Enlarge image

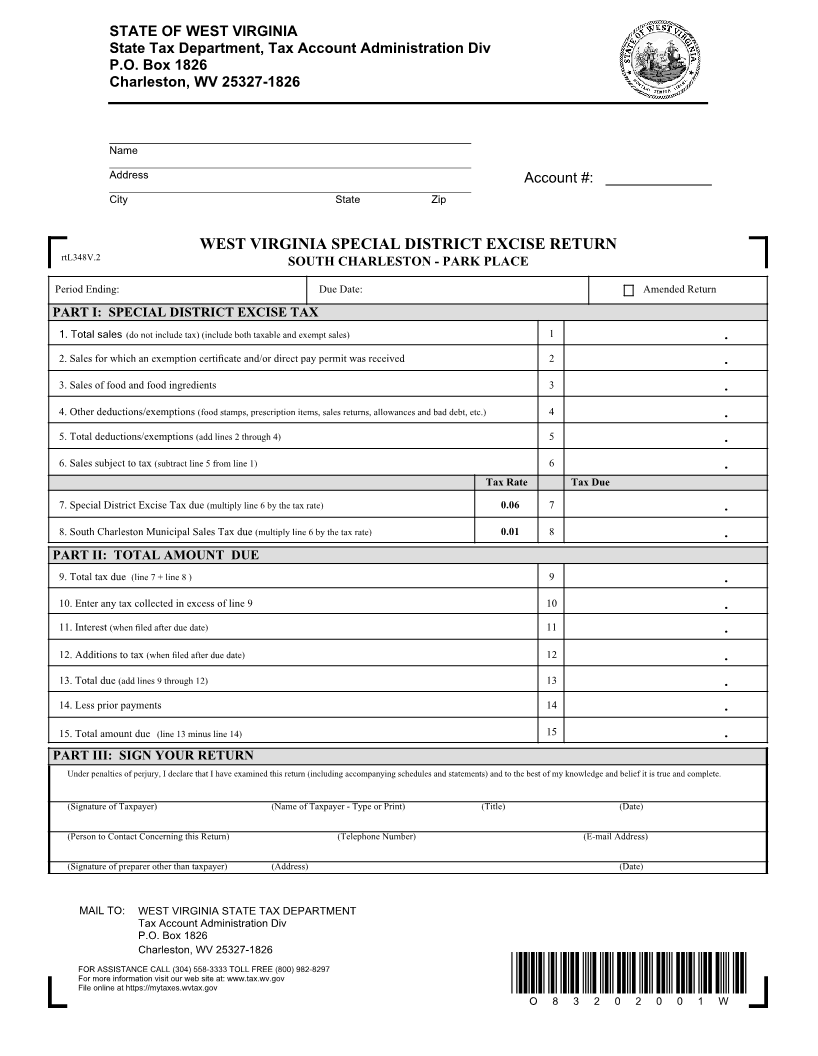

STATE OF WEST VIRGINIA

State Tax Department, Tax Account Administration Div

P.O. Box 1826

Charleston, WV 25327-1826

_____________________________________________________________

ENDURANCEName WARRANTY SERVICES, L.L.C. Letter Id: L1606389760

_____________________________________________________________ 400 SKOKIE BLVD STE 105IA 09/11/2020

NORTHBROOKAddress IL 60062-7937 A #:Account #: _____________2274-6111

_____________________________________________________________ Period: 10/31/2020

City State Zip

WEST VIRGINIA SPECIAL DISTRICT EXCISE RETURN

rtL348V.2 SOUTH CHARLESTON - PARK PLACE

Period Ending: Due Date: Amended Return

PART I: SPECIAL DISTRICT EXCISE TAX

1. Total sales (do not include tax) (include both taxable and exempt sales) 1 .

2. Sales for which an exemption certificate and/or direct pay permit was received 2 .

3. Sales of food and food ingredients 3 .

4. Other deductions/exemptions (food stamps, prescription items, sales returns, allowances and bad debt, etc.) 4 .

5. Total deductions/exemptions (add lines 2 through 4) 5 .

6. Sales subject to tax (subtract line 5 from line 1) 6 .

Tax Rate Tax Due

7. Special District Excise Tax due (multiply line 6 by the tax rate) 0.06 7 .

8. South Charleston Municipal Sales Tax due (multiply line 6 by the tax rate) 0.01 8 .

PART II: TOTAL AMOUNT DUE

9. Total tax due (line 7 + line 8 ) 9 .

10. Enter any tax collected in excess of line 9 10 .

11. Interest (when filed after due date) 11 .

12. Additions to tax (when filed after due date) 12 .

13. Total due (add lines 9 through 12) 13 .

14. Less prior payments 14 .

15. Total amount due (line 13 minus line 14) 15 .

PART III: SIGN YOUR RETURN

Under penalties of perjury, I declare that I have examined this return (including accompanying schedules and statements) and to the best of my knowledge and belief it is true and complete.

(Signature of Taxpayer) (Name of Taxpayer - Type or Print) (Title) (Date)

(Person to Contact Concerning this Return) (Telephone Number) (E-mail Address)

(Signature of preparer other than taxpayer) (Address) (Date)

MAIL TO: WEST VIRGINIA STATE TAX DEPARTMENT

Tax Account Administration Div

P.O. Box 1826

Charleston, WV 25327-1826

FOR ASSISTANCE CALL (304) 558-3333 TOLL FREE (800) 982-8297

For more information visit our web site at: www.tax.wv.gov

File online at https://mytaxes.wvtax.gov

O 8 3 2 0 2 0 0 1 W