- 23 -

Enlarge image

|

IT 1041

Rev. 12/22

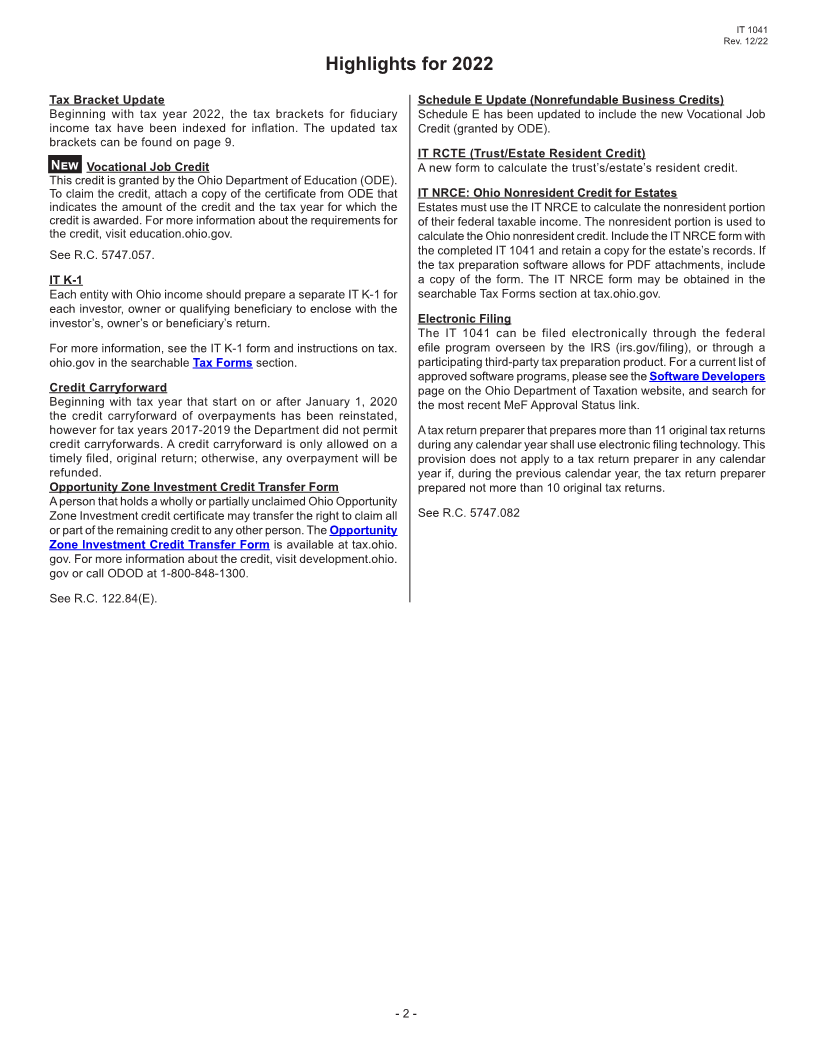

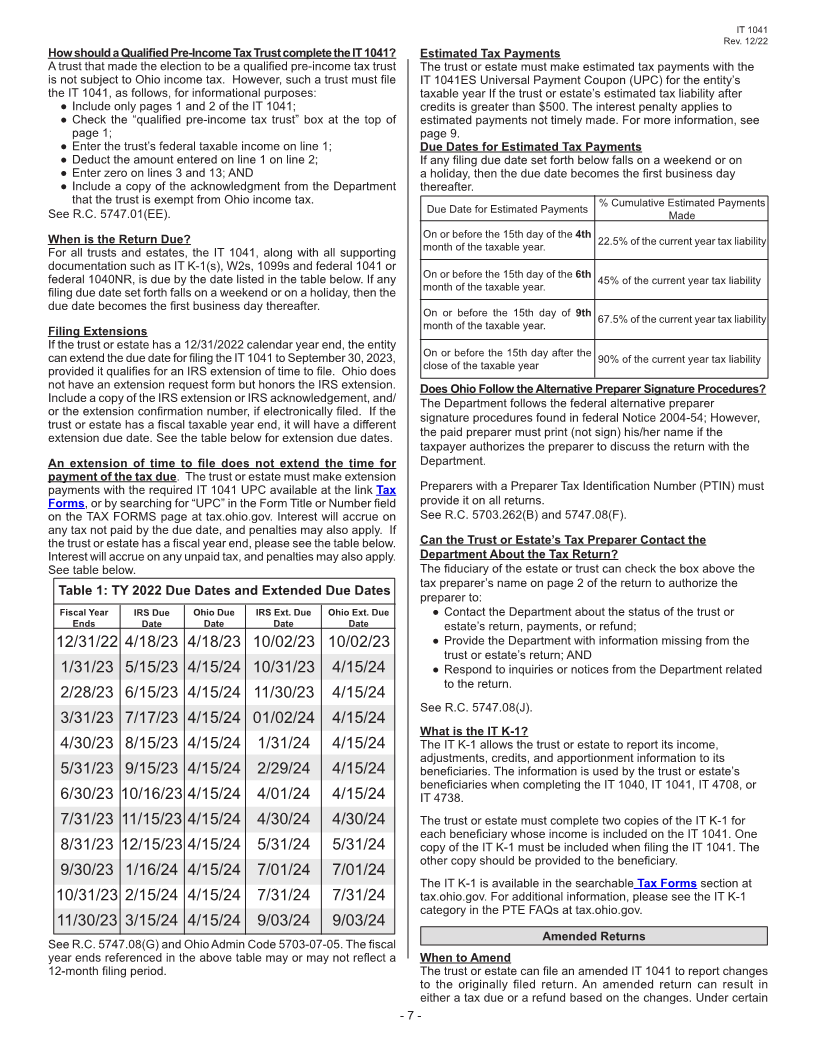

