Enlarge image

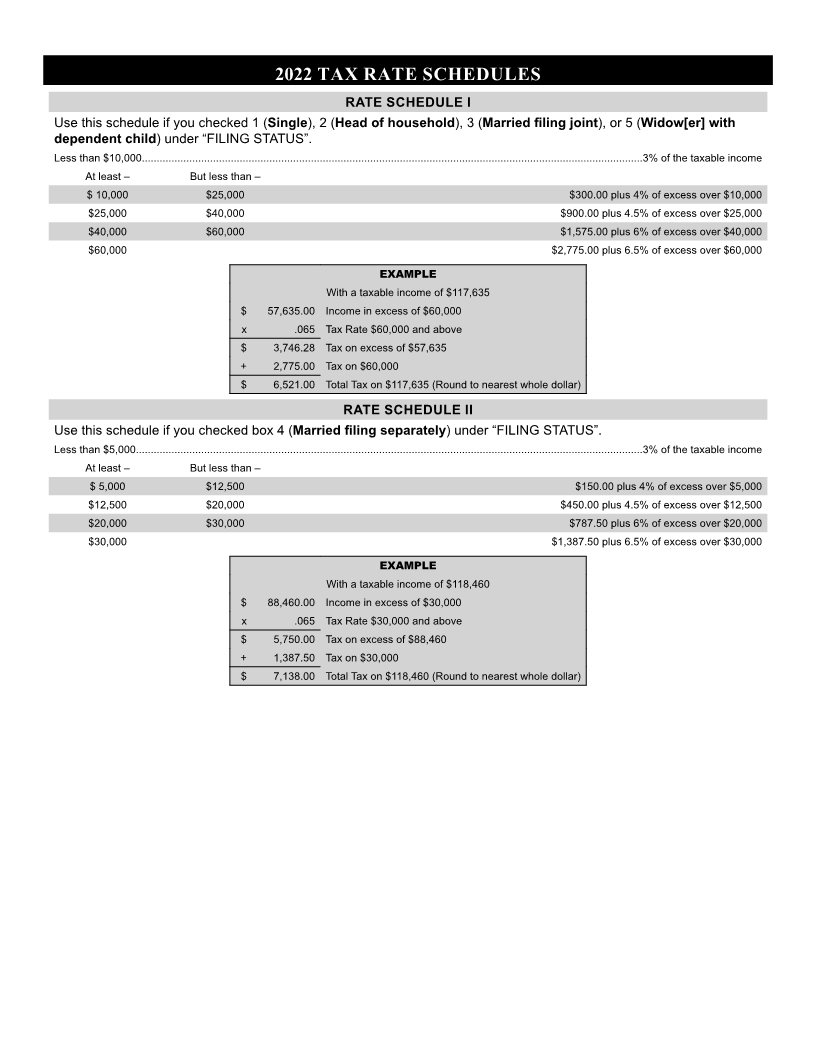

2022 TAX RATE SCHEDULES

RATE SCHEDULE I

Use this schedule if you checked 1 (Single), 2 (Head of household), 3 (Married filing joint ), or 5 (Widow[er] with

dependent child) under “FILING STATUS”.

Less than $10,000.........................................................................................................................................................................3% of the taxable income

At least – But less than –

$ 10,000 $25,000 $300.00 plus 4% of excess over $10,000

$25,000 $40,000 $900.00 plus 4.5% of excess over $25,000

$40,000 $60,000 $1,575.00 plus 6% of excess over $40,000

$60,000 $2,775.00 plus 6.5% of excess over $60,000

EXAMPLE

With a taxable income of $117,635

$ 57,635.00 Income in excess of $60,000

x .065 Tax Rate $60,000 and above

$ 3,746.28 Tax on excess of $57,635

+ 2,775.00 Tax on $60,000

$ 6,521.00 Total Tax on $117,635 (Round to nearest whole dollar)

RATE SCHEDULE II

Use this schedule if you checked box 4 (Married filing separately) under “FILING STATUS”.

Less than $5,000...........................................................................................................................................................................3% of the taxable income

At least – But less than –

$ 5,000 $12,500 $150.00 plus 4% of excess over $5,000

$12,500 $20,000 $450.00 plus 4.5% of excess over $12,500

$20,000 $30,000 $787.50 plus 6% of excess over $20,000

$30,000 $1,387.50 plus 6.5% of excess over $30,000

EXAMPLE

With a taxable income of $118,460

$ 88,460.00 Income in excess of $30,000

x .065 Tax Rate $30,000 and above

$ 5,750.00 Tax on excess of $88,460

+ 1,387.50 Tax on $30,000

$ 7,138.00 Total Tax on $118,460 (Round to nearest whole dollar)