Enlarge image

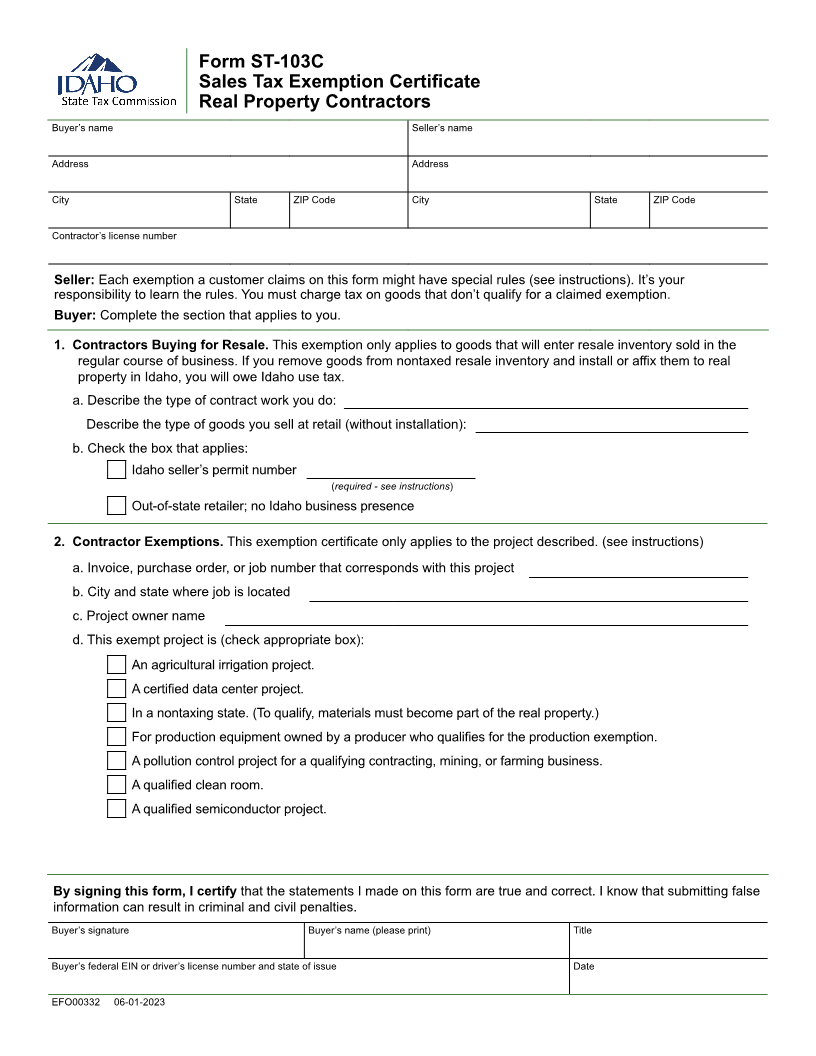

Form ST-103C

Sales Tax Exemption Certificate

Real Property Contractors

Buyer’s name Seller’s name

Address Address

City State ZIP Code City State ZIP Code

Contractor’s license number

Seller: Each exemption a customer claims on this form might have special rules (see instructions). It’s your

responsibility to learn the rules. You must charge tax on goods that don’t qualify for a claimed exemption.

Buyer: Complete the section that applies to you.

1. Contractors Buying for Resale. This exemption only applies to goods that will enter resale inventory sold in the

regular course of business. If you remove goods from nontaxed resale inventory and install or affix them to real

property in Idaho, you will owe Idaho use tax.

a. Describe the type of contract work you do:

Describe the type of goods you sell at retail (without installation):

b. Check the box that applies:

Idaho seller’s permit number

(required - see instructions)

Out-of-state retailer; no Idaho business presence

2. Contractor Exemptions. This exemption certificate only applies to the project described. (see instructions)

a. Invoice, purchase order, or job number that corresponds with this project

b. City and state where job is located

c. Project owner name

d. This exempt project is (check appropriate box):

An agricultural irrigation project.

A certified data center project.

In a nontaxing state. (To qualify, materials must become part of the real property.)

For production equipment owned by a producer who qualifies for the production exemption.

A pollution control project for a qualifying contracting, mining, or farming business.

A qualified clean room.

A qualified semiconductor project.

By signing this form, I certify that the statements I made on this form are true and correct. I know that submitting false

information can result in criminal and civil penalties.

Buyer’s signature Buyer’s name (please print) Title

Buyer’s federal EIN or driver’s license number and state of issue Date

EFO00332 06-01-2023