Enlarge image

INSTRUCTIONS FOR MAKING ESTIMATED PAYMENTS

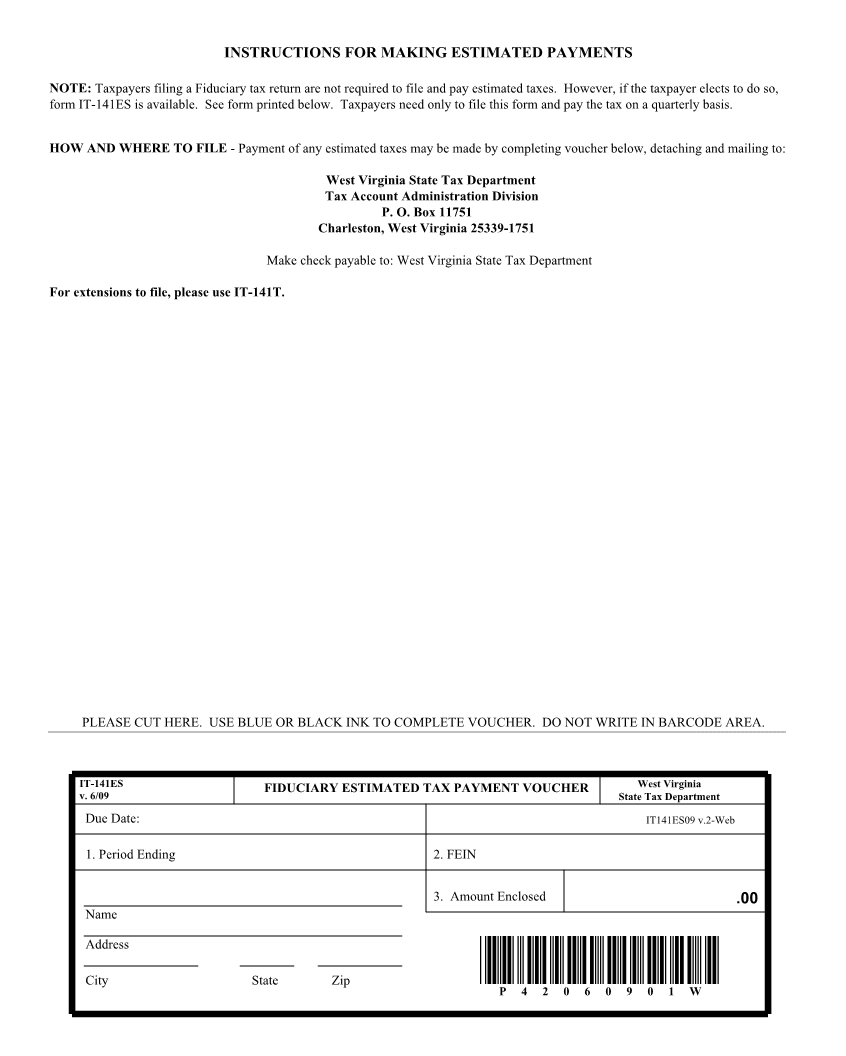

NOTE: Taxpayers filing a Fiduciary tax return are not required to file and pay estimated taxes. However, if the taxpayer elects to do so,

form IT-141ES is available. See form printed below. Taxpayers need only to file this form and pay the tax on a quarterly basis.

HOW AND WHERE TO FILE - Payment of any estimated taxes may be made by completing voucher below, detaching and mailing to:

West Virginia State Tax Department

Tax Account Administration Division

P. O. Box 11751

Charleston, West Virginia 25339-1751

Make check payable to: West Virginia State Tax Department

For extensions to file, please use IT-141T.

PLEASE CUT HERE. USE BLUE OR BLACK INK TO COMPLETE VOUCHER. DO NOT WRITE IN BARCODE AREA.

IT-141ES FIDUCIARY ESTIMATED TAX PAYMENT VOUCHER West Virginia

v. 6/09 State Tax Department

Due Date: IT141ES09 v.2-Web

1. Period Ending 2. FEIN

3. Amount Enclosed .00

Name

Address

City State Zip

P 4 2 0 6 0 9 0 1 W