- 3 -

Enlarge image

|

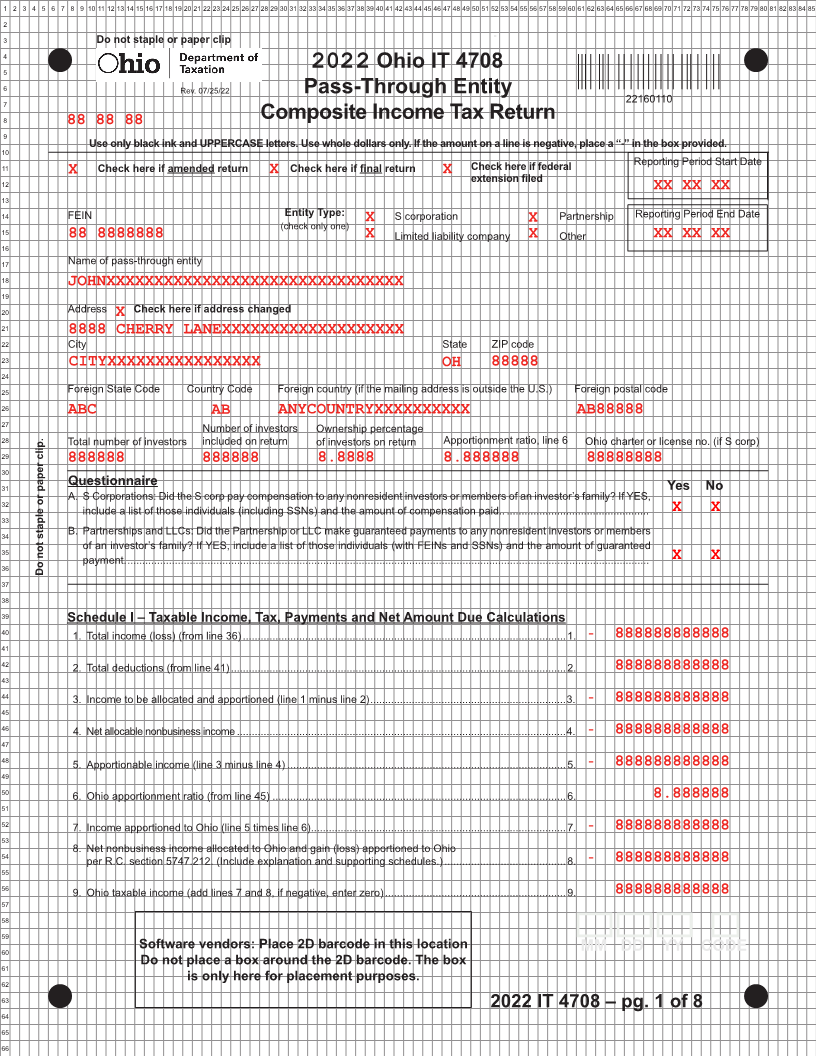

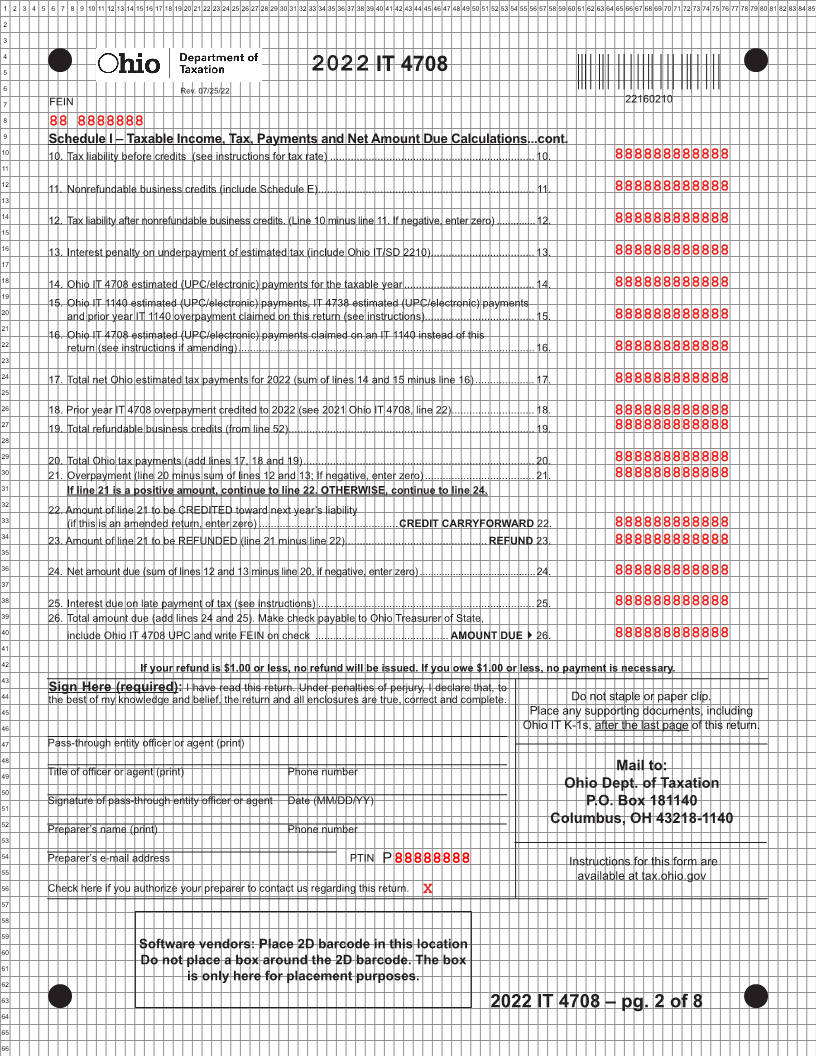

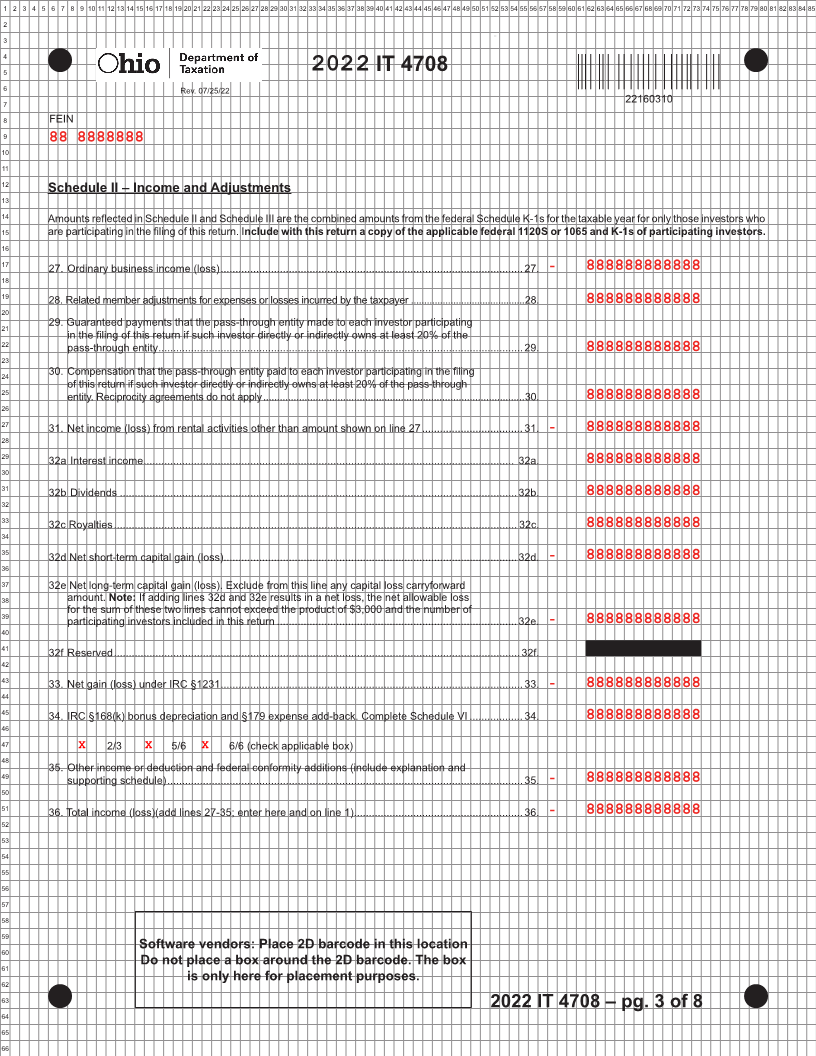

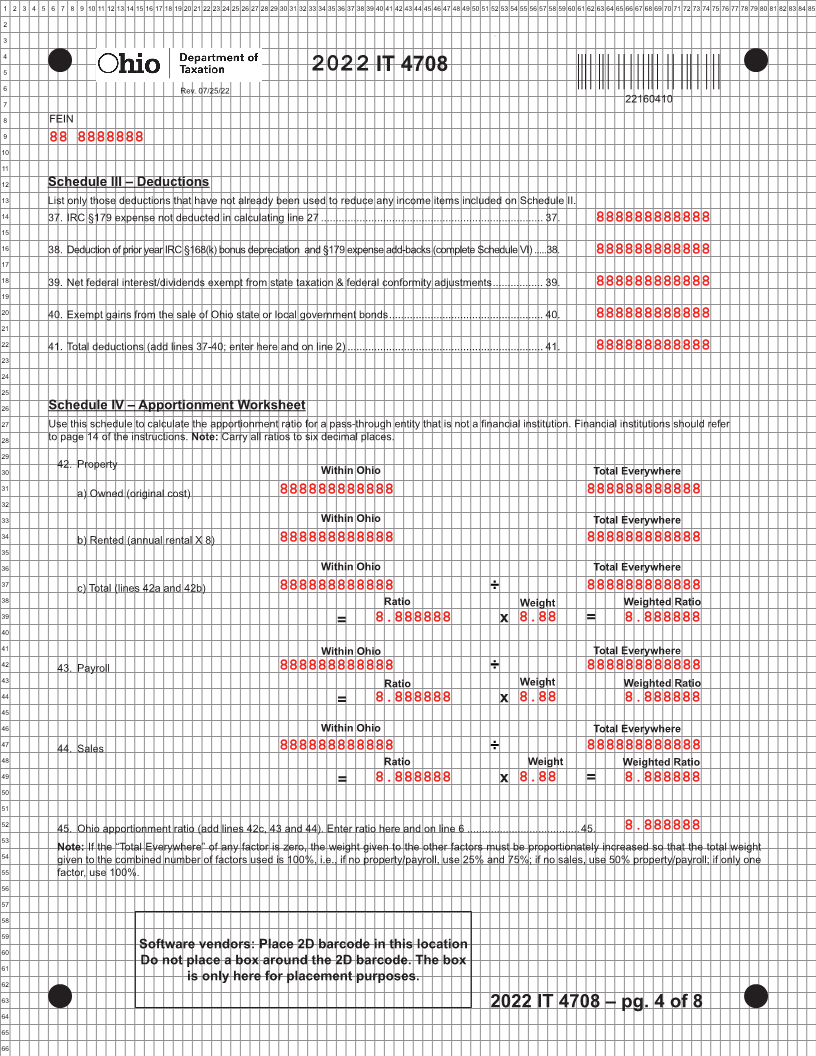

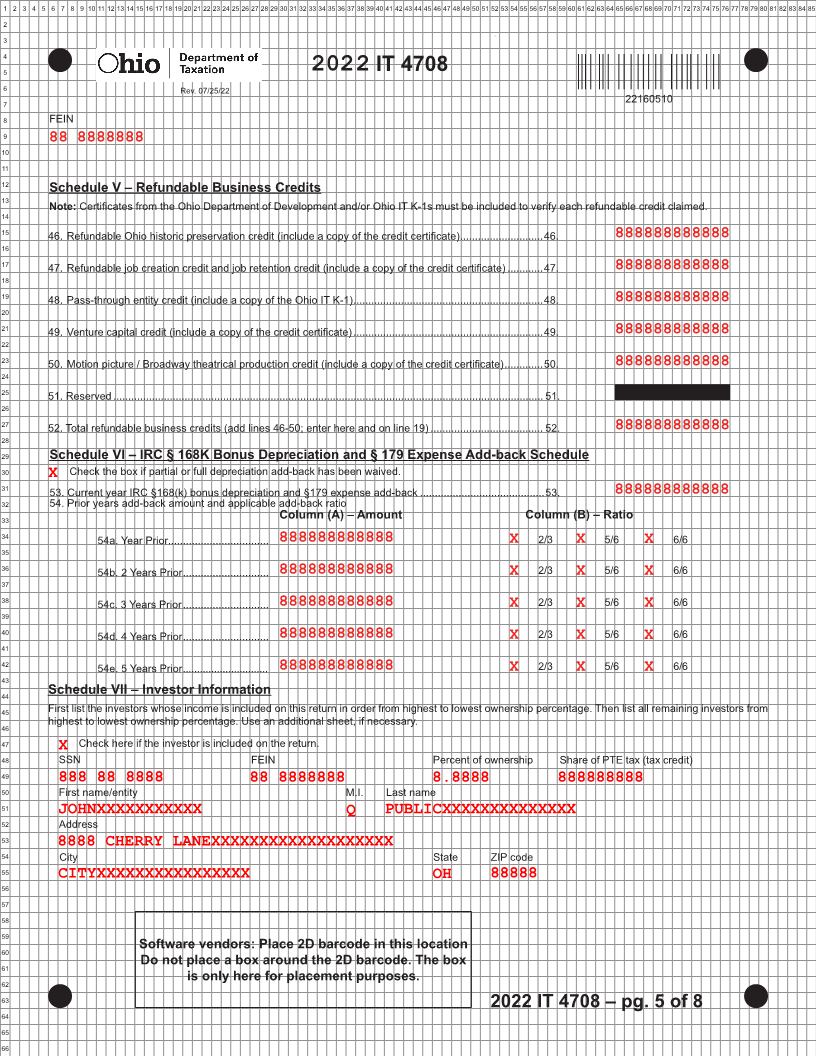

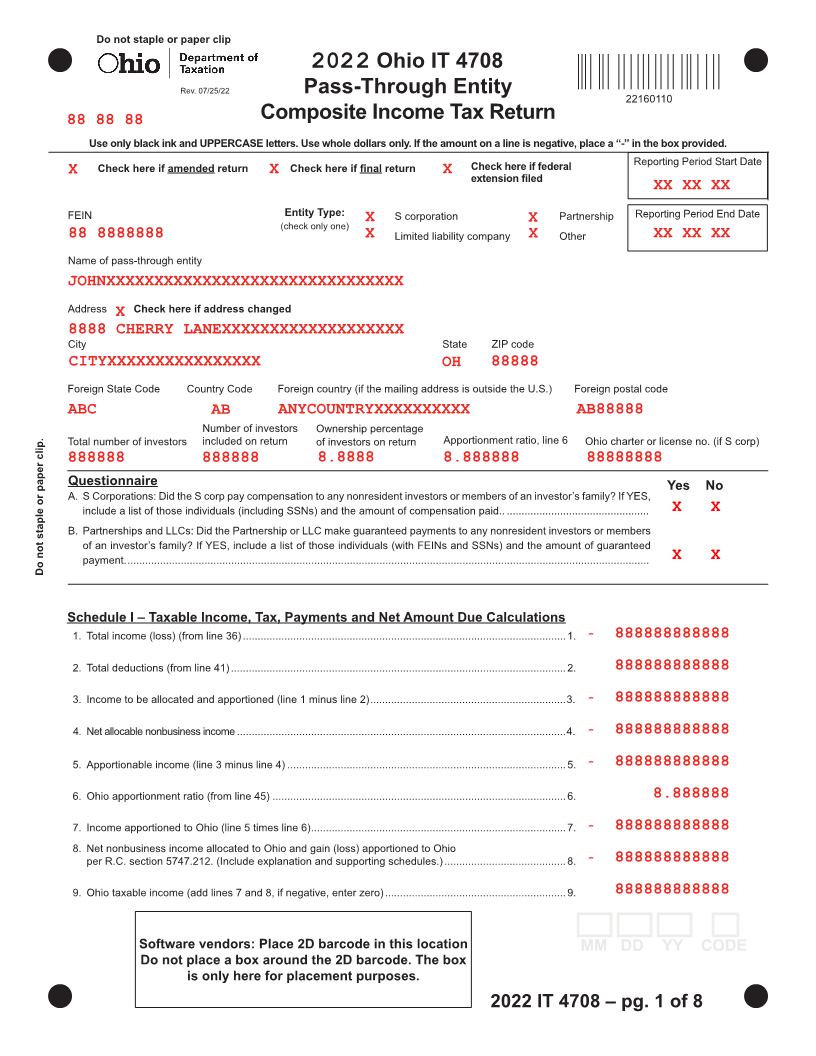

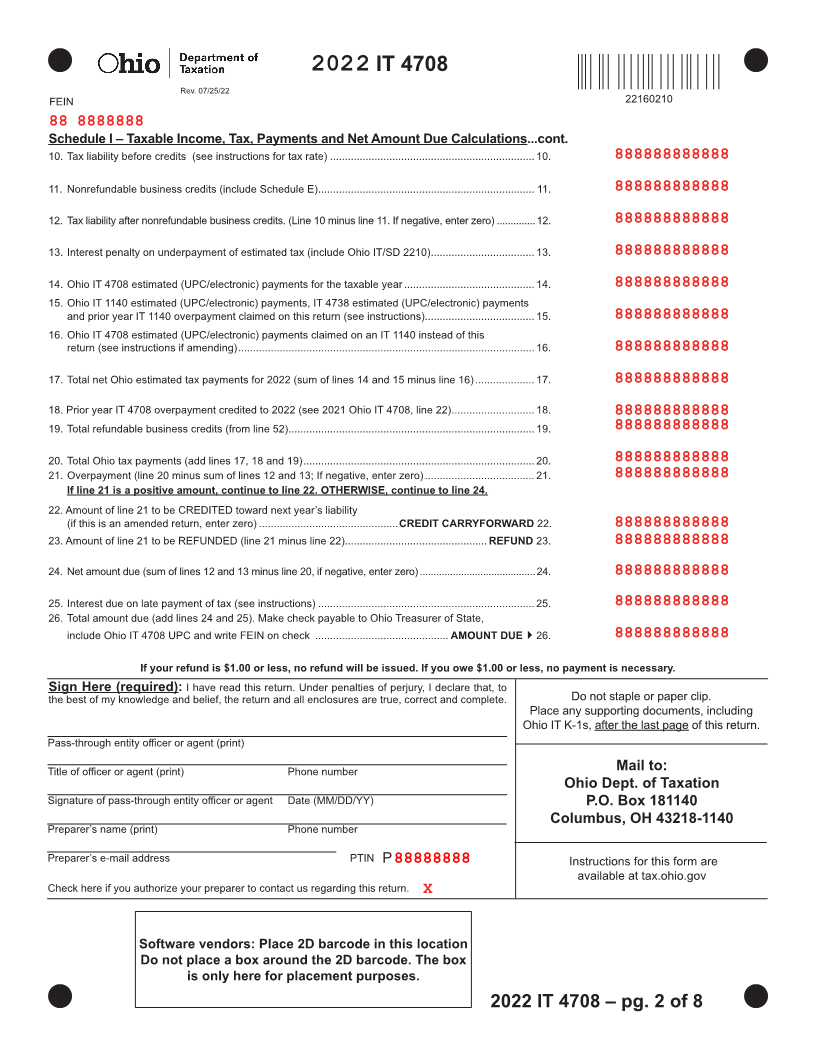