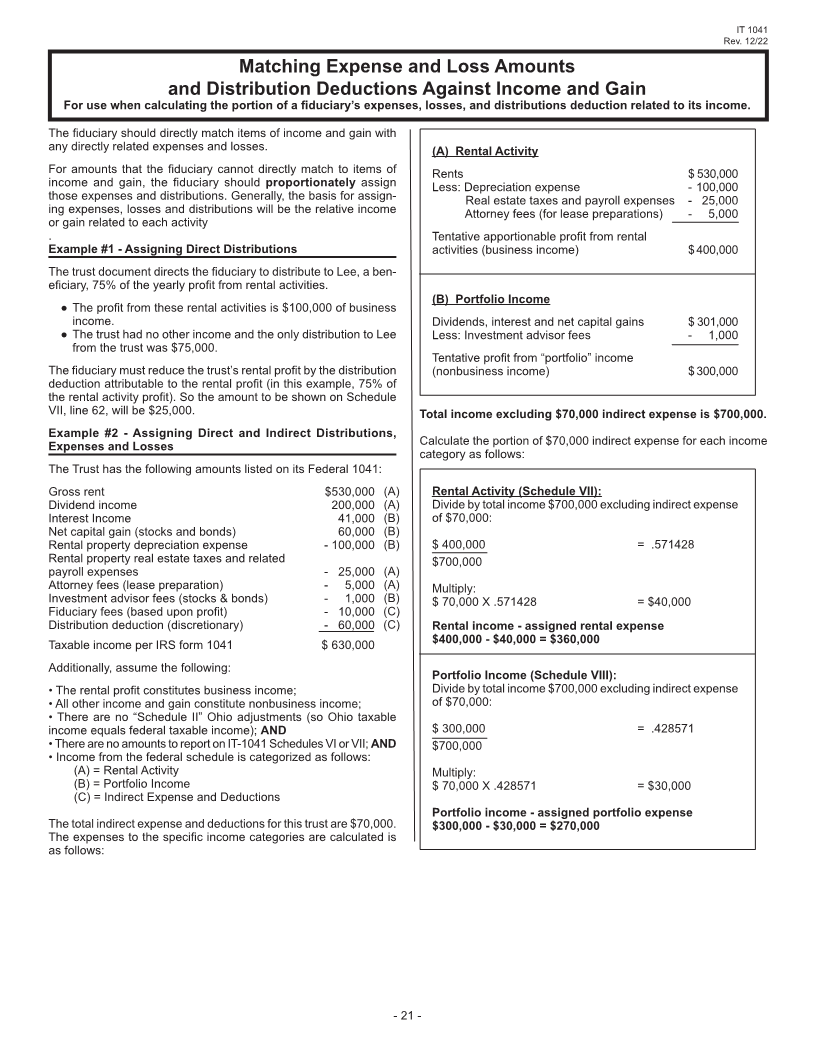

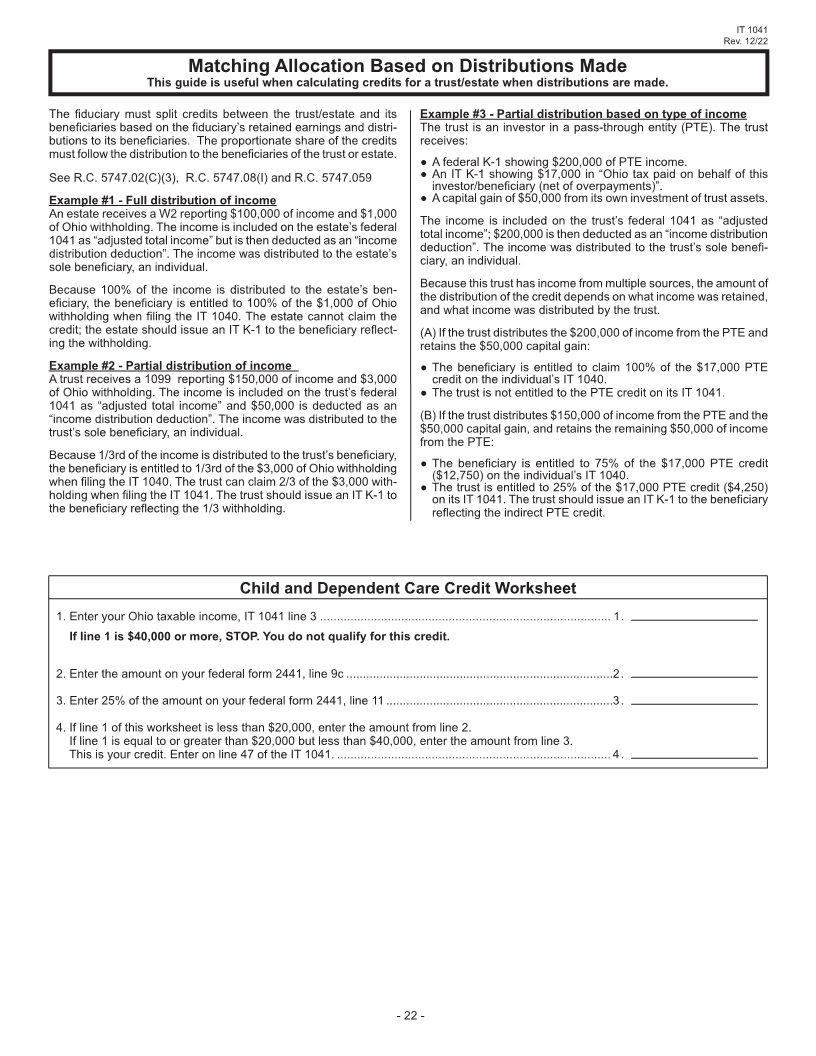

Matching Expense and Loss Amounts

and Distribution Deductions Against Income and Gain

For use when calculating the portion of a fiduciary’s expenses, losses, and distributions deduction related to its income.

