Enlarge image

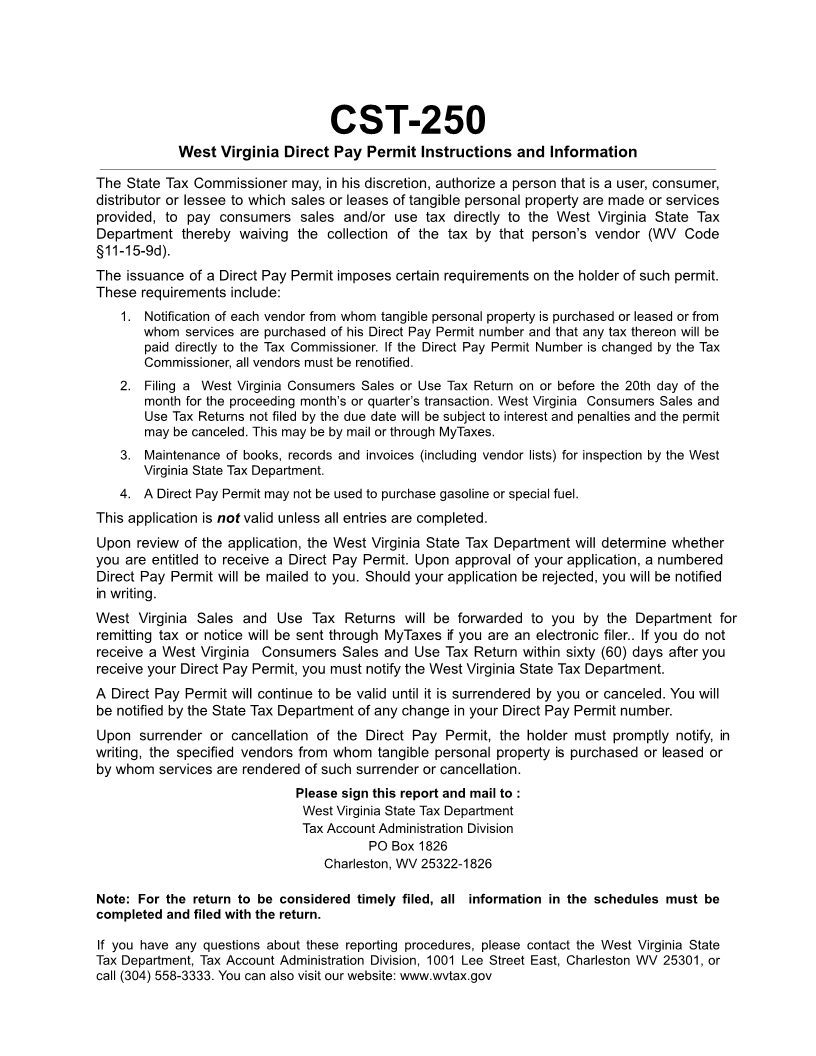

West Virginia

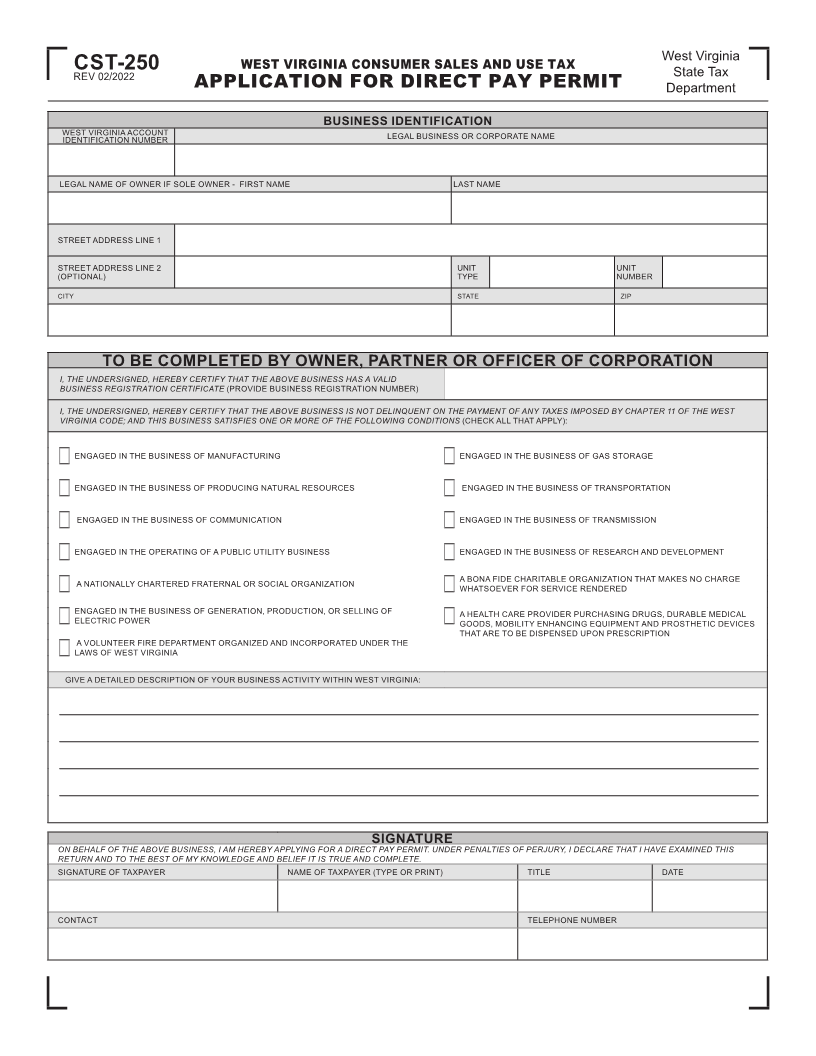

CST-250 WEST VIRGINIA CONSUMER SALES AND USE TAX State Tax

REV 02/2022

APPLICATION FOR DIRECT PAY PERMIT Department

BUSINESS IDENTIFICATION

WEST VIRGINIA ACCOUNT LEGAL BUSINESS OR CORPORATE NAME

IDENTIFICATION NUMBER

LEGAL NAME OF OWNER IF SOLE OWNER - FIRST NAME LAST NAME

STREET ADDRESS LINE 1

STREET ADDRESS LINE 2 UNIT UNIT

(OPTIONAL) TYPE NUMBER

CITY STATE ZIP

TO BE COMPLETED BY OWNER, PARTNER OR OFFICER OF CORPORATION

I, THE UNDERSIGNED, HEREBY CERTIFY THAT THE ABOVE BUSINESS HAS A VALID

BUSINESS REGISTRATION CERTIFICATE (PROVIDE BUSINESS REGISTRATION NUMBER)

I, THE UNDERSIGNED, HEREBY CERTIFY THAT THE ABOVE BUSINESS IS NOT DELINQUENT ON THE PAYMENT OF ANY TAXES IMPOSED BY CHAPTER 11 OF THE WEST

VIRGINIA CODE; AND THIS BUSINESS SATISFIES ONE OR MORE OF THE FOLLOWING CONDITIONS (CHECK ALL THAT APPLY):

ENGAGED IN THE BUSINESS OF MANUFACTURING ENGAGED IN THE BUSINESS OF GAS STORAGE

ENGAGED IN THE BUSINESS OF PRODUCING NATURAL RESOURCES ENGAGED IN THE BUSINESS OF TRANSPORTATION

