Enlarge image

STATE OF WEST VIRGINIA

State Tax Department, Tax Account Administration Div

P.O. Box 1826

Charleston, WV 25327-1826

SHEETZ INC 241_____________________________________________________________ Letter Id: L1906851840

Name

5700_____________________________________________________________6TH AVE AccountIssued:#: ________________12/31/2017

AddressALTOONA PA 16602-1111 Account #: 1026-1258

_____________________________________________________________ Period: 12/31/2017

City State Zip

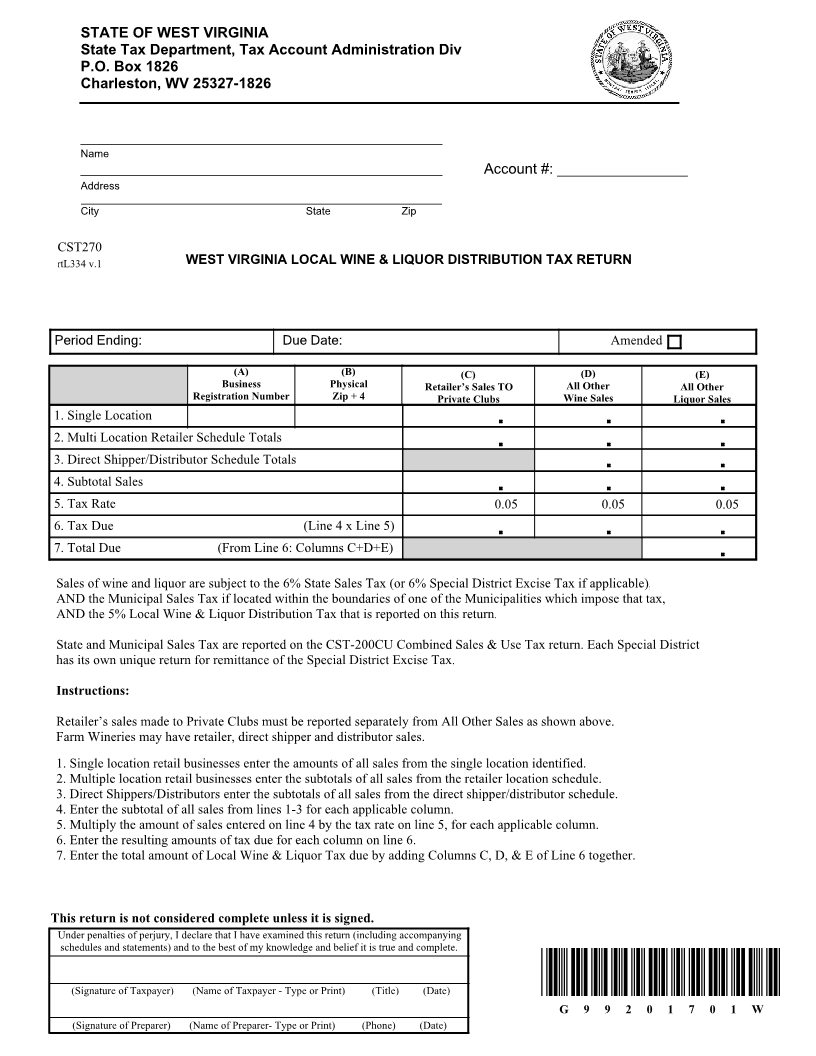

CST270

rtL334 v.1 WEST VIRGINIA LOCAL WINE & LIQUOR DISTRIBUTION TAX RETURN

Period Ending: Due Date: Amended

(A) (B) (C) (D) (E)

Business Physical Retailer’s Sales TO All Other All Other

Registration Number Zip + 4 Private Clubs Wine Sales Liquor Sales

1. Single Location

2. Multi Location Retailer Schedule Totals

3. Direct Shipper/Distributor Schedule Totals

4. Subtotal Sales

5. Tax Rate 0.05 0.05 0.05

6. Tax Due (Line 4 x Line 5)

7. Total Due (From Line 6: Columns C+D+E)

Sales of wine and liquor are subject to the 6% State Sales Tax (or 6% Special District Excise Tax if applicable),

AND the Municipal Sales Tax if located within the boundaries of one of the Municipalities which impose that tax,

AND the 5% Local Wine & Liquor Distribution Tax that is reported on this return.

State and Municipal Sales Tax are reported on the CST-200CU Combined Sales & Use Tax return. Each Special District

has its own unique return for remittance of the Special District Excise Tax.

Instructions:

Retailer’s sales made to Private Clubs must be reported separately from All Other Sales as shown above.

Farm Wineries may have retailer, direct shipper and distributor sales.

