- 12 -

Enlarge image

|

IT 1140

Rev. 12/22

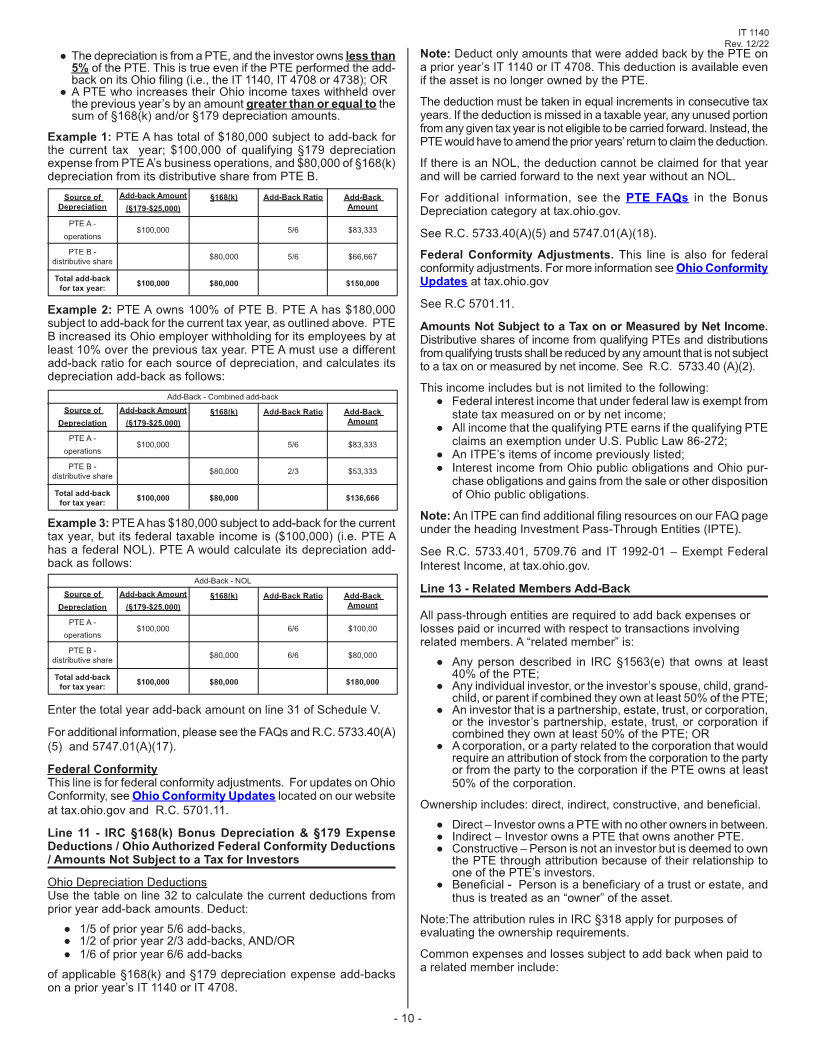

● The depreciation is from a PTE, and the investor owns less than Note: Deduct only amounts that were added back by the PTE on

5% of the PTE. This is true even if the PTE performed the add- a prior year’s IT 1140 or IT 4708. This deduction is available even

back on its Ohio filing (i.e., the IT 1140, IT 4708 or 4738); OR if the asset is no longer owned by the PTE.

● A PTE who increases their Ohio income taxes withheld over

the previous year’s by an amount greater than or equal to the The deduction must be taken in equal increments in consecutive tax

sum of §168(k) and/or §179 depreciation amounts. years. If the deduction is missed in a taxable year, any unused portion

