Enlarge image

Colorado Enterprise Zone Tax Guide

Enlarge image | Colorado Enterprise Zone Tax Guide |

Enlarge image |

Enterprise Zone Tax Guide

Enterprise zones are economically depressed areas

designated by the Colorado Economic Development Table of Contents

Commission based upon unemployment rate,

population growth rate, and/or per capita income. Part 1: Certification & Filing Requirements . . . 2

Enterprise zones may include both urban and rural Part 2: Investment Tax Credit . . . . . . . . . . . . 4

areas. There are sixteen designated enterprise zones in

Colorado. Maps and additional information about Part 3: Business Facility New Employee Credits . . 9

designated enterprises zones can be found online at

Part 4: Job Training Investment Tax Credit . . . 19

OEDIT.Colorado.gov/enterprise-zone-program.

Part 5: Research and Experimental Activities Credit . 21

Colorado has established several tax incentives for

private enterprises to start new businesses and to Part 6: Vacant Building Rehabilitation Credit . . . 25

expand existing businesses in enterprise zones. These

Part 7: Machinery and Machine Tools Exemption . . 29

incentives come primarily in the form of credits that

can be applied toward a taxpayer’s Colorado income

tax liability. These credits are generally based on

investments made or employees hired by the taxpayer

in an enterprise zone. There are also sales and use tax

exemptions allowed for certain machinery and machine

tools used solely and exclusively in an enterprise zone.

This publication is designed to provide taxpayers with

general information about tax incentives for business

activity and investments in enterprise zones. Nothing in

this publication modifies or is intended to modify the

requirements of Colorado’s statutes and regulations.

Taxpayers are encouraged to consult their tax advisors

for guidance regarding specific situations. Additionally,

taxpayers can request a General Information Letter

(GIL) or Private Letter Ruling (PLR) from the

Department on issues related to enterprise zone tax

credits and exemptions.

In addition to the tax incentives discussed in this

publication, an enterprise zone contribution credit is

allowed to taxpayers who make monetary or in-kind

contributions for the purpose of implementing the

economic development plan for an enterprise zone.

Please see Department publication Income Tax Topics:

Enterprise Zone Contribution Credit for additional

information about the contribution credit.

1

Revised December 2021

|

Enlarge image |

Part 1: Certification & Filing Requirements

Taxpayers must satisfy certain certification and filing Certification requirements

requirements to claim enterprise zone credits.

Additionally, taxpayers who claim enterprise zone Before filing an income tax return claiming any credit

credits are generally required to file electronically. The covered by pre-certification, the taxpayer must obtain

pre-certification, certification, and mandatory final certification from the enterprise zone

electronic filing requirements described in this Part 1 administrator. A taxpayer who has not satisfied the

apply to all enterprise zone credits discussed in this pre-certification requirements, discussed earlier in this

publication. publication, may not apply for any enterprise zone

credits. Applications for final certification must be

made online at OEDIT.Colorado.gov/enterprise-zone-

Pre-certification requirements program. OEDIT provides information to the

Department of Revenue confirming that taxpayers have

Before a taxpayer engages in any activity for which the complied with pre-certification and certification

taxpayer intends to claim any enterprise zone credit requirements.

discussed in this publication the taxpayer must apply

for pre-certification online at The final certification issued by the enterprise zone

OEDIT.Colorado.gov/enterprise-zone-program. As part administrator affirms only that the taxpayer’s business

of the application, the taxpayer must identify their address is within the boundaries of the enterprise zone,

business location within the enterprise zone and attest the taxpayer satisfied the applicable pre-certification

that: requirements, and, in the case of the vacant building

rehabilitation credit, that the expenditures are of a

➢ the taxpayer is aware of enterprise zone credits; qualified nature. The final certification does not

and establish the taxpayer’s eligibility for the credit or the

amount of the credit claimed. Any enterprise zone

➢ enterprise zone credits are a contributing factor to credits a taxpayer claims are subject to examination,

the start-up, expansion, or relocation of the audit, and adjustment by the Department of Revenue.

taxpayer's business in the enterprise zone.

Furthermore, the taxpayer must acknowledge in the Claiming credits

application that the pre-certification applies only to

activities that commence after the date that pre- Taxpayers must file a Colorado income tax return and

certification is issued by the enterprise zone Enterprise Zone Credit and Carryforward Schedule

administrator and before the end of the taxpayer’s (DR 1366) to claim any enterprise zone income tax

current income tax year. credits allowed to the taxpayer for the tax year.

Credits must be claimed on the return filed for the tax

The pre-certification applies only with respect to year in which the taxpayer earned the credit, even if

activities undertaken by the taxpayer at the business the taxpayer has no tax liability for that year to offset

location identified in the pre-certification. with the credit(s). Enterprise zone credits claimed, but

not applied to offset tax in the year claimed can

generally be carried forward to the following tax year.

Credits cannot be carried forward and applied toward

tax in subsequent tax years unless the taxpayer filed an

income tax return and form DR 1366 to properly claim

the credit for the tax year in which it was earned.

2

Revised December 2021

|

Enlarge image |

Part 1: Certification and Filing Requirements

Mandatory electronic filing Additional resources

Any taxpayer who claims one or more enterprise zone The following is a list of statutes, regulations, forms,

credits must file their Colorado income tax return and guidance pertaining to pre-certification,

electronically, unless filing electronically would cause certification, and filing requirements for enterprise

undue hardship for the taxpayer. A taxpayer may claim zone credits. This list is not, and is not intended to be,

enterprise zone credits on a paper return only if the an exhaustive list of authorities that govern the tax

taxpayer cannot file electronically because the treatment of every situation. Individuals and businesses

taxpayer does not have: with specific questions should consult their tax

advisors.

➢ access to a computer;

➢ sufficient internet access; Statutes and regulations

➢

➢ sufficient internet capability; or § 39-30-103, C.R.S. Zones established –review –

termination –repeal.

➢ sufficient computer knowledge.

➢ § 39-30-110, C.R.S. Electronic submissions.

Any taxpayer who claims one or more enterprise zone

➢

credits must also include with their return a completed § 39-30-111, C.R.S. Department of revenue –

Enterprise Zone Credit and Carryforward Schedule enterprise zone data –electronic filing –

(DR 1366). Additionally, S corporations, partnerships, submission of carryforward schedule.

and any other entity treated as a partnership for tax ➢ § 39-30-112, C.R.S. Data provided to department

purposes must file with their returns a completed Pass-

of revenue.

Through Entity Enterprise Zone Credit Distribution

Report (DR 0078A).

Forms and guidance

➢ Tax.Colorado.gov

➢ Enterprise Zone Credit and Carryforward Schedule

(DR 1366)

➢ Pass-Through Entity Enterprise Zone Credit

Distribution Report (DR 0078A)

➢ OEDIT.Colorado.gov/enterprise-zone-program

3

Revised December 2021

|

Enlarge image |

Part 2: Investment Tax Credit

The enterprise zone investment tax credit is allowed Several other types of property may also qualify as

for 3% of the taxpayer’s qualified investment made section 38 property if they are (1) depreciable under

during the tax year in qualified property used solely I.R.C. section 168 (without regard to useful life) or (2)

and exclusively in an enterprise zone for at least one otherwise eligible for depreciation (or amortization in

year. This Part 2 provides information about lieu of depreciation) and have a useful life of 3 years or

qualifications, calculations, and limitations applicable more. Please see I.R.C. section 48 and the associated

to the investment tax credit. federal regulations for information regarding specific

rules for the following types of property:

➢ air conditioning and heating units;

I.R.C. References in This Part 2

The enterprise zone investment tax credit ➢ tangible property used as an integral part of

is based upon provisions of the Internal manufacturing or extraction;

Revenue Code (“I.R.C.”) as it existed

immediately prior to the enactment of the ➢ tangible property used as an integral part of

federal Revenue Reconciliation Act of 1990. furnishing transportation, communications,

All references in this Part 2 to sections of electrical energy, gas, water, or sewage disposal

the I.R.C. are to those sections as they

services;

existed immediately prior to the

enactment of the federal Revenue ➢ tangible property that constitutes a research

Reconciliation Act of 1990.

facility or bulk storage facility;

➢ elevators and escalators;

Qualified property ➢ single-purpose agricultural or horticultural

structures;

Qualified property is property defined as “section 38

➢

property” in section 48 of the I.R.C. Section 38 qualified rehabilitation expenditures;

property generally includes tangible personal property

➢

that is depreciable under section 168 of the I.R.C. qualified timber property;

Section 168 prescribes the method of depreciation for ➢ a storage facility used in connection with

property either used in a trade or business or otherwise

distribution of petroleum products;

held for the production of income. Property that is

neither used in a trade or business nor held for the ➢ property used in lodging;

production of income is not qualified property and does

not qualify for the enterprise zone investment tax ➢ livestock;

credit. Additionally, any property the taxpayer elects

to expense pursuant to section 179 of the I.R.C. is not ➢ boilers fueled by oil or gas;

qualified property and does not qualify for the credit.