1. Single location retail businesses enter the amounts of all sales from the single location identified.

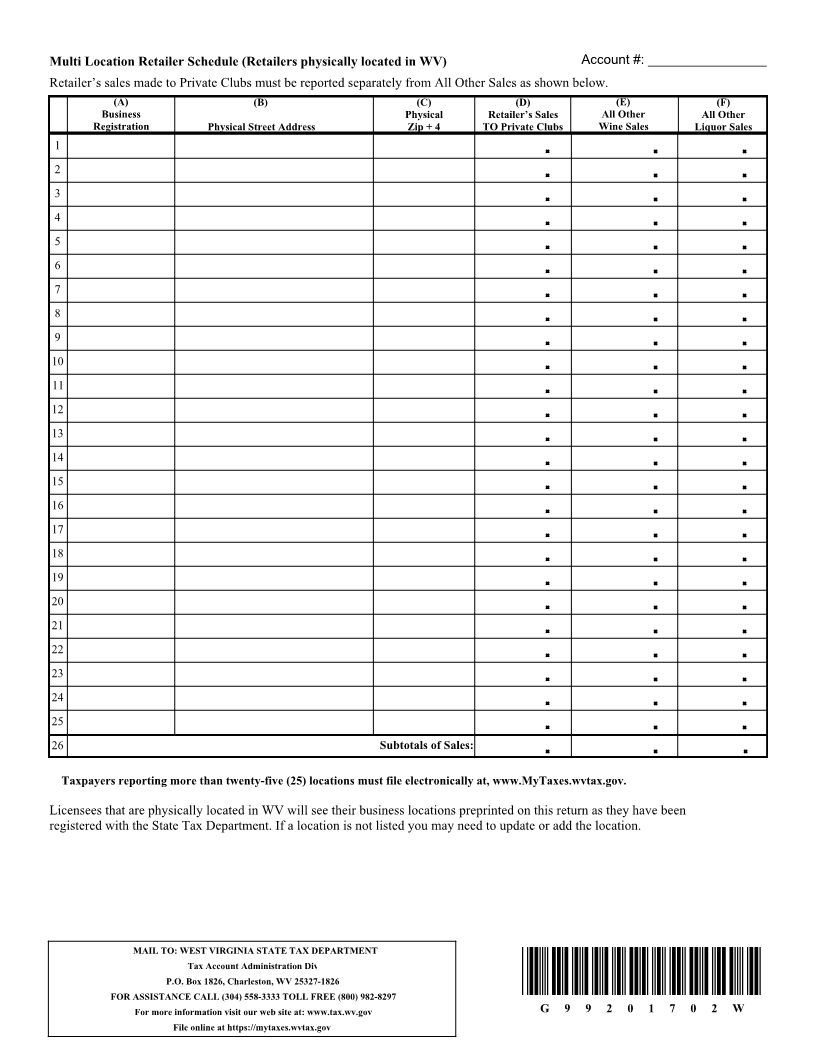

2. Multiple location retail businesses enter the subtotals of all sales from the retailer location schedule.

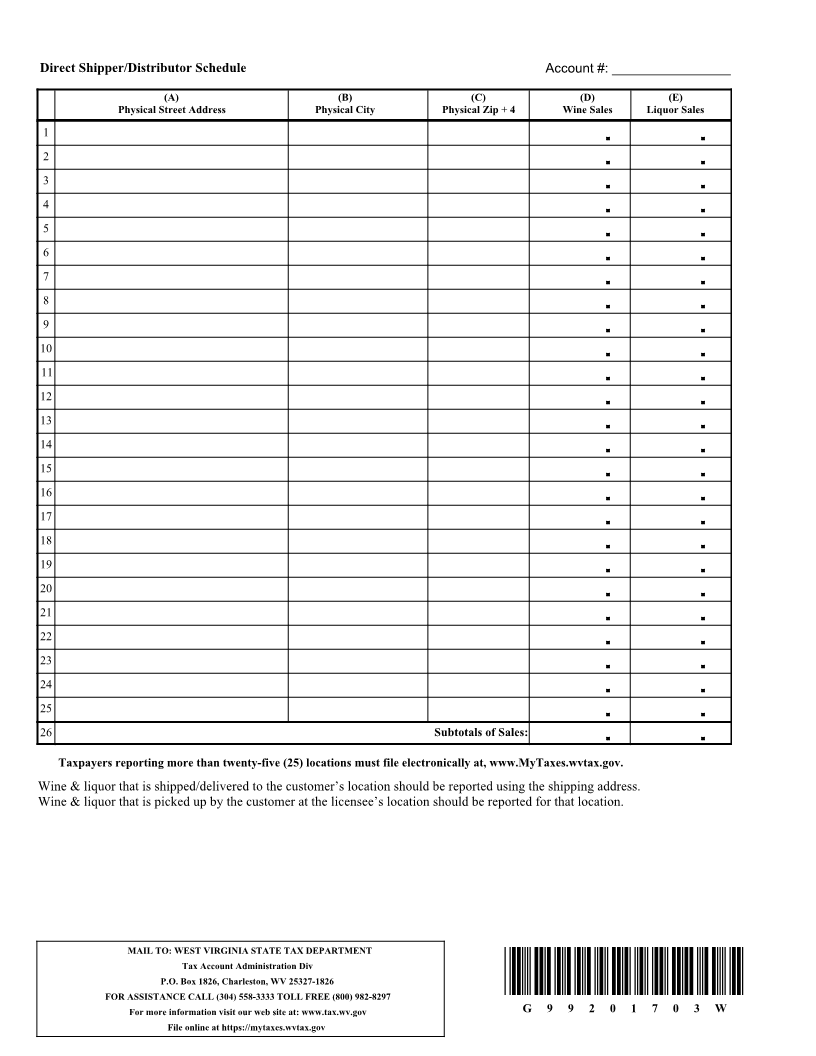

3. Direct Shippers/Distributors enter the subtotals of all sales from the direct shipper/distributor schedule.

4. Enter the subtotal of all sales from lines 1-3 for each applicable column.

5. Multiply the amount of sales entered on line 4 by the tax rate on line 5, for each applicable column.

6. Enter the resulting amounts of tax due for each column on line 6.

7. Enter the total amount of Local Wine & Liquor Tax due by adding Columns C, D, & E of Line 6 together.

This return is not considered complete unless it is signed.

Under penalties of perjury, I declare that I have examined this return (including accompanying

schedules and statements) and to the best of my knowledge and belief it is true and complete.

(Signature of Taxpayer) (Name of Taxpayer - Type or Print) (Title) (Date)

G 9 9 2 0 1 7 0 1 W

(Signature of Preparer) (Name of Preparer- Type or Print) (Phone) (Date)