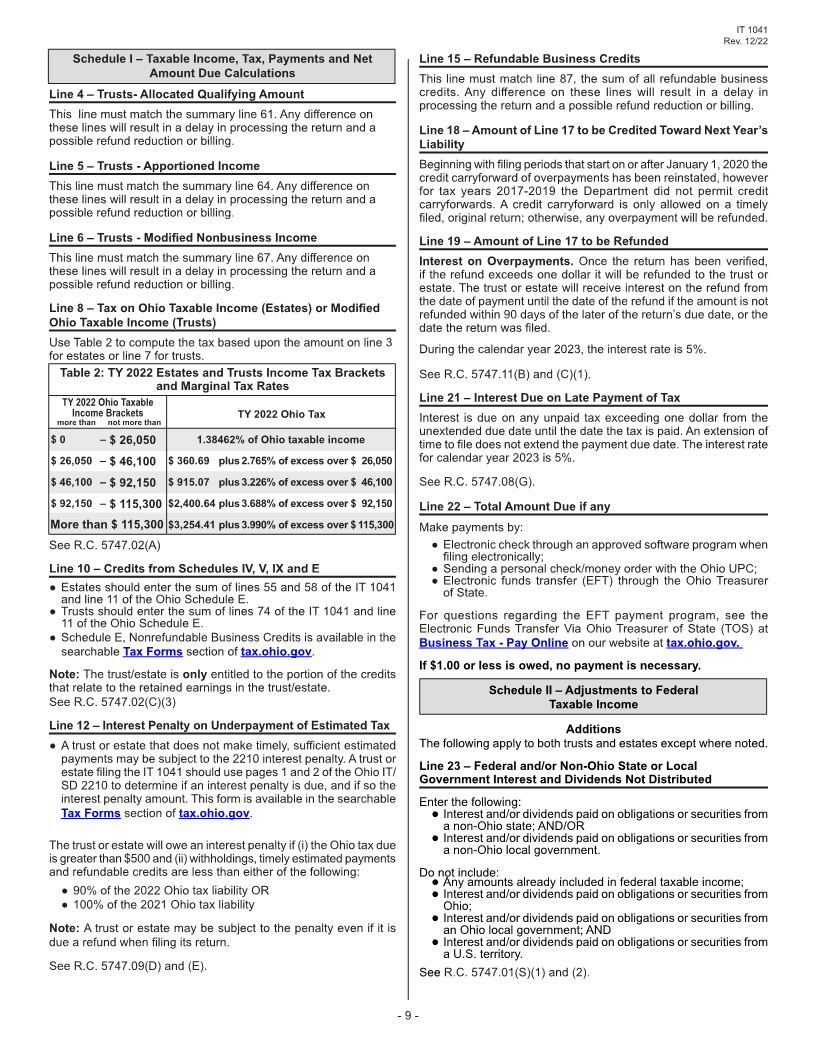

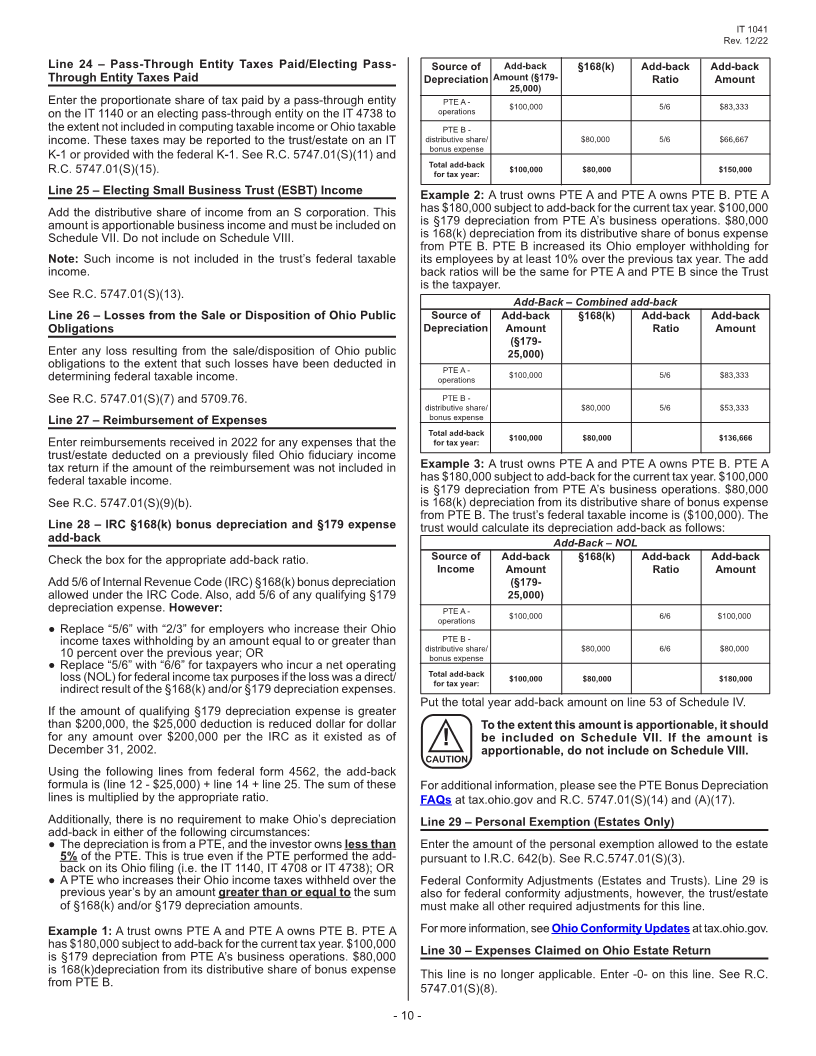

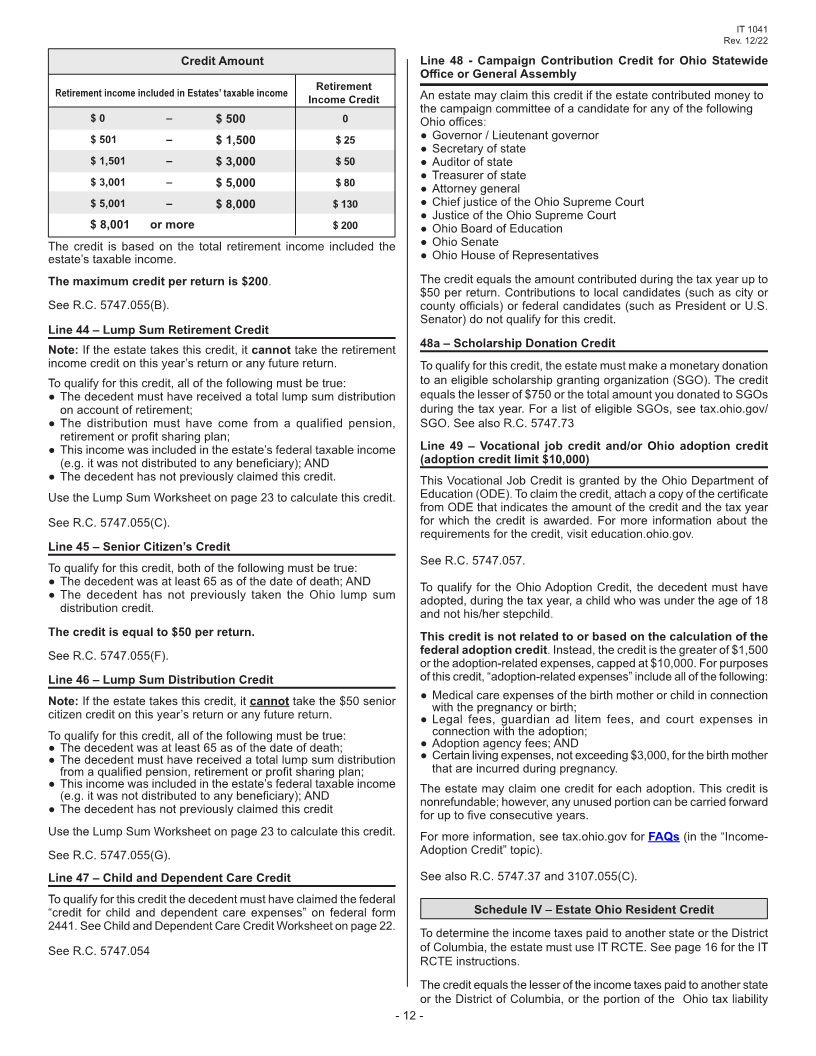

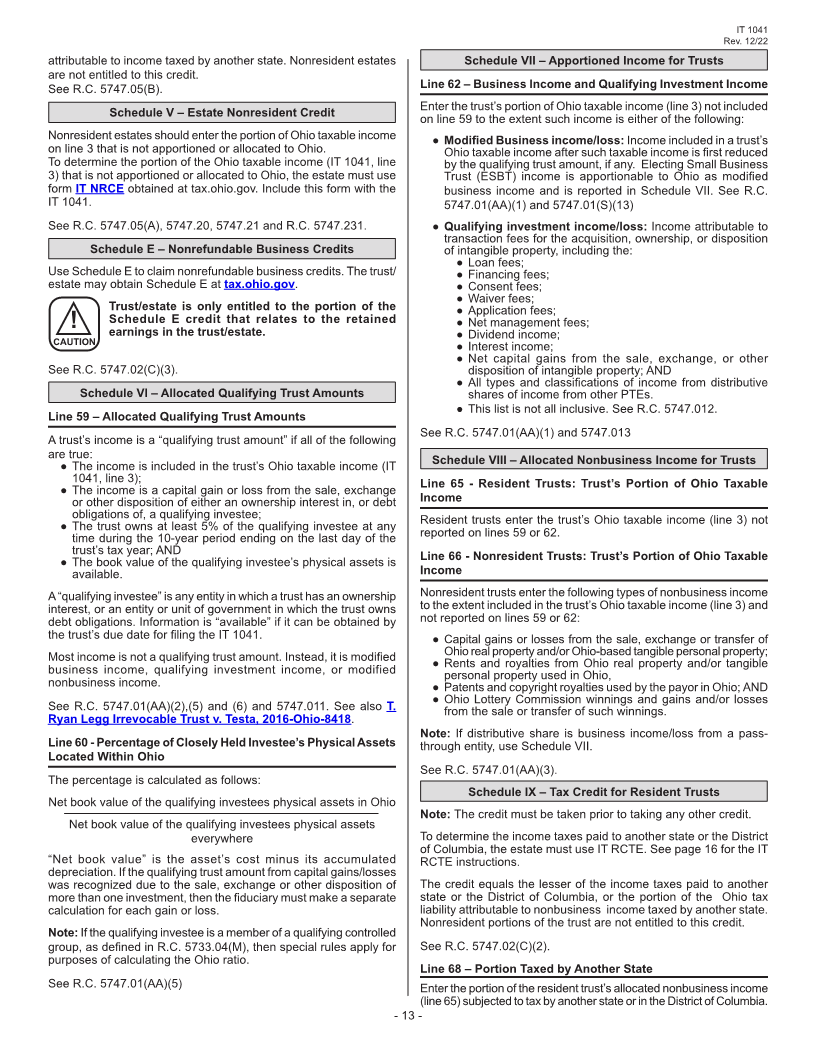

The fiduciary should directly match items of income and gain with

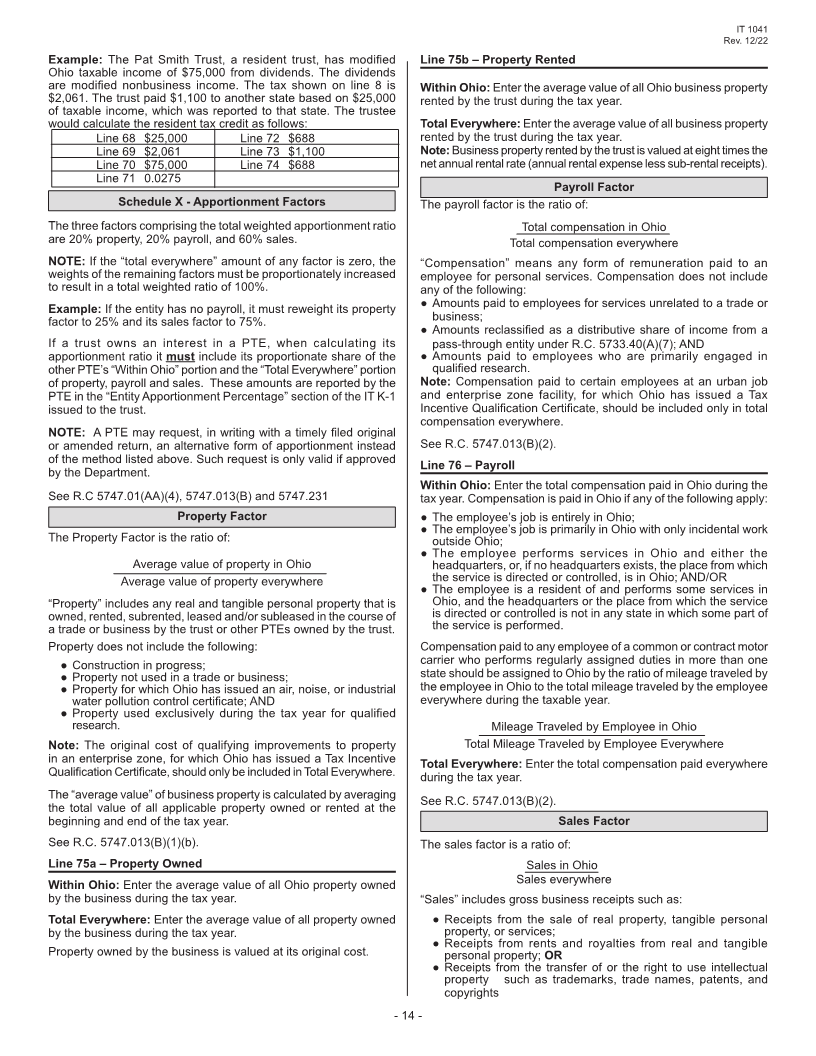

any directly related expenses and losses. (A) Rental Activity

For amounts that the fiduciary cannot directly match to items of Rents $ 530,000

income and gain, the fiduciary should proportionately assign Less: Depreciation expense - 100,000

those expenses and distributions. Generally, the basis for assign- Real estate taxes and payroll expenses - 25,000

ing expenses, losses and distributions will be the relative income Attorney fees (for lease preparations) - 5,000

or gain related to each activity

. Tentative apportionable profit from rental

Example #1 - Assigning Direct Distributions activities (business income) $ 400,000

