Enlarge image

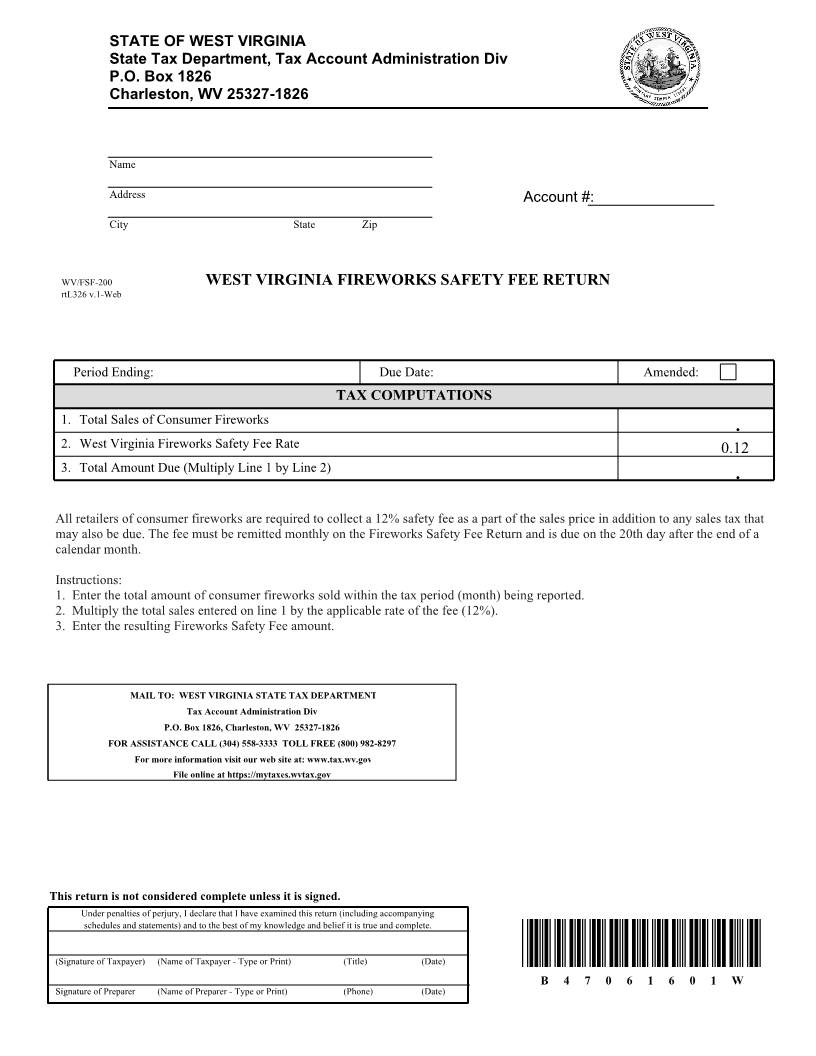

STATE OF WEST VIRGINIA

State Tax Department, Tax Account Administration Div

P.O. Box 1826

Charleston, WV 25327-1826

Name

Address Account #:

City State Zip

WV/FSF-200 WEST VIRGINIA FIREWORKS SAFETY FEE RETURN

rtL326 v.1-Web

Period Ending: Due Date: Amended:

TAX COMPUTATIONS

1. Total Sales of Consumer Fireworks .

2. West Virginia Fireworks Safety Fee Rate 0.12

3. Total Amount Due (Multiply Line 1 by Line 2) .

All retailers of consumer fireworks are required to collect a 12% safety fee as a part of the sales price in addition to any sales tax that

may also be due. The fee must be remitted monthly on the Fireworks Safety Fee Return and is due on the 20th day after the end of a

calendar month.

Instructions:

1. Enter the total amount of consumer fireworks sold within the tax period (month) being reported.

2. Multiply the total sales entered on line 1 by the applicable rate of the fee (12%).

3. Enter the resulting Fireworks Safety Fee amount.

MAIL TO: WEST VIRGINIA STATE TAX DEPARTMENT

Tax Account Administration Div

P.O. Box 1826, Charleston, WV 25327-1826

FOR ASSISTANCE CALL (304) 558-3333 TOLL FREE (800) 982-8297

For more information visit our web site at: www.tax.wv.gov

File online at https://mytaxes.wvtax.gov

This return is not considered complete unless it is signed.

Under penalties of perjury, I declare that I have examined this return (including accompanying

schedules and statements) and to the best of my knowledge and belief it is true and complete.

(Signature of Taxpayer) (Name of Taxpayer - Type or Print) (Title) (Date)

B 4 7 0 6 1 6 0 1 W

Signature of Preparer (Name of Preparer - Type or Print) (Phone) (Date)