➢ movie and television films;

➢ energy property; and

➢ sound recordings.

4

Revised December 2021

|

Enlarge image |

Part 2: Investment Tax Credit

Pre-certification When property is placed in service

Any taxpayer who intends to claim a credit must first For the purpose of determining a taxpayer’s qualified

pre-certify with the applicable enterprise zone investment, qualified property is placed in service in

administrator. No enterprise zone investment tax credit the earlier of the following tax years:

is allowed with respect to any property acquired by the

➢

taxpayer, or with respect to which the taxpayer paid or the tax year in which, under the taxpayer's

incurred any expense, prior to the taxpayer’s pre- depreciation practice, the period for depreciation

certification with the enterprise zone administrator for with respect to such property begins; or

the tax year. Please see Part 1 of this publication for

➢

additional information about pre-certification. the tax year in which the property is placed in a

condition or state of readiness and availability for

a specifically assigned function.

Qualified investment

Please see 26 CFR § 1.46-3(d), the section titled

“Placed in Service” in Chapter 1 of IRS Publication 946,

The allowable credit is an amount equal to 3% of the

How to Depreciate Property, and the following

taxpayer’s qualified investment during the tax year in

examples for additional guidance in determining the

qualified property that is used solely and exclusively in

tax year during which qualified property is placed in

an enterprise zone for at least one year. The qualified

service.

investment is a percentage of the basis or cost of

qualified property placed into service by the taxpayer

Examples

during the tax year. The applicable percentage may be

based on various factors, including the type of The following are examples of cases where property

property, the useful life of the property, whether the shall be considered in a condition or state of readiness

property is new or used when the taxpayer acquires it, and availability for a specifically assigned function:

and whether section 168 of the I.R.C. applies to the

property. Section 168 of the I.R.C. provides generally ➢ Parts are acquired and set aside during the taxable

for the accelerated cost recovery system for year for use as replacements for a particular

depreciable business assets. machine (or machines) in order to avoid

operational time loss.

The applicable percentage for property to which I.R.C.

section 168 applies is: ➢ Operational farm equipment is acquired during the

taxable year and it is not practicable to use such

➢ 60% for property classified as 3-year property in equipment for its specifically assigned function in

I.R.C. section 168(e); and the taxpayer's business of farming until the

following year.

➢ 100% for property classified as anything other than

3-year property in I.R.C. section 168(e). ➢ Equipment is acquired for a specifically assigned

function and is operational but is undergoing

Please see I.R.C. section 46(c)(2) for the applicable

testing to eliminate any defects.

percentage for section 38 property to which I.R.C.

section 168 does not apply.

5

Revised December 2021

|

Enlarge image |

Part 2: Investment Tax Credit

Special rules Renewable energy investments

Special rules apply to various types of property and In general, the credit can be used only to offset tax

investments. The following sections provide and cannot be used to claim a refund. However, any

information about special rules for: taxpayer who is allowed a credit for a new renewable

energy investment may elect to receive a refund for a

➢ used property; portion of the allowable credit if the new renewable

energy investment was both:

➢ property ultimately used solely and exclusively in

an enterprise zone for less than one year; ➢ placed in service on or after January 1, 2015, but

prior to January 1, 2021; and

➢ renewable energy investments;

➢ placed in service during a tax year commencing on or

➢ leased property; and after January 1, 2015, but prior to January 1, 2021.

➢ the commercial vehicle investment tax credit for

A new renewable energy investment is a qualified

heavy trucks, tractors, and semitrailers.

investment for a project that generates electricity

from eligible energy resources. Eligible energy

Used property resources generally include solar, wind, geothermal,

biomass, hydroelectricity, and recycled energy. Fossil

In the case of used property, the qualified investment fuels, nuclear fuels, and their derivatives are not

that may be considered in the calculation of the credit eligible energy resources. Please see section 40-2-

is limited to $150,000. 124(1)(a), C.R.S., for a complete definition of eligible

energy resources.

One-year requirement

A taxpayer who makes an election to receive a refund

The credit is allowed only for qualified property that is for a new renewable energy investment is allowed a

used solely and exclusively within an enterprise zone refund for 80% of the credit. By making the election,

for at least one year after the property is placed in the taxpayer agrees to forgo the remaining 20% of the

service. However, a taxpayer may file a tax return credit. The taxpayer may make the election no later

claiming the credit before the full year has elapsed. than the due date, including extensions, for filing the

For example, if a taxpayer places qualified property in tax return for the tax year during which the renewable

service in November of 2018, the taxpayer can file a energy investment was placed into service.

2018 income tax return claiming the credit in April

2019, before the full one-year period has elapsed. If the refund the taxpayer elects to receive is greater

than $750,000, the taxpayer will receive a refund of

If a taxpayer claims a credit for qualified property that $750,000 for the tax year the election is made and a

is not ultimately used solely and exclusively in an refund of $750,000 for each subsequent tax year until

enterprise zone, the taxpayer must file an amended the full amount of the allowable refunded has been

return to withdraw the credit claim for such property. refunded to the taxpayer. A taxpayer may make the

For example, if a taxpayer places qualified property in election to receive a refund with respect to multiple

service in November of 2018 and files a 2018 income

renewable energy investments, but in no event may the

tax return claiming the credit in April 2019, but uses

taxpayer receive a refund, for any tax year, totaling

the property outside of the enterprise zone in June

more than $750,000 for renewable energy investments.

2019, the taxpayer must file an amended 2018 return

to withdraw the claim for credit.

6

Revised December 2021

|

Enlarge image |

Part 2: Investment Tax Credit

Leased property Limits on use of the credit

Under certain conditions, the lessor of qualified Multiple limitations restrict the amount of credit a

property can elect to treat the lessee as having taxpayer can use for a given tax year. If the credit

acquired the property for the purpose of the credit.

allowed to the taxpayer exceeds these limits, the

Please see I.R.C. section 48(d) and 26 CFR § 1.48-4 for

taxpayer can generally carry forward the excess credit

additional information regarding leased property.

for application toward the tax due for subsequent tax

years. The amount of credit a taxpayer can use in a

Commercial vehicle investment tax credit given tax year is the lesser of:

Special rules apply for determining whether heavy ➢ the taxpayer’s net tax liability;

trucks, tractors, and semitrailers qualify for a credit

➢

and for calculating the amount of that credit. These the sum of $5,000 plus 50% of the taxpayer’s tax

special rules apply to heavy trucks, tractors, and net liability in excess of $5,000; or

semitrailers that meet all of the following criteria:

➢ $750,000.

➢ They have a gross vehicle weight rating (GVWR) of

54,000 pounds or greater. The $750,000 limit applies to any credit applied toward

tax, any refund the taxpayer receives for a renewable

➢ They are model year 2010 or newer. energy investment, and to the combined total of credit

applied and refund claimed by the taxpayer for the tax

➢ They are designated as Class A personal property year. If a taxpayer claims a $750,000 refund for a

for vehicle registration purposes. renewable energy investment, the taxpayer cannot

apply any credit toward tax for the same tax year. The

➢ They are licensed and registered in Colorado. $750,000 limit does not apply to any credit the

taxpayer has carried forward from a tax year prior to

Heavy trucks, tractors, and semitrailers, and any parts

2014.

associated therewith, are deemed to satisfy the one-

year requirement described earlier in this publication if

The limits on credit use apply to the investment tax

they are predominantly housed and based at the

credit and the job training investment tax credit

taxpayer’s business trucking facility within an enterprise

discussed in Part 4 of this publication. The combined

zone for the 12-month period following purchase.

amount of investment tax credit and job training

investment tax credit a taxpayer applies to offset tax

Subject to approval and certification by the Economic

for a given tax year cannot exceed the limits on credit

Development Commission, a commercial vehicle

use.

investment tax credit is allowed for heavy trucks,

tractors, and semitrailers that satisfy all of the

Please see sections 39-30-104(2)(a) and (b) and

requirements for the enterprise zone investment tax

39-22-507.5(3), C.R.S., for limits applicable to tax

credit. The allowable credit is equal to 1.5%, rather

years commencing prior to January 1, 2014.

than 3%, of the qualifying investments.

For additional information regarding commercial

vehicle investment tax credits allowed for heavy

trucks, tractors, and semitrailers, please visit

OEDIT.Colorado.gov/enterprise-zone-commercial-

vehicle-investment-tax-credit.

