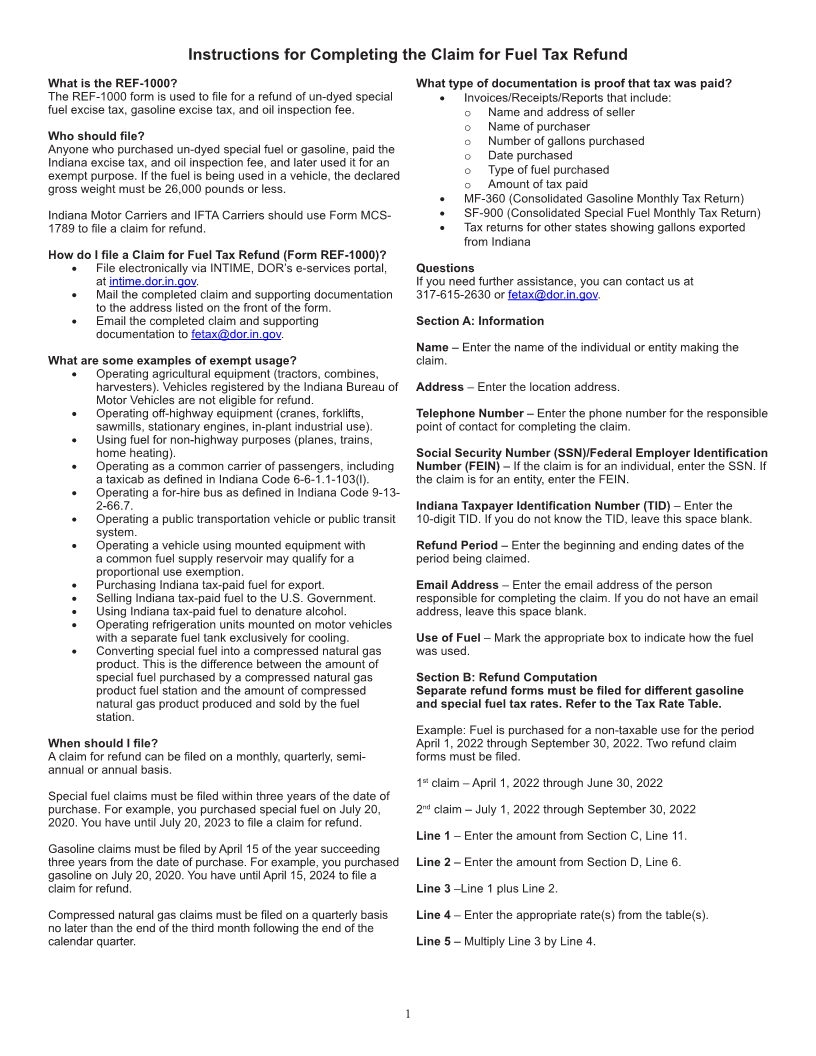

Enlarge image

Form REF-1000 Indiana Department of Revenue Mailing/Contact Information:

State Form 50854 Indiana Department of Revenue

(R16 / 6-23) Claim for Fuel Tax Refund P.O. Box 1971

Indianapolis, IN 46206-1971

317-615-2630

fetax@dor.in.gov

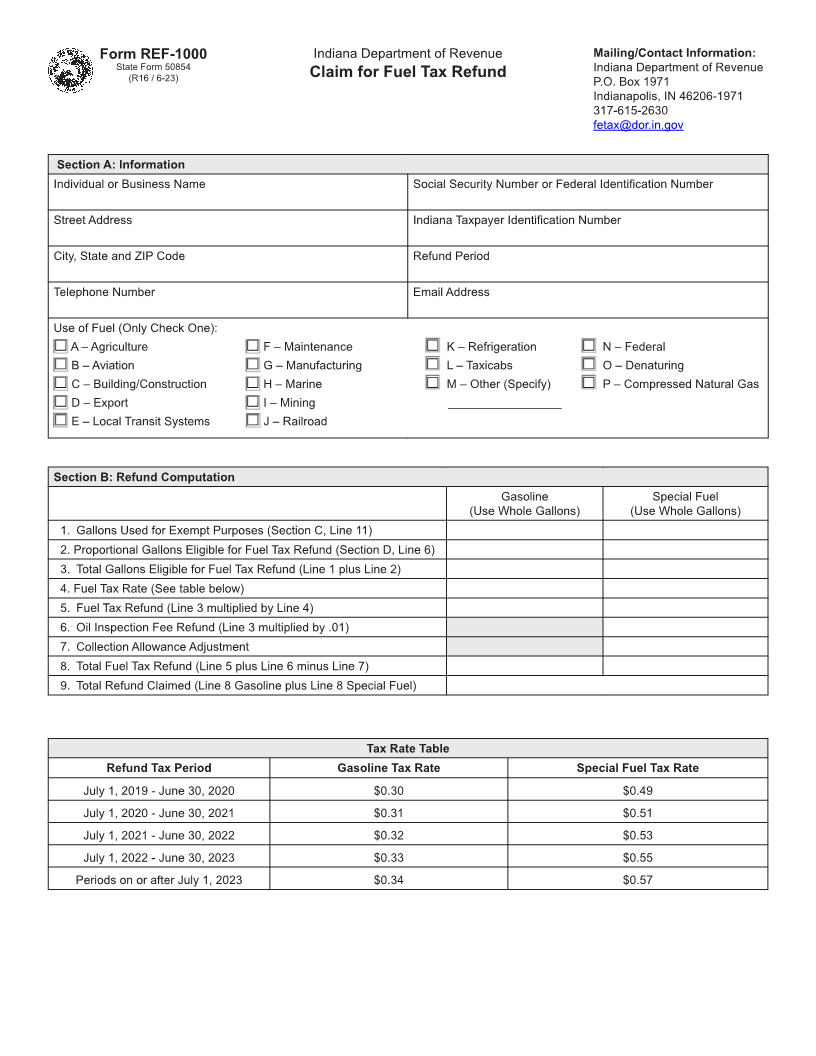

Section A: Information

Individual or Business Name Social Security Number or Federal Identification Number

Street Address Indiana Taxpayer Identification Number

City, State and ZIP Code Refund Period

Telephone Number Email Address

Use of Fuel (Only Check One):

□ A – Agriculture □ F – Maintenance □ K – Refrigeration □ N – Federal

□ B – Aviation □ G – Manufacturing □ L – Taxicabs □ O – Denaturing

□ C – Building/Construction □ H – Marine □ M – Other (Specify) □ P – Compressed Natural Gas

□ D – Export □ I – Mining _________________

□ E – Local Transit Systems □ J – Railroad

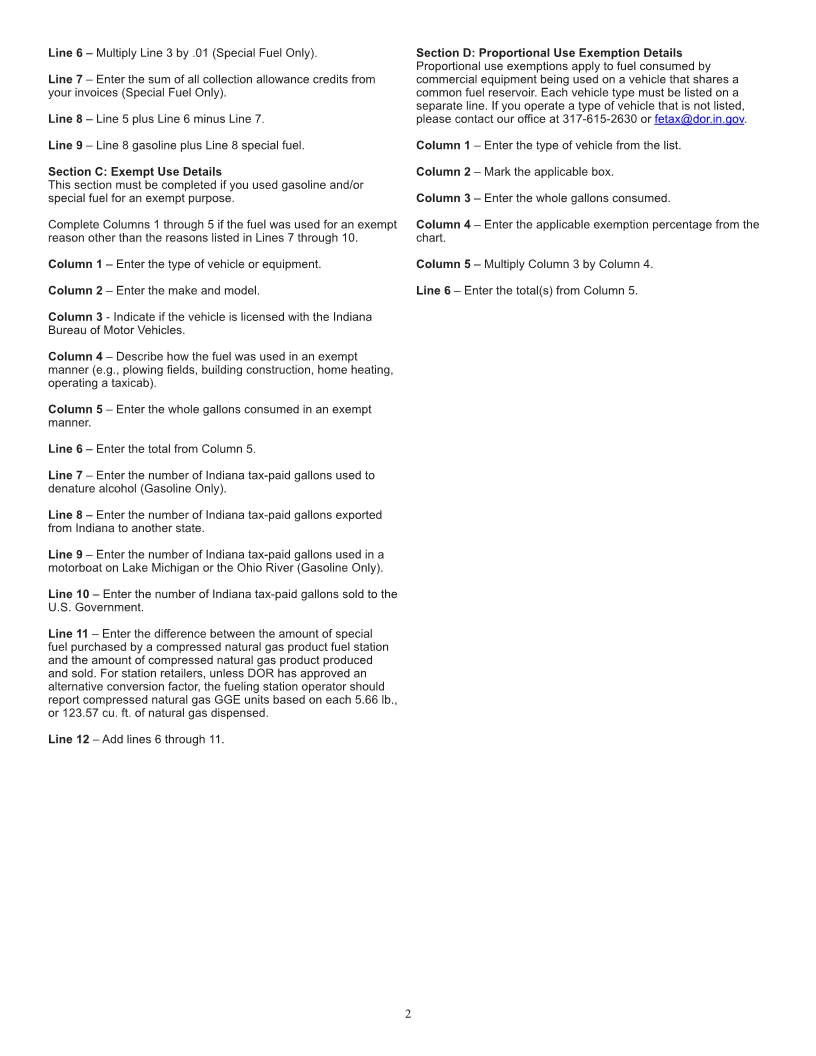

Section B: Refund Computation

Gasoline Special Fuel

(Use Whole Gallons) (Use Whole Gallons)