from any given tax year is not eligible to be carried forward. Instead, the

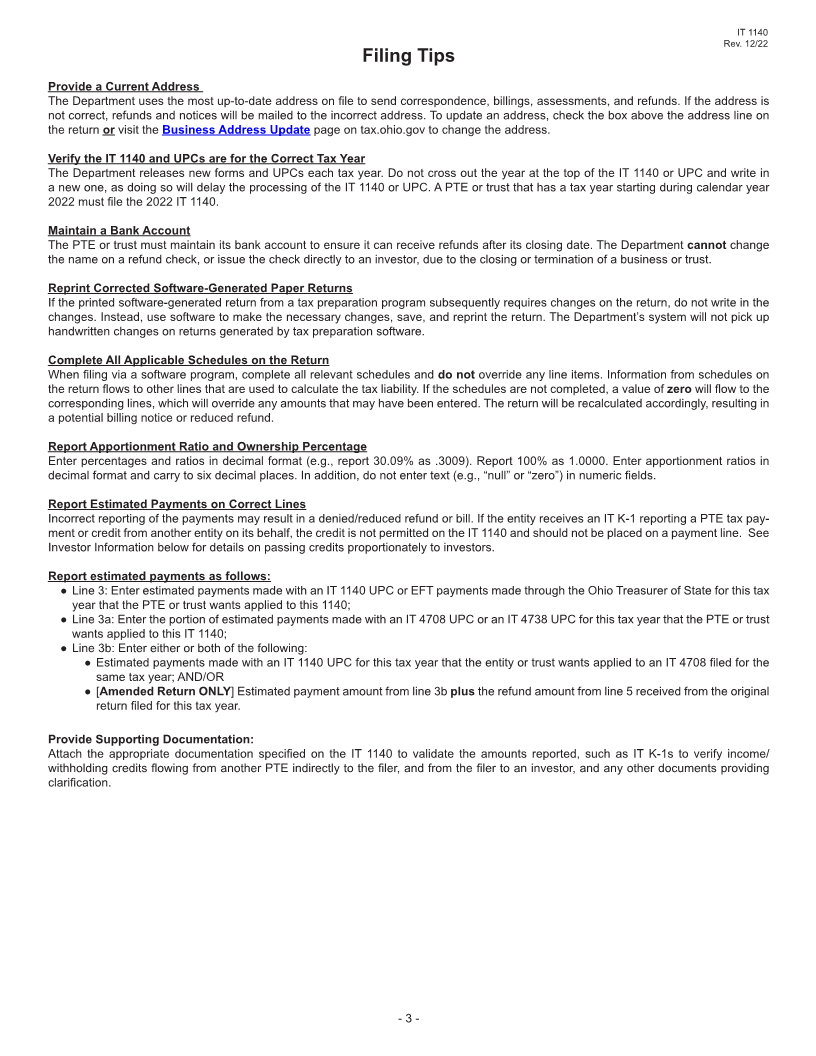

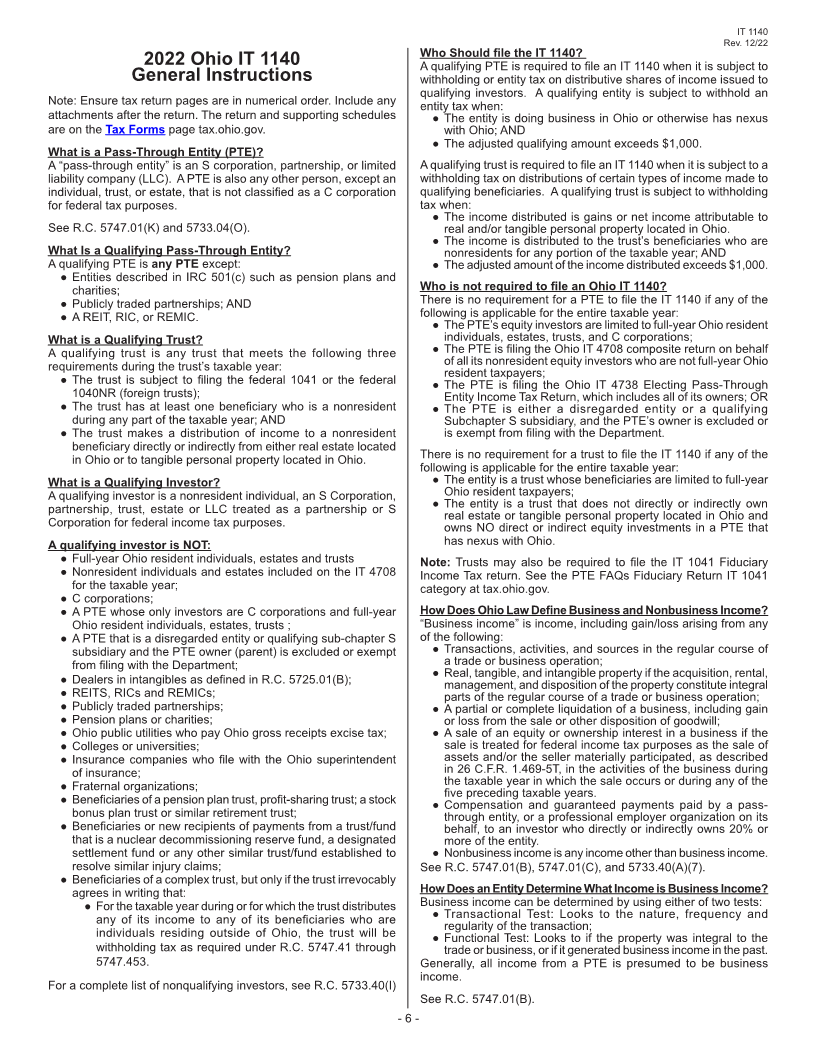

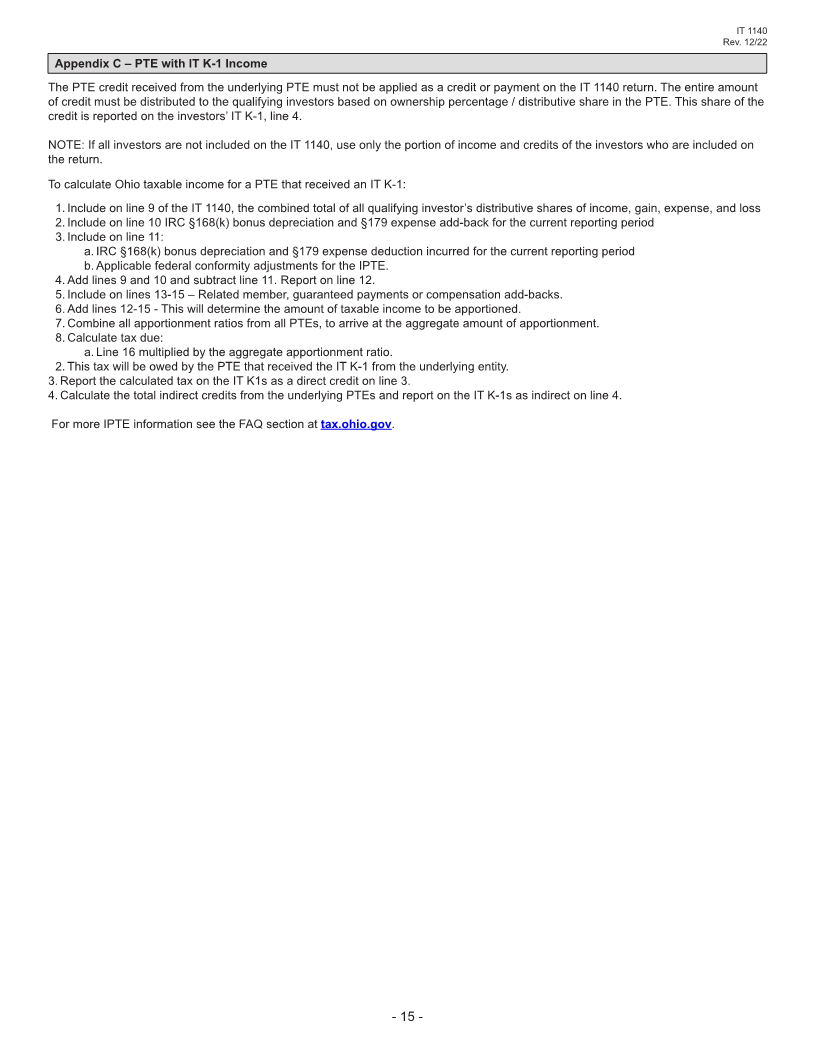

Example 1: PTE A has total of $180,000 subject to add-back for PTE would have to amend the prior years’ return to claim the deduction.

the current tax year; $100,000 of qualifying §179 depreciation

expense from PTE A’s business operations, and $80,000 of §168(k) If there is an NOL, the deduction cannot be claimed for that year

depreciation from its distributive share from PTE B. and will be carried forward to the next year without an NOL.

