Enlarge image

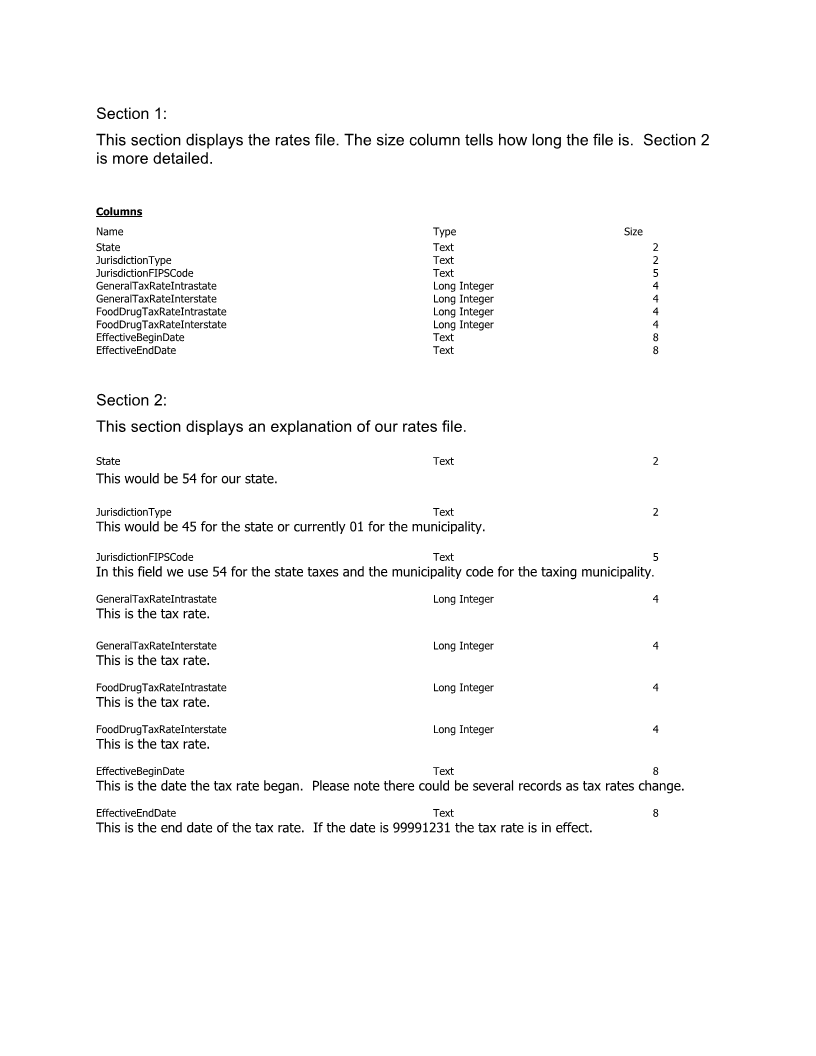

Section 1: This section displays the rates file. The size column tells how long the file is. Section 2 is more detailed. Columns Name Type Size State Text 2 JurisdictionType Text 2 JurisdictionFIPSCode Text 5 GeneralTaxRateIntrastate Long Integer 4 GeneralTaxRateInterstate Long Integer 4 FoodDrugTaxRateIntrastate Long Integer 4 FoodDrugTaxRateInterstate Long Integer 4 EffectiveBeginDate Text 8 EffectiveEndDate Text 8 Section 2: This section displays an explanation of our rates file. State Text 2 This would be 54 for our state. JurisdictionType Text 2 This would be 45 for the state or currently 01 for the municipality. JurisdictionFIPSCode Text 5 In this field we use 54 for the state taxes and the municipality code for the taxing municipality. GeneralTaxRateIntrastate Long Integer 4 This is the tax rate. GeneralTaxRateInterstate Long Integer 4 This is the tax rate. FoodDrugTaxRateIntrastate Long Integer 4 This is the tax rate. FoodDrugTaxRateInterstate Long Integer 4 This is the tax rate. EffectiveBeginDate Text 8 This is the date the tax rate began. Please note there could be several records as tax rates change. EffectiveEndDate Text 8 This is the end date of the tax rate. If the date is 99991231 the tax rate is in effect.