Enlarge image

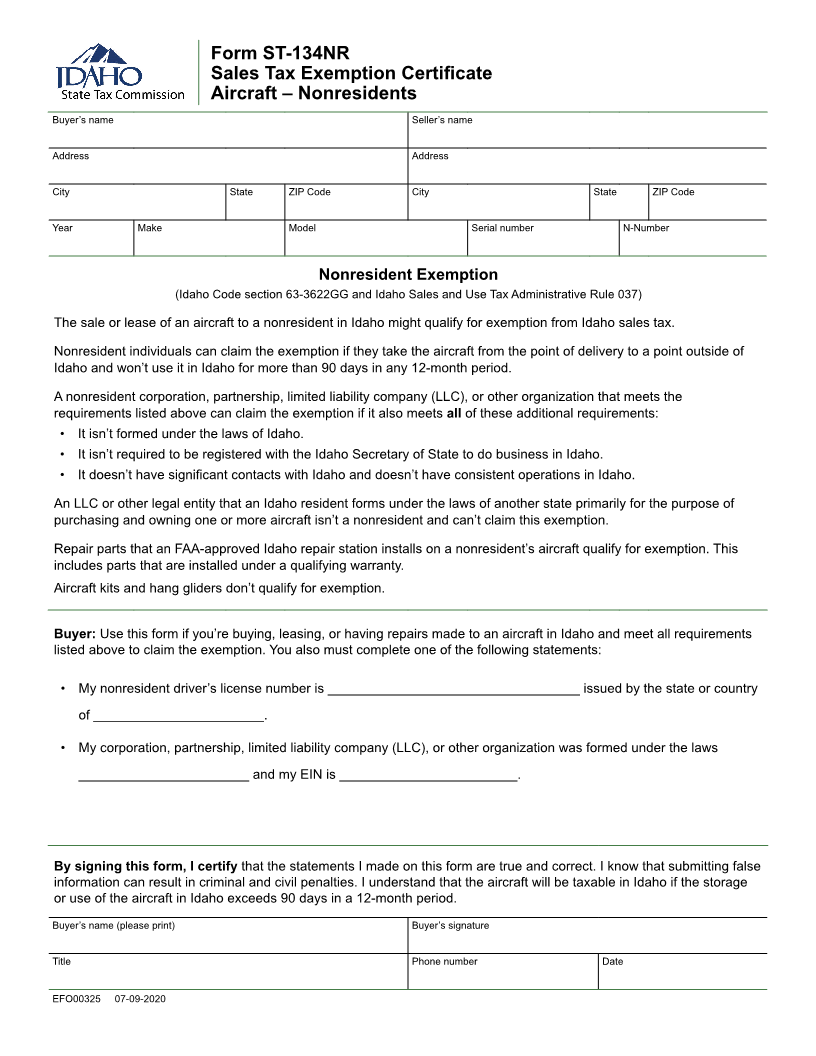

Form ST-134NR

Sales Tax Exemption Certificate

Aircraft – Nonresidents

Buyer’s name Seller’s name

Address Address

City State ZIP Code City State ZIP Code

Year Make Model Serial number N-Number

Nonresident Exemption

(Idaho Code section 63-3622GG and Idaho Sales and Use Tax Administrative Rule 037)

The sale or lease of an aircraft to a nonresident in Idaho might qualify for exemption from Idaho sales tax.

Nonresident individuals can claim the exemption if they take the aircraft from the point of delivery to a point outside of

Idaho and won’t use it in Idaho for more than 90 days in any 12-month period.

A nonresident corporation, partnership, limited liability company (LLC), or other organization that meets the

requirements listed above can claim the exemption if it also meets all of these additional requirements:

• It isn’t formed under the laws of Idaho.

• It isn’t required to be registered with the Idaho Secretary of State to do business in Idaho.

• It doesn’t have significant contacts with Idaho and doesn’t have consistent operations in Idaho.

An LLC or other legal entity that an Idaho resident forms under the laws of another state primarily for the purpose of

purchasing and owning one or more aircraft isn’t a nonresident and can’t claim this exemption.

Repair parts that an FAA-approved Idaho repair station installs on a nonresident’s aircraft qualify for exemption. This

includes parts that are installed under a qualifying warranty.

Aircraft kits and hang gliders don’t qualify for exemption.

Buyer: Use this form if you’re buying, leasing, or having repairs made to an aircraft in Idaho and meet all requirements

listed above to claim the exemption. You also must complete one of the following statements:

• My nonresident driver’s license number is __________________________________ issued by the state or country

of _______________________.

• My corporation, partnership, limited liability company (LLC), or other organization was formed under the laws

_______________________ and my EIN is ________________________.

By signing this form, I certify that the statements I made on this form are true and correct. I know that submitting false

information can result in criminal and civil penalties. I understand that the aircraft will be taxable in Idaho if the storage

or use of the aircraft in Idaho exceeds 90 days in a 12-month period.

Buyer’s name (please print) Buyer’s signature

Title Phone number Date

EFO0032 507-09-2020