- 7 -

Enlarge image

|

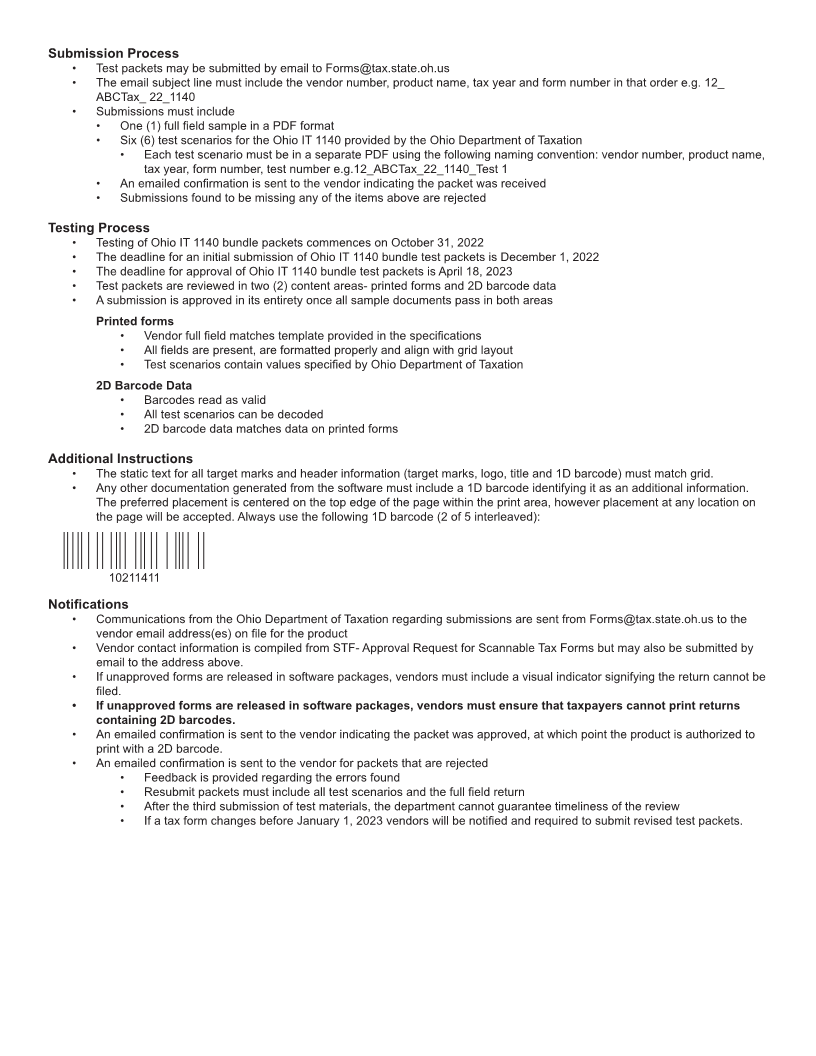

Submission Process

• Test packets may be submitted by email to Forms@tax.state.oh.us

• The email subject line must include the vendor number, product name, tax year and form number in that order e.g. 12_

ABCTax_ 22_1140

• Submissions must include

• One (1) full field sample in a PDF format

• Six (6) test scenarios for the Ohio IT 1140 provided by the Ohio Department of Taxation

• Each test scenario must be in a separate PDF using the following naming convention: vendor number, product name,

tax year, form number, test number e.g.12_ABCTax_22_1140_Test 1

• An emailed confirmation is sent to the vendor indicating the packet was received

• Submissions found to be missing any of the items above are rejected

Testing Process

• Testing of Ohio IT 1140 bundle packets commences on October 31, 2022

• The deadline for an initial submission of Ohio IT 1140 bundle test packets is December 1, 2022

• The deadline for approval of Ohio IT 1140 bundle test packets is April 18, 2023

• Test packets are reviewed in two (2) content areas- printed forms and 2D barcode data

• A submission is approved in its entirety once all sample documents pass in both areas

