Enlarge image

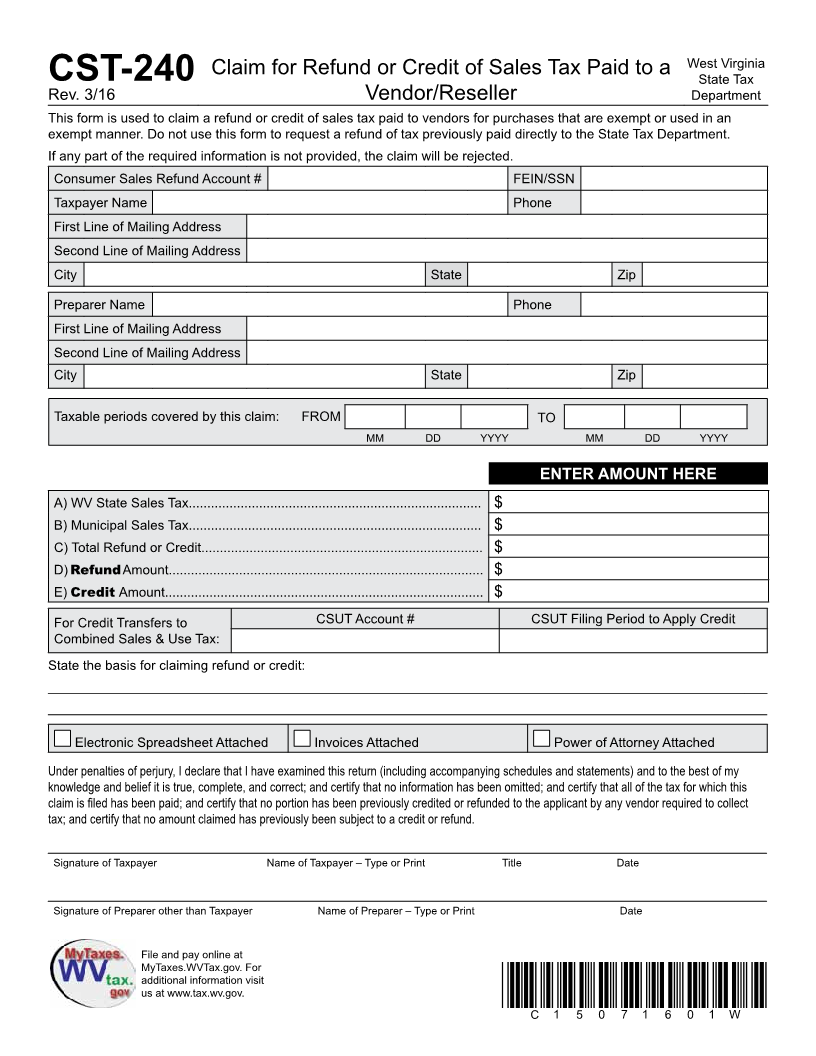

West Virginia

Claim for Refund or Credit of Sales Tax Paid to a

CST-240 State Tax

Rev. 3/16 Vendor/Reseller Department

This form is used to claim a refund or credit of sales tax paid to vendors for purchases that are exempt or used in an

exempt manner. Do not use this form to request a refund of tax previously paid directly to the State Tax Department.

If any part of the required information is not provided, the claim will be rejected.

Consumer Sales Refund Account # FEIN/SSN

Taxpayer Name Phone

First Line of Mailing Address

Second Line of Mailing Address

City State Zip

Preparer Name Phone

First Line of Mailing Address

Second Line of Mailing Address

City State Zip

Taxable periods covered by this claim: FROM TO

MM DD YYYY MM DD YYYY

EnTEr amounT hErE

A) WV State Sales Tax............................................................................... $

B) Municipal Sales Tax............................................................................... $

C) Total Refund or Credit............................................................................ $

D) Refund Amount..................................................................................... $

E) Credit Amount...................................................................................... $

For Credit Transfers to CSUT Account # CSUT Filing Period to Apply Credit

Combined Sales & Use Tax:

State the basis for claiming refund or credit:

_________________________________________________________________________________________________

_________________________________________________________________________________________________

Electronic Spreadsheet Attached Invoices Attached Power of Attorney Attached

Under penalties of perjury, I declare that I have examined this return (including accompanying schedules and statements) and to the best of my

knowledge and belief it is true, complete, and correct; and certify that no information has been omitted; and certify that all of the tax for which this

claim is filed has been paid; and certify that no portion has been previously credited or refunded to the applicant by any vendor required to collect

tax; and certify that no amount claimed has previously been subject to a credit or refund.

Signature of Taxpayer Name of Taxpayer – Type or Print Title Date

Signature of Preparer other than Taxpayer Name of Preparer – Type or Print Date

File and pay online at

MyTaxes.WVTax.gov. For

additional information visit

us at www.tax.wv.gov.

*c15071601W*