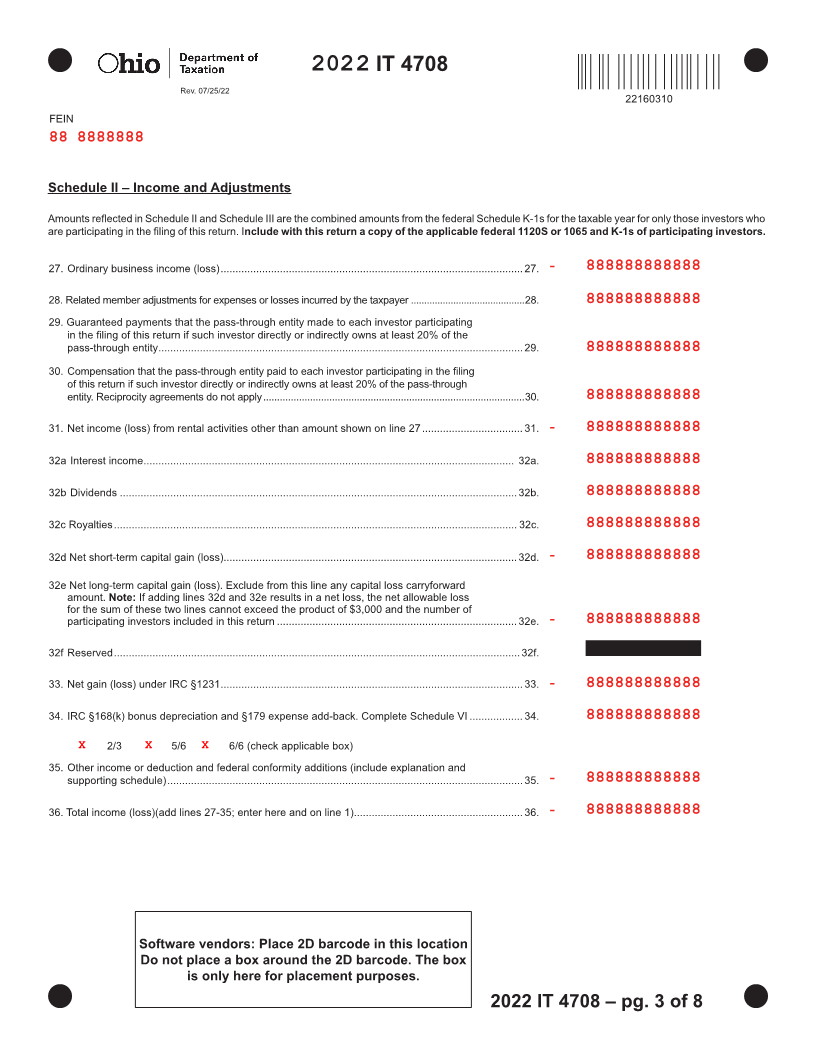

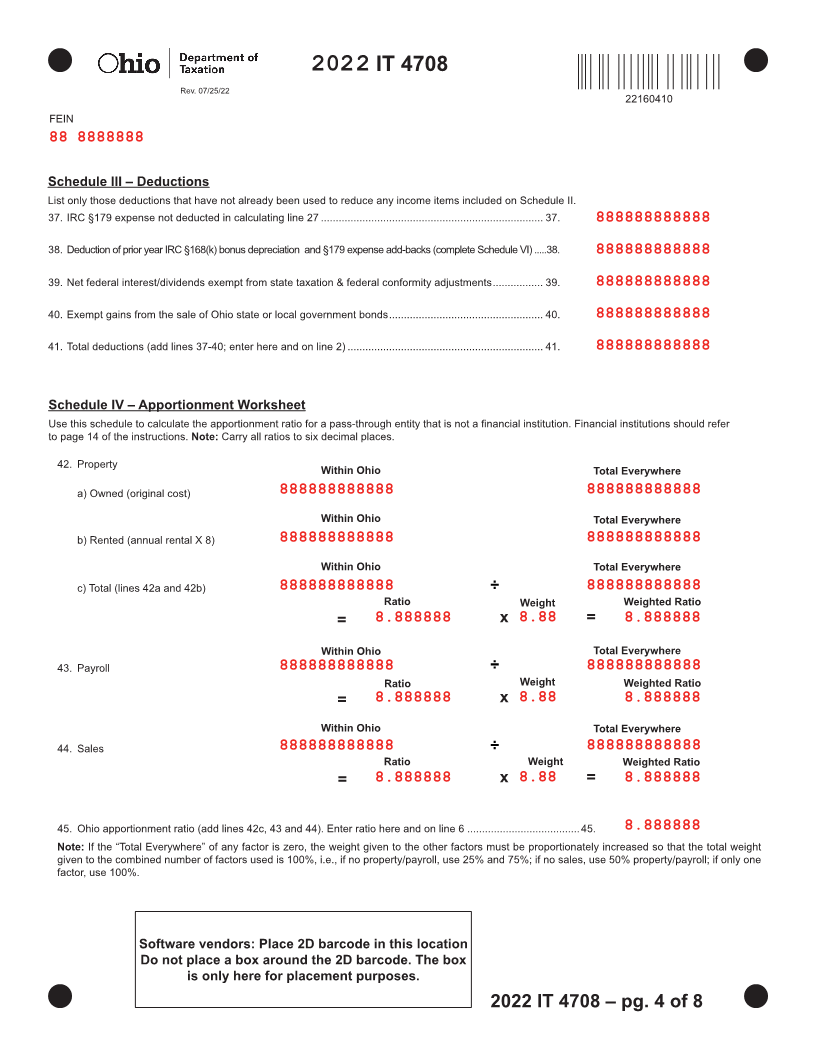

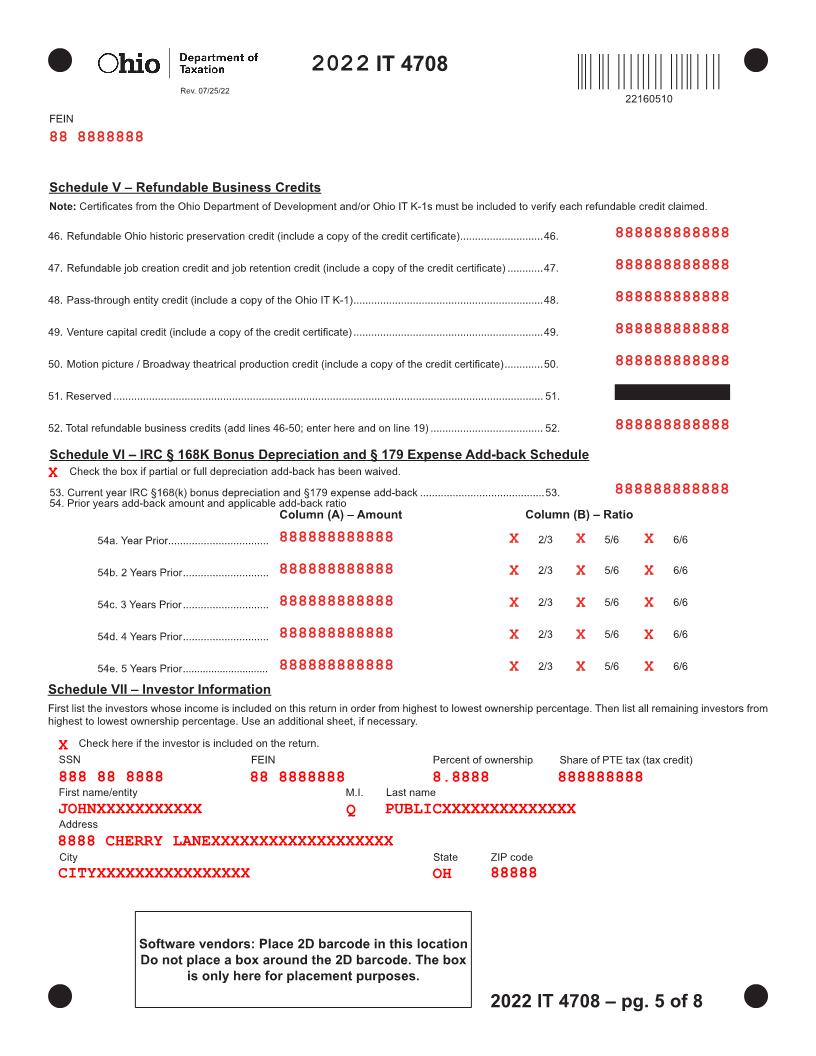

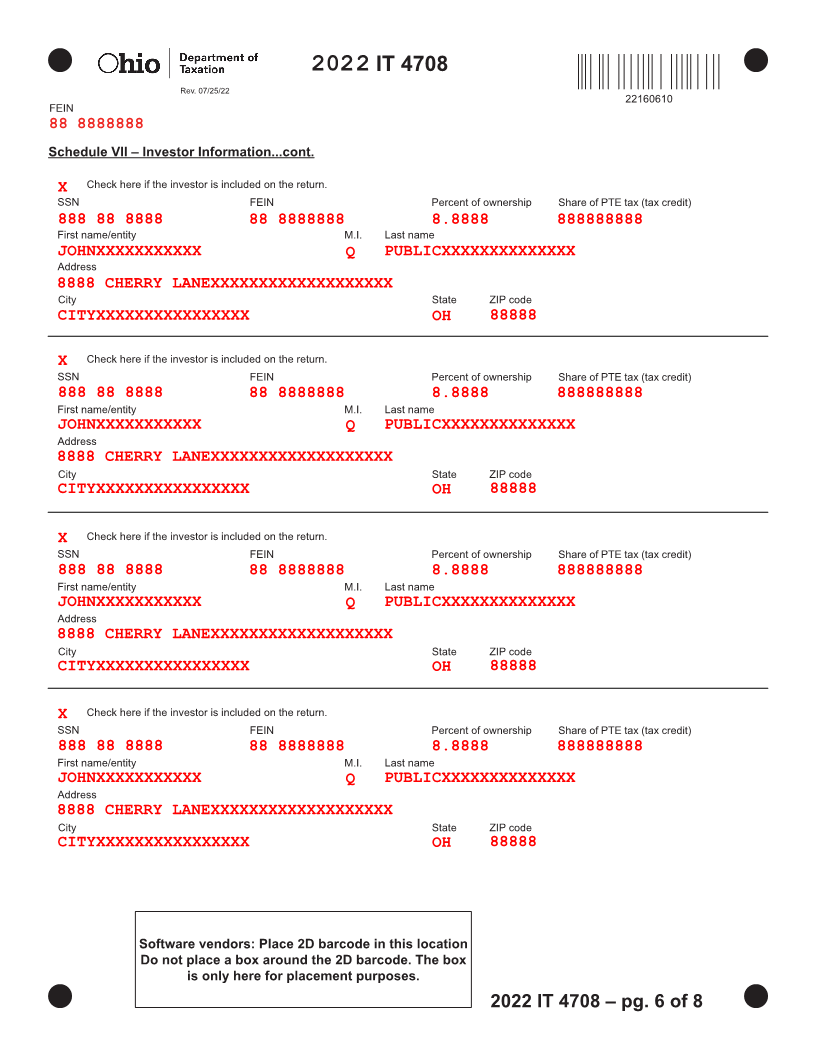

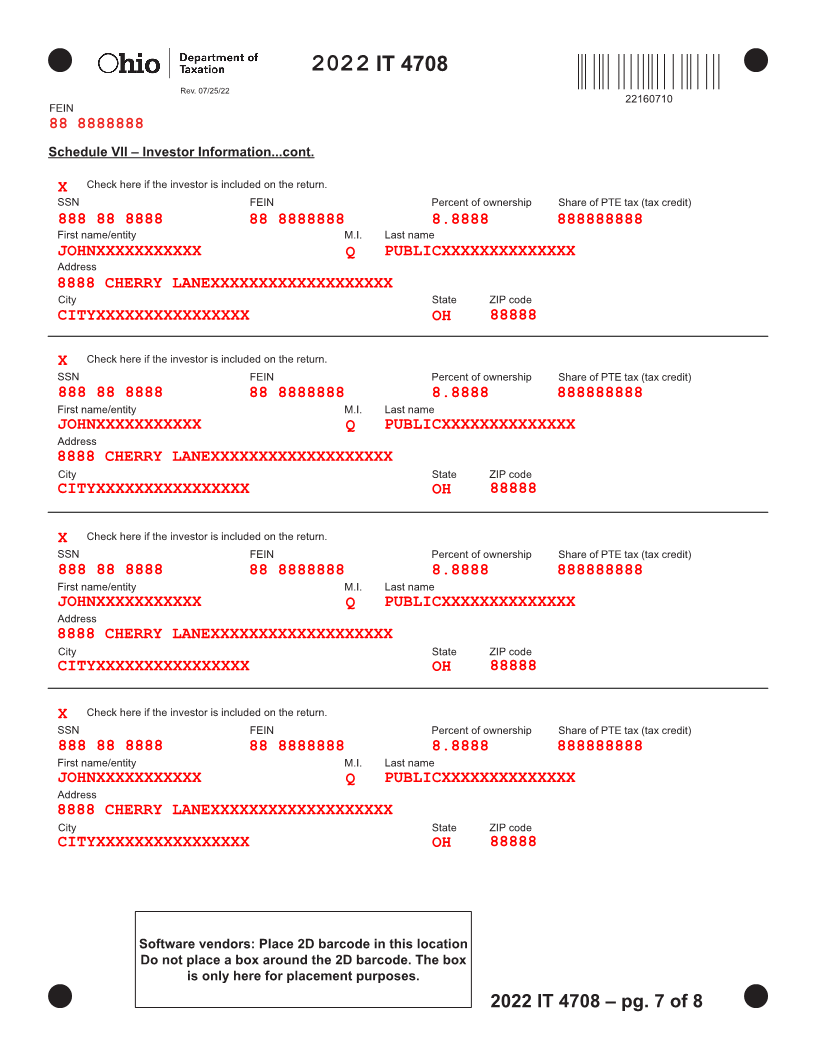

General Information (2022 Ohio IT 4708):

1) Dimensions:

Target or registration marks - 0.25” diameter circles. Follow grid layout for positioning.

1D barcode (2 of 5 interleaved) - .375”H x 1.5”W. Follow grid layout for positioning. Center the barcode number

directly under the barcode.

2D barcode (PDF 417) - See 2D instructions and schema. Follow grid layout for positioning. There is one 2D

barcode on each page of the Ohio IT 4708.

2) 1D barcode - The last two numbers of the 1D barcode represent the vendor number. Use the same vendor

number as you did for last year’s return. If you have a question about your barcode assignment, e-mail the Forms

Unit at Forms@tax.state.oh.us. The first six numbers are constant for this form (221601XX - 221608XX).

22 = tax year

16 = Ohio IT 4708

01-08 = page number

XX = vendor number (assigned to you by the Ohio Dept. of Taxation, Forms Unit).

NOTE: The vendor number also serves as the first two digits of the SSN and FEIN fields in the test

scenarios.

3) Use Arial or Courier font for the static text on the form. The static text for all target marks and header informa-

tion (target marks, logo, title and 1D barcode) must match grid. Note: Courier must be used for the static tax

year in the form title.

4) Use Courier, monospaced Arial, or monospaced Sans-Serif font for the variable data fields on the form.

