Enlarge image

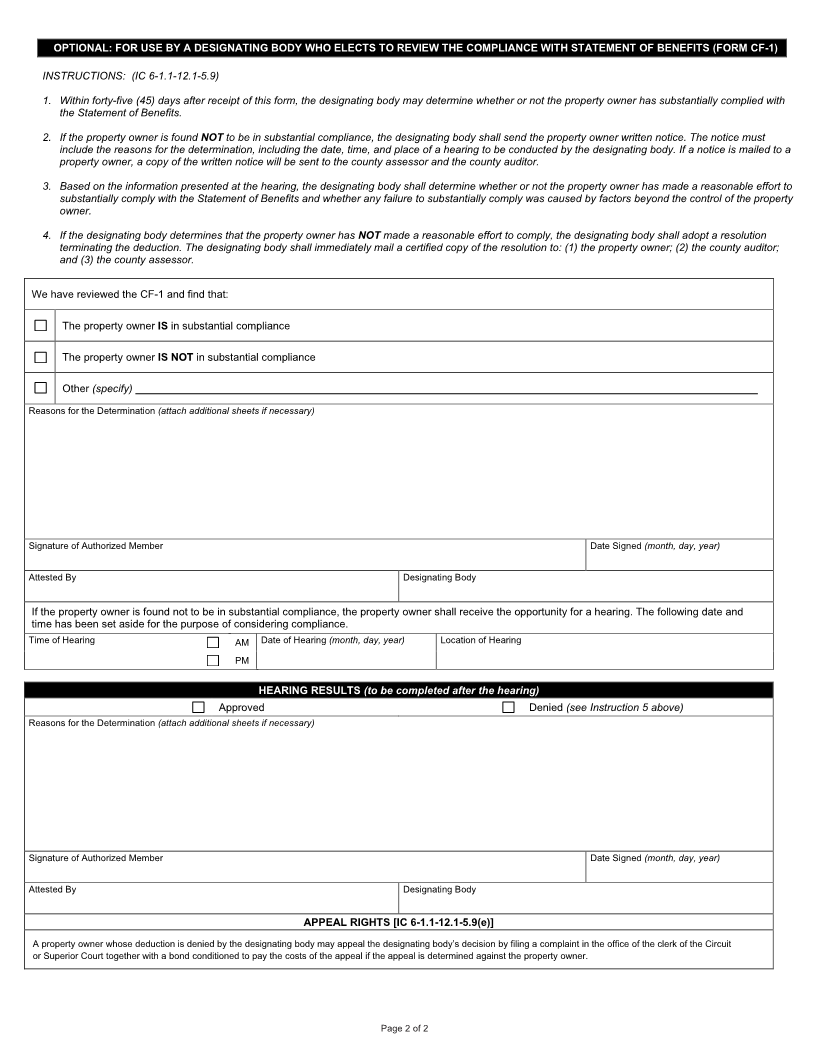

PRIVACY NOTICE FORM CF-1 / PP

COMPLIANCE WITH STATEMENT OF BENEFITS This form contains confidential

information pursuant to

PERSONAL PROPERTY IC 6-1.1-35-9 and IC 6-1.1-12.1-5.6. 20___ Pay 20___

State Form 51765 (R7 / 12-22)

Prescribed by the Department of Local Government Finance

INSTRUCTIONS: 1. Property owners whose Statement of Benefits was approved must file this form with the local designating body to show the extent to which

there has been compliance with the Statement of Benefits. (IC 6-1.1-12.1-5.6)

2. This form must be filed with the Form 103-ERA Schedule of Deduction from Assessed Value between January 1 and May 15, unless a filing

extension under IC 6-1.1-3.7 has been granted. A person who obtains a filing extension must file between January 1 and the extended due date

of each year.

3. With the approval of the designating body, compliance information for multiple projects may be consolidated on one (1) compliance form (CF-1).

SECTION 1 TAXPAYER INFORMATION

Name of Taxpayer County

Address of Taxpayer (number and street, city, state, and ZIP code) DLGF Taxing District Number

Name of Contact Person Telephone Number Email Address

( )

SECTION 2 LOCATION AND DESCRIPTION OF PROPERTY

Name of Designating Body Resolution Number Estimated State Date (month, day, year)

Location of Property Actual Start Date (month, day, year)

Description of new manufacturing equipment, new research and development equipment, new information technology equipment, or Estimated Completion Date (month, day, year)

new logistical distribution equipment to be acquired.

Actual Completion Date (month, day, year)

SECTION 3 EMPLOYEES AND SALARIES

EMPLOYEES AND SALARIES AS ESTIMATED ON SB-1 ACTUAL

Current Number of Employees

Salaries

Number of Employees Retained

Salaries

Number of Additional Employees

Salaries

SECTION 4 COST AND VALUES

MANUFACTURING RESEARCH & LOGISTICAL DISTRIBUTION IT EQUIPMENT

EQUIPMENT DEVELOPMENT EQUIPMENT EQUIPMENT

AS ESTIMATED ON SB-1 COST ASSESSED COST ASSESSED COST ASSESSED COST ASSESSED

VALUE VALUE VALUE VALUE

Values Before Project $ $ $ $ $ $ $ $

Plus: Values of Proposed Project $ $ $ $ $ $ $ $

Less: Values of Any Property Being Replaced $ $ $ $ $ $ $ $

Net Values Upon Completion of Project $ $ $ $ $ $ $ $

ACTUAL COST ASSESSED COST ASSESSED COST ASSESSED COST ASSESSED

VALUE VALUE VALUE VALUE

Values Before Project $ $ $ $ $ $ $ $

Plus: Values of Proposed Project $ $ $ $ $ $ $ $

Less: Values of Any Property Being Replaced $ $ $ $ $ $ $ $

Net Values Upon Completion of Project $ $ $ $ $ $ $ $

NOTE: The COST of the property is confidential pursuant to IC 6-1.1-12.1-5.6(c).

SECTION 5 WASTE CONVERTED AND OTHER BENEFITS PROMISED BY THE TAXPAYER

WASTE CONVERTED AND OTHER BENEFITS AS ESTIMATED ON SB-1 ACTUAL

Amount of Solid Waste Converted

Amount of Hazardous Waste Converted

Other Benefits:

SECTION 6 TAXPAYER CERTIFICATION

I hereby certify that the representations in this statement are true.

Signature of Authorized Representative Title Date Signed (month, day, year)

Page 1 of 2