- 17 -

Enlarge image

|

If the taxpayer has taxes due to the department, an official Post Filing Coupon (PFC) should be

generated by the software and given to the taxpayer.

Other Situations

Credit Limits

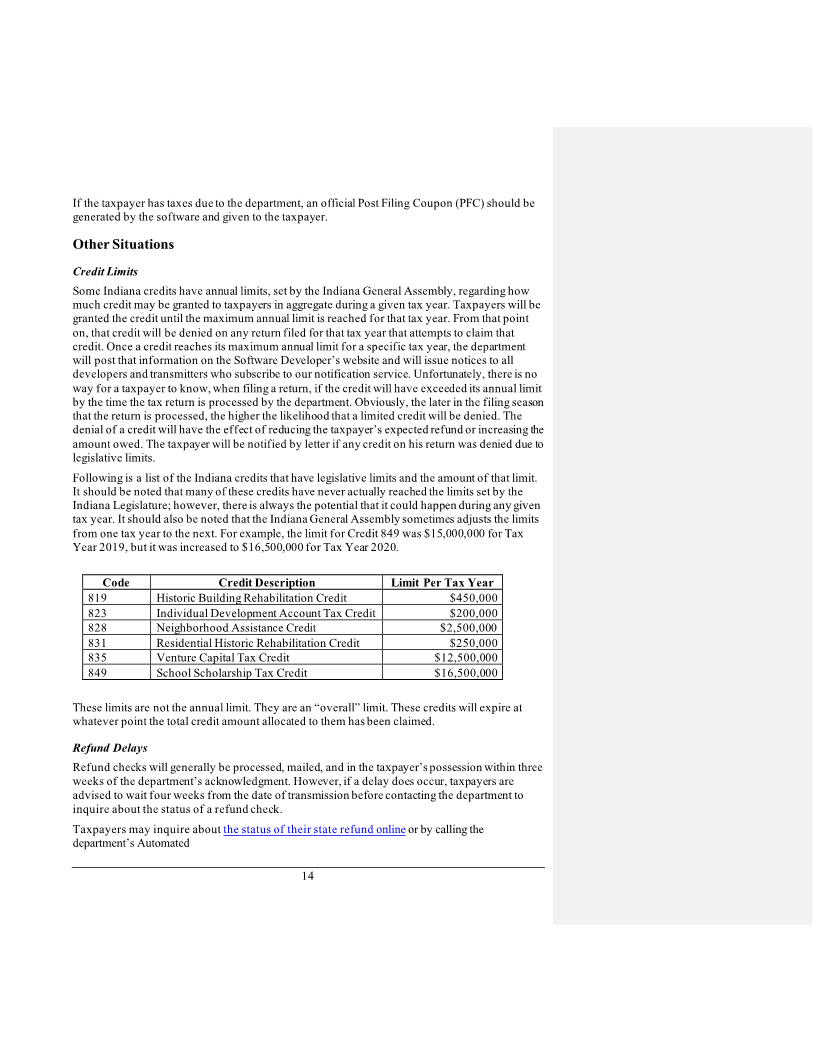

Some Indiana credits have annual limits, set by the Indiana General Assembly, regarding how

much credit may be granted to taxpayers in aggregate during a given tax year. Taxpayers will be

granted the credit until the maximum annual limit is reached for that tax year. From that point

on, that credit will be denied on any return filed for that tax year that attempts to claim that

credit. Once a credit reaches its maximum annual limit for a specific tax year, the department

will post that information on the Software Developer’s website and will issue notices to all

developers and transmitters who subscribe to our notification service. Unfortunately, there is no

way for a taxpayer to know, when filing a return, if the credit will have exceeded its annual limit

by the time the tax return is processed by the department. Obviously, the later in the filing season

that the return is processed, the higher the likelihood that a limited credit will be denied. The

denial of a credit will have the effect of reducing the taxpayer’s expected refund or increasing the

amount owed. The taxpayer will be notified by letter if any credit on his return was denied due to

legislative limits.