7

Revised December 2021

|

Enlarge image |

Part 2: Investment Tax Credit

Credit carryforwards

State statutes and regulations

If the credit a taxpayer may use is limited as described ➢ § 39-30-104, C.R.S. Credit against tax –investment

above, the taxpayer can generally carry forward the

in certain property –definitions.

excess credit to the next tax year. The number of years

a taxpayer can carry forward excess credits beyond the ➢ Rule 39-30-104. Enterprise zone investment tax credit.

tax year in which the investment was made depends on

the tax year for which the credit was initially allowed. Federal law

The credit carryforward periods reflected in Table 2-1

do not apply to renewable energy investments for The federal laws listed here, that apply to the

which the taxpayer has elected to receive a refund. enterprise zone investment tax credit, are those laws

as they existed immediately prior to the enactment of

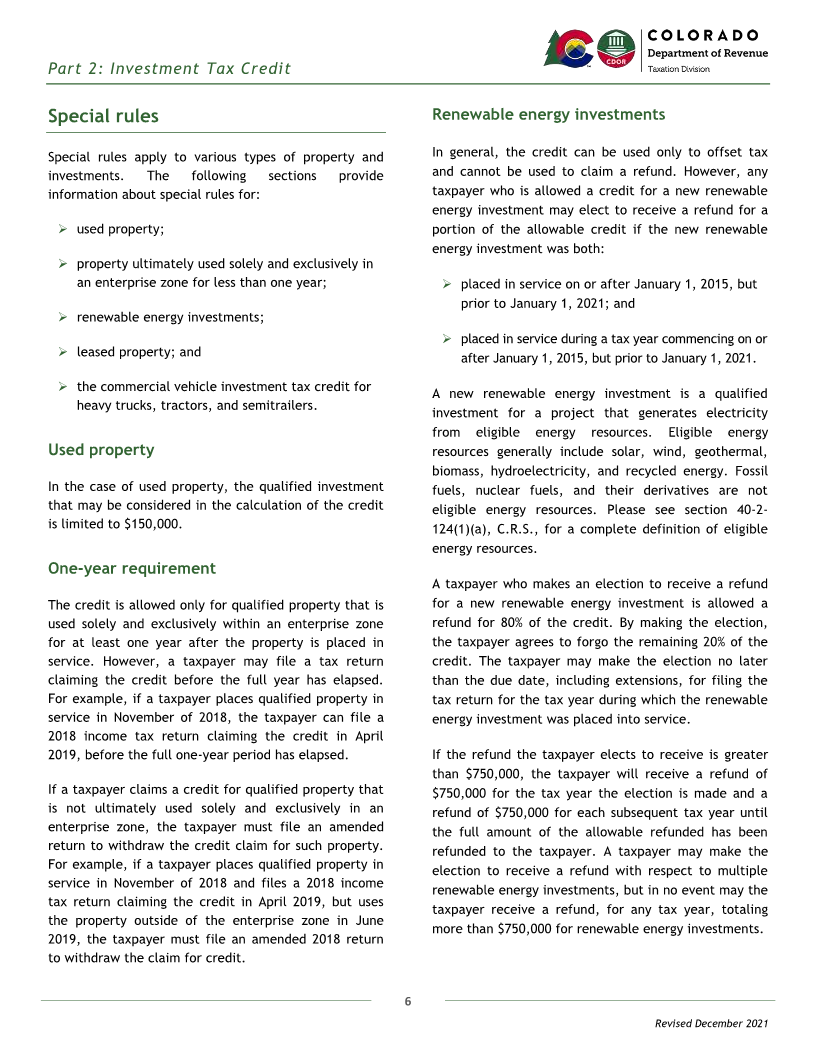

Table 2-1. Credit Carryforward Periods the federal Revenue Reconciliation Act of 1990.

2013 2014 2018 ➢ I.R.C. § 38. General business credit.

Tax Years and through and

prior 2017 later ➢ I.R.C. § 46. Amount of credit.

Credit carryforward 12 14 14 ➢ I.R.C. § 47. Certain dispositions…of section 38 property.

period years years years

➢ I.R.C. § 48. Definitions; special rules.

Carryforward period

20 22 14

for renewable energy ➢ I.R.C. § 167. Depreciation.

years years years

investments

➢ I.R.C. § 168. Accelerated cost recovery system.

Any credit that has not been used within the

Any federal regulations promulgated under these

carryforward period expires and is no longer available

sections may also apply to the enterprise zone

to the taxpayer.

investment tax credit.

Additional resources Forms and guidance

➢

The following is a list of statutes, regulations, forms, Tax.Colorado.gov

and guidance pertaining to the enterprise zone ➢ OEDIT.Colorado.gov/enterprise-zone-investment-

investment tax credit. This list is not, and is not

tax-credit

intended to be, an exhaustive list of authorities that

govern the tax treatment of every situation. Individuals ➢ OEDIT.Colorado.gov/enterprise-zone-commercial-

and businesses with specific questions should consult

vehicle-investment-tax-credit

their tax advisors.

➢ Enterprise Zone Credit and Carryforward Schedule

(DR 1366)

➢ IRS Publication 946, How to Depreciate Property

8

Revised December 2021

|

Enlarge image |

Part 3: Business Facility New Employee Credits

A taxpayer who operates a business facility in an Revenue-producing enterprises

enterprise zone is allowed a credit for the net increase

during the tax year in employees working at the facility. The taxpayer must operate the business facility in a

The taxpayer may claim additional employee credits if revenue-producing enterprise that engages in one or

certain qualifying criteria are met. This Part 3 provides more of the following activities:

information about business facility new employee

➢

credits, including discussion of the following subjects: the production, assembly, fabrication,

manufacturing, or processing of any agricultural,

➢ Qualifying criteria for business facilities and mineral, or manufactured product;

business facility employees

➢ the storage, warehousing, distribution, or sale of

➢ Calculation of net new business facility employees any products of agriculture, mining, or

for the tax year manufacturing;

➢ Additional credits for certain facilities and employees ➢ the feeding of livestock at a feedlot;

➢ Examples for calculating the credit ➢ the operation of laboratories or other facilities for

scientific, agricultural, animal husbandry, or

industrial research, development, or testing;

Business facilities

➢ the performance of services of any type; or

Enterprise zone business facility employee credits are

➢

allowed only to taxpayers who operate a business the administrative management of any of the

facility in an enterprise zone. The business facility activities listed above.

must meet certain criteria, must be used by the

taxpayer in a revenue-producing enterprise, and is Leased business facilities

subject to certain rules in the event the facility is

leased. If a taxpayer operates a business without any If a taxpayer owns a business facility in an enterprise

business facility, the taxpayer may not claim the zone and leases the entire facility to another person or

business facility new employee credit. business, the taxpayer cannot claim any employee

credits with respect to the facility. If the taxpayer

The taxpayer’s business facility must be a factory, mill, leases part of that facility to another person or

plant, refinery, warehouse, feedlot, or any other company and operates a revenue-producing enterprise

building or complex of buildings within which individuals in the remaining part, the taxpayer may claim

are customarily employed or that are customarily used employee credits only with respect to employees

to house machinery, equipment, or other property. employed by the taxpayer in that revenue-producing

enterprise.

Temporary structures and mobile units do not qualify

as business facilities, unless they are used in

association with permanent structures that qualify as

business facilities. If a temporary structure or mobile

unit is not used in association with a permanent

structure that qualifies as a business facility, any

employees working in connection with that temporary

structure or mobile unit are not business facility

employees and do not qualify for the credit.

9

Revised December 2021

|

Enlarge image |

Part 3: Business Facility New Employee Credits

Business facility employees Minimum time requirement

In general, a taxpayer may claim business facility The employee must perform duties in connection with

employee credits only with respect to employees who the operation of the business facility on:

satisfy the applicable business facility, work location,

➢

time, and withholding requirements. Special rules that a regular, full-time basis;

apply specifically to commercial drivers are discussed ➢ a part-time basis if the person is customarily

later in this publication.

performing his or her duties at least twenty hours

per week throughout the taxable year; or

Business facility and work requirements

➢ a seasonal basis if the person performs his or her

To qualify for the credit, an employee must work in or duties for substantially all of the season customary

at the business facility, within the enterprise zone, for the position in which the person is employed.

including the land on which the facility is located and

be employed by the taxpayer in connection with the In order to qualify as a business facility employee, the

operation of the taxpayer’s business facility during the employee must, throughout the taxable year,

taxable year for which the credit is claimed. An customarily perform duties for at least 20 hours per

employee’s duties are performed in connection with week in or at the business facility, in connection with

the operation of a business facility only if such duties the operation of the business facility. An employee who

contribute materially to the operation of a revenue- meets this requirement and all other applicable

producing enterprise conducted in or at the business requirements is considered a business facility employee

facility.

even if that employee also performs duties

unconnected with the business facility or outside the

An employee satisfies these requirements if they

enterprise zone.

customarily perform duties in or at the business

facility, in connection with the operation of the

facility, for at least 20 hours per week throughout the Withholding requirement

taxable year, regardless of whether they also perform

additional duties at another location either inside or The employee must receive compensation for duties

outside of the zone. For example, if an employee performed in the operation of the business facility from

customarily performs duties at the business facility in which Social Security, Medicare, and income taxes are

connection with the operation of the facility for at withheld by either:

least 20 hours per week, the employee qualifies for the

credit even if that employee also spends some ➢ the taxpayer; or

additional time working from their home outside of the

enterprise zone. ➢ an employee leasing company acting as the

employing unit for, or co-employer with, the

In general, an employee whose duties are not taxpayer, if the taxpayer is a work-site employer.

performed in connection with the operation of the See section 8-70-114(2)(a)(V) and (VII), C.R.S.

business facility or are performed outside of the

enterprise zone do not qualify as business facility The withholding requirement is not satisfied with

employees. Examples of non-qualifying employees may respect to any “statutory employee” for whom the

include employees who perform landscaping, taxpayer withholds Social Security and Medicare taxes,

housecleaning, or construction duties at the customer’s pursuant to I.R.C. section 3121(d)(3), but not income

location. taxes.

