts paid on obligations or securi- ● The amount was deducted as an Ohio 529 included in federal adjusted gross income for

ties from a U.S. territory or the federal plan contribution or tuition credit purchase 2022. See R.C. 5747.01(A)(11)(b).

on the Ohio Schedule of Adjustments in

government.

any tax year. Line 7 – Accelerated Depreciation

See R.C. 5747.01(A)(1).

See R.C. 5747.01(A)(9) and 5747.70. Add 5/6 of your bonus depreciation allowed

Line 2 – Pass-Through Entity Add-Back under Internal Revenue Code section

Line 4 – Ohio Public Obligations 168(k). Also add 5/6 of your depreciation

Enter Ohio pass-through entity tax (from the expense allowed under Internal Revenue

IT 1140 and/or IT 4738) to the extent it was Enter any loss resulting from the sale/dispo-

deducted or excluded in arriving at your sition of Ohio public obligations to the extent Code section 179 less the amount that

federal adjusted gross income. The tax that such losses have been deducted in would have been allowed under section

may be reported to you on an Ohio IT K-1 determining federal adjusted gross income. 179 as it existed on Dec. 31, 2002.

or provided with the federal K-1. See R.C. See R.C. 5747.01(A)(8).

5747.01(A)(15) and (36).

|

Enlarge image |

16 2022 Ohio Schedule of Adjustments

Replace “5/6” with “2/3” for employers who Line 13 – State or Municipal Income Tax annual limitation of $4,000 per beneficiary.

increased their Ohio income taxes withheld Overpayments Married taxpayers may deduct up to a maxi-

by an amount equal to or greater than 10% mum of $4,000 per beneficiary whether their

over the previous year. Replace “5/6” with Enter the amount from your 2022 federal filing status is married filing jointly or married

“6/6” for taxpayers who incur a net operat- income tax return, Schedule 1, line 1. See filing separately.

ing loss for federal income tax purposes if R.C. 5747.01(A)(11)(a).

the loss was a result of the 168(k) and/or Use the worksheet on page 28 to assist you

179 depreciation expenses. Line 14 - Taxable Social Security in calculating the unused portion of your

STABLE account contributions. For more

Benefits

No add-back is required for: information, see the "Income - STABLE

● Employers who increased their Ohio Deduct the amount on your federal 1040 or Account Deduction" topic at tax.ohio.

income taxes withheld over the previous 1040-SR, line 6b. Do not enter any non-tax- gov/FAQ . See also R.C. 5747.01(A)(29)

year by at least their total 168(k) and 179 able portion of your Social Security benefits. and 5747.78.

depreciation expenses; See R.C. 5747.01(A)(5).

● 168(k) or 179 depreciation from a pass- Line 19 – Nonresident Income from Ohio

through entity in which the taxpayer owns Line 15 - Certain Railroad Benefits Disaster Work

less than 5%.

Deduct railroad benefits, to the extent they Deduct income included in your federal

This add-back is deductible on the Ohio are exempt from state taxation and included adjusted gross income if all of the following

Schedule of Adjustments in future tax years. in your federal adjusted gross income, such are true:

Use the worksheet on page 28 to assist you as: ● You are a nonresident of Ohio;

in calculating your future years' deductions. ● Railroad retirement benefits; ● The income was received for disaster

● Supplemental railroad retirement benefits; work in Ohio during a disaster response

For more information, see the "Income - ● Dual railroad retirement benefits; period; AND

Bonus Depreciation" topic at tax.ohio. ● Railroad disability benefits; OR ● You did not receive any other Ohio-

gov/FAQ. See also R.C. 5747.01(A)(17). ● Railroad unemployment benefits. sourced income during the tax year.

For the purposes of this line, “income”

Line 8 – Federal Interest and Dividends Note: Do not report any amounts already includes compensation paid to an employee

included on line 14 as taxable Social Security of a business performing disaster work in

Enter interest or dividends on obligations of benefits. Ohio, as well as amounts paid to a business

the U.S. government exempt from federal

taxation but not exempt from state taxation. See R.C. 5747.01(A)(5). performing disaster work in Ohio.