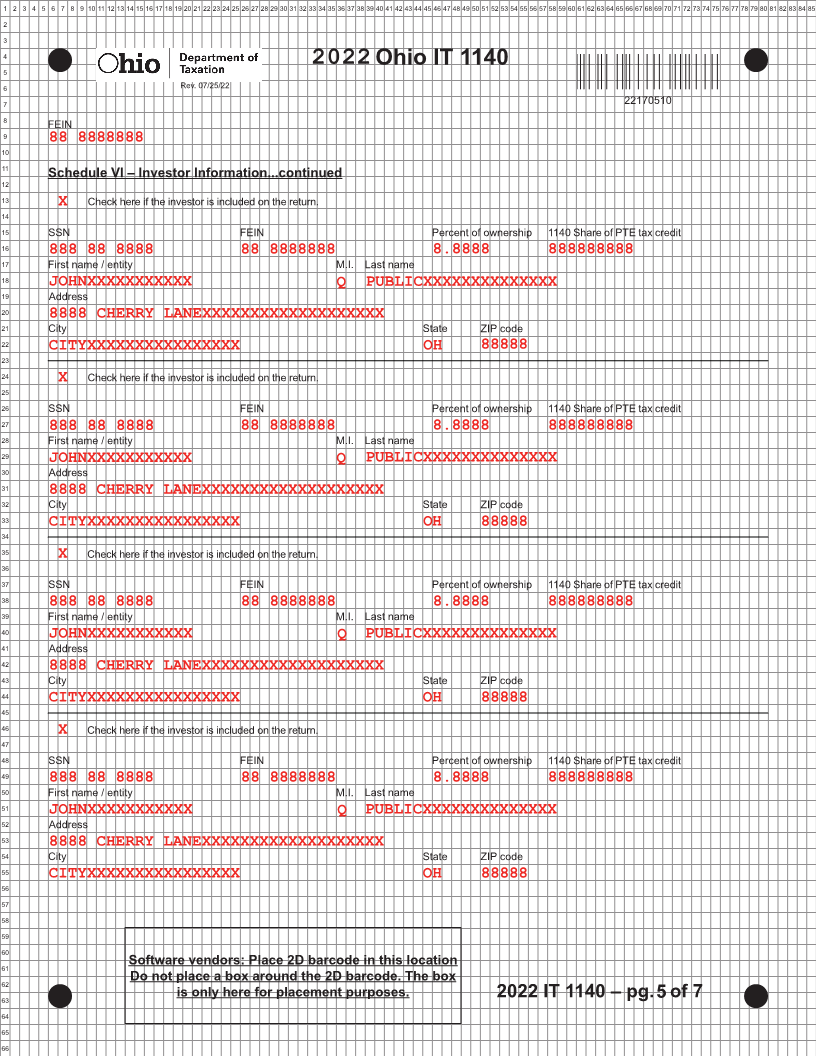

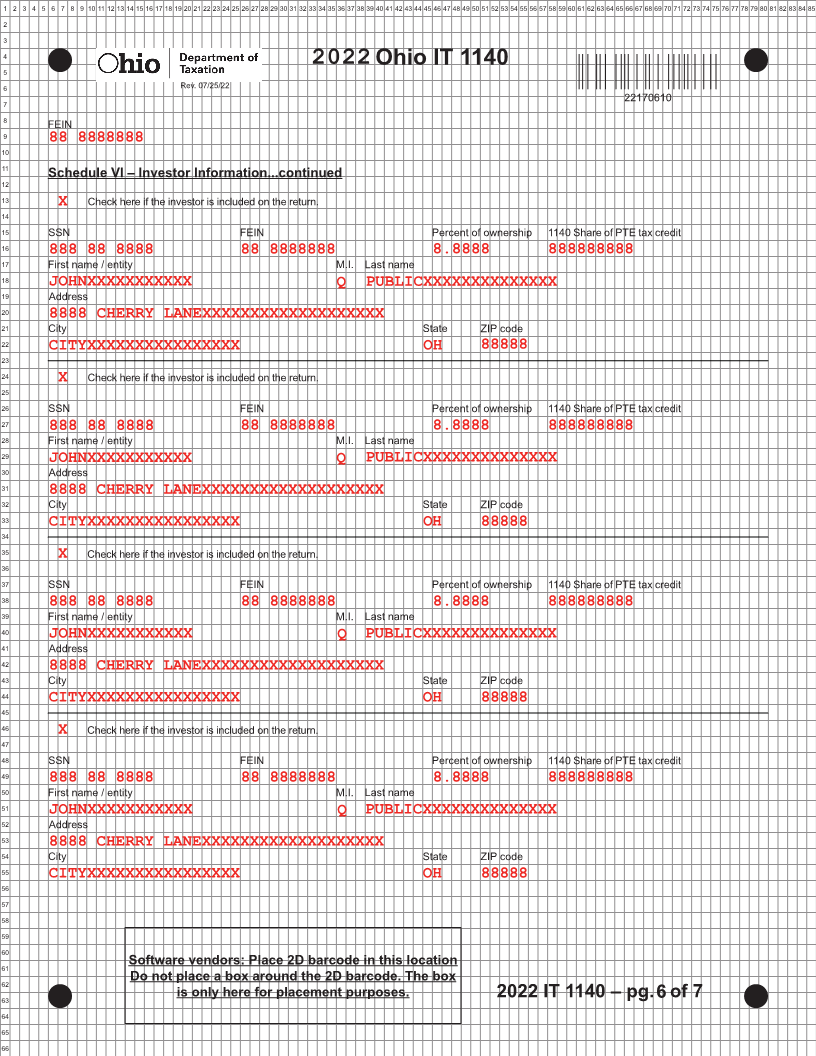

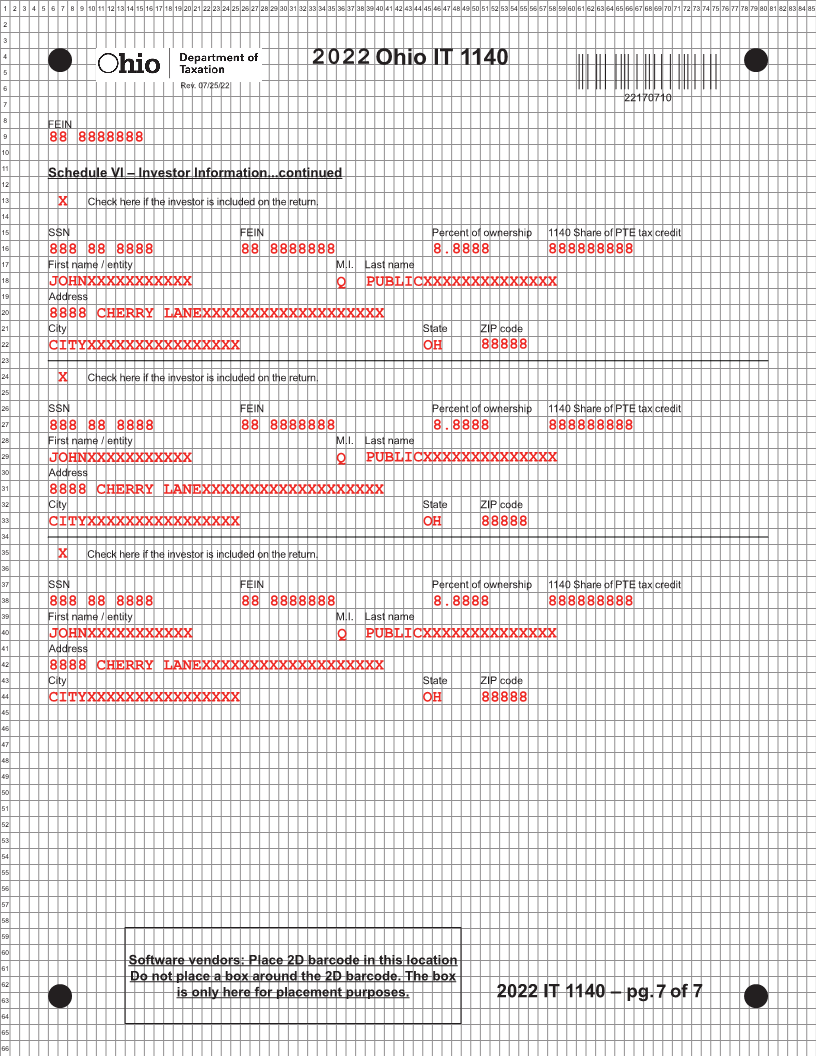

Printed forms

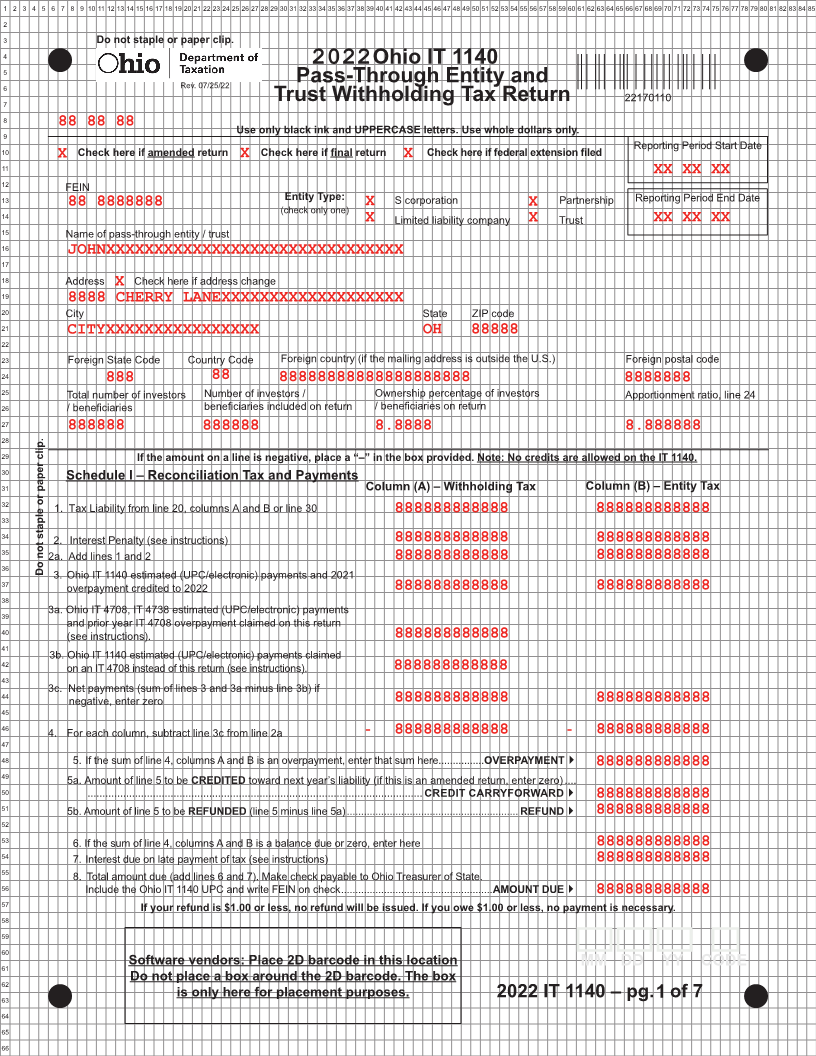

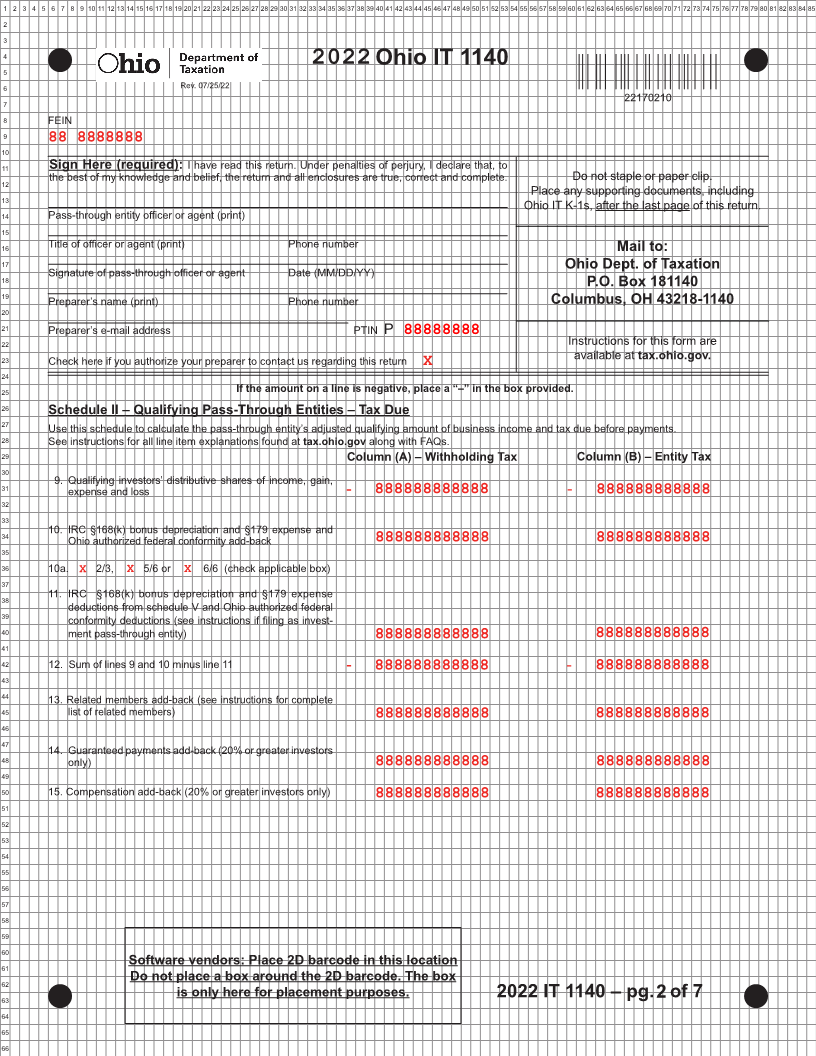

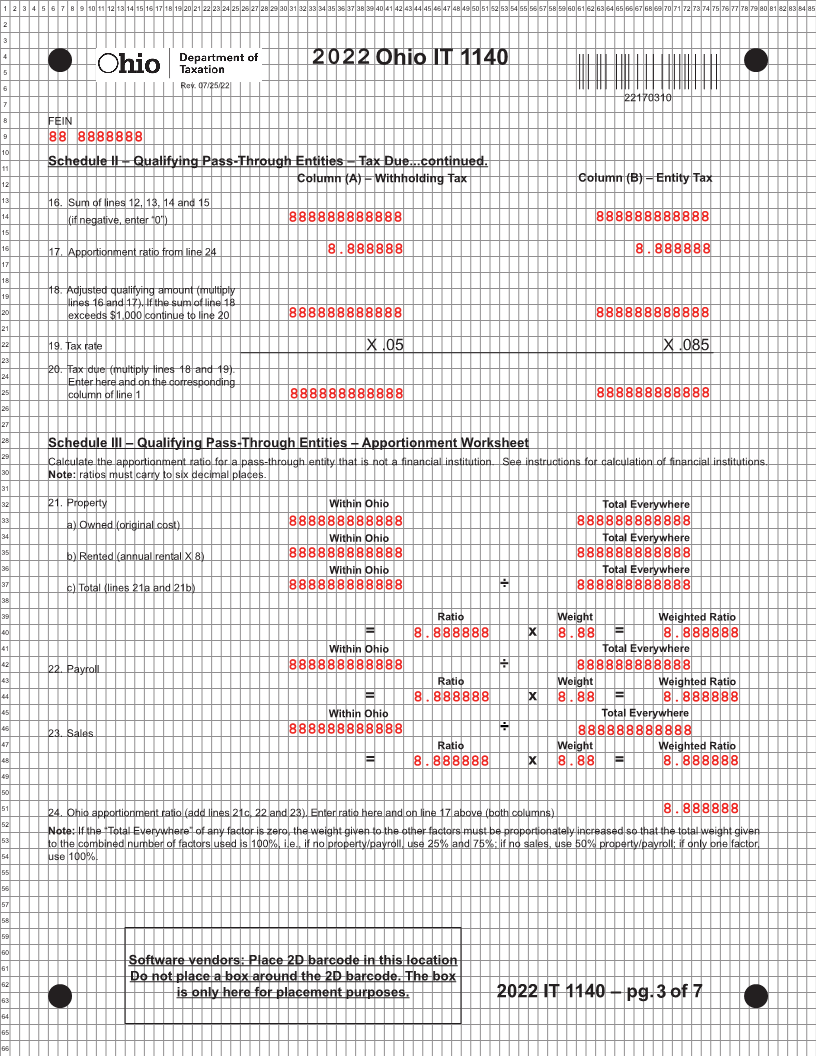

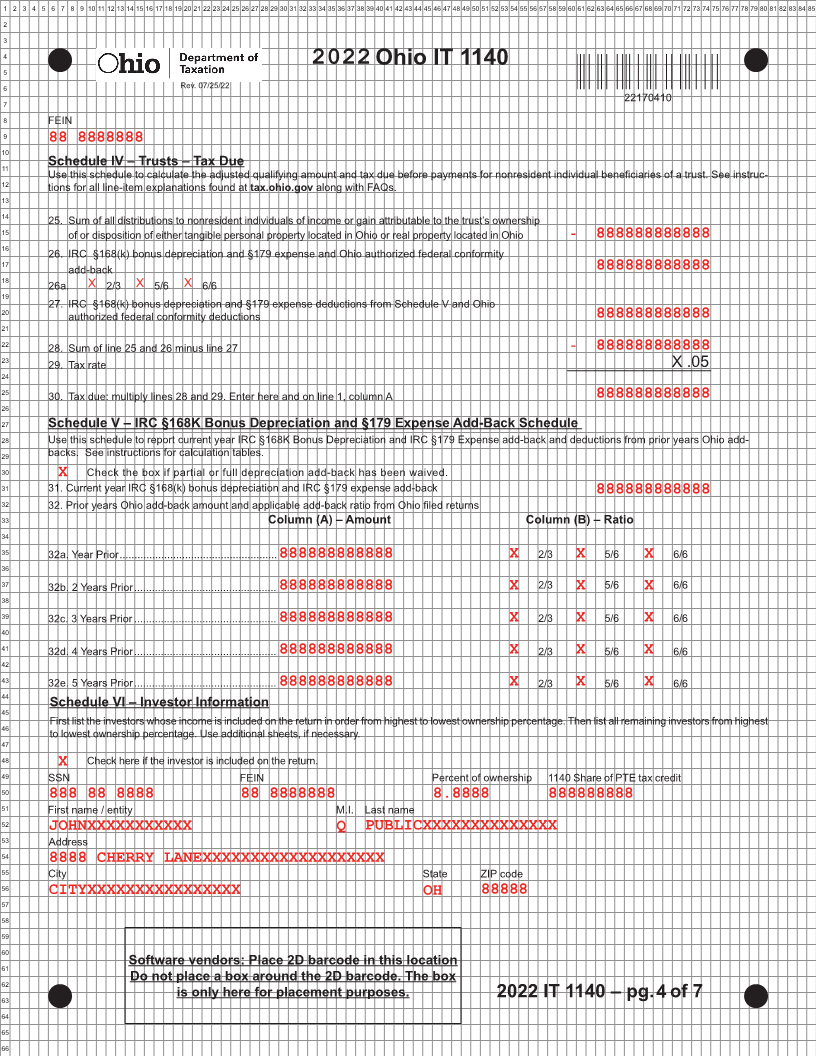

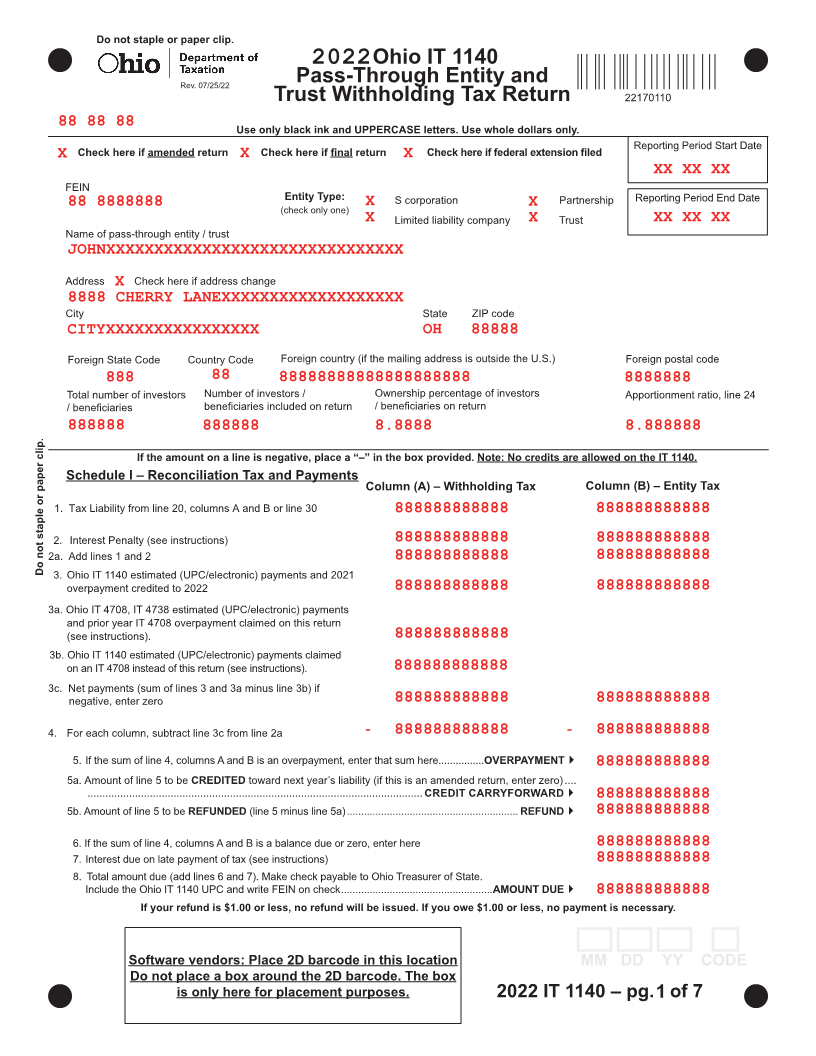