10

Revised December 2021

|

Enlarge image |

Part 3: Business Facility New Employee Credits

Commercial drivers Averaging employees for the year

Special rules apply to any employee whose primary In determining the credit, the taxpayer must calculate

duties consist of operating a commercial motor vehicle the total number of business facility employees working

with a commercial driver's license. These employees in connection with the business facility for the current

generally are not required to work at or in the business tax year and for each preceding tax year. In general,

facility, provided they spend no more than 5% of their the number of business facility employees for any year

total time at any business of the employer other than is calculated by adding together the number of business

the business within the zone. These employees must facility employees on the last business day of each

nonetheless customarily perform duties for at least 20 month of the tax year and dividing the total by 12. The

hours per week throughout the taxable year that taxpayer must use this formula even if the taxpayer’s

contribute materially to the operation of a revenue- tax year is a short tax year consisting of fewer than 12

producing enterprise conducted in or at the business months, as may occur if the taxpayer is not in

facility. They are also subject to the withholding existence for the entire tax year or changes their

requirements discussed earlier in this publication. annual accounting period (please see IRS

Publication 538, Accounting Periods and Methods for

additional information regarding short tax years).

Employee credit calculation

However, the number of business facility employees is

The credit is based on the taxpayer’s total number of calculated differently if the taxpayer’s business facility is

business facility employees, averaged over the course in operation for less than the entire tax year, as might be

of the tax year, as described later in this section. For the case if the facility operates seasonally or otherwise

the business facility’s first year of operation, the ceases all operation for some period of time during the

taxpayer is allowed a credit of $1,100 for each business year. If the taxpayer’s business facility is in operation for

facility employee working within the enterprise zone. less than the entire tax year, the number of business

For each subsequent tax year, the taxpayer is allowed facility employees is calculated by adding together the

a credit of $1,100 for each additional business facility number of business facility employees on the last business

employee working within the enterprise zone in excess day of each full calendar month of the tax year during

of the highest total number of business facility which the facility was in operation and dividing the total

employees for any prior tax year. For any year by the number of such full calendar months of operation.

subsequent to the facility’s first year of operation, the If the business facility’s period of operation commences

credit is allowed only for the additional employees at or ceases during a calendar month, and the business

the facility, even if the taxpayer did not operate the facility is therefore not in operation for the full calendar

facility in the prior year(s) and/or acquired the facility month, that partial month of operation is not considered

from another taxpayer. An employer must satisfy all in the calculation of business facility employees. A

applicable per-certification requirements to qualify for business facility is considered to be in operation for less

any employee credits. than the entire taxable year only if all business activities

conducted at the facility cease temporarily for a period of

not less than one full calendar month during the taxable

year. Business activities are not deemed to have ceased

at a facility in any month during which any employee

performs work at or in the facility or during which the

generation of any gross revenue can be attributed to the

facility.

11

Revised December 2021

|

Enlarge image |

Part 3: Business Facility New Employee Credits

Pre-certification

Changes to enterprise zone boundaries

Before a taxpayer engages in any activity for which the

In general, the continuing operations at an existing

taxpayer intends to claim any enterprise zone business

business facility initially located outside of an

facility new employee credit, the taxpayer must apply

enterprise zone that is absorbed into an enterprise

for pre-certification from the enterprise zone

zone when the boundaries for the zone are redrawn

administrator. Please see Part 1 of this publication for

will not qualify for any enterprise zone employee

additional information regarding pre-certification

credits. Employee credits are allowed only to a

requirements.

taxpayer who, before engaging in any activity for which

they intend to claim a credit, has certified that the

If a taxpayer does not pre-certify as required by law

credits are a contributing factor to the start-up,

prior to the commencement of the tax year, the

expansion, or relocation of a taxpayer’s business in the

number of employees for any month that commences

enterprise zone. If this condition has not been met, the

prior to pre-certification during such tax year is

taxpayer may not claim any enterprise zone employee

deemed not to exceed the highest number of business

credits with respect to employees at the facility, even

facility employees calculated for any prior tax year. In

after the boundaries of the enterprise zone have been

calculating the number of business facility employees

redrawn to include the facility. If an existing business

for any prior year, in order to determine the increase

facility is absorbed into an enterprise zone when the

in employees in the current tax year, the number of

boundaries for the zone are redrawn, a subsequent

business facility employees employed by the taxpayer

expansion of the facility may qualify the enterprise

at the business facility on the last business day of each

zone credits.

month of the prior year(s) shall be included in the

calculation, regardless of whether the taxpayer pre-

certified prior to or during such prior year(s). Replacement business facilities

Please see Example 3-6, later in this publication, for If the taxpayer’s business facility is a replacement

illustrations of credit calculations for taxpayers who business facility, special rules apply for calculating the

have commenced operations prior to satisfying pre- number of business facility employees. A replacement

certification requirements. business facility is a business facility at which the

taxpayer (or a related taxpayer) operates a revenue-

producing enterprise substantially similar to a revenue-

producing enterprise that was operated by the taxpayer

(or a related taxpayer) at another business facility in

this state that discontinued operating on or before the

close of the first taxable year in which commercial

operations commenced at the new business facility.

In calculating the credit for a replacement business

facility, the average number of business facility

employees for any given year must be reduced by the

average number of employees at the old facility during

the three taxable years preceding the first taxable year

that the replacement business facility is first available

for use by the taxpayer or capable of being used by the

taxpayer in a revenue-producing enterprise.

12

Revised December 2021

|

Enlarge image |

Part 3: Business Facility New Employee Credits

Other employee credits Calculation for other employee credits

Taxpayers may be able to claim up to four additional Except for the health insurance credit, the other

credits for business facility employees. Qualifying employee credits shown in Table 3-1, later in this

criteria for these credits are detailed in Table 3-1, publication, are allowed only with respect to

later in this publication. Some of these additional employees for whom the taxpayer claims the standard

credits are allowed for employees who work in enterprise zone employee credit. The taxpayer must

enhanced rural enterprise zones or in connection with first calculate the number of business facility

business facilities that add value to agricultural employees (for the first year of operation) or the

commodities through manufacturing or processing, number of additional business facility employees (for

which are explained in greater detail in the following any subsequent year of operation) and then determine

sections. which of those employees meet the additional

qualifying criteria detailed in Table 3-1. The credits

Enhanced rural enterprise zones allowed for enhanced rural enterprise zones and for

processing agricultural commodities are in addition to

An enhanced rural enterprise zone is any portion of any the standard enterprise zone employee credit.

county that is within the boundaries of an enterprise

zone and that meets certain criteria established by Employee health insurance credit

law. Every two years, the Office of Economic

Development and International Trade (“OEDIT”) A taxpayer may claim the health insurance credit only

determines which counties meet the qualifying criteria for the first two full tax years the taxpayer is located in

to be designated as enhanced rural enterprise zones. the enterprise zone. Any tax year of less than 12

Please see OEDIT.Colorado.gov/enterprise-zone- months is not considered a full tax year. The health

program and section 39-30-103.2, C.R.S., for additional insurance credit is not allowed for any tax year

information regarding the designation of enhanced subsequent to the first two full tax years that a

rural enterprise zones. taxpayer operates a business facility in an enterprise

zone, regardless of whether the taxpayer qualified for

Agricultural processing or claimed any credit for the first two full tax years.

A business adds value to agricultural commodities The taxpayer may claim the health insurance credit each

through manufacturing or processing if it engages of the first two full tax years for each employee that

directly in an activity that substantially transforms an meets the qualifying criteria (please see Table 3-1, later

agricultural commodity into a form other than that in this publication). The credit is calculated by

which enters the normal agricultural commodity averaging the qualifying employees for the tax year, as

marketing channels. Harvesting, cleaning, packaging, described earlier in this publication, but, unlike other

storing, transporting, wholesaling, retailing, or employee credits, the credit is allowed for all

otherwise distributing commodities without qualifying employees rather than just the increase in

substantially changing the form of the commodity do qualifying employees over the highest total number of

not qualify. qualifying employees in any prior tax year.