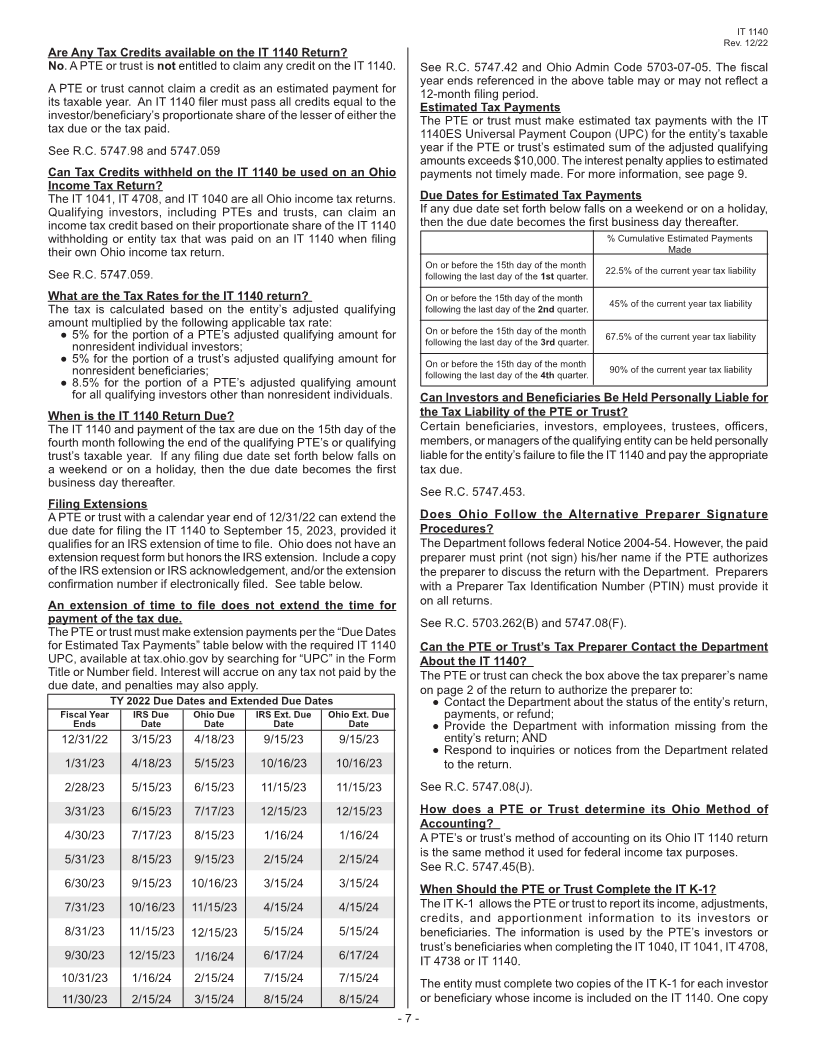

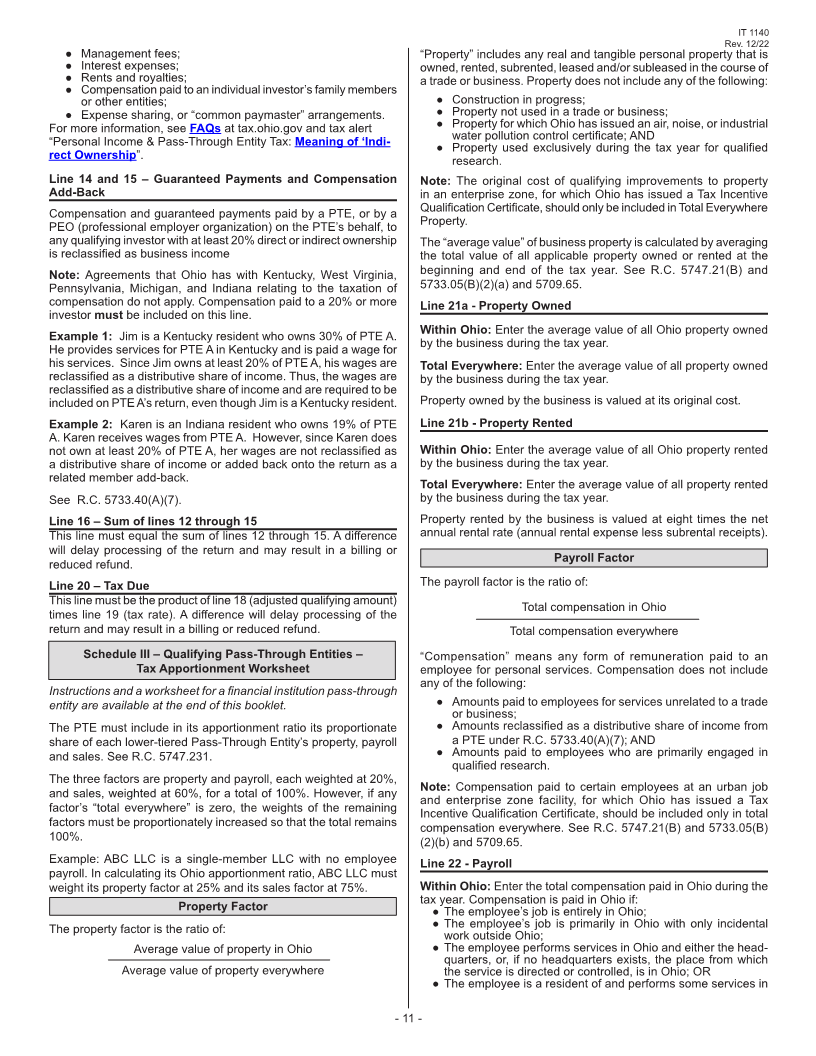

Source of Add-back Amount §168(k) Add-Back Ratio Add-Back For additional information, see the PTE FAQs in the Bonus

Depreciation (§179-$25,000) Amount Depreciation category at tax.ohio.gov.

PTE A -

operations $100,000 5/6 $83,333 See R.C. 5733.40(A)(5) and 5747.01(A)(18).

PTE B - $80,000 5/6 $66,667 Federal Conformity Adjustments. This line is also for federal

distributive share

conformity adjustments. For more information see Ohio Conformity

Total add-back $100,000 $80,000 $150,000 Updates at tax.ohio.gov

for tax year:

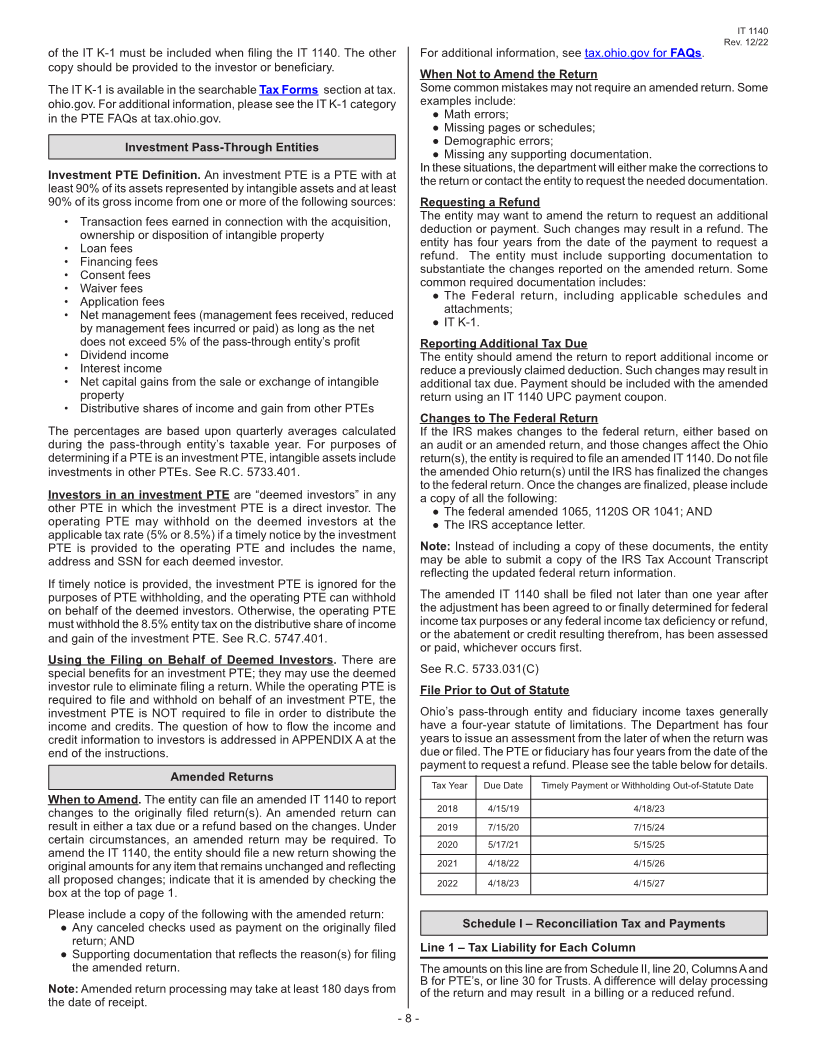

Example 2: PTE A owns 100% of PTE B. PTE A has $180,000 See R.C 5701.11.

subject to add-back for the current tax year, as outlined above. PTE Amounts Not Subject to a Tax on or Measured by Net Income.

B increased its Ohio employer withholding for its employees by at Distributive shares of income from qualifying PTEs and distributions

least 10% over the previous tax year. PTE A must use a different from qualifying trusts shall be reduced by any amount that is not subject

add-back ratio for each source of depreciation, and calculates its to a tax on or measured by net income. See R.C. 5733.40 (A)(2).

depreciation add-back as follows:

Add-Back - Combined add-back This income includes but is not limited to the following:

● Federal interest income that under federal law is exempt from

Source of Add-back Amount §168(k) Add-Back Ratio Add-Back state tax measured on or by net income;

Depreciation (§179-$25,000) Amount

● All income that the qualifying PTE earns if the qualifying PTE

PTE A - $100,000 5/6 $83,333 claims an exemption under U.S. Public Law 86-272;

operations ● An ITPE’s items of income previously listed;

PTE B - $80,000 2/3 $53,333 ● Interest income from Ohio public obligations and Ohio pur-

distributive share

chase obligations and gains from the sale or other disposition

Total add-back $100,000 $80,000 $136,666 of Ohio public obligations.

for tax year:

Note: An ITPE can find additional filing resources on our FAQ page

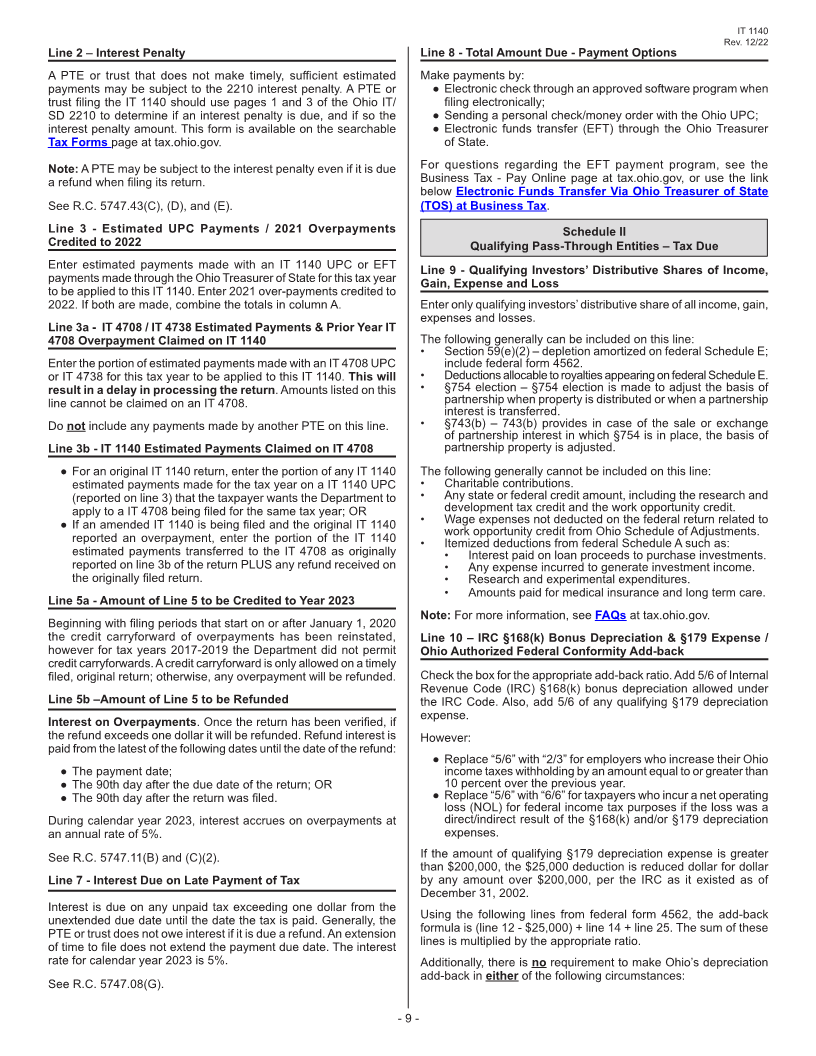

Example 3: PTE A has $180,000 subject to add-back for the current under the heading Investment Pass-Through Entities (IPTE).

tax year, but its federal taxable income is ($100,000) (i.e. PTE A

has a federal NOL). PTE A would calculate its depreciation add- See R.C. 5733.401, 5709.76 and IT 1992-01 – Exempt Federal

back as follows: Interest Income, at tax.ohio.gov.

Add-Back - NOL

Source of Add-back Amount §168(k) Add-Back Ratio Add-Back Line 13 - Related Members Add-Back

Depreciation (§179-$25,000) Amount

PTE A - $100,000 6/6 $100,00 All pass-through entities are required to add back expenses or

operations losses paid or incurred with respect to transactions involving

PTE B - $80,000 6/6 $80,000 related members. A “related member” is:

distributive share ● Any person described in IRC §1563(e) that owns at least

Total add-back $100,000 $80,000 $180,000 40% of the PTE;

for tax year: ● Any individual investor, or the investor’s spouse, child, grand -

child, or parent if combined they own at least 50% of the PTE;

Enter the total year add-back amount on line 31 of Schedule V. ● An investor that is a partnership, estate, trust, or corporation,

or the investor’s partnership, estate, trust, or corporation if

For additional information, please see the FAQs and R.C. 5733.40(A) combined they own at least 50% of the PTE; OR

(5) and 5747.01(A)(17). ● A corporation, or a party related to the corporation that would

require an attribution of stock from the corporation to the party

Federal Conformity or from the party to the corporation if the PTE owns at least

This line is for federal conformity adjustments. For updates on Ohio 50% of the corporation.

Conformity, see Ohio Conformity Updates located on our website

at tax.ohio.gov and R.C. 5701.11. Ownership includes: direct, indirect, constructive, and beneficial.

● Direct – Investor owns a PTE with no other owners in between.

Line 11 - IRC §168(k) Bonus Depreciation & §179 Expense ● Indirect – Investor owns a PTE that owns another PTE.

Deductions / Ohio Authorized Federal Conformity Deductions ● Constructive – Person is not an investor but is deemed to own

/ Amounts Not Subject to a Tax for Investors the PTE through attribution because of their relationship to

one of the PTE’s investors.

Ohio Depreciation Deductions ● Beneficial - Person is a beneficiary of a trust or estate, and

Use the table on line 32 to calculate the current deductions from thus is treated as an “owner” of the asset.

prior year add-back amounts. Deduct:

Note:The attribution rules in IRC §318 apply for purposes of

● 1/5 of prior year 5/6 add-backs, evaluating the ownership requirements.

● 1/2 of prior year 2/3 add-backs, AND/OR

● 1/6 of prior year 6/6 add-backs Common expenses and losses subject to add back when paid to

a related member include:

of applicable §168(k) and §179 depreciation expense add-backs

on a prior year’s IT 1140 or IT 4708.

- 10 -

|