Enlarge image

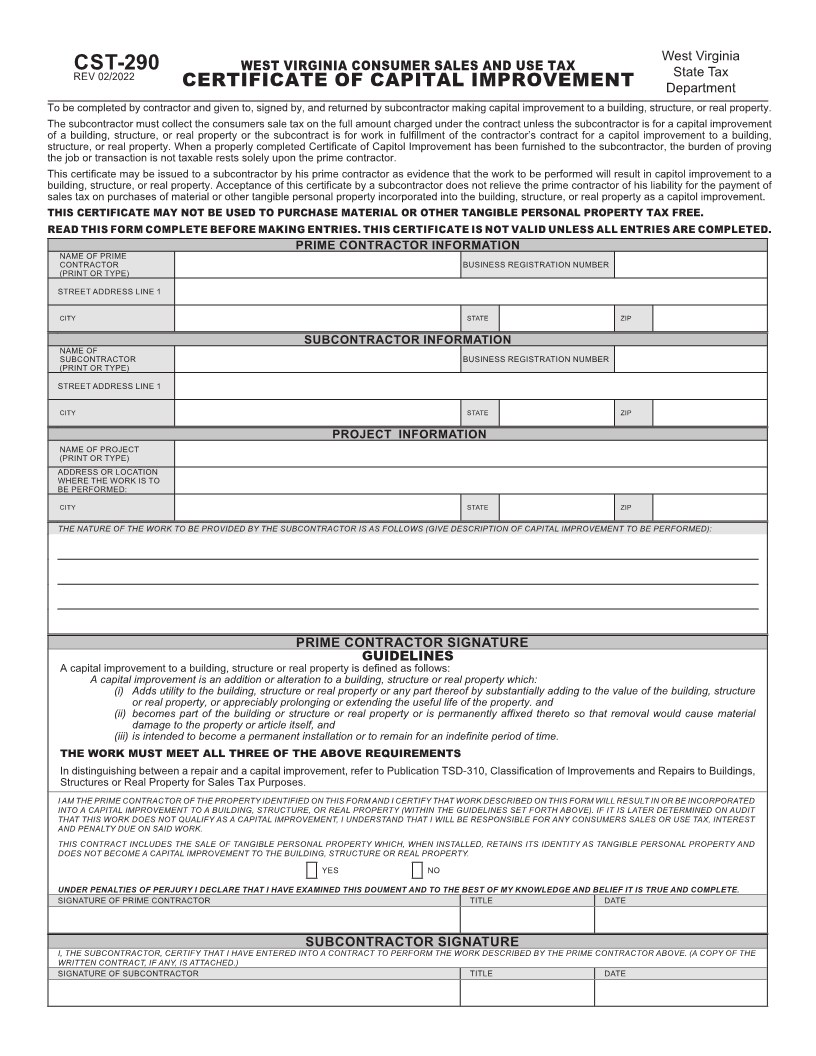

West Virginia

CST-290 WEST VIRGINIA CONSUMER SALES AND USE TAX State Tax

REV 02/2022

CERTIFICATE OF CAPITAL IMPROVEMENT Department

To be completed by contractor and given to, signed by, and returned by subcontractor making capital improvement to a building, structure, or real property.

The subcontractor must collect the consumers sale tax on the full amount charged under the contract unless the subcontractor is for a capital improvement

of a building, structure, or real property or the subcontract is for work in fulfillment of the contractor’s contract for a capitol improvement to a building,

structure, or real property. When a properly completed Certificate of Capitol Improvement has been furnished to the subcontractor, the burden of proving

the job or transaction is not taxable rests solely upon the prime contractor.

This certificate may be issued to a subcontractor by his prime contractor as evidence that the work to be performed will result in capitol improvement to a

building, structure, or real property. Acceptance of this certificate by a subcontractor does not relieve the prime contractor of his liability for the payment of

sales tax on purchases of material or other tangible personal property incorporated into the building, structure, or real property as a capitol improvement.

