Enlarge image

WWWestWestWestestestginiaginiaginiaVV VVState StaStateVirirte axiriraxDepartmentirginiaDeaxStaginiaDeparpartmenttmentState te TT TT Tax Deax Deparpartmenttment

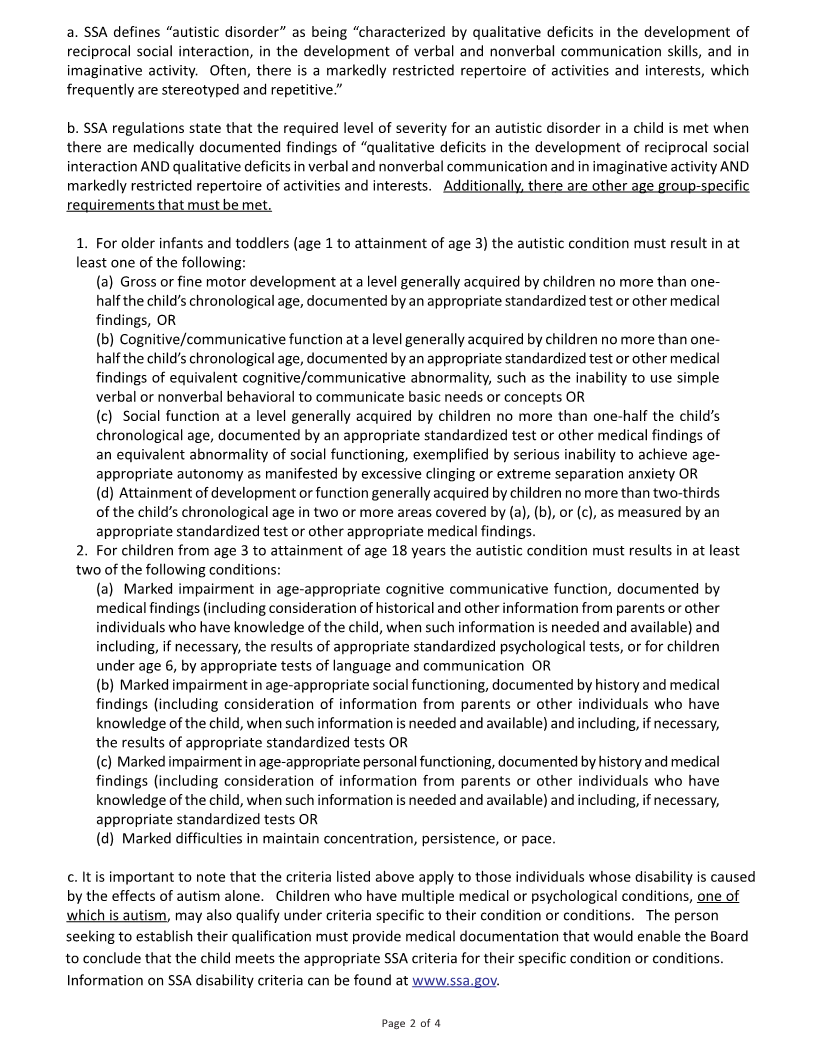

WEST VIRGINIA CHILDREN WITH AUTISM TRUST BOARD

CHECKLIST FOR APPLICANTS

General Information

West Virginia Code §§44-16-1 et seq. establishes the West Virginia Children with Autism Trust Board (Board) to

qualify trust accounts created to provide support for a child with autism. When a trust is qualified under this

statute the parent or guardian establishing the trust becomes eligible for certain tax benefits. To qualify, the

person designated as the beneficiary of the trust must meet certain eligibility requirements. If the Board determines

that the beneficiary is eligible, we will perform the second level of eligibility review to determine whether the

trust itself meets the statutory standards. If both eligibility standards are met – eligibility of the beneficiary and

eligibility of the trust – the Board will issue a ruling that the eligibility requirements are met, allowing the parent

or guardian eligibility to receive the tax benefits.

It is important to read the statute and observe its definitions in attempting to qualify a trust for these purposes.

Eligibility of the Individual

Applicable Definitions

“ ‘Autism’ means a complex developmental disability and spectrum disorder, whose diagnosis must be clinically

confirmed by qualified physicians and psychiatrists after extensive examination and testing, defined by a certain

set of behaviors and symptoms which affects a person’s ability to communicate and interact with others.” West

Virginia Code §44-16-1 (a)

“ ‘Child with autism’ means a child, under the age of eighteen, who has been clinically diagnosed as having

autism to a degree to which it results in a moderate or severe impairment in two or more areas of daily living, as

the terms ‘moderate impairment’, ‘severe impairment’ and ‘daily living’ are defined under Title II or Title XVI of

the Social Security Disability Act, or a child who has been clinically diagnosed with autism and has been determined

to be disabled under either Title II or title XVI of the Social Security Disability Act for any reason.” West Virginia

Code §44-16-1 (c)

1. Was the beneficiary of the trust a person under the age of eighteen years at the time that the trust was

created? If the answer is yes, please provide a certified copy of the child’s birth certificate.

2. Has the beneficiary of the trust been diagnosed with autism ? If the answer is yes, please provide a

statement from a physician to confirm the diagnosis. Note: The term “physician” includes psychiatrists,

osteopathic physicians, and medical doctors.

3. Has the beneficiary of the trust qualified for Social Security Disability benefits or SSI as a disabled

individual? If the answer is yes, please provide documentation from the Social Security Administration. If

the answer is no, please proceed to Question 4.

4. Has the beneficiary of the trust produced evidence that they have a condition (autism) or multiple

conditions (one of which is autism) that would meet the Social Security Administration’s definition of

moderate or severe impairment on daily living activities? If the beneficiary of the trust has not qualified

for Social Security Disability benefits or SSI as a disabled individual, the person seeking to qualify the trust

must present clinical evidence that would allow the Board to conclude that the beneficiary’s condition

meets the standards established by the Social Security Administration (SSA) for a moderate or severe

impairment in two or more areas of daily living.

Page 1 of 4