Enlarge image

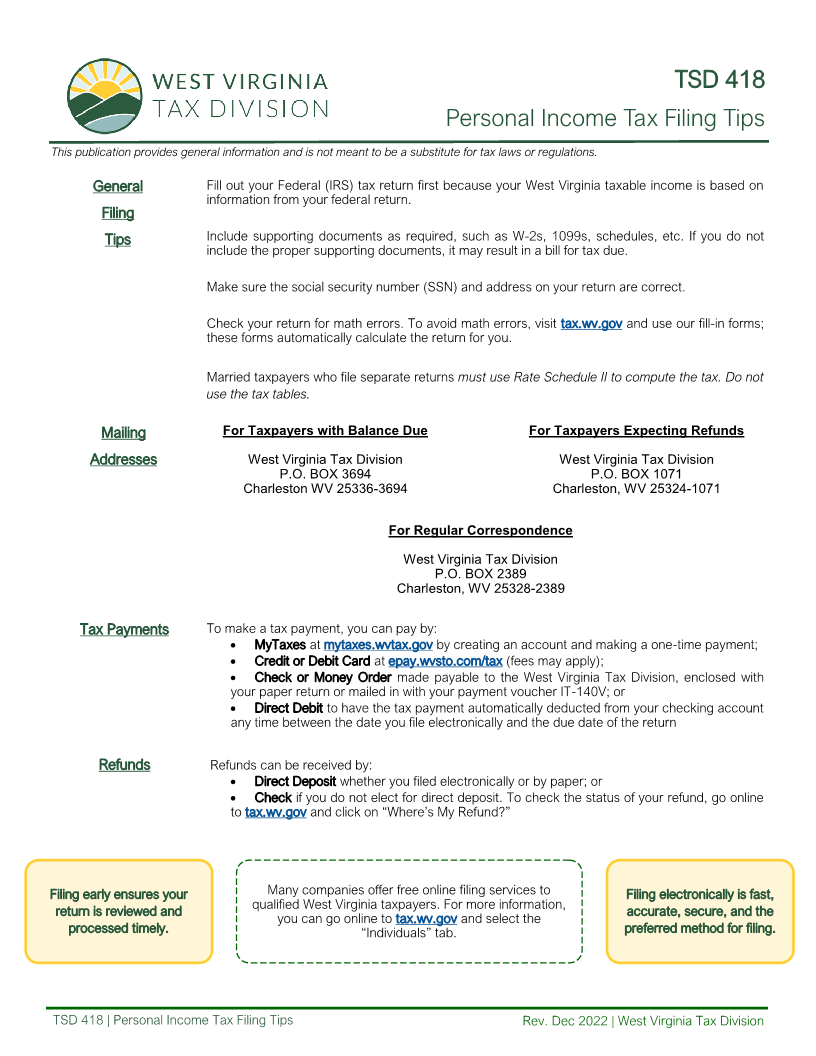

TSD 418

Personal Income Tax Filing Tips

This publication provides general information and is not meant to be a substitute for tax laws or regulations.

General Fill out your Federal (IRS) tax return first because your West Virginia taxable income is based on

information from your federal return.

Filing

Tips Include supporting documents as required, such as W 2s,- 1099s, schedules, etc. If you do not

include the proper supporting documents, it may result in a bill for tax due.

Make sure the social security number (SSN) and address on your return are correct.

Check your return for math errors. To avoid math errors, visit tax.wv.gov and use our fill-in forms;

these forms automatically calculate the return for you.

Married taxpayers who file separate returns must use Rate Schedule II to compute the tax. Do not

use the tax tables.

Mailing For Taxpayers with Balance Due For Taxpayers Expecting Refunds

Addresses West Virginia Tax Division West Virginia Tax Division

P.O. BOX 3694 P.O. BOX 1071

Charleston WV 25336-3694 Charleston, WV 25324-1071

For Regular Correspondence

West Virginia Tax Division

P.O. BOX 2389

Charleston, WV 25328-2389

Tax Payments To make a tax payment, you can pay by:

• MyTaxes at mytaxes.wvtax.gov by creating an account and making a one-time payment;

• Credit or Debit Card at epay.wvsto.com/tax (fees may apply);

• Check or Money Order made payable to the West Virginia Tax Division, enclosed with

your paper return or mailed in with your payment voucher IT-140V; or

• Direct Debit to have the tax payment automatically deducted from your checking account

any time between the date you file electronically and the due date of the return

Refunds Refunds can be received by:

• Direct Deposit whether you filed electronically or by paper; or

• Check if you do not elect for direct deposit. To check the status of your refund, go online

to tax.wv.gov and click on “Where’s My Refund? ”

Filing early ensures your Many companies offer free online filing services to Filing electronically is fast,

qualified West Virginia taxpayers. For more information,

return is reviewed and accurate, secure, and the

you can go online to tax.wv.gov and select the

processed timely. “Individuals”tab. preferred method for filing.

TSD 418 | Personal Income Tax Filing Tips Rev. Dec 2022 | West Virginia Tax Division