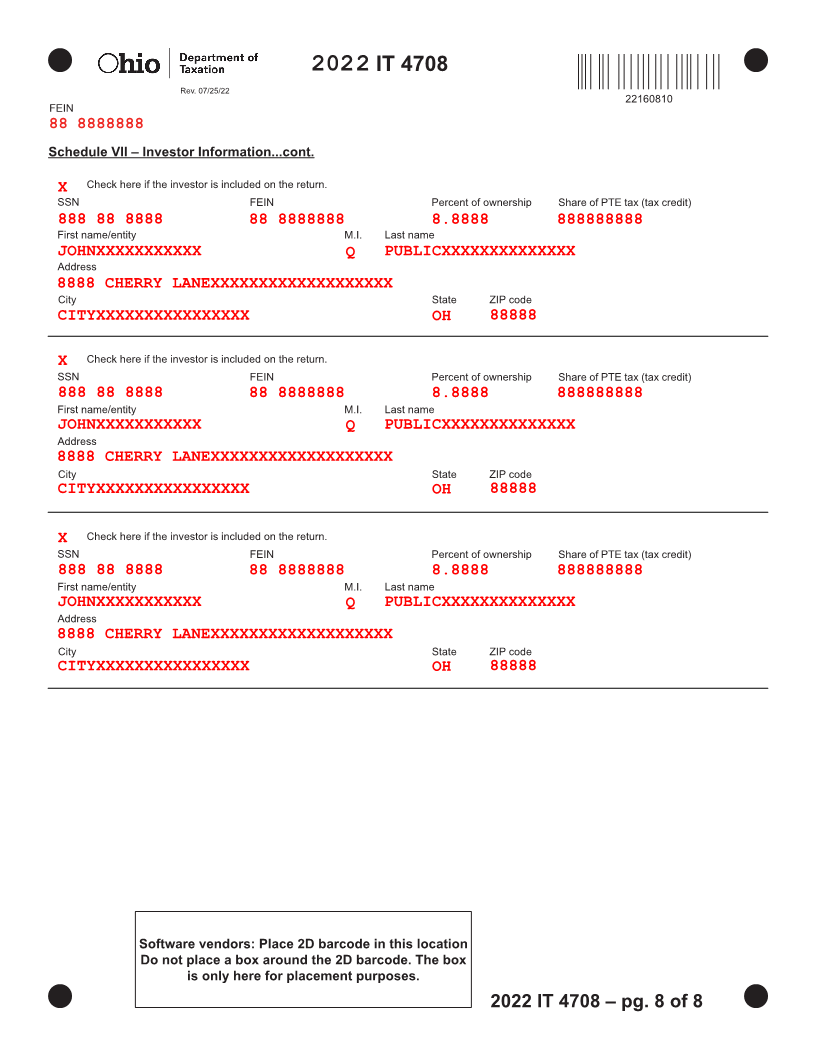

5) Follow the grid layout for the variable data fields shown in red. Ensure that the tax year, target or reg-

istration marks, “For Department Use Only” area and the 1D and 2D barcodes follow grid layout.

6) Do not use commas, hyphens or decimals in the variable data fields except where shown in specs.

7) You must include a leading zero on ratio fields. For example, if the ratio is .000026, it should display as 0.000026.

8) The possible negative fields for this return are Schedule I, lines 1, 3, 4, 5, 7, and 8 and Schedule II, lines 27,

31, 32d, 32e, 33, 35, and 36. Do not hard-code negative signs.

9) Provide guidance to customers regarding duplex printing that instructs them to print pages 1 and 2 together;

pages 3 and 4 together; and pages 5 and 6 together. Taxpayers have filed returns with pages 2 and 3 duplexed

or a worksheet or software receipt on the back of a page of the return. This slows the processing of the tax return.

10) Any other documentation generate the following message for customers: “Do not enclose other docu-

mentation unless it is specified on the tax return or instructions.” Taxpayers often submit worksheets and

receipts from the vendor product, which slows the processing of tax returns. Any other documentation generated

from the software must include a 1D barcode identifying it as an additional information. The preferred placement

is centered on the top edge of the page within the print area, however placement at any location on the page will

be accepted. Always use the following 1D barcode (2 of 5 interleaved):