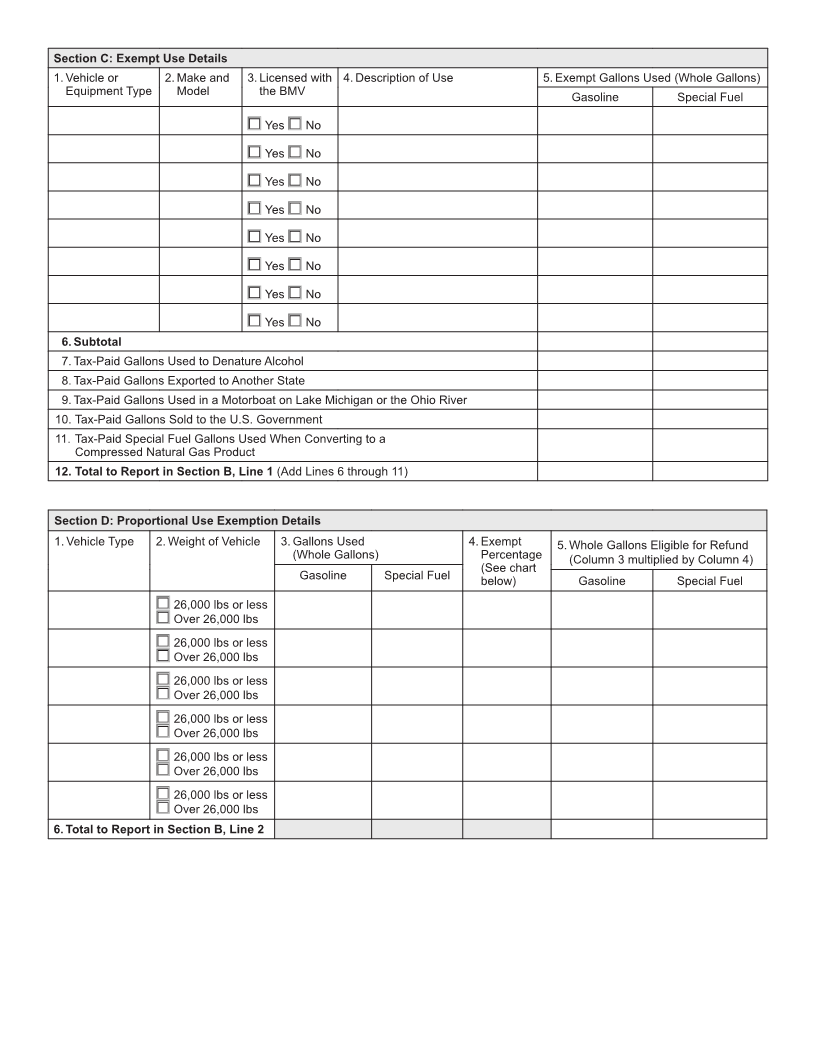

1. Gallons Used for Exempt Purposes (Section C, Line 11)

2. Proportional Gallons Eligible for Fuel Tax Refund (Section D, Line 6)

3. Total Gallons Eligible for Fuel Tax Refund (Line 1 plus Line 2)

4. Fuel Tax Rate (See table below)

5. Fuel Tax Refund (Line 3 multiplied by Line 4)

6. Oil Inspection Fee Refund (Line 3 multiplied by .01)

7. Collection Allowance Adjustment

8. Total Fuel Tax Refund (Line 5 plus Line 6 minus Line 7)

9. Total Refund Claimed (Line 8 Gasoline plus Line 8 Special Fuel)

Tax Rate Table

Refund Tax Period Gasoline Tax Rate Special Fuel Tax Rate

July 1, 2019 - June 30, 2020 $0.30 $0.49

July 1, 2020 - June 30, 2021 $0.31 $0.51

July 1, 2021 - June 30, 2022 $0.32 $0.53

July 1, 2022 - June 30, 2023 $0.33 $0.55

Periods on or after July 1, 2023 $0.34 $0.57