Enlarge image

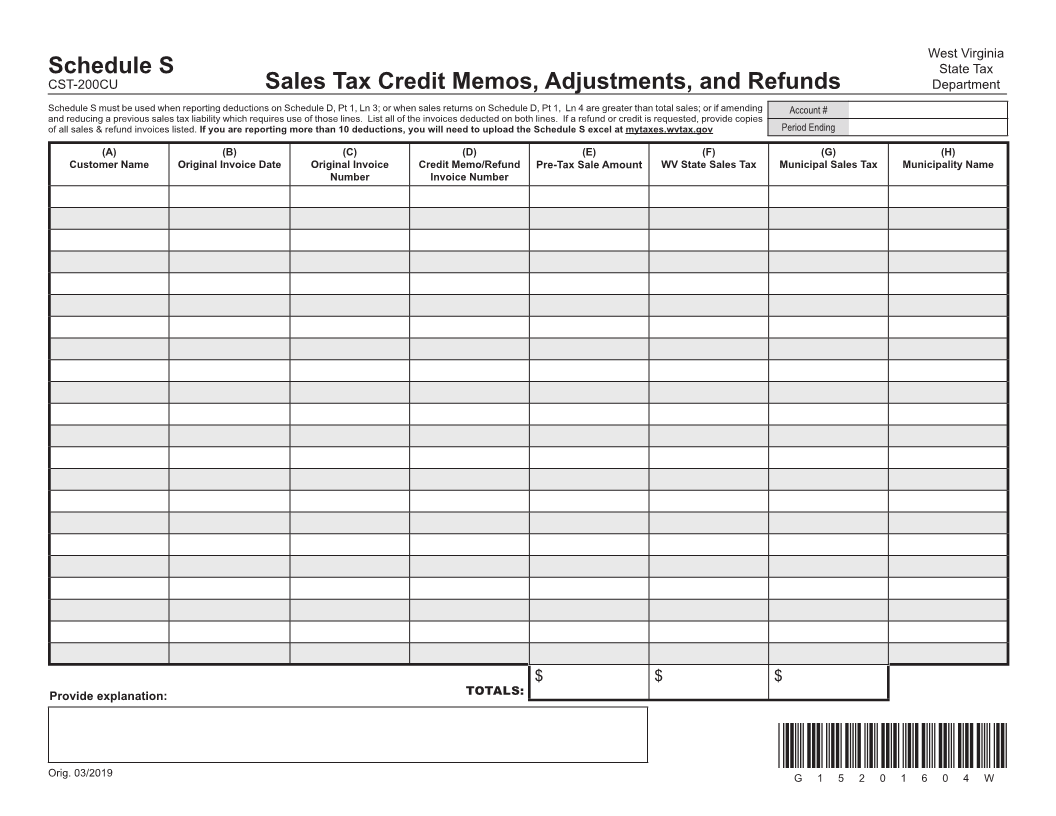

W 4 State Tax (H) 0 West Virginia Department 6 Municipality Name 1 0 2 5 (G) 1 Account # G Period Ending Municipal Sales Tax $ *G15201604W* (F) WV State Sales Tax $ (E) Pre-Tax Sale Amount $ (D) TOTALS: Invoice Number Credit Memo/Refund (C) Number Original Invoice Sales Tax Credit Memos, Adjustments, and Refunds (B) If you are reporting more than 10 deductions, you will need to upload the Schedule S excel at mytaxes.wvtax.gov Original Invoice Date (A) Customer Name Schedule S CST-200CU Schedule S must be used when reporting deductions on Schedule D, Pt 1, Ln 3; or when sales returns on Schedule D, Pt 1, Ln 4 are greater than total sales; or if amending and reducing a previous sales tax liability which requires use of those lines. List all of the invoices deducted on both lines. If a refund or credit is requested, provide copies of all sales & refund invoices listed. Provide explanation: Orig. 03/2019