See R.C. 5747.01(A)(2). “Disaster work” means repairing, renovating,

Line 16 – Income from Ohio Public installing, or constructing property and

Line 9 – Federal Conformity Additions Obligations equipment destroyed by the declared

disaster, provided that the property or

This line is only for federal conformity adjust- Deduct any of the following to the extent equipment is owned by a public utility,

ments. Do not enter any federal Schedule A included in your federal adjusted gross commercial mobile radio service provider,

adjustments on this line. For updates on Ohio income: cable service provider, or video service

conformity, see tax.ohio.gov/conformity. ● Interest income earned from Ohio public provider. Disaster work also includes any

See also R.C. 5701.11. obligations and Ohio purchase obligations; preparation for these activities.

● Gains from the sale or disposition of Ohio

Deductions public obligations; OR The "disaster response period" is based

● Income from a certain transfer agreement on when the president of the U.S. or the

Line 11 – Business Income Deduction or an enterprise transferred under that governor of Ohio declares that an emergency

agreement. exists in Ohio. It begins 10 days prior to

In order to take this deduction, you must the declaration and ends 60 days after the

complete the Ohio Schedule IT BUS. See the See R.C. 5747.01(A)(7), (8), and (26). declaration expires or is rescinded.

instructions on page 19. Enter the amount

from Ohio Schedule IT BUS, line 11, on this Line 17 – Individual Development See R.C. 5747.01(A)(30) and 5703.94.

line. See R.C. 5747.01(A)(28). Accounts

Line 20 – Federal Interest and

Enter contributions you made to an Ohio Dividends Exempt from State Taxation

Line 12 – Reciprocity Wages county's individual development account

Enter compensation amounts earned in Ohio program. Only amounts contributed for the Enter interest and dividend income, to the

during the portion of the year that you were purpose of matching funds are eligible for this extent included in federal adjusted gross in-

a resident of Indiana, Kentucky, Michigan, deduction. You cannot enter amounts you come, from obligations issued by the U.S.

Pennsylvania, and/or West Virginia. Do not deposited into your own individual develop- government or its possessions/territories

include any Ohio sourced business income, ment account. that are exempt from Ohio tax by federal law.

lottery or casino winnings, rental or royalty in- For more information, contact your local Examples include:

come, capital gains, or non-employee wages. county department of job and family services. ● U.S. savings bonds (Series E, EE, H or I);

Exception: This deduction does not apply to See R.C. 5747.01(A)(16). ● Treasury notes, bills and bonds;

compensation from a pass-through entity in ● Sallie Maes.

which you directly or indirectly own at least Line 18 – STABLE Contributions

Examples of interest income that are not

20%. R.C. 5733.40(A)(7) reclassifies such Deduct contributions you made to a STABLE deductible:

compensation as a distributive share of (Ohio ABLE) account, up to $4,000 per ben- ● Interest paid by the IRS on a federal

income from the pass-through entity. eficiary per year. Contributions exceeding the income tax refund;

$4,000 limitation may be deducted on future ● Interest income from Fannie Maes or

See R.C. 5747.01(A)(33) and 5747.05(A)(2). years' returns until fully utilized, subject to the Ginnie Maes.

|

Enlarge image |

2022 Ohio Schedule of Adjustments 17

For more examples of deductible amounts, or nonresident credit; AND ● The servicemember is a nonresident of Ohio.

see Information Release IT 1992-01 titled ● In the current tax year, you claimed either

"Exempt Federal Interest Income," at tax. (i) an itemized deduction on your federal Also deduct compensation earned by a

ohio.gov. See also R.C. 5747.01(A)(3). Schedule A for the amount repaid OR (ii) civilian spouse in Ohio if all of the following

a tax credit on your federal 1040 based are true:

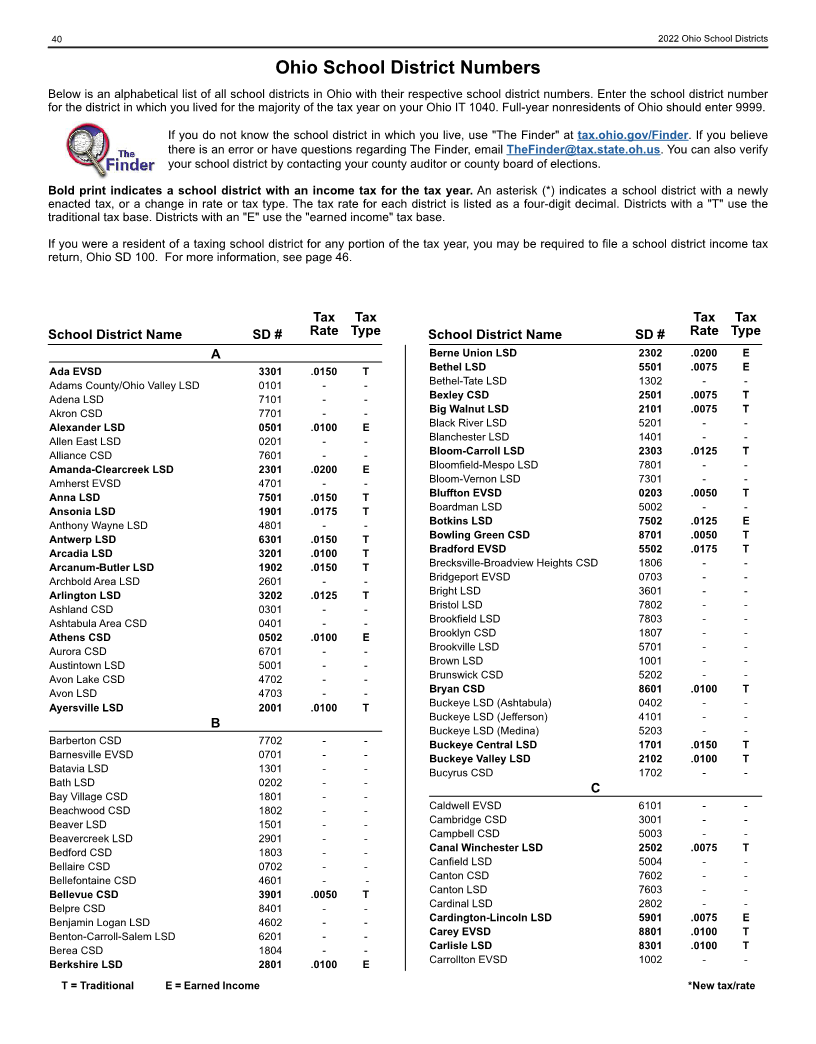

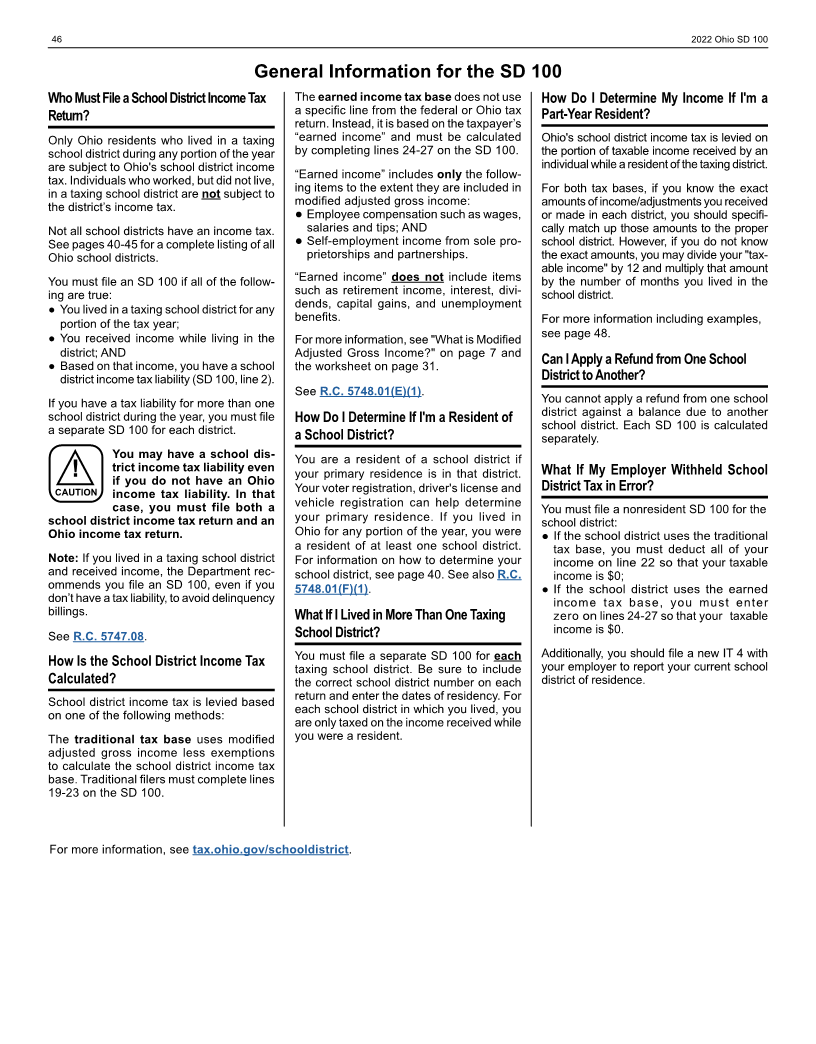