13

Revised December 2021

|

Enlarge image |

Part 3: Business Facility New Employee Credits

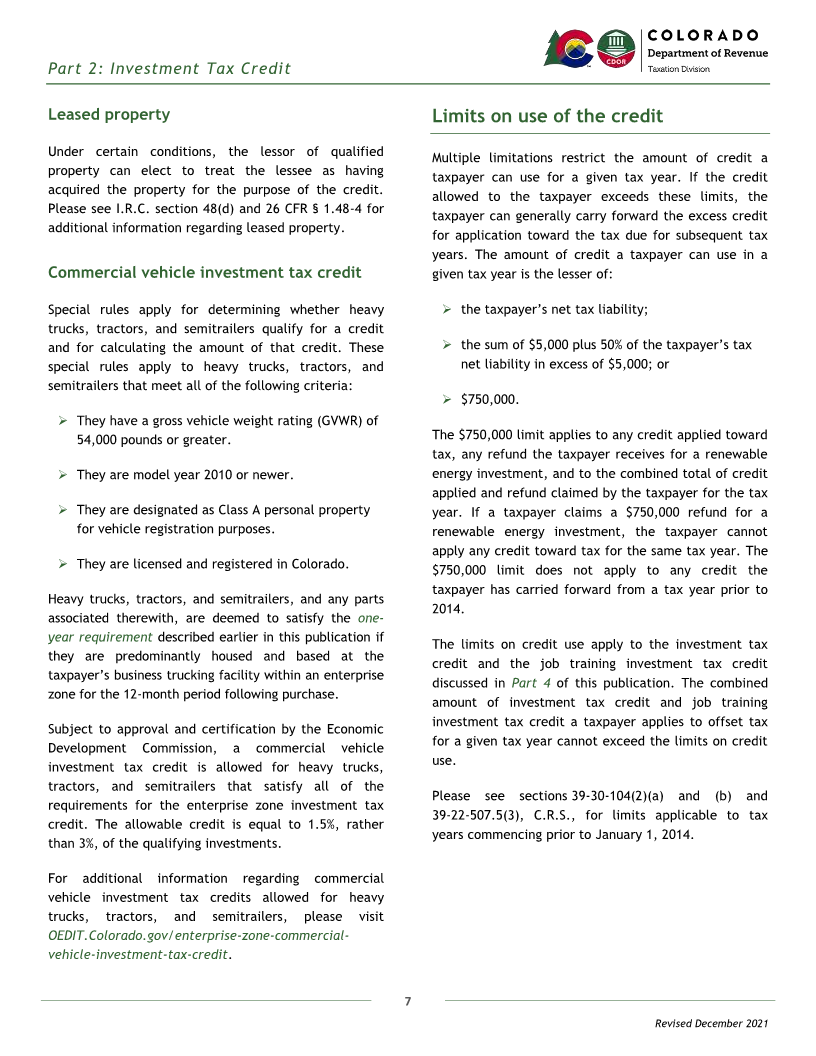

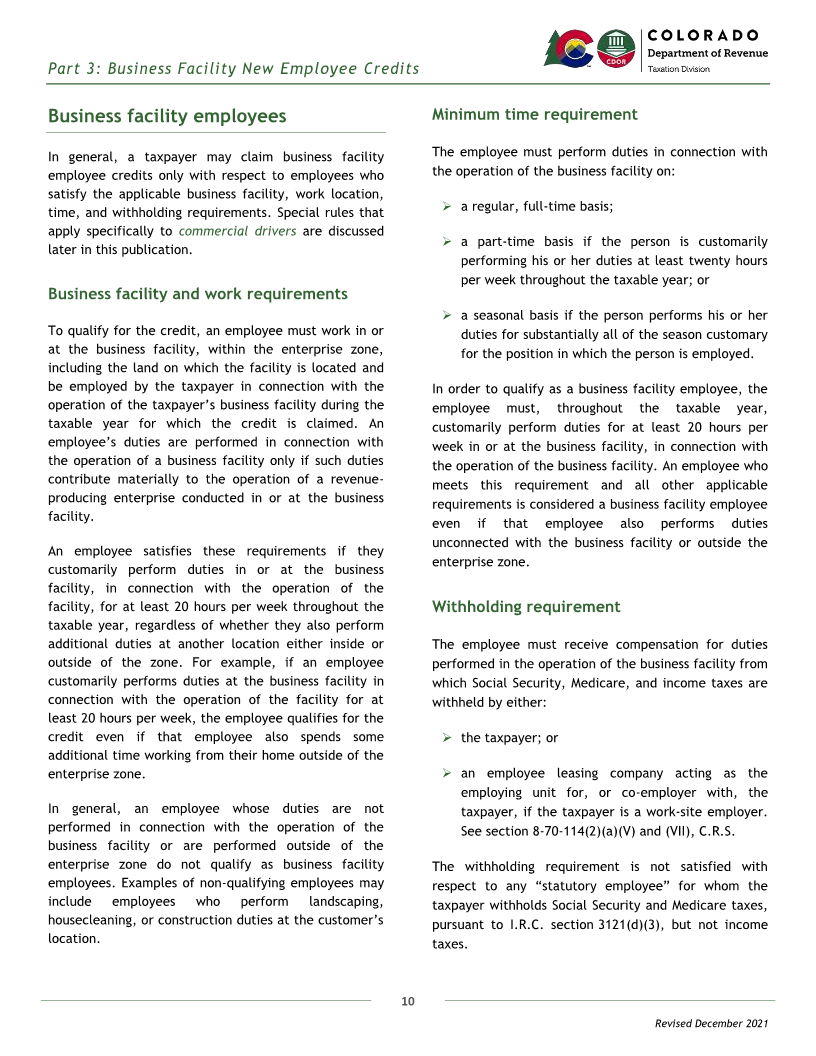

Table 3-1 outlines the qualifying criteria for each of employee credits are allowed in addition to, and not

the five different enterprise zone business facility instead of, the standard enterprise zone employee

employee credits, including both the standard credit. Please see Employee credit calculation, earlier

enterprise zone employee credit and the four in this publication, for information about calculating

additional employee credits. If the applicable the number of qualifying employees for each credit.

qualifying criteria are met, the four additional

Table 3-1. Business Facility New Employee Credits

Credit per Carry-

Credit Qualifying criteria

employee forward

Enterprise zone ➢ The employee must be a business facility employee who satisfies all

$1,100 5 years

employee credit applicable requirements.

➢ The employee must be a business facility employee who satisfies all

Enhanced rural applicable requirements.

$2,000 7 years

enterprise zone ➢ The employee must work during the tax year in an enhanced rural

employee credit

enterprise zone.

➢ The employee must be a business facility employee who satisfies all

applicable requirements.

Enterprise zone ➢ The taxpayer must operate a business facility that adds value to

agricultural

agricultural commodities through manufacturing or processing.

$500 5 years

manufacturing ➢ The employee does not need to work directly in agricultural

or processing

employee credit manufacturing or processing, but must be employed in the operation of

the facility that adds value to agricultural commodities through

manufacturing or processing.

➢ The employee must be a business facility employee who satisfies all

applicable requirements.

➢

Enhanced rural The employee must work during the tax year in an enhanced rural

enterprise zone enterprise zone.

agricultural ➢ The taxpayer must operate a business facility that adds value to $500 7 years

manufacturing agricultural commodities through manufacturing or processing.

or processing ➢ The employee does not need to work directly in agricultural

employee credit manufacturing or processing, but must be employed in the operation of

the facility that adds value to agricultural commodities through

manufacturing or processing.

➢ The employee must be a business facility employee who satisfies all

applicable requirements.

➢ The employee must be insured under a health insurance plan or

program provided by the taxpayer.

Enterprise zone ➢ The taxpayer must contribute 50% or more of the total cost of the

employee health $1,000 5 years

health insurance plan or program.

insurance credit ➢ The plan or program must be a self-insurance program or comply with

the provisions of Parts 1, 2, 3, or 4 of Article 16 of Title 10, C.R.S.

➢ The health insurance plan or program must include partial or complete

coverage for hospital and physician services.