ENGAGED IN THE BUSINESS OF COMMUNICATION ENGAGED IN THE BUSINESS OF TRANSMISSION

ENGAGED IN THE OPERATING OF A PUBLIC UTILITY BUSINESS ENGAGED IN THE BUSINESS OF RESEARCH AND DEVELOPMENT

A NATIONALLY CHARTERED FRATERNAL OR SOCIAL ORGANIZATION A BONA FIDE CHARITABLE ORGANIZATION THAT MAKES NO CHARGE

WHATSOEVER FOR SERVICE RENDERED

ENGAGED IN THE BUSINESS OF GENERATION, PRODUCTION, OR SELLING OF A HEALTH CARE PROVIDER PURCHASING DRUGS, DURABLE MEDICAL

ELECTRIC POWER GOODS, MOBILITY ENHANCING EQUIPMENT AND PROSTHETIC DEVICES

THAT ARE TO BE DISPENSED UPON PRESCRIPTION

A VOLUNTEER FIRE DEPARTMENT ORGANIZED AND INCORPORATED UNDER THE

LAWS OF WEST VIRGINIA

GIVE A DETAILED DESCRIPTION OF YOUR BUSINESS ACTIVITY WITHIN WEST VIRGINIA:

SIGNATURE

ON BEHALF OF THE ABOVE BUSINESS, I AM HEREBY APPLYING FOR A DIRECT PAY PERMIT. UNDER PENALTIES OF PERJURY, I DECLARE THAT I HAVE EXAMINED THIS

RETURN AND TO THE BEST OF MY KNOWLEDGE AND BELIEF IT IS TRUE AND COMPLETE.

SIGNATURE OF TAXPAYER NAME OF TAXPAYER (TYPE OR PRINT) TITLE DATE

CONTACT TELEPHONE NUMBER