Enlarge image

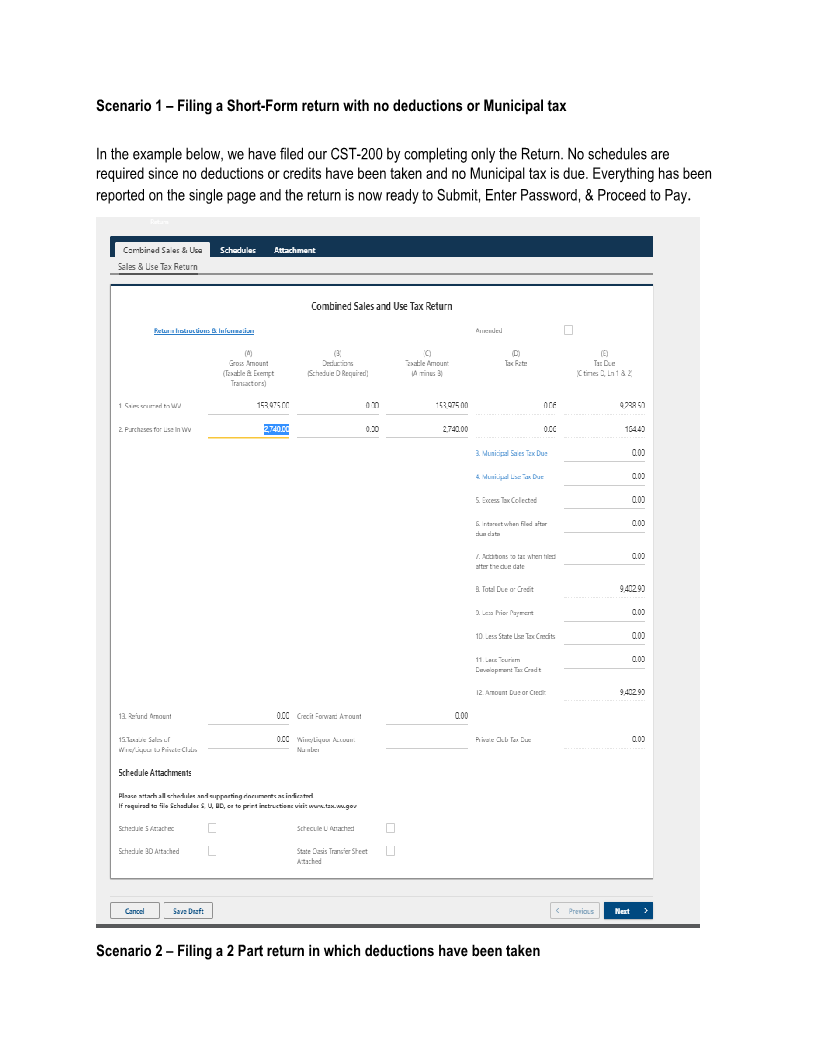

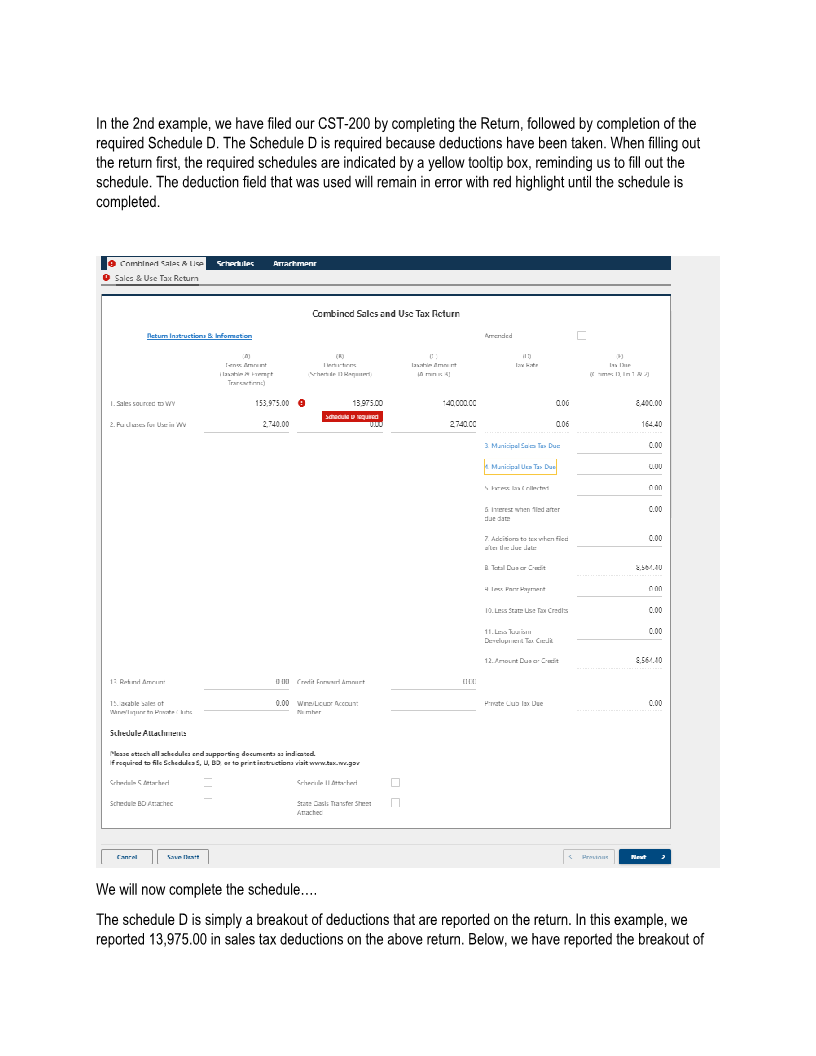

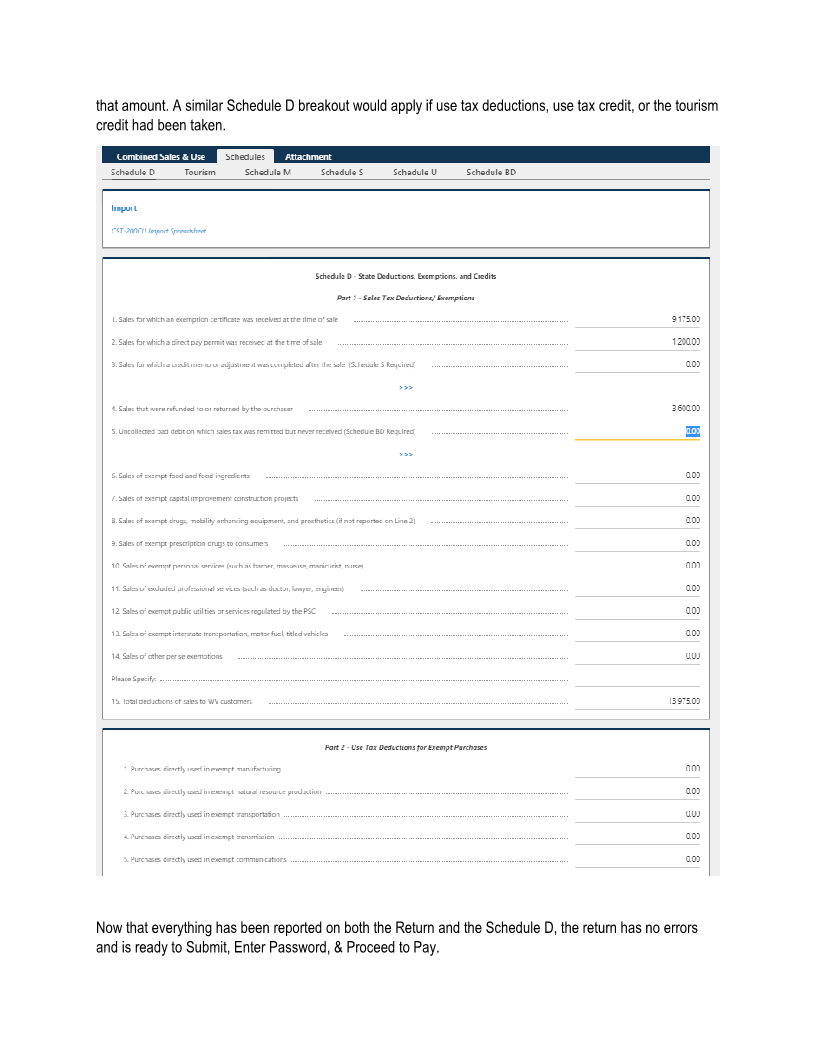

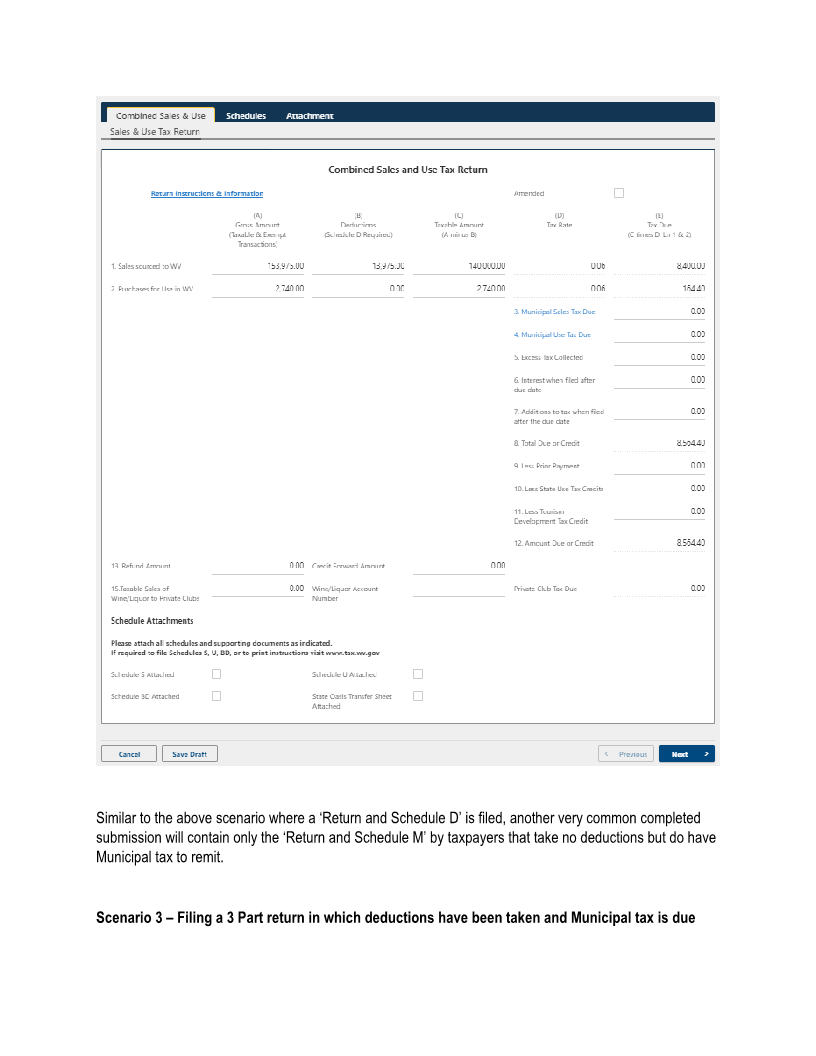

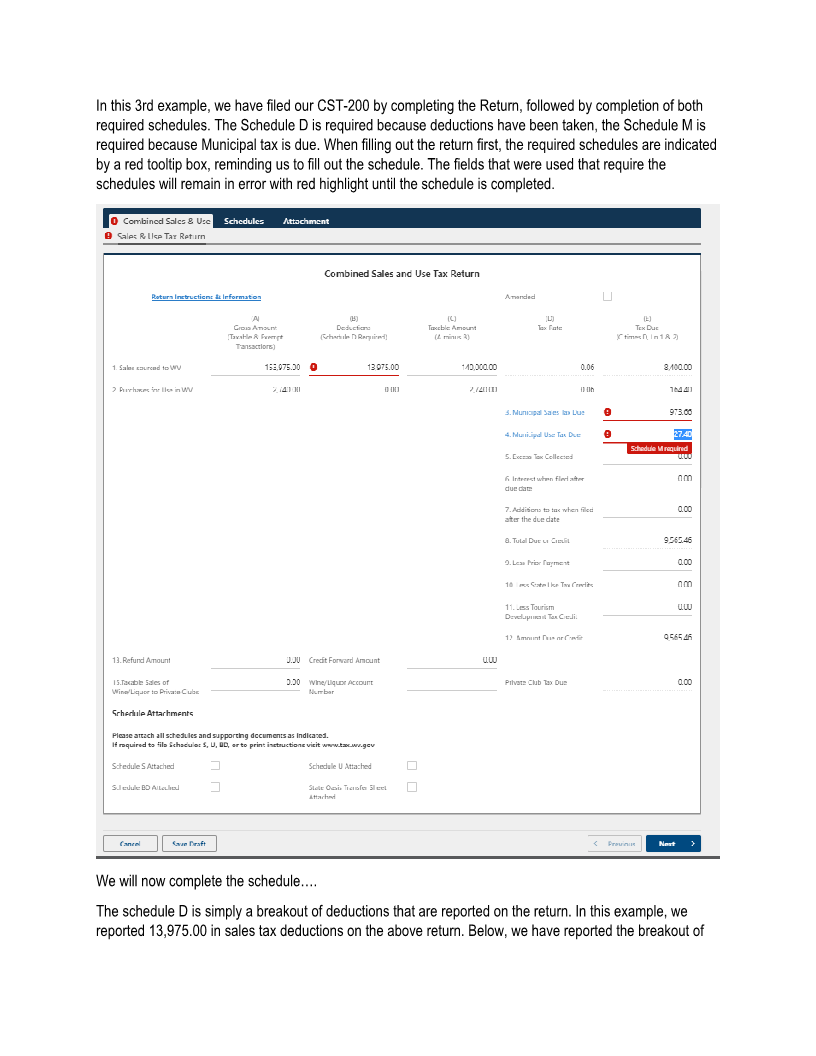

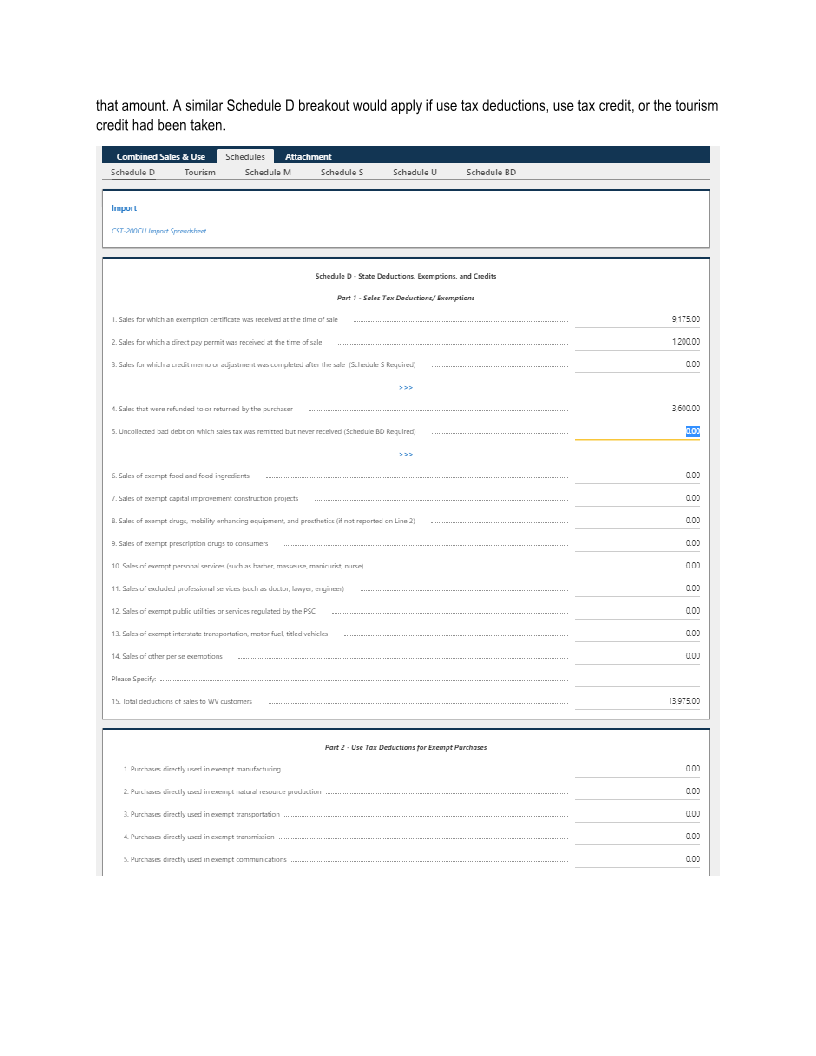

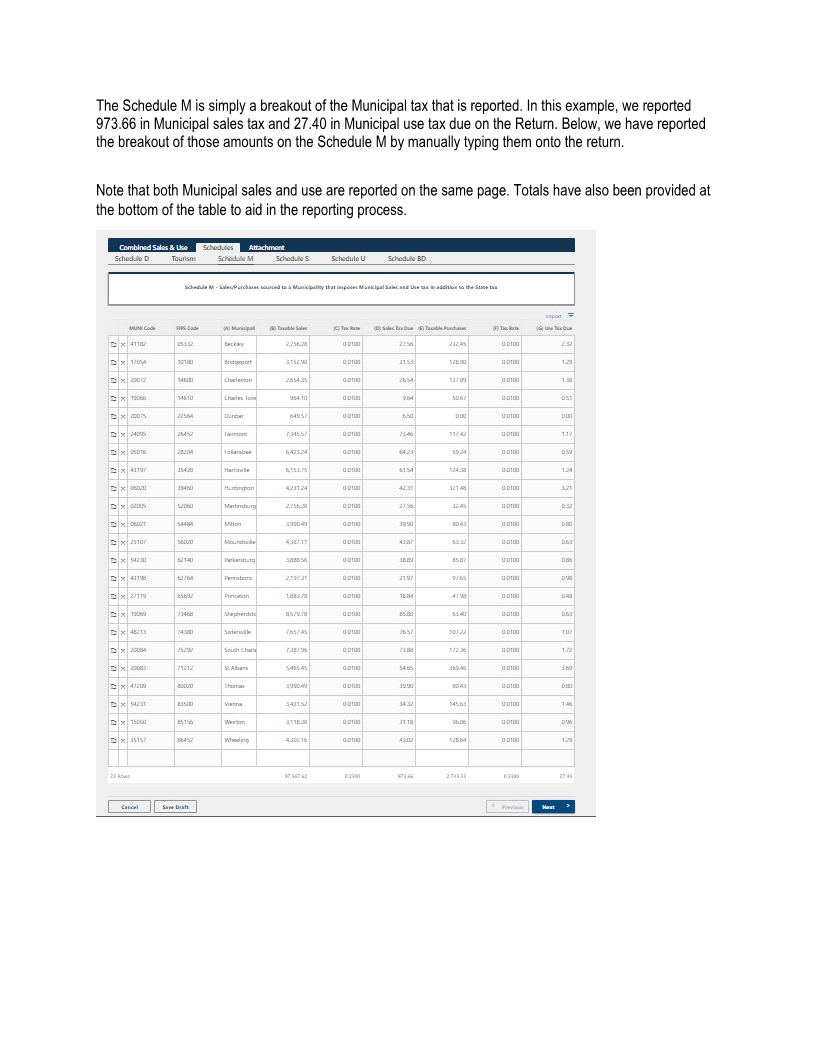

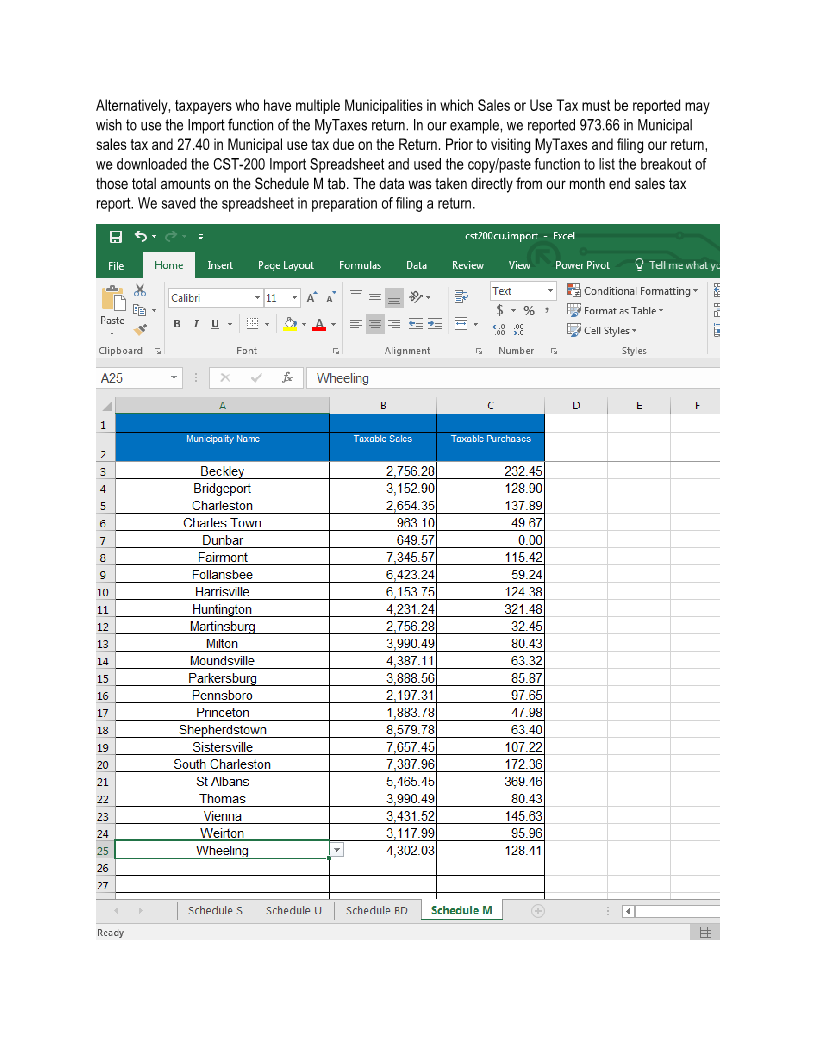

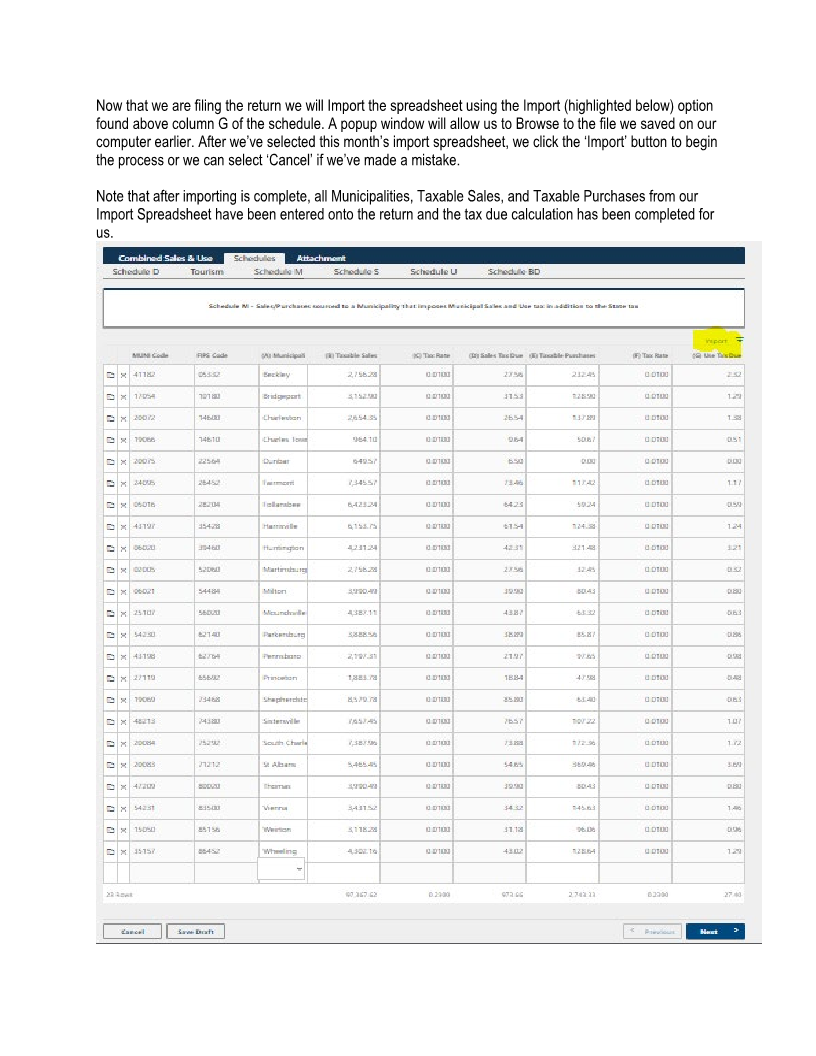

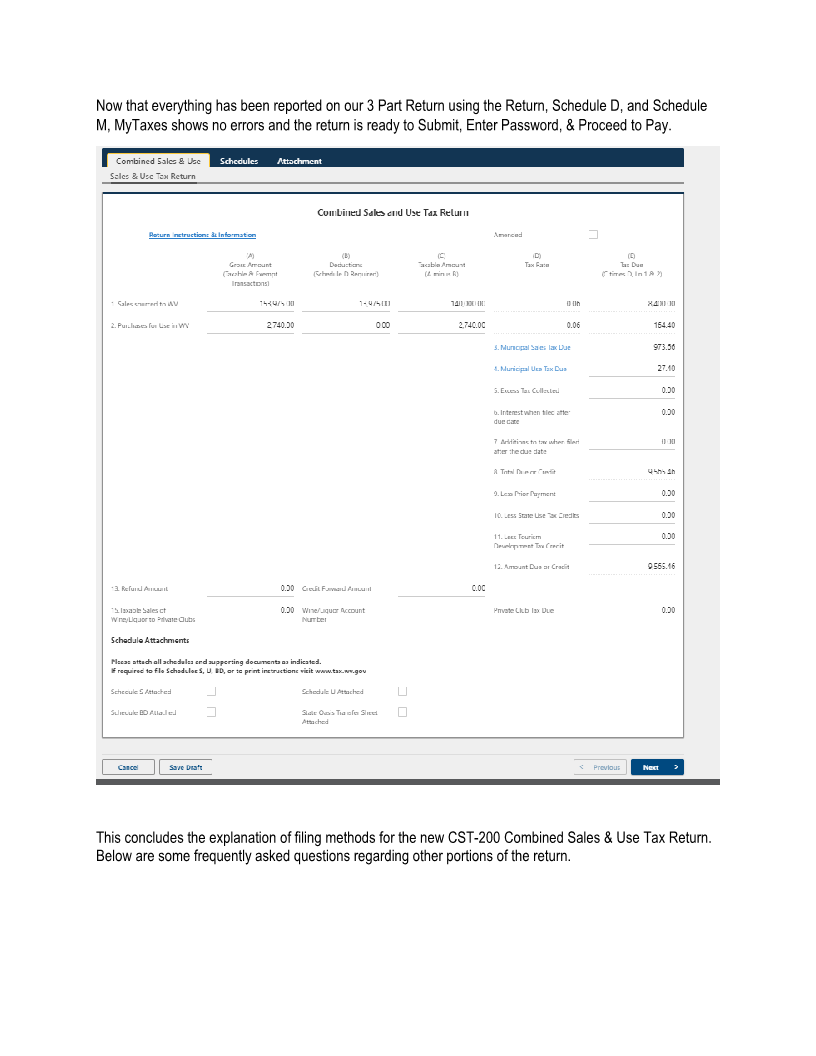