14

Revised December 2021

|

Enlarge image |

Part 3: Business Facility New Employee Credits

Examples Example 3-2. Subsequent tax years

The taxpayer described in Example 3-1 continues

The following examples illustrate the calculation of

operation of its business facility in the next three tax

business facility employee credits.

years. Using the Employee credit calculation, described

earlier in this publication and in Example 3-1 , the

Example 3-1. First tax year of operation

taxpayer has 15 business facility employees in the 1st

year, 22 in the 2nd year, 18 in the 3rd year, and 25 in

A taxpayer begins operation of its business facility on

the 4th year. The following table illustrates the

March 18th. The taxpayer’s tax year runs from March

18 ththrough December 31 .stThe number of employees increase in employees over the highest preceding year

and the allowable credit for each year.

working at the facility on the last business day of each

month is:

2nd 3rd 4th

Tax Years

March: 6 August: 18 year year year

April: 8 September: 24 Employees for tax year 22 18 25

May: 9 October: 26

June: 12 November: 25 Highest total number of

15 22 22

employees in any prior year

July: 15 December: 37

Increase over highest prior year 7 0 3

Under the general rules for calculating the credit,

discussed in Employee credit calculation, earlier in this Allowable credit $7,700 $0 $3,300

publication, the number of business facility employees

for the year is calculated by adding together the Example 3-3. Health insurance credit

number of business facility employees on the last

business day of each month of the tax year and dividing The taxpayer described in Examples 3-1 and 3-2

the total (180) by 12. The result is a total of 15 provides health insurance each year to all employees.

The insurance meets the requirements to qualify for

business facility employees for the tax year. The

the health insurance credit.

taxpayer is allowed a credit of $1,100 for each

employee or $16,500 total ($1,100 x 15).

Unlike the other enterprise zone employee credits, the

health insurance credit is allowed for all employees that

meet the qualifying criteria, not just the increase in those

employees over the highest number in any prior year, but

it is allowed only for the first two full tax years that the

business facility is located in the enterprise zone.

The taxpayer’s first tax year of operation was not a full

tax year, so the taxpayer cannot claim the health

insurance credit for that year. Instead, the taxpayer

can claim the credit for the 2nd and 3rd years of

operation, since those are the taxpayer’s first two full

tax years located in the enterprise zone.

The taxpayer had 22 qualifying employees in the 2nd

year and 18 qualifying employees in the 3rd year. The

taxpayer can claim a credit of $22,000 ($1,000 x 22) for

the 2nd year and $18,000 ($1,000 x 18) for the 3rd year.

15

Revised December 2021

|

Enlarge image |

Part 3: Business Facility New Employee Credits

Example 3-4. Other employee credits Example 3-5. A facility operating for less than the

entire tax year

The business facility of the taxpayer described in

Examples 3-1 and 3-2 was not in an enhanced rural Each tax year, a taxpayer operates the same business

enterprise zone in the year it began operations. facility in an enterprise zone seasonally from mid-May

However, beginning with the 3rd year of operation, the through mid-October. At all other times, there is no

location of the facility was designated as an enhanced activity and there are no employees working at the

rural enterprise zone. facility. The taxpayer’s tax year runs from January 1 st

through December 31st.

The taxpayer did not increase employees at the facility

in the 3rd year (18 employees for the year compared Since all business activities conducted at the facility

with 22 in a prior year), so the taxpayer could not cease temporarily during the tax year and the business

claim the standard employee credit or the enhanced facility is therefore in operation for less than the entire

rural employee credit for the 3rd year. tax year, as described earlier in this publication, the

calculation of the number of business facility

In the 4th year, the taxpayer’s 25 employees employees for the year includes only the full calendar

represented an increase of three employees over the months of operation. The number of employees

highest total number of employees in any prior year. working at the facility on the last business day of each

The taxpayer can claim both a standard employee full calendar month of operation is:

credit of $3,300 ($1,100 x 3) and the enhanced rural

enterprise zone credit of $6,000 ($2,000 x 3) for these June: 9 August: 14

three additional employees. July: 12 September: 5

The number of business facility employees for the year

is calculated by adding together the number of business

facility employees on the last business day of each

month of the tax year and dividing the total (40) by the

number of full calendar months during which the

facility was in operation (4). The result is a total of 10

business facility employees for the tax year, resulting

in an increase of two business facility employees over

the eight business facility employees, which was the

highest number of business employees for any prior tax

year. The taxpayer is allowed a credit of $1,100 for

each of the two additional employees or $2,200 total

($1,100 x 2).

16

Revised December 2021

|

Enlarge image |

Part 3: Business Facility New Employee Credits

Example 3-6. Pre-certification after commencing The credit for tax year 2019 is computed by subtracting

operations the average number of business facility employees in

2019 by the highest average number of business facility

A taxpayer commences operations at a business facility employees for any prior year and multiplying the result

in an enterprise zone on January 1, 2018, and is a by $1,100. The average number of business facility

calendar year filer whose 2018 tax year runs from employees for 2019 is calculated by adding together

January 1, 2018, to December 31, 2018. The taxpayer the number of employees at the end of each month

employs eight business facility employees at the facility during the tax year (eight for each month January

at the end of each month of the 2018 tax year. through August and 11 for each month September

However, the taxpayer does not pre-certify, as through December) and dividing the sum (108) by 12,

described in Part 1 of this publication, either prior to resulting in nine business facility employees for tax

or at any time during the 2018 tax year. Consequently, year 2019. The nine business facility employees for tax

for the purpose of calculating the credit allowed for year 2019 is one more than the eight business facility

the 2018 tax year, the taxpayer is deemed to have zero employees that were the highest average from any

employees (the highest average number of employees prior year. Therefore, the taxpayer is allowed a credit

in any prior tax year) at the end of each month during of $1,100 ($1,100 x 1).

the 2018 tax year and is therefore not allowed any

credit. The taxpayer continues operation of the business

facility throughout tax year 2020, employing eleven

Beginning in January 2019, and throughout the entirety business facility employees at all times during the tax

of tax year 2019, the taxpayer employs 11 business year. The credit for tax year 2020 is calculated by

facility employees. On August 15, 2019, the taxpayer subtracting the average number of business facility

pre-certifies with the enterprise zone administrator. employees for tax year 2020 (11 employees) by the

For the purpose of calculating the credit for tax year highest average number of business facility employees

2019, the number of business facility employees for any for any prior year (11 employees, for tax year 2019).

month in 2019 commencing prior to pre-certification is Because the average number of business facility

deemed not to exceed the highest average number of employees for tax year 2020 is no greater than the

business facility employees for any prior year. highest average number of business facility employees

Consequently, the number of business facility for any prior year, the allowable credit for tax year

employees from January 2019 through August 2019 is 2020 is $0.

deemed to be eight, rather than 11.

17

Revised December 2021

|

Enlarge image |

Part 3: Business Facility New Employee Credits

Credit carryforwards

The credit a taxpayer can use for any tax year is limited

to the taxpayer’s net tax liability. If the allowable credit

exceeds the taxpayer’s net tax liability, the taxpayer

can carry forward the excess credit for application

toward the tax due for subsequent tax years. Please see

Table 3-1, earlier in this publication, for the allowable

carryforward period applicable to the different

enterprise zone employee credits. Any credit that has

not been used within the carryforward period expires

and is no longer available to the taxpayer.

Additional resources

The following is a list of statutes, regulations, forms,

and guidance relevant to enterprise zone business

facility employee credits. This list is not, and is not

intended to be, an exhaustive list of authorities that

govern the tax treatment of every situation. Individuals

and businesses with specific questions should consult

their tax advisors.

Statutes and regulations

➢ § 39-30-105.1, C.R.S. Credit for new enterprise

zone business employees –definitions.

➢ Rule 39-30-105.1. Enterprise zone business facility

employee credits.

Forms and guidance

➢ Tax.Colorado.gov

➢ OEDIT.Colorado.gov/enterprise-zone-new-

employee-tax-credit

➢ OEDIT.Colorado.gov/enterprise-zone-employer-

sponsored-health-insurance-tax-credit

➢ Enterprise Zone Credit and Carryforward Schedule

(DR 1366)

18

Revised December 2021

|

Enlarge image |

Part 4: Job Training Investment Tax Credit

A taxpayer who invests in a qualified job training Other expenses

program for employees who work predominantly within

an enterprise zone may claim a credit equal to 12% of Other expenses incurred by the taxpayer either inside

the qualified investment. This Part 4 provides or outside of an enterprise zone may be qualified

information about qualified job training programs, investments. Such expenses must be incurred for a

qualified investments, the credit calculation, and the qualified job training program for employees working

allowable carryforward period for any excess credits. predominantly within an enterprise zone. Examples of

qualifying expenses may include:

➢

Qualified job training programs expensed equipment,

➢

A qualified job training program is a structured training supplies,

or basic education program to improve the job skills of ➢ training staff wages or fees,

the taxpayer’s employees who work predominantly

within an enterprise zone. The program may be ➢ training contract costs,

conducted at the taxpayer’s location or off-site. The

training program may be conducted by the taxpayer or ➢ virtual and in-person training classes and courses,

by another entity.

➢ temporary space rental, and

➢

Qualified investment travel expenses.

For the purpose of calculating the credit, the qualified Non-qualifying expenses

investment may include investments in real property

and capital equipment, as well as other expenses that Non-qualifying expenses that do not qualify for the

meet the following requirements. credit include, but are not limited to, expenses

incurred for any of the following purposes:

Real property and capital equipment ➢ the regular operation of a business;

The taxpayer’s costs in purchasing, leasing, or improving ➢ on-the-job training that is not part of a qualified

real property or capital equipment may qualify for the

job training program;

credit. Eligible real property may include land, buildings,

real property improvements, leasehold improvements, ➢ wages paid to employees being trained; or

and leased space. The property or equipment must satisfy

all of the following requirements: ➢ training employees who are or will be working

primarily outside of the enterprise zone.