The trust document directs the fiduciary to distribute to Lee, a ben-

eficiary, 75% of the yearly profit from rental activities.

(B) Portfolio Income

● The profit from these rental activities is $100,000 of business

income. Dividends, interest and net capital gains $ 301,000

● The trust had no other income and the only distribution to Lee Less: Investment advisor fees - 1,000

from the trust was $75,000.

Tentative profit from “portfolio” income

The fiduciary must reduce the trust’s rental profit by the distribution (nonbusiness income) $ 300,000

deduction attributable to the rental profit (in this example, 75% of

the rental activity profit). So the amount to be shown on Schedule

VII, line 62, will be $25,000. Total income excluding $70,000 indirect expense is $700,000.

Example #2 - Assigning Direct and Indirect Distributions,

Expenses and Losses Calculate the portion of $70,000 indirect expense for each income

category as follows:

The Trust has the following amounts listed on its Federal 1041:

Gross rent $530,000 (A) Rental Activity (Schedule VII):

Dividend income 200,000 (A) Divide by total income $700,000 excluding indirect expense

Interest Income 41,000 (B) of $70,000:

Net capital gain (stocks and bonds) 60,000 (B)

Rental property depreciation expense - 100,000 (B) $ 400,000 = .571428

Rental property real estate taxes and related $700,000

payroll expenses - 25,000 (A)

Attorney fees (lease preparation) - 5,000 (A) Multiply:

Investment advisor fees (stocks & bonds) - 1,000 (B) $ 70,000 X .571428 = $40,000

Fiduciary fees (based upon profit) - 10,000 (C)

Distribution deduction (discretionary) - 60,000 (C) Rental income - assigned rental expense

Taxable income per IRS form 1041 $ 630,000 $400,000 - $40,000 = $360,000

Additionally, assume the following:

Portfolio Income (Schedule VIII):

• The rental profit constitutes business income; Divide by total income $700,000 excluding indirect expense

• All other income and gain constitute nonbusiness income; of $70,000:

• There are no “Schedule II” Ohio adjustments (so Ohio taxable

income equals federal taxable income); AND $ 300,000 = .428571

• There are no amounts to report on IT-1041 Schedules VI or VII; AND $700,000

• Income from the federal schedule is categorized as follows:

(A) = Rental Activity Multiply:

(B) = Portfolio Income $ 70,000 X .428571 = $30,000

(C) = Indirect Expense and Deductions

Portfolio income - assigned portfolio expense

The total indirect expense and deductions for this trust are $70,000. $300,000 - $30,000 = $270,000

The expenses to the specific income categories are calculated is

as follows:

- 21 -

|