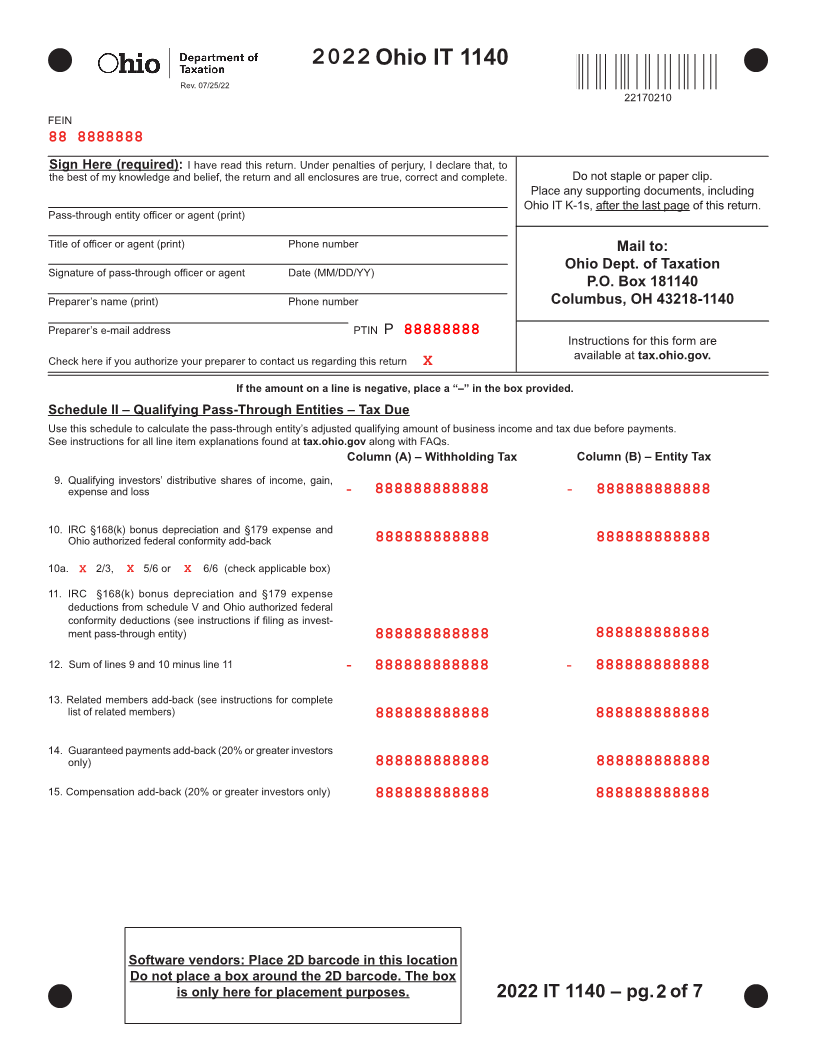

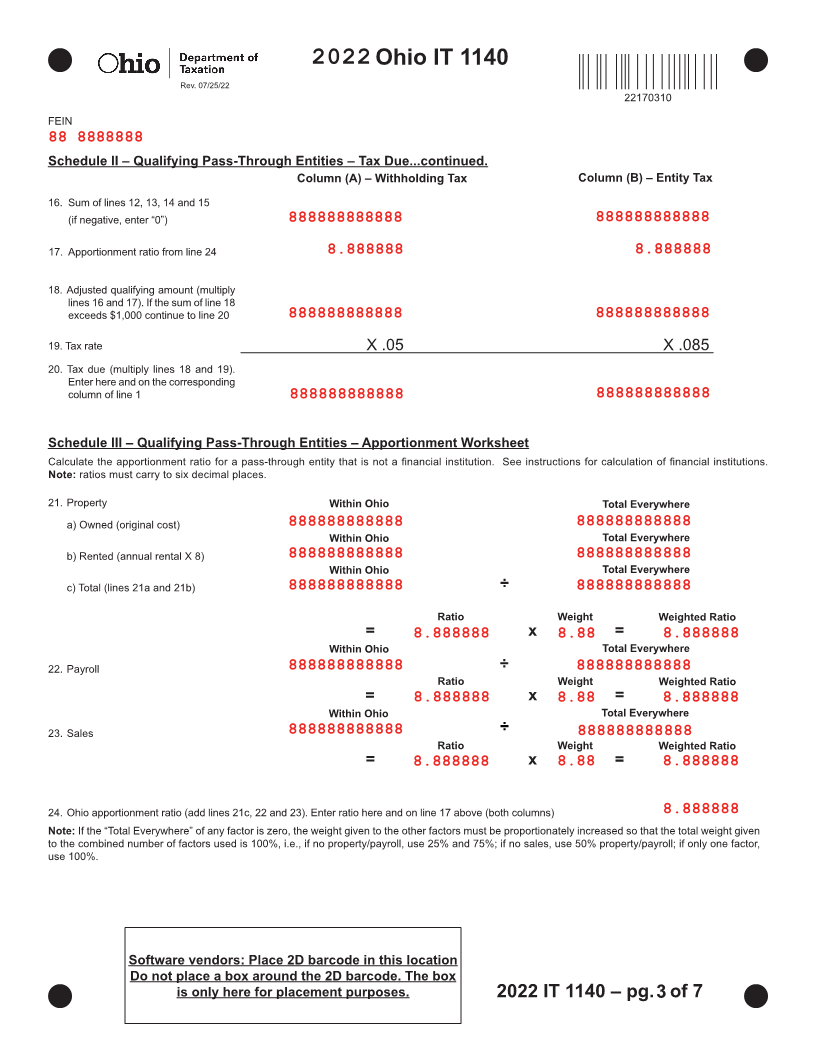

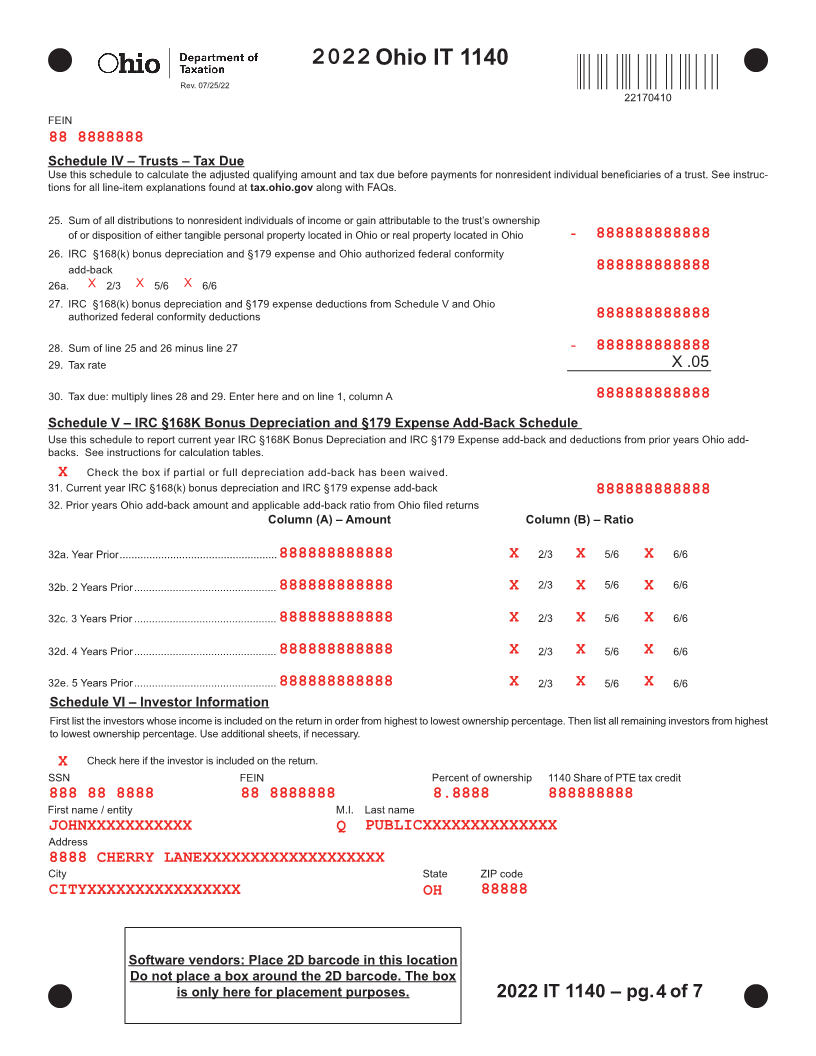

• Vendor full field matches template provided in the specifications

• All fields are present, are formatted properly and align with grid layout

• Test scenarios contain values specified by Ohio Department of Taxation

2D Barcode Data

• Barcodes read as valid