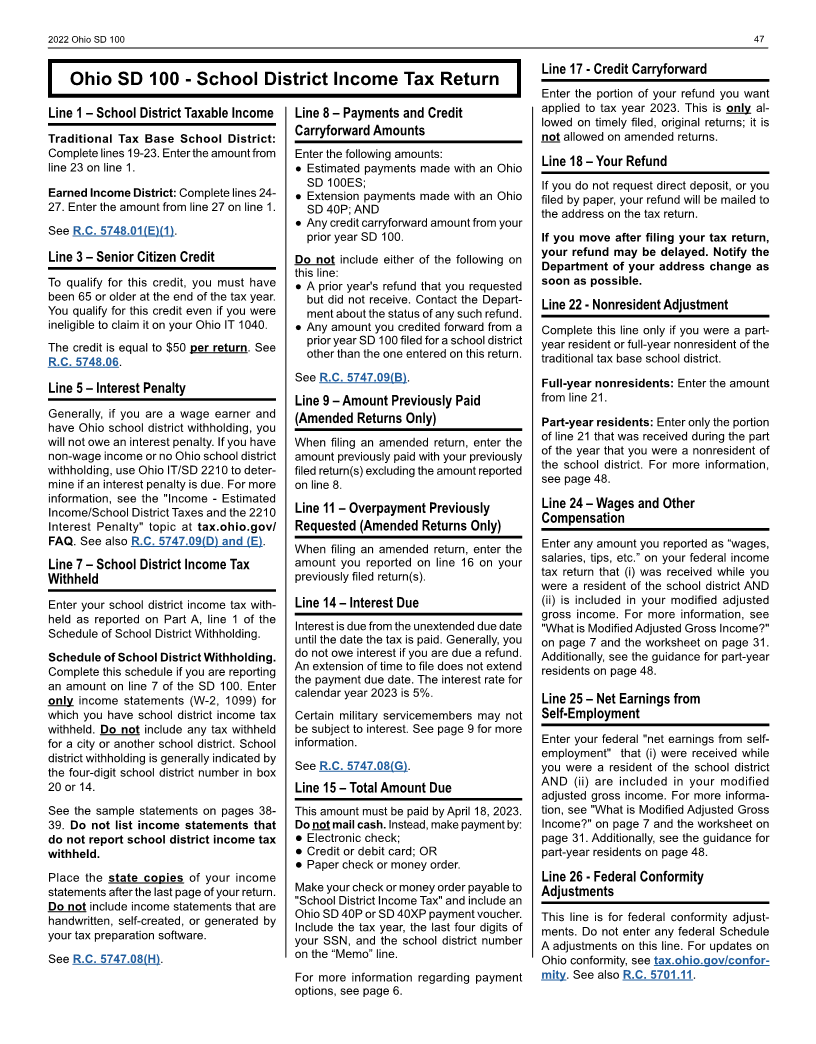

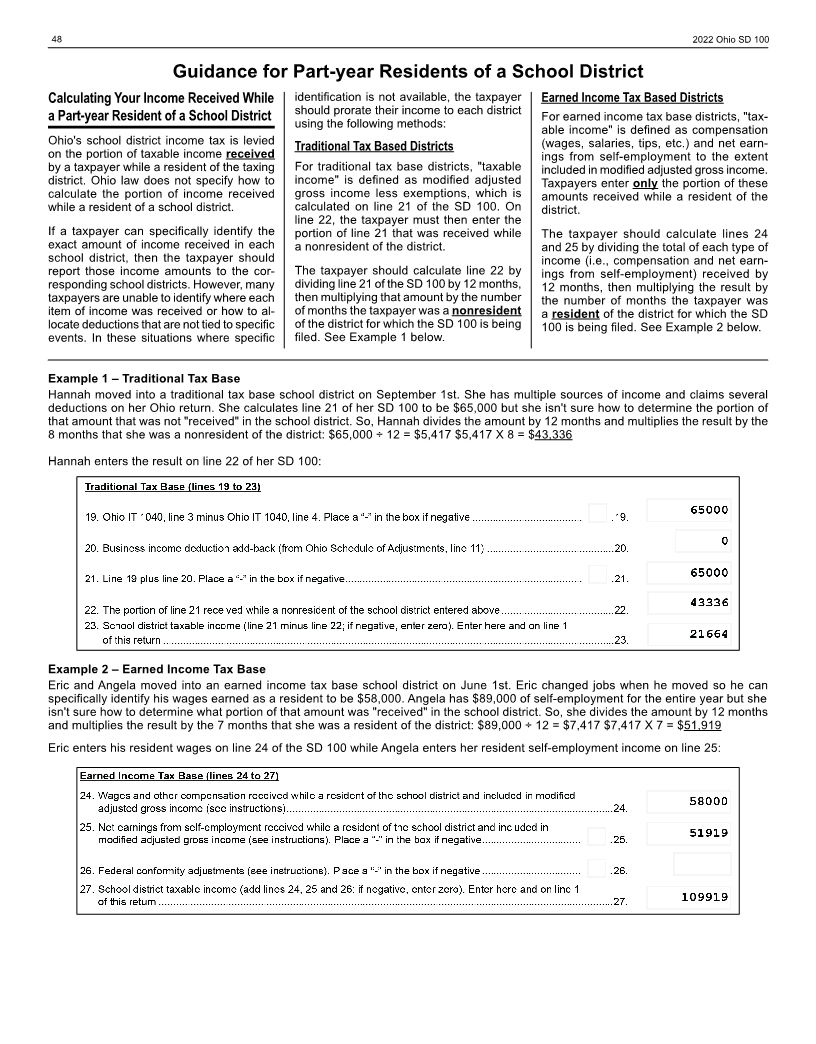

Line 21 – Ohio Depreciation Deduction upon the amount repaid. ● The civilian spouse and the servicemem-