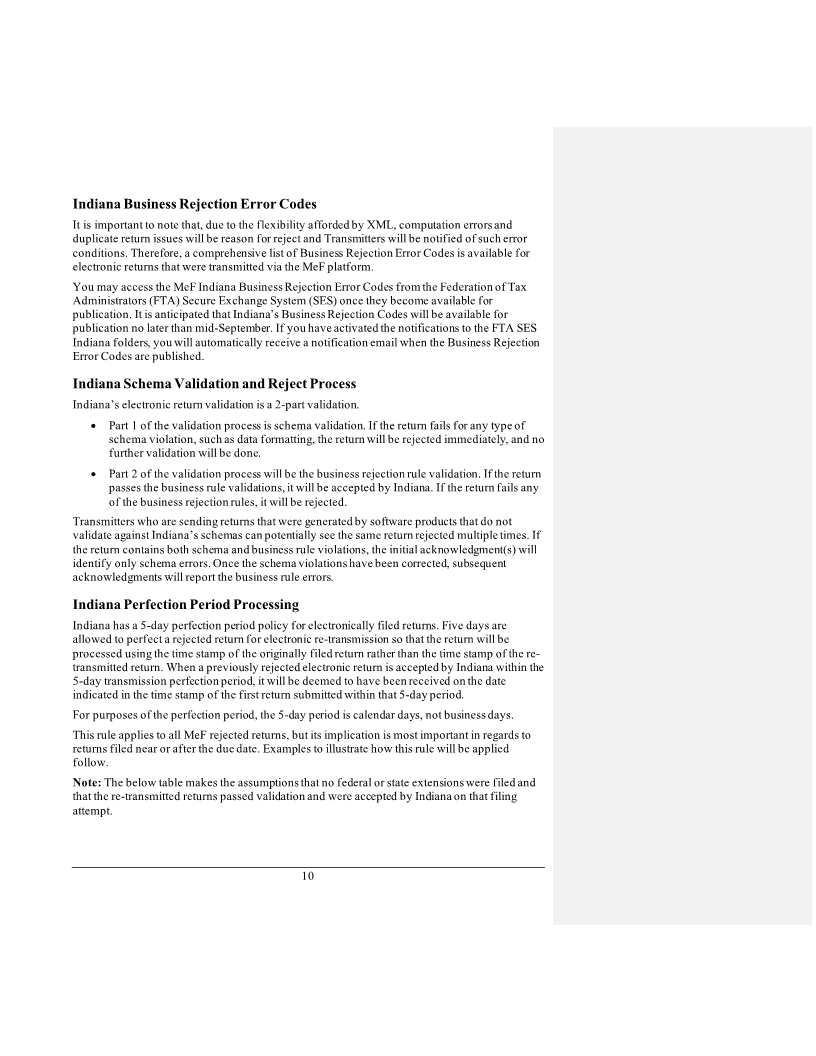

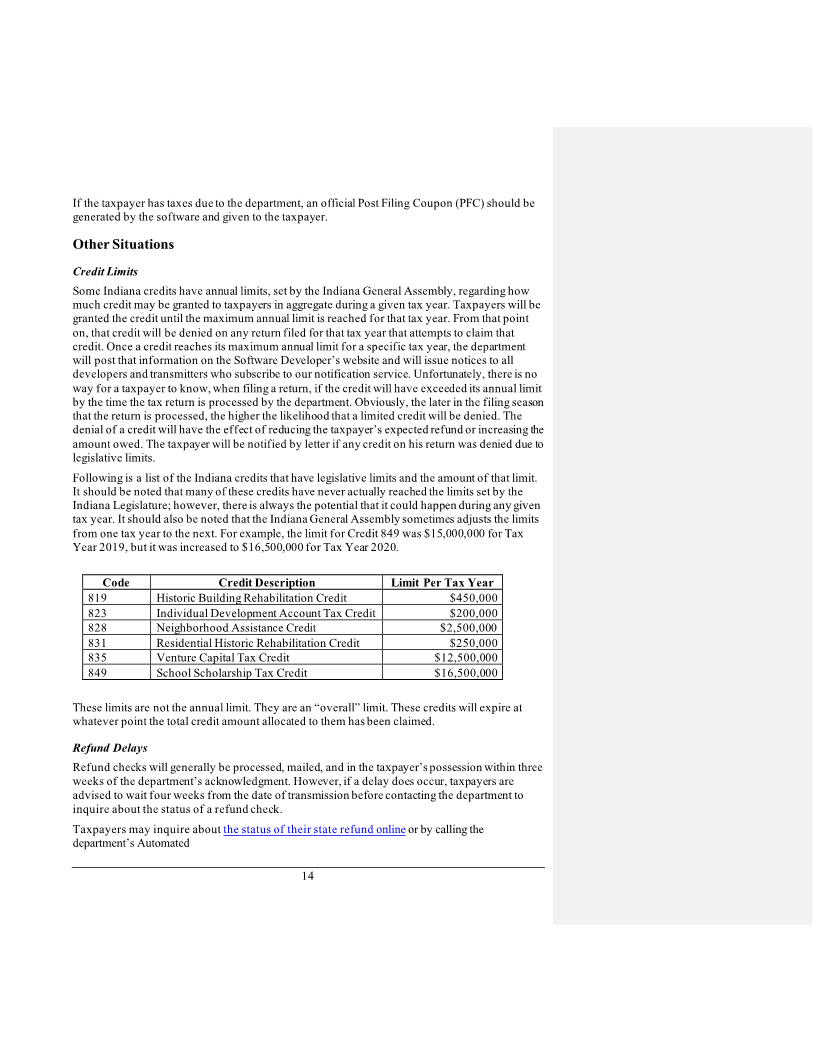

Following is a list of the Indiana credits that have legislative limits and the amount of that limit.

It should be noted that many of these credits have never actually reached the limits set by the

Indiana Legislature; however, there is always the potential that it could happen during any given

tax year. It should also be noted that the Indiana General Assembly sometimes adjusts the limits

from one tax year to the next. For example, the limit for Credit 849 was $15,000,000 for Tax

Year 2019, but it was increased to $16,500,000 for Tax Year 2020.

Code Credit Description Limit Per Tax Year

819 Historic Building Rehabilitation Credit $450,000

823 Individual Development Account Tax Credit $200,000

828 Neighborhood Assistance Credit $2,500,000

831 Residential Historic Rehabilitation Credit $250,000

835 Venture Capital Tax Credit $12,500,000

849 School Scholarship Tax Credit $16,500,000

These limits are not the annual limit. They are an “overall” limit. These credits will expire at

whatever point the total credit amount allocated to them has been claimed.

Refund Delays

Refund checks will generally be processed, mailed, and in the taxpayer’s possession within three

weeks of the department’s acknowledgment. However, if a delay does occur, taxpayers are

advised to wait four weeks from the date of transmission before contacting the department to

inquire about the status of a refund check.

Taxpayers may inquire about the status of their state refund online or by calling the

department’s Automated

14

|