THIS CERTIFICATE MAY NOT BE USED TO PURCHASE MATERIAL OR OTHER TANGIBLE PERSONAL PROPERTY TAX FREE.

READ THIS FORM COMPLETE BEFORE MAKING ENTRIES. THIS CERTIFICATE IS NOT VALID UNLESS ALL ENTRIES ARE COMPLETED.

PRIME CONTRACTOR INFORMATION

NAME OF PRIME

CONTRACTOR BUSINESS REGISTRATION NUMBER

(PRINT OR TYPE)

STREET ADDRESS LINE 1

CITY STATE ZIP

SUBCONTRACTOR INFORMATION

NAME OF

SUBCONTRACTOR BUSINESS REGISTRATION NUMBER

(PRINT OR TYPE)

STREET ADDRESS LINE 1

CITY STATE ZIP

PROJECT INFORMATION

NAME OF PROJECT

(PRINT OR TYPE)

ADDRESS OR LOCATION

WHERE THE WORK IS TO

BE PERFORMED:

CITY STATE ZIP

THE NATURE OF THE WORK TO BE PROVIDED BY THE SUBCONTRACTOR IS AS FOLLOWS (GIVE DESCRIPTION OF CAPITAL IMPROVEMENT TO BE PERFORMED):

PRIME CONTRACTOR SIGNATURE

GUIDELINES

A capital improvement to a building, structure or real property is defined as follows:

A capital improvement is an addition or alteration to a building, structure or real property which:

(i) Adds utility to the building, structure or real property or any part thereof by substantially adding to the value of the building, structure

or real property, or appreciably prolonging or extending the useful life of the property. and

(ii) becomes part of the building or structure or real property or is permanently affixed thereto so that removal would cause material

damage to the property or article itself, and

(iii) is intended to become a permanent installation or to remain for an indefinite period of time.

THE WORK MUST MEET ALL THREE OF THE ABOVE REQUIREMENTS

In distinguishing between a repair and a capital improvement, refer to Publication TSD-310, Classification of Improvements and Repairs to Buildings,

Structures or Real Property for Sales Tax Purposes.

I AM THE PRIME CONTRACTOR OF THE PROPERTY IDENTIFIED ON THIS FORM AND I CERTIFY THAT WORK DESCRIBED ON THIS FORM WILL RESULT IN OR BE INCORPORATED

INTO A CAPITAL IMPROVEMENT TO A BUILDING, STRUCTURE, OR REAL PROPERTY (WITHIN THE GUIDELINES SET FORTH ABOVE). IF IT IS LATER DETERMINED ON AUDIT

THAT THIS WORK DOES NOT QUALIFY AS A CAPITAL IMPROVEMENT, I UNDERSTAND THAT I WILL BE RESPONSIBLE FOR ANY CONSUMERS SALES OR USE TAX, INTEREST

AND PENALTY DUE ON SAID WORK.

THIS CONTRACT INCLUDES THE SALE OF TANGIBLE PERSONAL PROPERTY WHICH, WHEN INSTALLED, RETAINS ITS IDENTITY AS TANGIBLE PERSONAL PROPERTY AND

DOES NOT BECOME A CAPITAL IMPROVEMENT TO THE BUILDING, STRUCTURE OR REAL PROPERTY.

YES NO

UNDER PENALTIES OF PERJURY I DECLARE THAT I HAVE EXAMINED THIS DOUMENT AND TO THE BEST OF MY KNOWLEDGE AND BELIEF IT IS TRUE AND COMPLETE.

SIGNATURE OF PRIME CONTRACTOR TITLE DATE

SUBCONTRACTOR SIGNATURE

I, THE SUBCONTRACTOR, CERTIFY THAT I HAVE ENTERED INTO A CONTRACT TO PERFORM THE WORK DESCRIBED BY THE PRIME CONTRACTOR ABOVE. (A COPY OF THE

WRITTEN CONTRACT, IF ANY, IS ATTACHED.)

SIGNATURE OF SUBCONTRACTOR TITLE DATE