➢ it must be used entirely within an enterprise zone;

➢ it must be used primarily for qualified job training

program purposes or to make a training site

accessible; and

➢ it must not be eligible for enterprise zone

investment tax credit discussed in Part 2 of this

publication.

19

Revised December 2021

|

Enlarge image |

Part 4: Job Training Investment Tax Credit

Pre-certification Additional resources

Any taxpayer who intends to claim a credit must first The following is a list of statutes, regulations, forms,

pre-certify with the applicable enterprise zone and guidance pertaining to the enterprise zone job

administrator. No job training investment tax credit is training investment tax credit. This list is not, and is

allowed with respect to any property acquired or any not intended to be, an exhaustive list of authorities

expense paid or incurred prior to the taxpayer’s pre- that govern the tax treatment of every situation.

certification with the enterprise zone administrator for Individuals and businesses with specific questions

the tax year. If investments are made in multiple tax, should consult their tax advisors.

the taxpayer must submit a separate pre-certification

form for each year, prior to making any investments in

Statutes and regulations

that year. Please see Part 1 of this publication for

additional information about pre-certification. ➢ § 39-30-104, C.R.S. Credits against tax –

investment in certain property –definitions.

Credit calculation and carryforward

Forms and guidance

The allowable credit is equal to 12% of the taxpayer’s ➢ Tax.Colorado.gov

qualified investment during the tax year in a qualified

job training program. ➢ OEDIT.Colorado.gov/enterprise-zone-job-training-

tax-credit

The limits on credit use discussed in Part 2 of this

publication apply to the investment tax credit and the ➢ Enterprise Zone Credit and Carryforward Schedule

job training investment tax credit. The combined

(DR 1366)

amount of investment tax credit and job training

investment tax credit a taxpayer applies to offset tax

for a given tax year cannot exceed the limits on credit

use. Any excess credit that cannot be used to offset tax

can be carried forward to the following tax year as

discussed in Part 2 of this publication.

20

Revised December 2021

|

Enlarge image |

Part 5: Research and Experimental Activities Credit

An income tax credit is allowed to any taxpayer who Qualifying expenditures

makes expenditures in research and experimental

activities conducted in an enterprise zone for the Qualifying expenditures generally include all costs

purpose of carrying out a trade or business. This Part 5 incident to the development or improvement of a

provides information about qualifying expenditures and product. Examples of qualifying expenditures include:

calculation of the credit.

➢ salaries for those engaged in research or

experimentation efforts;

Research and experimental expenditures

➢ amounts incurred to operate and maintain

Research or experimental expenditures that qualify for research facilities (e.g., utilities, depreciation,

the credit are any expenditures subject to the federal rent, etc.);

income tax treatment prescribed by section 174 of the

➢

Internal Revenue Code. Eligible expenditures must be expenditures for materials and supplies used and

incurred in connection with the taxpayer's trade or consumed in the course of research or

business and represent research and development costs experimentation (including amounts incurred in

in the experimental or laboratory sense. These conducting trials);

expenditures generally include all costs incident to the

➢

development or improvement of a product. the costs of obtaining a patent, such as attorneys'

fees expended in making and perfecting a patent

A “product” for which research and experimental application; and

expenditures are made can be a pilot model, process,

➢

formula, invention, technique, patent, or similar property. expenditures paid or incurred for research or

The product can be used by the taxpayer in its trade or experimentation conducted on the taxpayer’s

business or developed for sale, lease, or license. behalf by another person or organization (such as

a research institute, foundation, engineering

Whether expenditures qualify as research or experimental company, or similar contractor).

expenditures depends on the nature of the activity to

which the expenditures relate, not the nature of the The credit is allowed only for the amount of research

product or improvement being developed or the level of and experimental expenditures that is reasonable

technological advancement the product or improvement under the circumstances. In general, the amount of an

represents. The ultimate success, failure, sale, or use of expenditure for research or experimental activities is

the product is not relevant to a determination of reasonable if the amount would ordinarily be paid for

eligibility of expenditures for the credit. like activities by like enterprises under like

circumstances. Amounts supposedly paid for research

Research or experimental expenditures are those made that are not reasonable under the circumstances may

for activities intended to discover information that be characterized as disguised dividends, gifts, loans, or

would eliminate uncertainty concerning the similar payments.

development or improvement of a product. Uncertainty

exists if the information available to the taxpayer does Please see section 174 of the Internal Revenue Code

not establish the capability or method for developing or and 26 CFR § 1.174-2 for additional information about

improving the product or the appropriate design of the research and experimental expenditures.

product. Costs may qualify for the credit if paid or

incurred after production begins, but before

uncertainty concerning the development or

improvement of the product is eliminated.

21

Revised December 2021

|

Enlarge image |

Part 5: Research and Experimental Activities Credit

Non-qualifying expenditures Credit calculation

The credit is not allowed for any expenditures for: The allowable credit is based upon an increase in the

taxpayer’s research and experimental expenditures in

➢ the acquisition or improvement of land or

an enterprise zone over the two prior years. The credit

depreciable property;

is equal to 3% of the amount by which the taxpayer’s

research and experimental expenditures in an

➢ the purpose of ascertaining the existence,

enterprise zone exceed the average of the taxpayer’s

location, extent, or quality of any deposit of ore

research and experimental expenditures in the same

or other mineral (including oil and gas);

enterprise zone over the two preceding tax years.

➢ the ordinary testing or inspection of materials or

The credit calculated as described above is not allowed

products for quality control (quality control

entirely for the tax year in which the expenditures

testing);

were made. Instead, the credit is divided evenly over

➢ efficiency surveys; four tax years. Twenty-five percent of the credit is

allowed for the tax year in which the expenditures

➢ management studies; were made and 25% of the credit is allowed for each of

the subsequent three tax years.

➢ consumer surveys;

➢ advertising or promotions; Credit carryforward

➢ the acquisition of another's patent, model, If the credit allowed exceeds the income tax the

production, or process; or taxpayer otherwise owes for the tax year, the excess

credit may be carried forward and applied toward the

➢ research in connection with literary, historical, or taxpayer’s tax liability for the following tax year. Any

similar projects. excess credit after application toward tax for the

subsequent year may be further carried forward until

the full amount of the credit has been used.

Pre-certification

Any taxpayer who intends to claim a credit must first

pre-certify with the applicable enterprise zone

administrator. No credit is allowed with respect to any

activity undertaken by the taxpayer prior to the

taxpayer’s pre-certification with the enterprise zone

administrator for the tax year. If expenditures are

made in multiple tax years, the taxpayer must submit a

separate pre-certification form for each year, prior to

making any expenditures for that year. Please see

Part 1 of this publication for additional information

about pre-certification.

22

Revised December 2021

|

Enlarge image |

Part 5: Research and Experimental Activities Credit

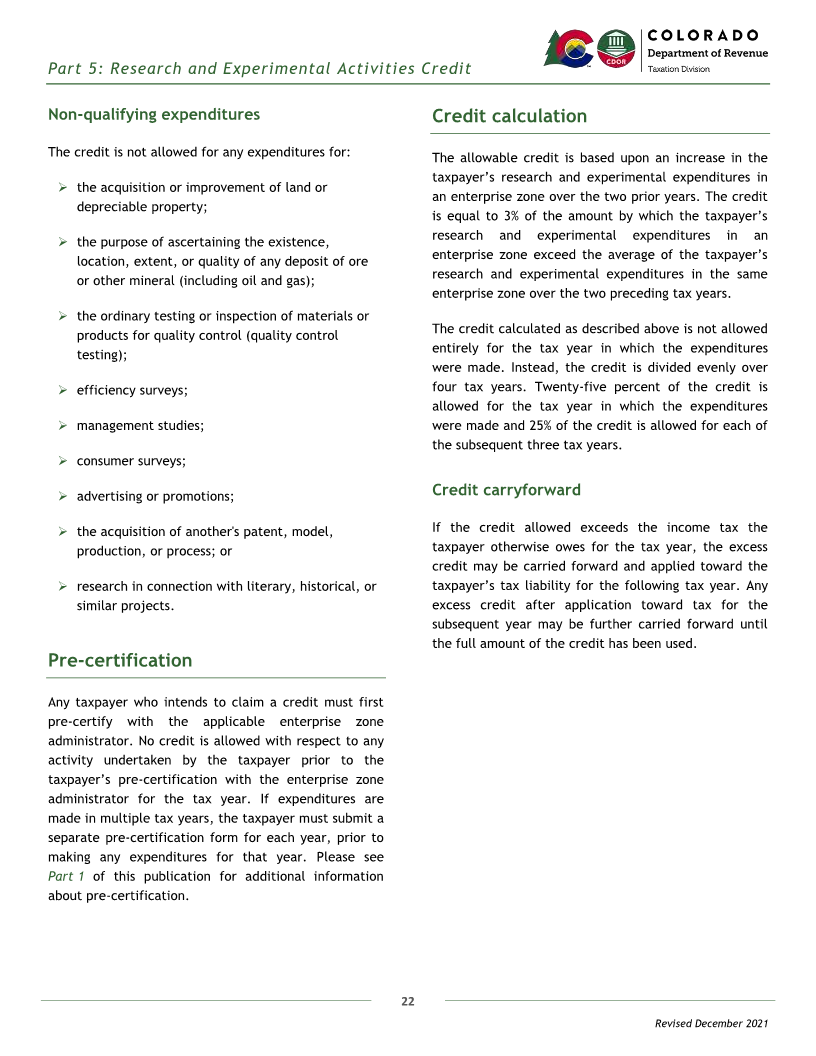

Examples Example 5-2

The taxpayer from Example 5-1 incurs $200,000 in

The following examples illustrate the calculation of the

expenditures for research and experimental activities

credit and carryforwards.