Filing the CST-200 Sales & Use Tax Return via MyTaxes The CST-200CU is intended to simplify the reporting process by offering a streamlined return with additional schedules for certain circumstances and to allow for more accurate accrual-based sales tax reporting. The MyTaxes version allows users to start by entering data on the schedules followed by completing the return, similar to the functionality of older versions. Alternatively, users may now start by completing the return and will then be prompted to complete the applicable schedules. When navigating the return on MyTaxes there are two main tabs visible to the user, labelled ‘Return’ and ‘Schedules’ The tab labelled ‘Return’ is the return. It includes data that is only entered on the return as well as totals from the schedules whenever they are applicable. The Return can often be filed by itself by a large majority of taxpayers, without any schedules, when no deductions to sales or use tax are taken and when no Municipal sales or use tax is due. The tab labelled ‘Schedules’ contains the additional schedules required for various tax situations. The most common schedules being the Schedule D and Schedule M; Schedule D is used when deductions have been taken that reduce the gross amount of sales or purchases that are subject to tax, or when either of two specific tax credits are taken that reduce the overall liability due. Schedule M is used to report sales or purchases that are sourced to a Municipality that imposes Municipal sales & use tax in addition to the State tax. On the previous version of the return, Municipal sales & use tax required two different schedules (B & C), they have now been combined into one Schedule M. Schedules S, U, & BD are used for very specific situations. 97% of tax filers will not use these three (3) additional schedules. These will be discussed later in this document. The ‘Import’ option of the MyTaxes return allows taxpayers to import the Municipal Schedule M as well as the supplemental Schedules S, U, & BD directly to the return using an Import Spreadsheet. The spreadsheet allows direct entry typing or copy/paste functionality to simplify the data entry process. The Import Spreadsheet can be downloaded using the hyperlink found on the MyTaxes return or by visiting: http://public.wvtax.gov/Documents/CST/cst200cu.import.xlsm Below we will outline the process of filing a return with these 3 scenarios: • A ‘short-form’ return filed using only one (1) tab labelled Return • A 2 part return using the Return and Schedule D • A 3 part return requiring the Return, Schedule D, and Schedule M