Enlarge image

01-156 CLEAR FORM PRINT FORM

(Rev.2-17/9)

USE TAX INFORMATION

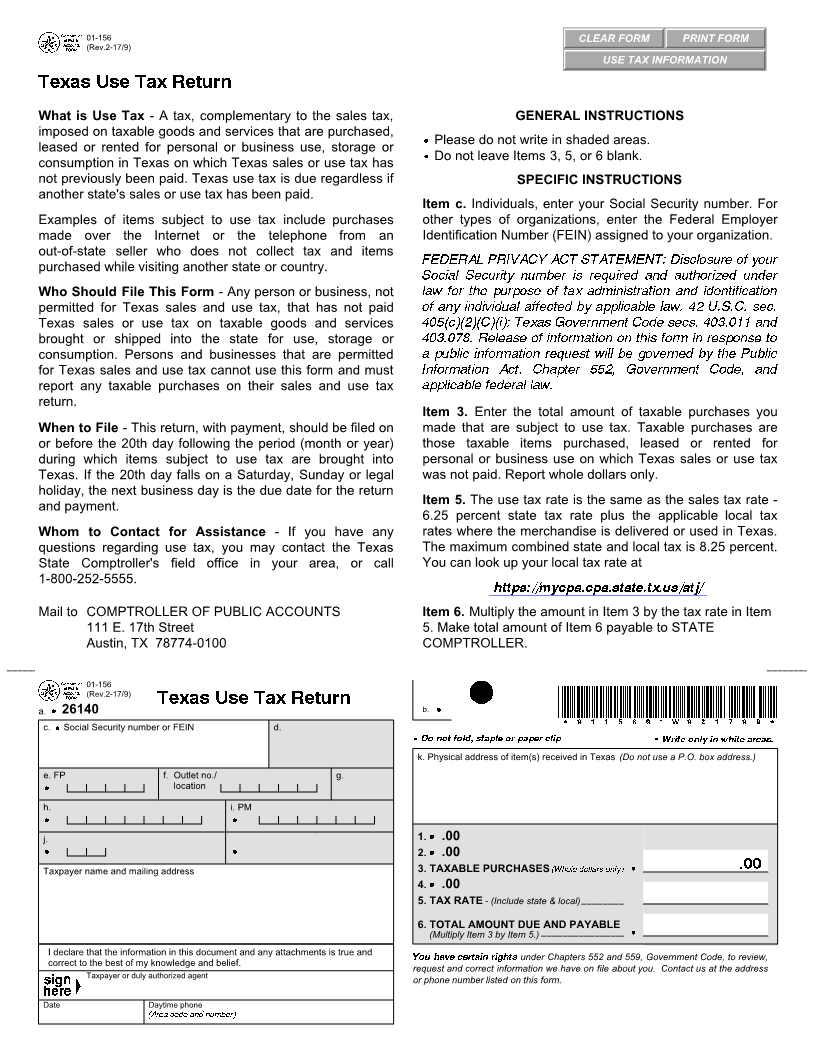

Texas Use Tax Return

What is Use Tax - A tax, complementary to the sales tax, GENERAL INSTRUCTIONS

imposed on taxable goods and services that are purchased,

Please do not write in shaded areas.

leased or rented for personal or business use, storage or

Do not leave Items 3, 5, or 6 blank.

consumption in Texas on which Texas sales or use tax has

not previously been paid. Texas use tax is due regardless if SPECIFIC INSTRUCTIONS

another state's sales or use tax has been paid.

Item c. Individuals, enter your Social Security number. For

Examples of items subject to use tax include purchases other types of organizations, enter the Federal Employer

made over the Internet or the telephone from an Identification Number (FEIN) assigned to your organization.

out-of-state seller who does not collect tax and items

FEDERAL PRIVACY ACT STATEMENT: Disclosure of your

purchased while visiting another state or country.

Social Security number is required and authorized under

Who Should File This Form - Any person or business, not law for the purpose of tax administration and identification

permitted for Texas sales and use tax, that has not paid of any individual affected by applicable law. 42 U.S.C. sec.

Texas sales or use tax on taxable goods and services 405(c)(2)(C)(i); Texas Government Code secs. 403.011 and

brought or shipped into the state for use, storage or 403.078. Release of information on this form in response to

consumption. Persons and businesses that are permitted a public information request will be governed by the Public

for Texas sales and use tax cannot use this form and must Information Act, Chapter 552, Government Code, and

report any taxable purchases on their sales and use tax applicable federal law.

return.

Item 3. Enter the total amount of taxable purchases you

When to File - This return, with payment, should be filed on made that are subject to use tax. Taxable purchases are

or before the 20th day following the period (month or year) those taxable items purchased, leased or rented for

during which items subject to use tax are brought into personal or business use on which Texas sales or use tax

Texas. If the 20th day falls on a Saturday, Sunday or legal was not paid. Report whole dollars only.

holiday, the next business day is the due date for the return

and payment. Item 5. The use tax rate is the same as the sales tax rate -

6.25 percent state tax rate plus the applicable local tax

Whom to Contact for Assistance - If you have any rates where the merchandise is delivered or used in Texas.

questions regarding use tax, you may contact the Texas The maximum combined state and local tax is 8.25 percent.

State Comptroller's field office in your area, or call You can look up your local tax rate at

1-800-252-5555.

https://mycpa.cpa.state.tx.us/atj/

Mail to COMPTROLLER OF PUBLIC ACCOUNTS Item 6. Multiply the amount in Item 3 by the tax rate in Item

111 E. 17th Street 5. Make total amount of Item 6 payable to STATE

Austin, TX 78774-0100 COMPTROLLER.

01-156

(Rev.2-17/9) Texas Use Tax Return

a. 26140

I b. I *0115601W021709*

c. ISocial Security number or FEIN d. .Do not fold, staple or paper clip .Write only in white areas.

k. Physical address of item(s) received in Texas (Do not use a P.O. box address.)

e. FP f. Outlet no./ g.

I location

h. i. PM

I I

j. 1. I .00

I I 2. I .00

.00

Taxpayer name and mailing address 3. TAXABLE PURCHASES (Whole dollars only) I

4. I .00

5. TAX RATE - (Include state & local)

6. TOTAL AMOUNT DUE AND PAYABLE

(Multiply Item 3 by Item 5.) I

I declare that the information in this document and any attachments is true and You have certain rights under Chapters 552 and 559, Government Code, to review,

correct to the best of my knowledge and belief. request and correct information we have on file about you. Contact us at the address

Taxpayer or duly authorized agent or phone number listed on this form.

Date Daytime phone

(Area code and number)