conducted in the same enterprise zone in tax year

Example 5-1 2018. The taxpayer’s average expenditures in the same

enterprise zone in the two prior tax years were

A taxpayer incurs $140,000 in expenditures for research $120,000 ($100,000 for tax year 2016 and $140,000 for

and experimental activities conducted in an enterprise tax year 2017). The $200,000 of expenditures in 2018 is

zone in tax year 2017. The taxpayer’s research and $80,000 more than the taxpayer’s average expenditures

experimental expenditures in the same enterprise zone in the same enterprise zone over the two preceding tax

for tax years 2015 and 2016 were $0 and $100,000, years.

respectively, for an average of $50,000. The $140,000

of expenditures in 2017 is $90,000 more than the The total allowable credit is $2,400 (3% x $80,000). The

taxpayer’s average expenditures in the same enterprise total allowable credit is divided evenly over the current

zone over the two preceding tax years. tax year and the three following tax years. The

taxpayer can claim a credit of $600 (25% of the total

The total allowable credit is $2,700 (3% x $90,000). The credit) for tax year 2018 and for each of the three

credit is divided evenly over the current tax year and subsequent tax years.

the three following tax years. The taxpayer can claim a

credit of $675 (25% of the total credit) for tax year Illustration of Example 5-2

2017 and for each of the three subsequent tax years. 2016 expenditures $ 100,000

2017 expenditures $ 140,000

Illustration of Example 5-1

2018 expenditures $ 200,000

2015 expenditures $ 0

Average of 2016 and 2017 $ 120,000

2016 expenditures $ 100,000

2018 expenditures minus the average

$ 80,000

2017 expenditures $ 140,000 from the two prior years

Average of 2015 and 2016 $ 50,000 Total credit (3% of increase) $ 2,400

2017 expenditures minus the average Credit allowed for 2018 (25% of total) $ 600

$ 90,000

from the two prior years

Credit allowed for 2019 (25% of total) $ 600

Total credit (3% of increase) $ 2,700

Credit allowed for 2020 (25% of total) $ 600

Credit allowed for 2017 (25% of total) $ 675

Credit allowed for 2021 (25% of total) $ 600

Credit allowed for 2018 (25% of total) $ 675

Credit allowed for 2019 (25% of total) $ 675

Credit allowed for 2020 (25% of total) $ 675

23

Revised December 2021

|

Enlarge image |

Part 5: Research and Experimental Activities Credit

Example 5-3 Additional resources

The taxpayer from Examples 5-1 and 5-2 had a tax

The following is a list of statutes, regulations, forms,

liability of $400 for tax year 2017. The taxpayer applied

and guidance pertaining to the enterprise zone

$400 of the $675 credit allowed for tax year 2017 to

research and experimental activities credit. This list is

offset the entire tax amount due. The remaining $275

not, and is not intended to be, an exhaustive list of

of credit is carried forward to tax year 2018.

authorities that govern the tax treatment of every

For tax year 2018, the taxpayer will have available situation. Individuals and businesses with specific

credits totaling $1,550, consisting of the following: questions should consult their tax advisors.

➢ $675, equal to 25% of the total credit allowed for Statutes and regulations

expenditures made during 2017;

➢ § 39-30-105.5, C.R.S. Credit…for research and

➢ $600, equal to 25% of the total credit allowed for experimental activities.

expenditures made during 2018; and ➢ I.R.C. § 174. Research and experimental

expenditures.

➢ $275 allowed in the prior year and carried forward

to the 2018 tax year. ➢ 26 CFR § 1.174-2. Definition of research and

experimental expenditures.

The taxpayer’s 2018 tax liability is $500. After applying

$500 of the available credit to offset the tax due, the

taxpayer has $1,050 credit remaining to carry forward Forms and guidance

to tax year 2019.

➢ Tax.Colorado.gov

➢ OEDIT.Colorado.gov/enterprise-zone-research-

and-development-tax-credit

➢ Enterprise Zone Credit and Carryforward Schedule

(DR 1366)

24

Revised December 2021

|

Enlarge image |

Part 6: Vacant Building Rehabilitation Credit

Any taxpayer who is the owner or tenant of a qualified Qualified expenditures

building in an enterprise zone may claim an income tax

credit for qualified expenditures for the purpose of Qualified expenditures are expenditures necessary to

rehabilitating the building. This Part 6 provides rehabilitate a qualified building for commercial use

information about qualifying expenditures and the that are associated with any of the following:

credit calculation.

➢ exterior improvements,

Qualified buildings ➢ structural improvements,

➢

A qualified building is a building located in an mechanical improvements, or

enterprise zone that is at least 20 years old and has

➢

been unoccupied for at least two years. For the electrical improvements.

purpose of the credit, a “building” is defined to include

A building is rehabilitated for commercial use only if

the entire physically contiguous structure, regardless of

both:

whether it has been legally divided into separate units.

To qualify for the credit, the entire physically ➢ the taxpayer’s primary use of the building is for

contiguous structure must be unoccupied for at least commercial purposes; and

two years.

➢ the taxpayer does not use any part of the building

A building is not considered to be unoccupied at any as their residence, either full-time or part-time.

time during which the building is actively utilized by

the owner, a lessor, or any other party in the operation

of a trade or business including, but not limited to, any Examples of Qualified Expenditures

storage within the building of inventory, equipment, or

Qualified expenditures necessary to rehabilitate a

other property for an operating business. However, the

qualified building may include expenditures

mere presence of tangible personal property in an

associated with any of the following:

otherwise unoccupied building does not disqualify the

building for the credit. Additionally, transitory use of a

➢

building that is not related to the conduct of any trade demolition ➢ painting ➢ exterior repair

or business does not disqualify the building for the ➢ carpentry ➢ ceilings ➢ tuckpointing

credit.

➢ sheetrock ➢ fixtures ➢ cleanup

The pre-certification described in Part 1 of this

publication must identify the location of the building. ➢ plaster ➢ doors ➢ roofing and

➢ windows ➢ cleaning flashing

➢ sprinkler systems for fire protection purposes

25

Revised December 2021

|

Enlarge image |

Part 6: Vacant Building Rehabilitation Credit

Non-qualified expenditures Federal rehabilitation credit

A variety of costs that may be associated with Additionally, a taxpayer who is allowed a federal

rehabilitation do not qualify for the credit. Qualified rehabilitation credit pursuant to sections 38, 46, and 47

expenditures do not include costs associated with: of the Internal Revenue Code cannot claim the vacant

building rehabilitation credit for the same

➢ acquisition ➢ interior furnishings rehabilitation expenditures.

➢ excavation ➢ landscaping

However, a taxpayer who claims a commercial historic

➢ grading ➢ repairs to outbuildings preservation tax credit on their Colorado income tax

return is not precluded from claiming the enterprise

➢ paving zone vacant building rehabilitation credit for the same

building.

➢ new additions, except as may be required to

comply with building and safety codes

Additionally, s“ oft costs” do not qualify for the credit. Credit calculation

“Soft costs” include costs associated with:

The allowable credit is generally equal to 25% of the

➢ loan fees ➢ bid bonds taxpayer’s aggregate qualified expenditures during the

tax year. However, the total credit allowed to each

➢ closing ➢ appraisals

taxpayer with respect to any given building is limited

➢ bids ➢ sales and marketing to $50,000. The limit applies to the aggregate amount

of the credit, whether allowed in one or more tax

➢ insurance ➢ project signs and phones years, and to the building as a whole, whether the

➢ copying ➢ temporary power taxpayer is the owner or tenant of the entire building

or one or more separate units therein.

➢ rent loss during construction

The limit applies to each individual, estate, trust, or C