Enlarge image

Form 910 — Instructions

Withholding Payment

Payment Requirements. If your account filing Check Payment. Make your check or money order

cycle is monthly, semimonthly, quarterly, or payable to the Idaho State Tax Commission. Don't staple

annually, you must pay the withheld Idaho income your check to your return or send a check stub.

taxes electronically or with a Form 910, Idaho

Withholding Payment Voucher. All payments are Payments of $100,000 or more. Idaho law requires

due on or before the due date as shown in the due you to use ACH Debit or ACH credit (electronic funds

date table below. transfer) when making payments of $100,000 or more.

If you file a paper return, indicate on the return that

Please include the Form 910 with your check or you paid by one of these methods. If you're making an

money order to ensure your account is properly electronic funds transfer for the first time, read more

credited. If you didn’t withhold income taxes, you at tax.idaho.gov/epay. To request our "ACH Credit

must file a "zero" payment. Addenda and Bank Information" form, email us at

Zero Payments. You can file zero payments in eft@tax.idaho.gov or fax (208) 334-7625.

one of the following ways: If the address on your form

Change of Mailing Address.

1. Through our website at tax.idaho.gov/efile, is incorrect, check the "Mailing Address Change" box on

either through quickpay or a Taxpayer Access Form 910 and provide your new address.

Point (TAP) account.

2. By electronic funds transfer (EFT). (See below.) New Owner. If you're a new owner of a business, don't

use a form from a previous owner. Accounts aren't

3. By using a Form 910 and entering a "0" in transferable. You can apply for a new account number

the "Payment Amount" box. Mail it to: Idaho through tax.idaho.gov by clicking on "Apply for a

State Tax Commission, PO Box 76, Boise, ID business permit" under the Online Services heading.

83707-0076. You can also complete the Idaho Business Registration

Electronic payments. There's no fee when paying form available online at tax.idaho.gov or by calling

by ACH Debit. If you pay by credit card or e-check, us at (208) 334-7660 in the Boise area or toll free at

our third-party provider will charge a convenience (800) 972-7660.

fee. American Express, Discover, MasterCard, If you want to cancel your account,

Cancel Account.

and Visa are accepted. To make credit/debit card, check the "Cancel Account" box on your Form 910.

e-check, and ACH Debit payments, use TAP at

tax.idaho.gov. For more information, visit our Signature. You must sign your Form 910.

E-Pay page at tax.idaho.gov/epay.

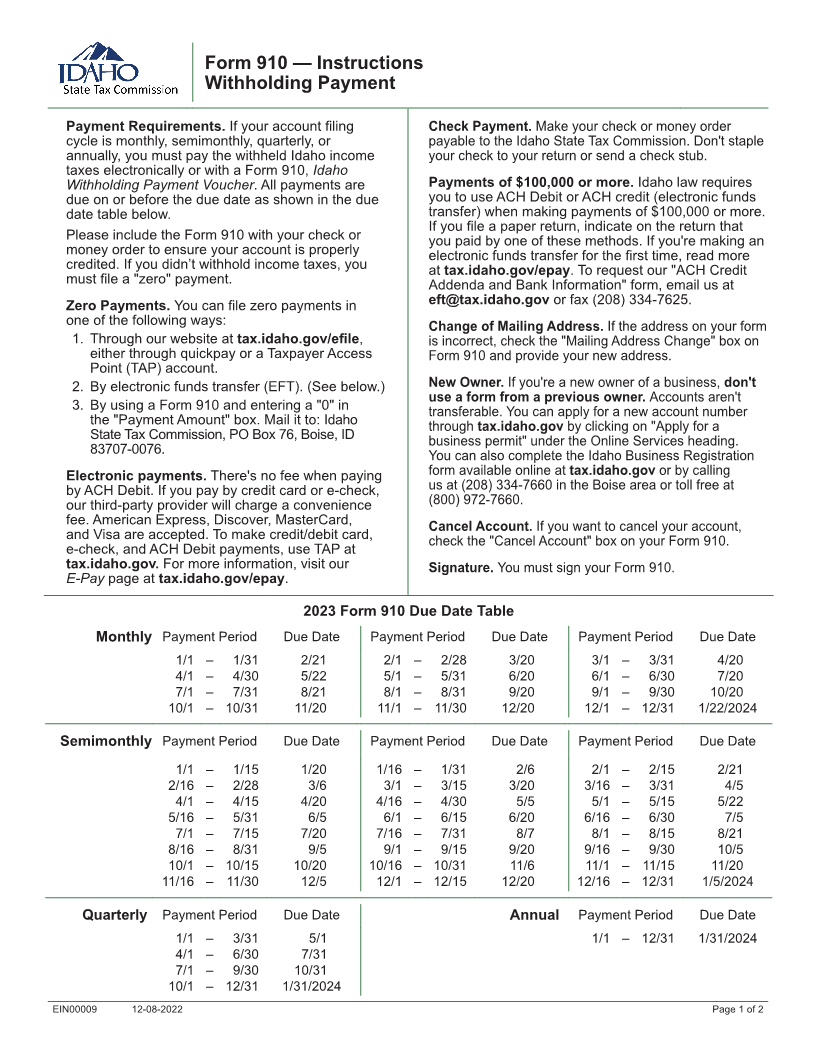

2023 Form 910 Due Date Table

Monthly Payment Period Due Date Payment Period Due Date Payment Period Due Date

1/1 – 1/31 2/21 2/1 – 2/28 3/20 3/1 – 3/31 4/20

4/1 – 4/30 5/22 5/1 – 5/31 6/20 6/1 – 6/30 7/20

7/1 – 7/31 8/21 8/1 – 8/31 9/20 9/1 – 9/30 10/20

10/1 – 10/31 11/20 11/1 – 11/30 12/20 12/1 – 12/31 1/22/2024

Semimonthly Payment Period Due Date Payment Period Due Date Payment Period Due Date

1/1 – 1/15 1/20 1/16 – 1/31 2/6 2/1 – 2/15 2/21

2/16 – 2/28 3/6 3/1 – 3/15 3/20 3/16 – 3/31 4/5

4/1 – 4/15 4/20 4/16 – 4/30 5/5 5/1 – 5/15 5/22

5/16 – 5/31 6/5 6/1 – 6/15 6/20 6/16 – 6/30 7/5

7/1 – 7/15 7/20 7/16 – 7/31 8/7 8/1 – 8/15 8/21

8/16 – 8/31 9/5 9/1 – 9/15 9/20 9/16 – 9/30 10/5

10/1 – 10/15 10/20 10/16 – 10/31 11/6 11/1 – 11/15 11/20

11/16 – 11/30 12/5 12/1 – 12/15 12/20 12/16 – 12/31 1/5/2024

Quarterly Payment Period Due Date Annual Payment Period Due Date

1/1 – 3/31 5/1 1/1 – 12/31 1/31/2024

4/1 – 6/30 7/31

7/1 – 9/30 10/31

10/1 – 12/31 1/31/2024

EIN00009 12-08-2022 Page 1 of 2