• All test scenarios can be decoded

• 2D barcode data matches data on printed forms

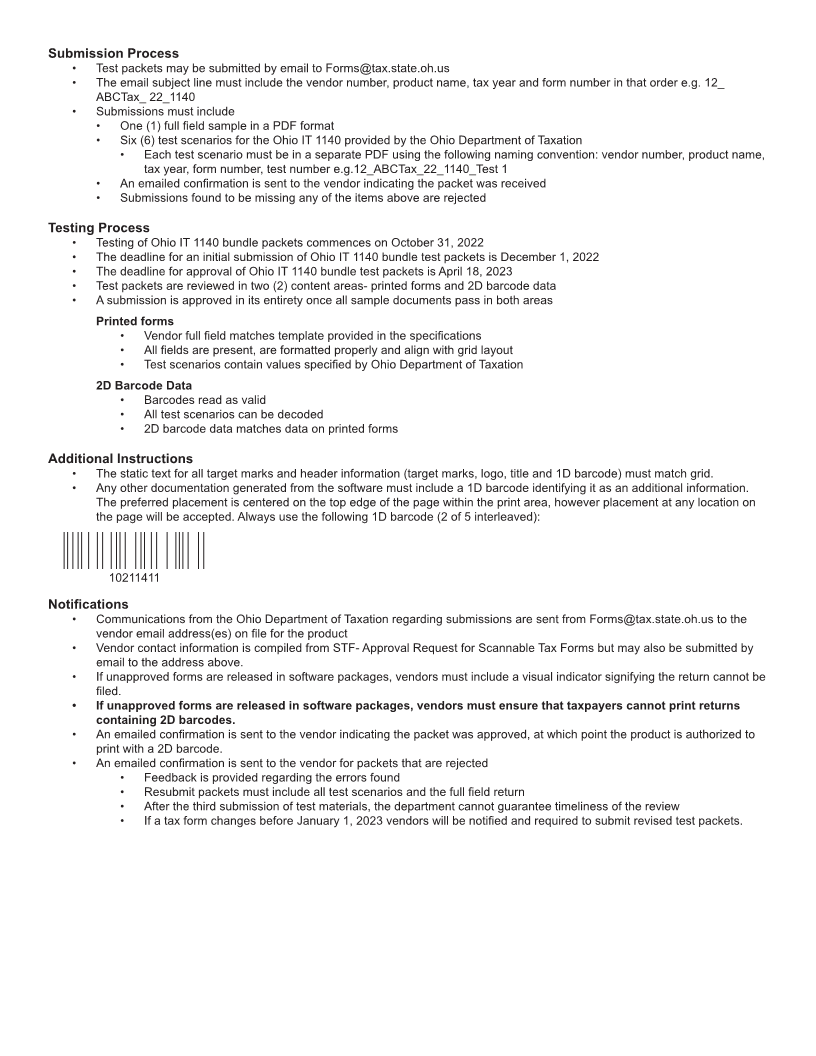

Additional Instructions

• The static text for all target marks and header information (target marks, logo, title and 1D barcode) must match grid.

• Any other documentation generated from the software must include a 1D barcode identifying it as an additional information.

The preferred placement is centered on the top edge of the page within the print area, however placement at any location on

the page will be accepted. Always use the following 1D barcode (2 of 5 interleaved):

10211411

Notifications

• Communications from the Ohio Department of Taxation regarding submissions are sent from Forms@tax.state.oh.us to the

vendor email address(es) on file for the product

• Vendor contact information is compiled from STF- Approval Request for Scannable Tax Forms but may also be submitted by

email to the address above.

• If unapproved forms are released in software packages, vendors must include a visual indicator signifying the return cannot be

filed.

• If unapproved forms are released in software packages, vendors must ensure that taxpayers cannot print returns

containing 2D barcodes.

• An emailed confirmation is sent to the vendor indicating the packet was approved, at which point the product is authorized to

print with a 2D barcode.

• An emailed confirmation is sent to the vendor for packets that are rejected

• Feedback is provided regarding the errors found

• Resubmit packets must include all test scenarios and the full field return

• After the third submission of test materials, the department cannot guarantee timeliness of the review

• If a tax form changes before January 1, 2023 vendors will be notified and required to submit revised test packets.

|