10211411

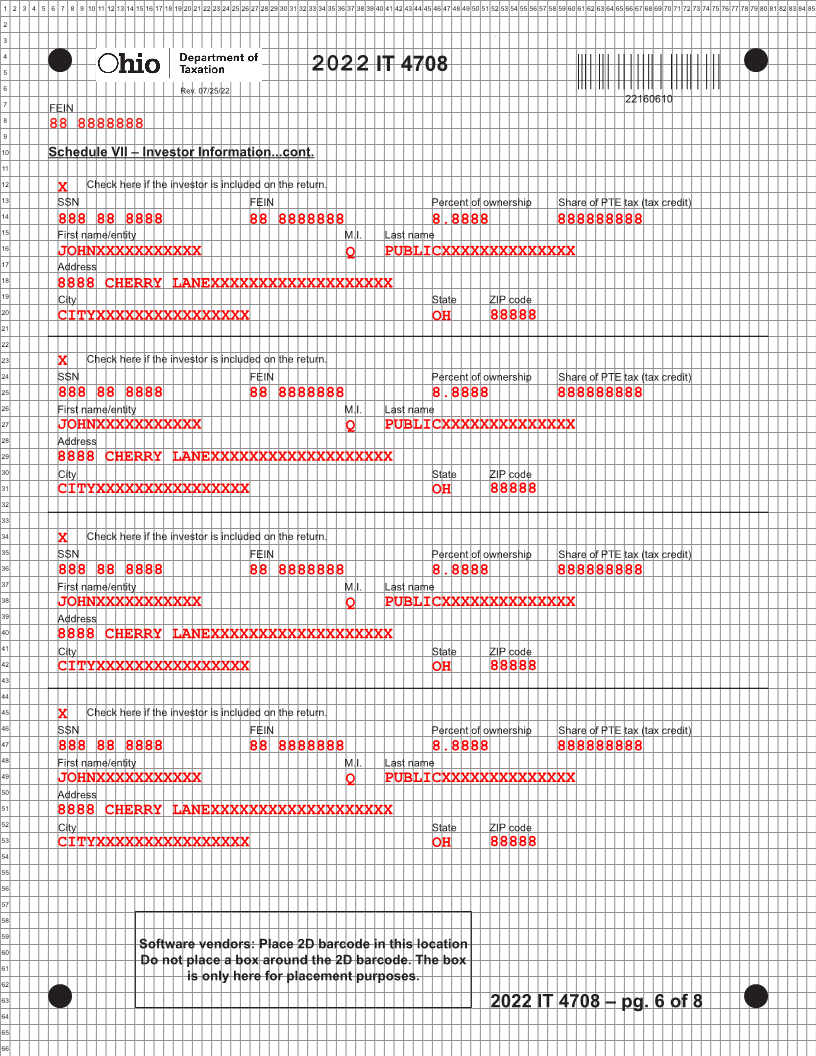

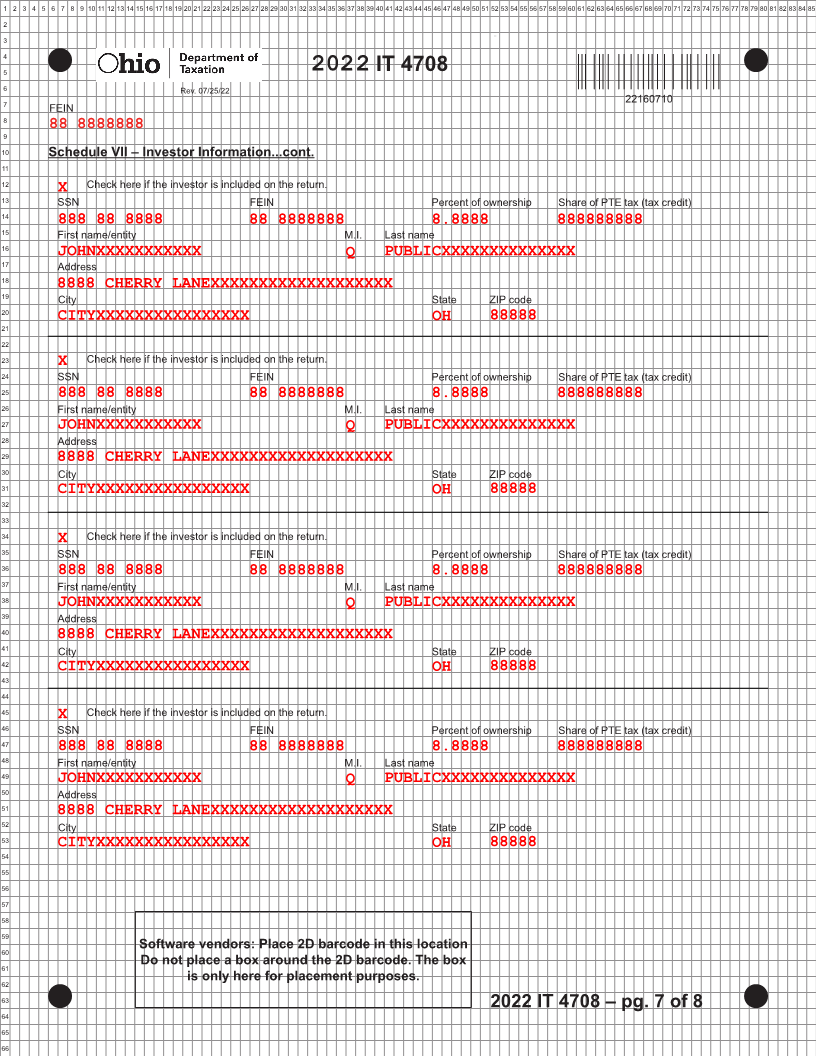

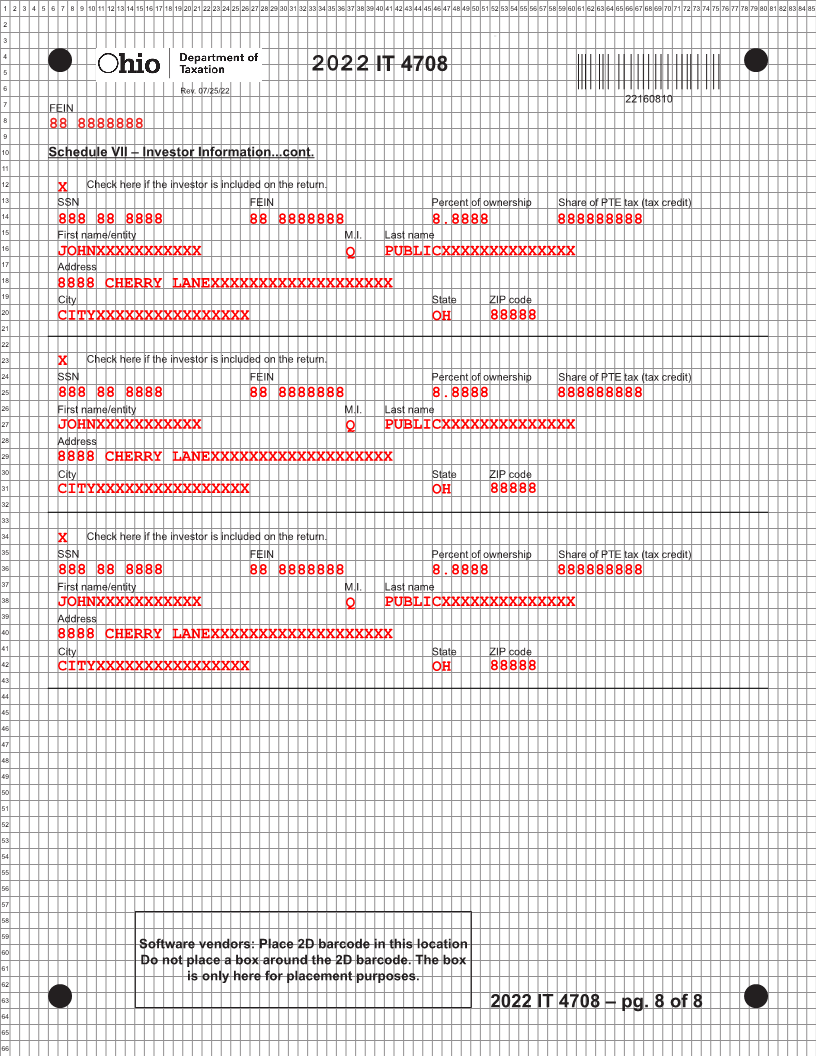

11) The 4708 Schedule VII pages 5-8 can include up to 12 investors. Generate duplicate copies of page 8 to ac-

commodate any additional investors, however omit the standard 1D and 2D barcodes from the duplicate pages and

include the 10211411 barcode indicated above.

|